ESOP Calculator Guide to Project Employee Stock Ownership Plan Tax Benefits

ESOP Calculator Guide to Project Employee Stock Ownership Plan Tax Benefits

An Employee Stock Ownership Plan (ESOP) is not just a valuable instrument to make employees align their interests with a long-term development of a business but also a potent financial instrument that can provide significant tax savings to both the managers and the employees. In the case of owners reviewing an ESOP as an aspect of their succession strategy, the financial consequences of this action, especially in connection with possible tax savings, is one of the main decision variables, highlighting the Tax advantages of ESOP for business owners Singapore.

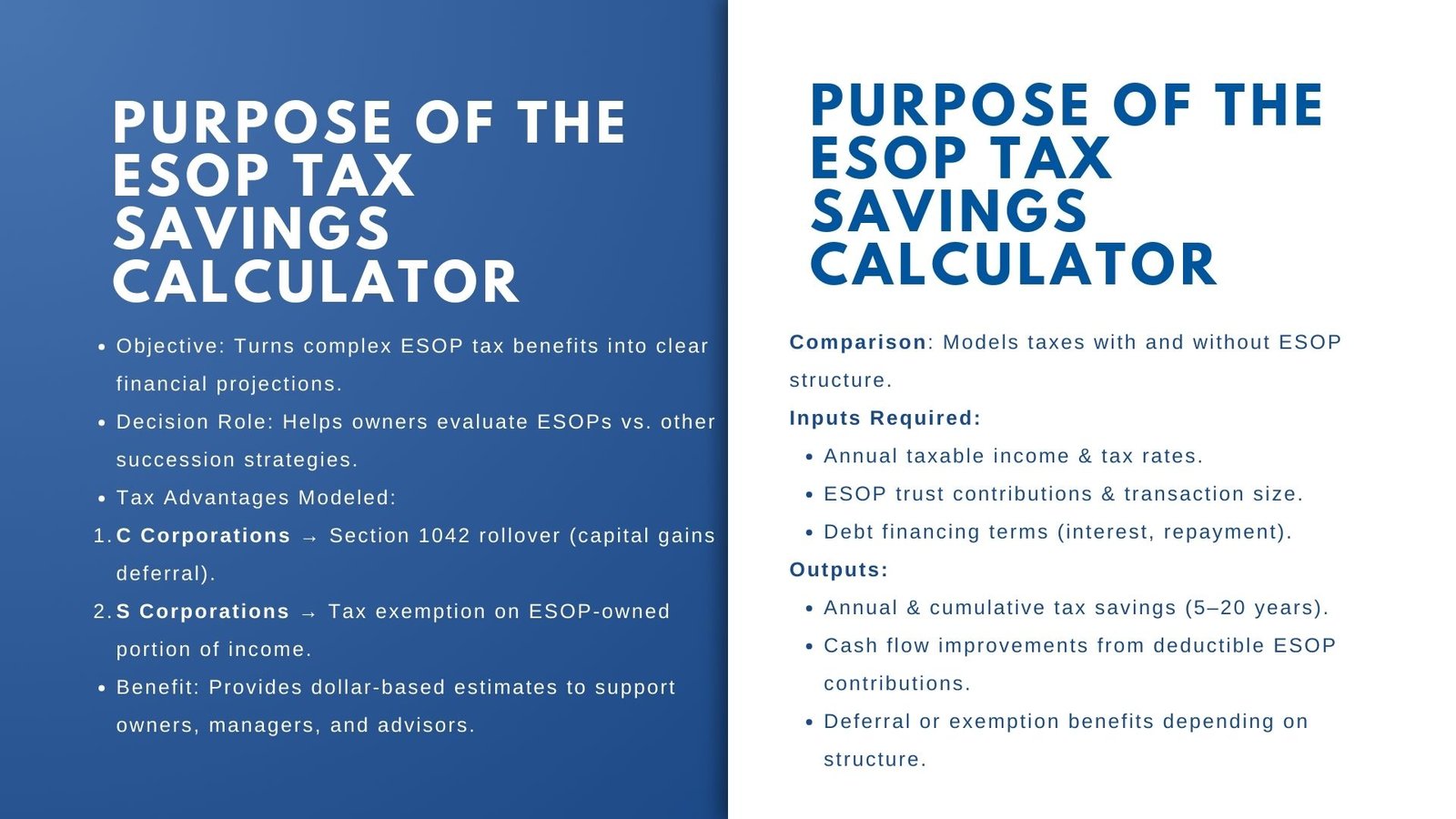

Although the broad idea of tax advantaged ESOP is much talked about, it is not always a simple matter to quantify it as it involves an interaction between corporate and individual taxes, deductions against them and capital treatment gained. It is here that the ESOP tax advantage calculator enters the picture enabling owners and financial managers to approximate the actual savings that a realizable program of establishing an ESOP can achieve, often supported by ESOP valuation services Singapore.

Stakeholders may model the effect that different variables will have on the overall tax liability and savings by using an ESOP calculator. These variables include the amount of the transaction, taxable income of the company, debt financing, and ESOP trust contribution. The amount of these savings can be estimated with ease through a clear projection of the savings and they help make the decision of considering an ESOP as an option to transition ownership much easier than the other ownership transition methods. In this guide, we will look into what an ESOP calculator entails, its functionality, the values it requires, the tax regulations that it considers and how to use its output in making real life decisions.

Understanding ESOP Calculator Guide to Project Employee Stock Ownership Plan Tax Benefits

An ESOP tax advantage calculator is basically a financial modeling calculator tool that converts the somewhat intangible tax savings of ESOP ownership into dollars-and-cents figures. The main role that the tool plays is the provision of forward estimates of the influence of the tax shares on the liabilities by the business owners and its advisors within a specified period.

Without this kind of projection, owners can pick and choose to be either too cautious or too aggressive, thus they can either make decisions too risk averse or too aggressive. Some businesses also complement this analysis with an advanced business valuation calculator Singapore for companies to get a fuller financial picture.

An illustrative example is that in C corporation ESOP structure the contribution to ESOP would be tax-deductible and in some scenarios, sellers would be able to defer capital gains taxes using the investment of the proceeds into qualified replacement property under Section 1042 of the Internal Revenue Code. The same effect happens in an S corporation ESOP where the ESOP owned part of the business is free of federal income tax liabilities hence providing an unending tax shield to the company. Such advantages are potentially large and the specific amount of savings is always limited by the situation specific to each company in terms of finances and taxation.

The ESOP calculator aids in appreciating these variables as it runs them through the tax calculations formula and gives the estimate of annual and the build up saving. An ESOP tax projection provides an on-balance-sheet perspective of just how the system may work as a corporate entity as opposed to using general rules or averages within the industry. This form of detail is especially helpful when offering the ESOP idea to the shareholders, lenders and employees because it substitutes wholesome propositions with numbers.

How the ESOP Calculator Works in Practice

Essentially, the ESOP tax benefit calculator works by pitting two things together, one being how the company performs financially and providing taxes to the government without the ESOP, and the other one is how the company does regarding the same on the condition that it has the ESOP. The comparative process isolates the differences related to tax and enables the user to visualize the incremental benefits derived by the ESOP structure.

The user enters basic financial information on the taxable annual income, current tax rates, payroll rates, contributions to the ESOP the user intends to make, transaction size assuming it is a leveraged ESOP, and the schedules on repayment of the debts in this process. The calculator can also take into account the capital gains deferral under Section 1042, in the event that the business is contemplating a C corporation ESOP indicating what amount tax can be deferred and the impact on the net proceeds. In the case of S corporations, the calculator includes into consideration the percentage of ownership percentage owned by the ESOP and subtracts the tax exemption on the percentage of income.

Based on that, the tool implements the tax regulations and deductions that apply and projects a picture of the total taxes paid under either scenario. The disparity between these values is the amount of tax that can be saved and this value can either be expressed on a yearly basis or in terms of a cumulative savings over a given duration like five, ten, or twenty years. In more sophisticated models, the calculator is able to consider the impact of state income taxes and alterations to corporate tax rates, inflation, and possible profit growth of companies, giving the picture a more comprehensive feel.

Key Factors That Influence the Results

Although calculating result provided by the calculator has been very helpful, it is crucial that accuracy of projected data is determined by the quantity and realism of data being fed to the calculator. There are quite a number of factors that are of significant interest in the determination of the amount of tax savings that the ESOP shall give out.

One of the most important variables is the profitability of the company because high taxable income would tend to improve the effect of the deduction and exemptions. In a similar manner, the extent of the firm sold to the ESOP influences the tax benefit reached, and a full ESOP ownership of an S corporation practically erases federal income tax on the profits of the company.

The other very important factor is the structure of debt. Under leveraged ESOPs, a loan to the ESOP is paid off by the company using pre-tax money generating a deduction that would not be present without ESOP. This is capable of increasing the flow of cash in the repayment period by a drastic margin. Nevertheless, the price of the borrowing, the repayment plan, and the possibility of the firm to repay the loan without stretching itself beyond the limits has to be taken into account.

Tax savings profile is also different due to the structure of the corporate structure: C corporation or S corporation. C corporation sellers have the benefit of the 1042 rollover which can be a very effective deferral strategy, and S corporations enjoy the benefits of an on-going tax exemption on the portion owned by the ESOP. Moreover, state taxes regulations may increase or minimize the amount of estimated savings, so it is noteworthy that the calculator should consider the jurisdiction where the business is located.

Interpreting the Results for Strategic Planning

When a set of projections is prepared by the calculator there should be an interpretation in the broader strategic goals of the firm. This is an example, a projection of substantial short term savings on taxes may make an ESOP more appealing to an owner who needs immediate cash flow improvements whereas the modest but steady long term savings may be more appealing to an owner that needs years of productivity.

One should also keep in mind that the calculator is concerned with the tax savings, and this is not the whole ESOP equation. Other considerations, e.g., engagement of the employee, cultural fit, governance needs, transaction costs, should also go into play in the determination of whether an ESOP should take place. Such results of the calculator should hence be considered as a part of the financial aspect of an overall decision, rather than a determining factor itself.

Business owners tend to rely on the findings by utilizing them in conjunction with financial advisors, ESOP consultants, and legal counsel. The projections can also be used by lenders to determine the viability of funding an ESOP transaction, especially when the generated savings enhance cash flow and debt-servicing ability of the company to a great degree.

Limitations and the Need for Professional Review

Although calculators of ESOP tax advantages provide useful illustrations of benefit potential, such tools should not be used in lieu of a thorough financial and legal analysis. Most calculators are based on stagnant assumptions that cannot entirely take into consideration other changes in tax regulations and unanticipated reactions in the company or complicated predecessor. They are also not likely to reflect non-tax financial gains of ESOPs, like better employee retention or enhanced worker productivity.

Due to these factors, it is more appropriate to consider the calculator a first-pass screening device as opposed to a financial plan. After realizing a projection of it leads to potential success, it is crucial to have the numbers analyzed by experts in ESOP transactions. A thorough examination will not only emphasize on taxes but also valuation, financing, measures to be taken with regards to compliance and long-term viability.

At the end of the day, calculating an ESOP tax advantage with a calculator is all about putting something into clear perspective that might otherwise become murky due to the abstractions as well as the generalized recommendations. With their potential benefits translated into actual projections, the tool can make business owners discuss and make more determined decisions, prevent any risk of miscalculation, and meet both their financial expectations and their visions of the future of the firm.