Advanced ESOP Accounting and Compliance Training

Common Accounting Mistakes in ESOPs and How to Avoid Them

Introduction: Advanced ESOP Accounting and Compliance Training

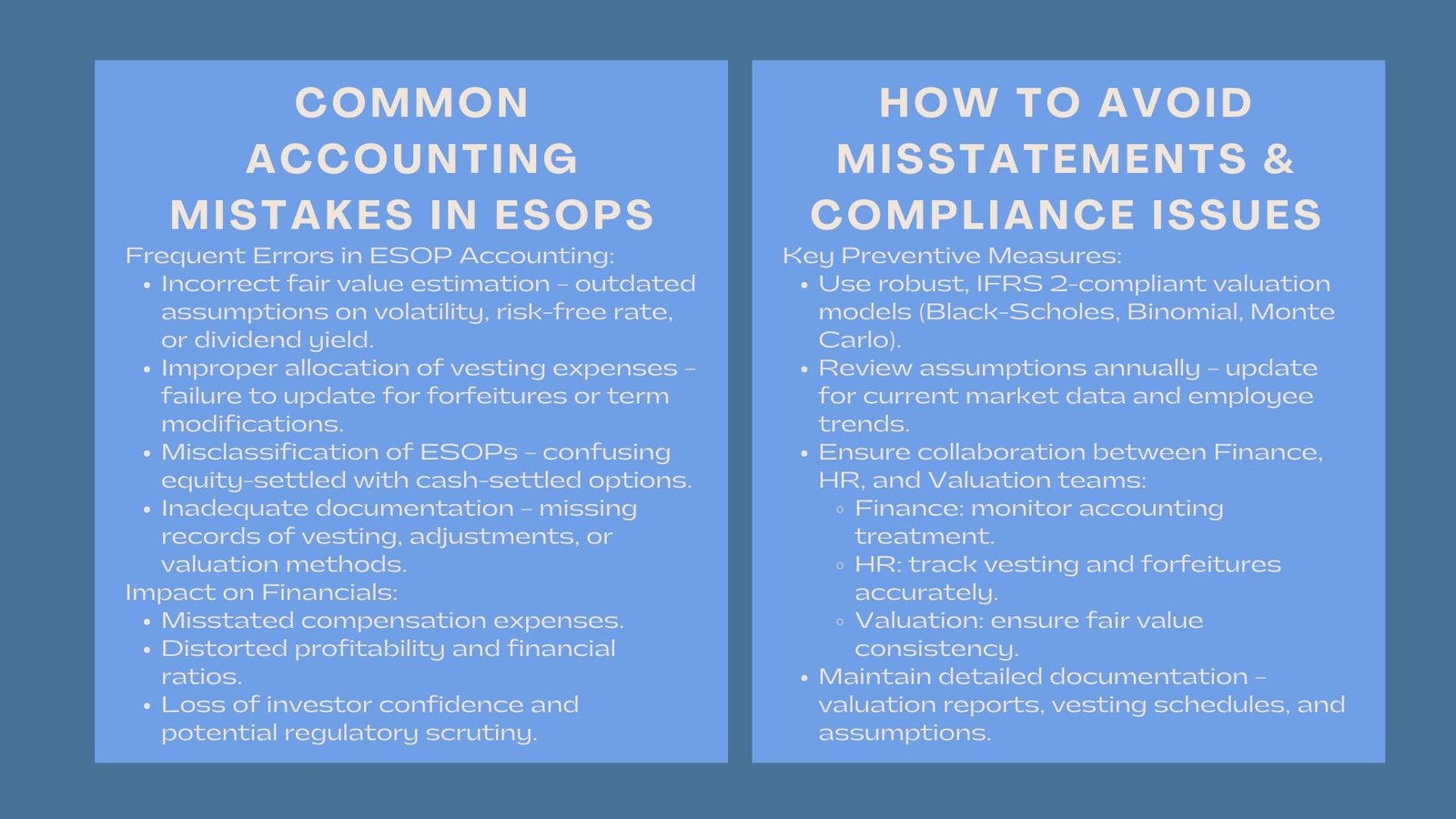

The ESOPs (Employee Stock Ownership Plans) and ESOSs are renowned incentives, although they are subject to accounting mistakes. Missteps are common in fair value estimation, allocation of vesting expenses and that of forfeitures. Such errors may differentiate the financial performance and can subject companies to regulatory investigations. Companies may use outdated assumptions regarding stock price volatility, risk-free rates, expected life of the options, or dividend yields. This can result in either an understated or overstated compensation expense, affecting both profitability and investor confidence.

The most common mistake is to appraise stock options inadequately- mistakes often occur because of the use of old or unsound assumptions. The second problem is IFRS 2 compliant ESOP accounting practices Singapore the inability to adapt to the forfeitures by employees or adjustment of the terms of vesting, which resulted in exaggerated costs of compensation.

By understanding these frequent errors, organizations can proactively implement strategies to avoid misstatements, maintain compliance with IFRS 2, and provide stakeholders with transparent financial reporting.

Avoiding Misstatements and Compliance Issues

In order to avoid such mistakes, companies need to have a strong model of valuation, review assumptions on an annual basis, and good records. The cooperation between financing, HR and valuation professionals is what makes sure that the treatment is consistent between periods of reporting.This ensures that the compensation costs recognized in the financial statements are accurate and reflective of current market conditions.

Second, collaboration between finance, HR, and valuation professionals is critical. Finance teams provide oversight on accounting treatments, HR ensures accurate common ESOP accounting mistakes and solutions Singapore employee records and eligibility tracking, while valuation experts confirm that the fair value calculations adhere to IFRS 2 standards. Maintaining detailed documentation of vesting schedules, forfeitures, and adjustments enhances internal control and minimizes the risk of errors

Lastly, understanding the distinction between equity-settled and cash-settled options is essential. Misclassifying these can have a material impact on financial statements. The other inaccuracy that has been made is to consider equity-settled options as cash-settled and this may cause tremendous chemical misstatement in financial statements. The most important thing is understanding and processing the IFRS 2 definitions.

Auditor and Investor Expectations

Auditors require open-minded assumptions of valuation and full disclosure. Any gaps in methodology, inconsistencies in assumptions, or lack of documentation can trigger audit adjustments, increase scrutiny, and potentially lead to regulatory issues. The investors seek transparency on the ESOP effect on profits and dilution. An auditing environment that is rigorous on an ESOP account provides trust and limits audit risk. Investors are interested not only in understanding potential earnings dilution but also in assessing the effectiveness of employee incentive schemes in driving company growth. By meeting these expectations, companies demonstrate strong governance, foster confidence in their reporting, and signal that employee incentives are aligned with long-term shareholder value.

Conclusion

To prevent errors in ESOP accounting, a matter that demands technical expertise is necessary accompanied with a sense of practical discipline. A firm that managed to approach ESOPs as rigorously as cash-based compensation is professional and honest. Correct and transparent accounting ensures that compensation costs are accurately reflected in the financial statements while aligning employee motivation with organizational performance.

After all, compliance but clarity is the objective. ESOP accounting is transparent, thus aligning the motivation level of the employees with the confidence of the investors, which is a win-win situation in the expansion of the business on a sustainable basis. Companies that master ESOP accounting not only protect themselves from regulatory risk but also create a win-win situation—enhancing employee engagement while maintaining the trust of investors, setting the stage for sustainable and profitable business growth.