Advanced ESOP Trends and Best Practice

Latest Trends in Employee Stock Option Plans in 2025

Introduction to Advanced ESOP Trends and Best Practice

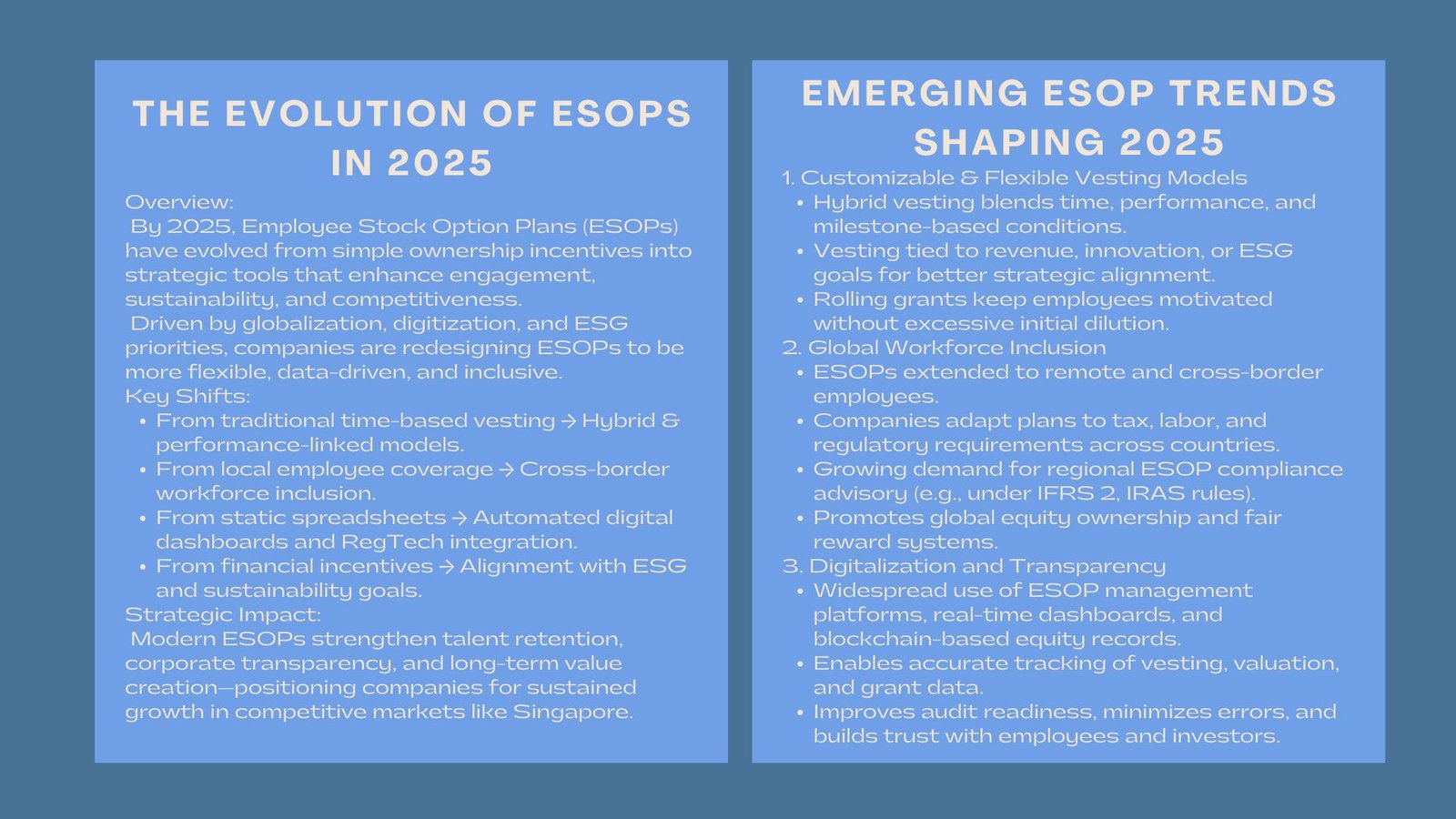

By the year 2025, Employee Stock Option Plans (ESOPs) have changed to much more than ownership incentives. The changing global economic conditions, competition of talents, and digitization compelled businesses to flexibilize ESOP to ensure inclusiveness and responding to sustainability objectives. Rapid digitization, global talent competition, and changing regulatory frameworks have compelled companies to rethink how ESOPs are structured and administered.

The 2025 ESOP trends for startups in Singapore have evolved and are getting more intricate in a vibrant market, including data-driven valuation, regulatory technology (RegTech), and cross-border mobility planning, where there are both startups and multinational corporations. These trends reflect a dynamic market environment where companies aim to motivate employees while maintaining transparency, governance, and scalability.

Trend 1: Customizable and Flexible Vesting Models

The conventional time-based vesting is being replaced by the hybridized model that enables the incorporation of the performance-based and milestone-based vesting. Companies are linking ESOP vesting to strategic objectives, such as revenue growth, ESG (Environmental, Social, Governance) goals, or operational milestones, ensuring that employee contributions are aligned with organizational performance.

Firms are now connecting Flexible and digital ESOP models for employee retention vesting to revenue growth, ESG delivery, or strategic accomplishments to make sure that the input of employees aligns to the performance by the firm.

Other technological companies have rolling grants, where employees can receive a new option every year, which is more effective at retaining without leading to high initial dilution. This approach effectively retains talent over the long term while reducing the risk of high upfront dilution. By customizing vesting schedules, companies can incentivize sustained performance, reward innovation, and enhance workforce engagement without compromising shareholder value.

Trend 2: ESOPs as a Tool for Global Workforce Inclusion

With the growing Remote and hybrid work, businesses are offering ESOPs to foreign workers. This has increased the number of transnational ESOP structures to suit tax and regulatory disparities in jurisdictions. Companies increasingly design cross-border ESOP structures to address differing tax regulations, labor laws, and withholding tax requirements in multiple jurisdictions.

The demand of local firms to comply with the IFRS 2 and local labor legislation, as well as the local withholding tax requirements, is growing in Singapore where firms are increasingly looking to get the regional ESOP compliance advisory. Providing ESOPs to a global workforce helps companies attract top talent worldwide while maintaining regulatory compliance and creating equitable incentives for employees regardless of location.

Trend 3: Digitalization and Transparency

ESOP administration sites are redefining the methods of the companies to monitor grants, vest road maps and valuations. Scalable ESOP management has become an industry standard consisting of blockchain-based equity records, real-time dashboards and automated accounting integrations. Companies now rely on platforms and dashboards that provide real-time tracking of grants, vesting schedules, and valuations. Some organizations even utilize blockchain-based equity records to enhance security, accuracy, and transparency.

This digitalization makes the ESOPs more transparent to the employees and the investors and makes them more audit ready and less error prone. Employees benefit from visibility into their equity ownership, vesting progress, and projected gains, which strengthens engagement and trust. Investors also gain confidence in the company’s governance and reporting standards, knowing that equity plans are managed transparently.

Trend 4: ESG and Long-Term Value Alignment

The amount of businesses integrating ESOPs and Environmental, Social and Governance (ESG) measures and metrics is on the rise. Employees who contribute to carbon reduction, social responsibility, or good governance may receive accelerated vesting or additional share allocations.The culture of purpose can be strengthened by ensuring that the employees who aid in cutting carbon footprint or good governance are accelerated in their vesting or given extra shareholdings. This approach not only motivates employees to contribute to sustainable initiatives but also enhances the company’s long-term value and reputation in the market.

Conclusion

The 2025 ESOPs are no longer fixed benefit programs, but contain tools of engagement, governance and growth.

Flexible, data driven, and inclusive ESOP models allow companies to have competitive advantage of attracting and retaining talent. Flexible, data-driven, and inclusive ESOP models give companies a competitive advantage in attracting and retaining top talent while ensuring transparency and compliance.

These emerging trends in ESOPs in the changing market in Singapore are an indication of a new era of equity-based compensation whereby innovation will meet compliance, and employee ownership will create sustainable value.

In the long run, the organizations that would be able to adjust to such trends will not just reward its people but also business proof them in the future in order to provide a more equal and high-performing corporate environment. Over time, disciplined and adaptive ESOP programs become cornerstones of high-performing, equitable, and future-proof businesses, fostering a culture where employee ownership drives both personal and corporate success.