Simple Advantages How ESOP Valuations Impact Tax Reporting and Succession Planning

Simple Advantages How ESOP Valuations Impact Tax Reporting and Succession Planning

The deployment of Employees Stock Ownership Plans (ESOPs) of tax reporting serves more than a basic transfer of equity to employees, it has a bearing on corporate tax strategy and holds an influence over the future of the business through the succession plan. Since the Esophagus valuations are used to define the fair market value (FMV) of company shares, they are the key drivers in setting the tax liability, deductible expenses, and the possibility of any of the exit strategies by the owners. Knowledge of the interplay of ESOP valuations, tax reporting and succession planning is essential to all owners, executives, advisors, and trustees.

The Tax Dimensions of ESOP Valuations

Independent valuations conducted annually not only help in fairness in the operations conducted in an ESOP but also help in complying with taxes. In a privately owned firm whereby an ESOP is sponsored, the share which the ESOP plan holds turns into a physical asset that could be scrutinized by the IRS. The implication of the income and deferred taxes are:

- Deductible ESOP Contributions: Companies which sponsor ESOPs are tax deductible to the extent they make contributions, both in the form of stock and cash into the plan. The IRS only permits the deduction up to FMV that figurates through valuation. Stating greater FMV than there is will decrease deductible benefits, and lesser exposes fiduciaries to penalty.

- Capital Gains Treatment for Sellers: Sellers that are selling shareholders in most instances will qualify in receiving deferral on capital gains under the section 1042 of Internal Revenue Code. But to qualify, and the amount deferred, the valuation must be accurate and the requirements must be followed based on FMV standards.

- Basis and Depreciation in Related Entities In a few cases, related entities hold stocks of ESOP by other pass-through entities such as S-corporations. Valuations affect distributions and determination of tax Computation because distribution considerations are based on taxable earnings and shareholder basis.

Since ESOPs are governed by stringent laws, the focus on the accuracy of valuation is why one may or may not be able to claim appropriate deductions, deferrals and taxation. Valuations need to conform to the IRS rules and must be backed by professional records.

How Valuation Shapes Succession Planning for Business Owners

The use of ESOP as a way to plan succession on the part of business owners is common. As opposed to selling to external parties, the owner transfers the ownership to workers by selling it one by one through the ESOP. The operation of the business to make this transfer carries the central process of valuation:

- Purchase Price of Owner Shares: The seller owner invariably transfers all or most ownership interests either to the ESOP. The valuation defines the price at which the company buys back those shares of the owner or the retiring participants. FMV must be accurate so that the owner of the property can get a fair price, and the price has to be defendable by the ESOP.

- Financing and Repurchase Liquidity Planning: The amount that the company is capable of raising debt to finance the share buyout depends on the value pegged by the valuation. It also directs the posting of future liquidity reserves where due to redemptions of employees and the carve-out of the owners.

- Timing and Phasing to Reduce Taxes: The owners may spread over the years any transfers they want of the ownership. The distinct tranches are based on different valuations that keep on changing according to the company performance and in the market. Such successive valuations affect the method of taxing the transaction, as well as the possibility of deferring capital gains.

Since valuations form the basis of transfer pricing and other forms of financing schemes, they directly determine how the succession plans will work as well as their success in line with the ESOP concept.

Real-World Tax Implications of ESOP Valuation Accuracy

A number of tax sensitive cases depend on accuracy in valuation:

- Section 1042 Transactions: The owner of a C-corporation is able to sell the stock of the company to an ESOP that holds at least 30-percent of the corporation stock and rolls the proceeds on a sale of that stock into qualified replacement property, and defer the capital gains tax. The reinvestment limitation is defined by accuracy of valuation. FMV that is overstated results in less allowable deferral; FMV that is understated can result in audit and penalties.

- S‑corporation ESOPs: Shares owned by an ESOP are not included in taxable income of an S corporation S-corporation ESOPs: are those in which share ownership held by an S-corporation ESOP does not count towards federal income tax purposes. Unrecognized share of the company earnings may lead to tax-free profit to the ESOP- a benefit to the employee-owners at a second hand. Nevertheless, the accuracy of valuation would result in accurate calculation of pass-through tax and reduce the risk of discrepancy.

- Deduction Limits and Compensation Structuring: ESOP contributions and stock based compensation is narrowly scrutinized by the IRS. In case there are inconsistencies between valuation and financial performance, deductions/max allowed limits could be challenged not only as to tax of corporations but also as to executive compensation forceful claims.

- ERISA Oversight: ESOPs should be defensible valuations under such ERISA standards of a fiduciary duty. The DOL can audit where valuation of oddities seems to be absentminded or vary in opposite to the current financial outcomes. When correctly done, a valuation reduces the exposure of the fiduciary and maintains the tax treatment.

Accurate valuation is more than just technical, but is at the core of tax benefits expected in order to escape tax penalties or operational risk.

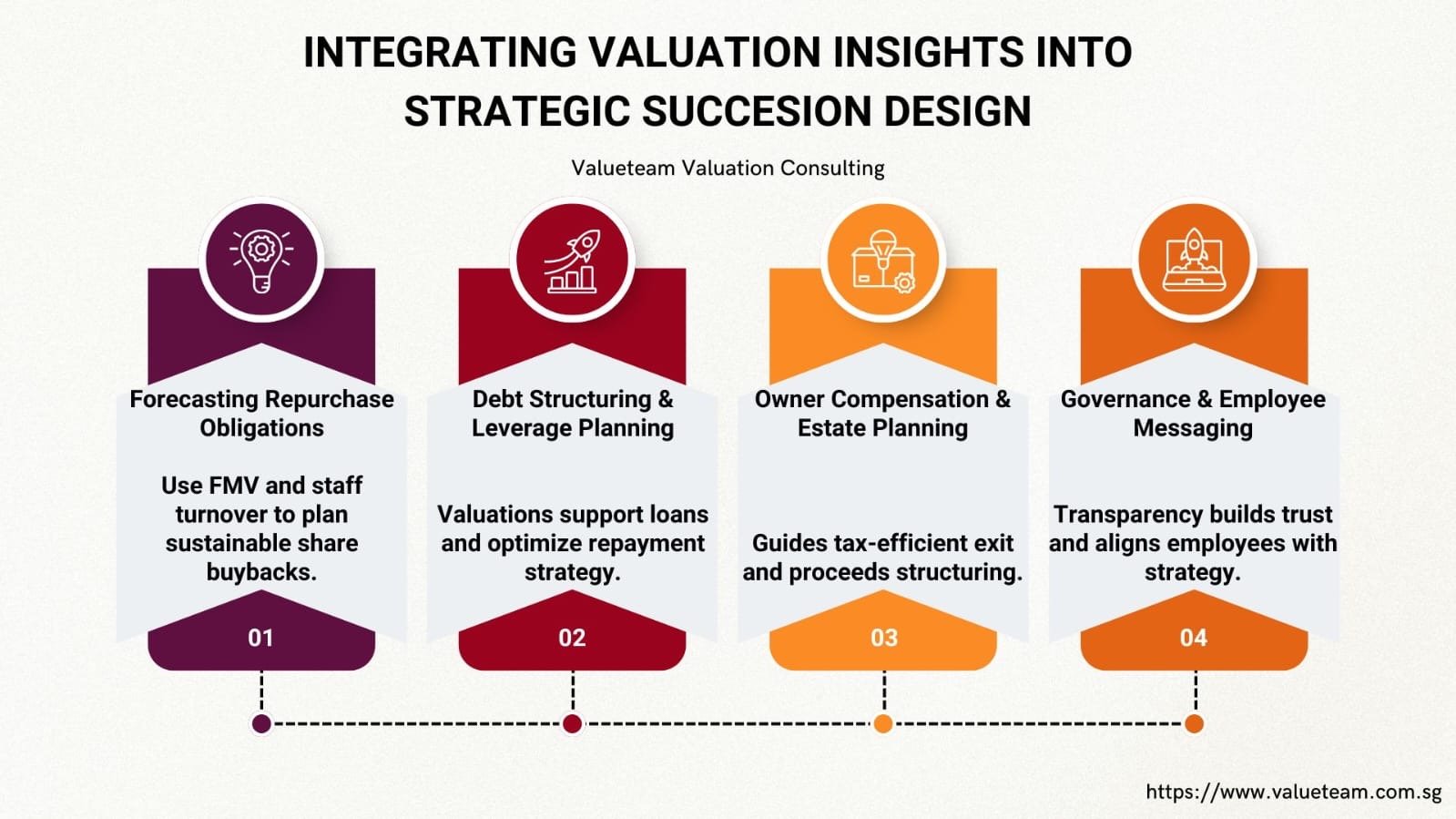

Integrating Valuation Insights into Strategic Succession Design

Successful ESOP succession planning builds from valuation insights:

- Forecasting Repurchase Obligations: The pro-rate FMV on a per-share basis along with the estimated staff turnover rates can be used to formulate long term financial models. This will ensure that the company can afford to repurchase the shares offered to retiring employees without upsetting cash flow.

- Debt Structuring and Leverage Planning: There is commonly the use of internal or outside debt in which the companies fund the ESOP buy out. The valuation report can be looked at by lenders to evaluate worth and ability to repay. Prudent valuation facilitates issuance of loans and can lead to decrease of interest expense.

- Owner Compensation and Estate Planning: Estate Planning/ Owner Compensation: Proper valuation determines the amount of gain subject to tax by the selling owner, and might have a bearing on the form in which proceeds are structured (e.g. ordinary income over time, capital gain deferral, estate gift). Some planning of exit strategies with tax efficiency also follows sequential valuation to decide the time to exit.

- Governance and Employee Messaging: Transparency in presenting boards and employees the valuation results builds-up credibility. Governance policies with references to methodology, review cycle, and decision limits make sure that valuation becomes the process of the organization with support of the strategy and trust.

There is hence more to valuation than determining share price; it is the foundation of the financial and communication framework of the effective ESOP transition.

Ensuring Validity: Working with Independent Valuers

Since valuation is a difficult process, with much at stake in tax reporting and succession planning, there is a need to consult with skilled professionals in the work of independent valuers. These professionals give:

- Objective Assessment: Buffering the share value of ESOP against internal influence or pressure.

- Methodological Rigor: Utilising income, market and asset-based methodologies, sensitivity testing should be based on company risk and industry standards.

- Documentation Strength: Prominent reports giving details of assumptions, market comparisons, control/markets adjustment and scenario analysis.

- Defensibility in Review: Reports capable of withstanding IRS, DOL, or ERISA inspection, showing historical support, and being consistent with financial statistics.

A value which can be subjected to audit is an affirmation of legitimacy in the tax filings and succession planning, and a defense against subsequent transaction liability to the fiduciaries.

Conclusion: Valuation as a Strategic Linchpin

Valuations under ESOPs do more than provide an internal price of a share- they affect significant company valuation course Singapore involving tax savings, succession implementation and financial planning. Independent valuations provide the business owners with an opportunity to unlock tax-efficient results, map their exit plans in line with employee value and assist anticipated corporate governance with realistic data.

No matter what stage you are in your ownership transition, designing tax-efficient compensation, or preparing a long term liquidity roadmap, combining valuation expertise into your ESOP planning will be crucial to compliance and strategic performance.

So summarily, ESOP valuations are not a cost; they are a business investment incorporating tax efficiencies and ownership succession strength and fidelity.