Advanced ESOP Valuation and Ownership Training

How ESOPs Affect Company Valuation and Equity Structure

Introduction: Advanced ESOP Valuation and Ownership Training

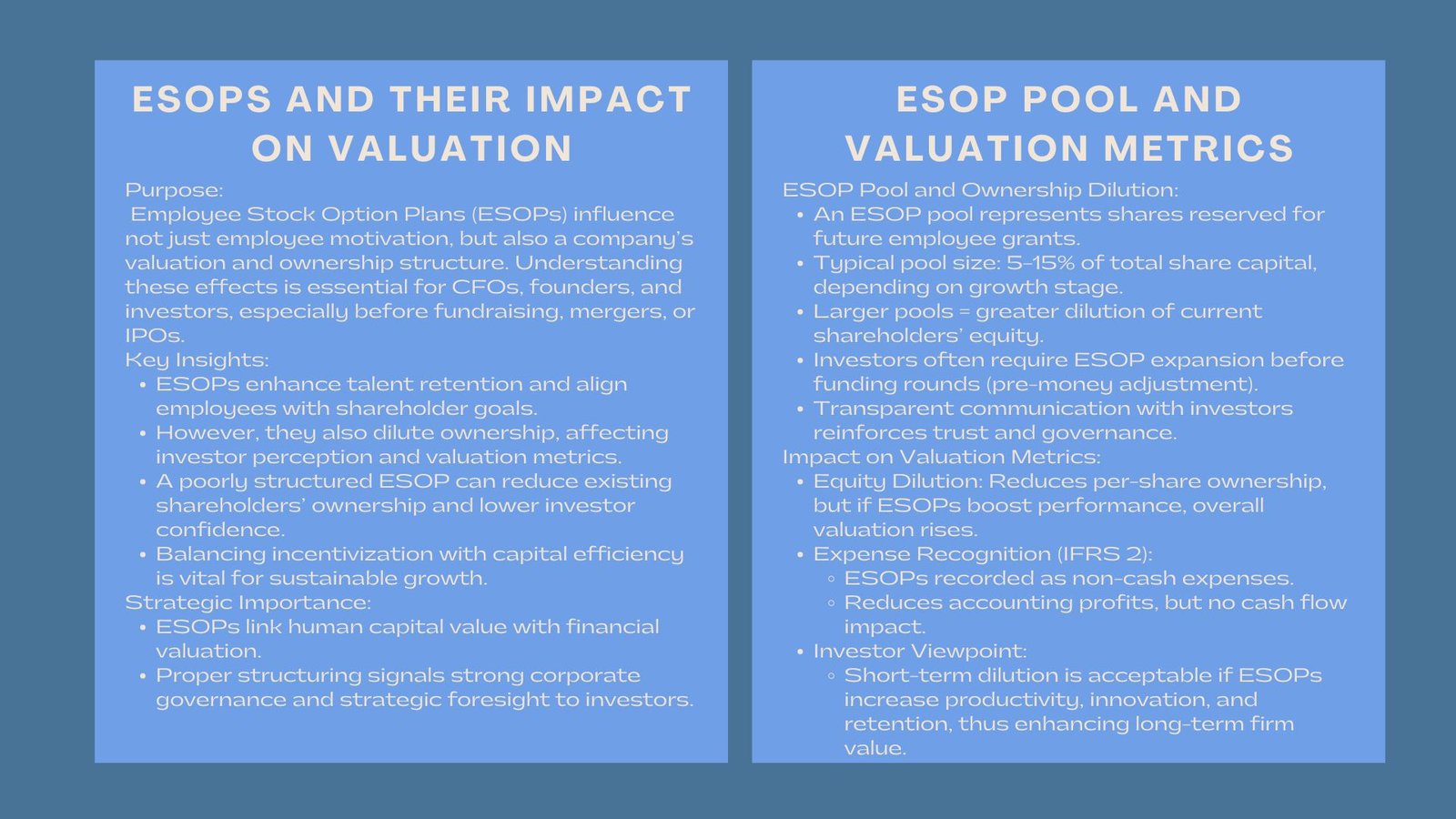

The valuation and equity structure of a company are directly affected by the Employee Stock Option Plans (ESOPs). Though they are very effective motivators of the workforce, they also symbolize a possible watering down of ownership which is one of the careful considerations of investors when an entrepreneur plans fundraising, merger, or IPO. However, while ESOPs serve as an incentive mechanism, they also have a direct impact on the valuation and equity structure of a company. For CFOs, founders, and investors, understanding these impacts is crucial, especially when preparing for fundraising rounds, mergers, or an initial public offering (IPO).

The impact of ESOPs on valuation is an important knowledge that CFOs, founders and investors have to be aware of when trying to make a choice between talent retention, and efficiency of purchase of capital. A poorly planned ESOP may reduce the proportion of shares held by existing shareholders, which can affect investor confidence and valuation metrics. Therefore, companies need to carefully balance the desire to incentivize employees with the need to maintain efficient capital structure and protect shareholder value.

ESOP Pool and Ownership Dilution

An ESOP pool is an amount of the equity of the company that would be granted in the future. The bigger the pool the greater the level of dilution that may be experienced by current shareholders. Larger ESOP pools mean that more shares will be issued in the future, reducing the ownership percentage of current shareholders.

The percentage of ESOPs normally accepted by investors is 5 to 15 percent of the entire amount of share capital based on the level of growth and number of people required.Venture capitalists often require companies to establish or refresh their ESOP pool before a funding round, rather than diluting ownership afterward. This pre-funding adjustment has a direct impact on the pre-money valuation and share percentages, which is an essential consideration for founders negotiating with investors.

Inventure capitalists frequently insist on businesses to renew or increase their ESOP pool before they are funded, that is, dilution is not something done to the company subsequent to funding. This has a direct effect on the pre-money valuation and share percentages. Clear communication with investors about the size and purpose of the ESOP pool also demonstrates transparency, governance, and strategic foresight.

Impact on Valuation Metrics

ESOPs have such impacts on valuation:

- Equity Dilution: The introduction of new shares dilutes the holders of the current share. If the ESOP effectively improves employee performance, productivity, and retention, the overall company value can increase despite minor dilution.

- Expense Recognition: ESOPs under IFRS2 are treated as expenses, and can decrease accounting profits, but it does not have an impact on the cash flow. This accounting treatment reduces reported profits but does not affect cash flows directly. Investors understand that these are non-cash expenses designed to enhance human capital and long-term growth.

- Although dilution does lower per-share results such as the EPS, investors tend to look favorably upon Impact of ESOP on company valuation Singapore, provided that they increase employee productivity, innovation and retention, which ultimately increases the company value. By understanding these impacts, companies can design ESOPs that support growth while maintaining the confidence of investors and other stakeholders.

Balancing Incentives with Equity Efficiency

The companies should strike a balance between employee motivation and retention of ownership. Best practices include:

- Establishing an adequate Equity dilution and ESOP planning for startups which is consistent with growth strategies.

- Reviewing unvested options after a while in order to prevent excessive dilution.

- Tying rewards on performance-based vesting.

An appropriate ESOP program is an indication that a company is concerned with good governance and capital discipline by the investors. Maintaining transparency with investors regarding ESOP policies and their expected impact on ownership and valuation.

A disciplined ESOP program demonstrates that a company prioritizes good governance and capital efficiency. It reassures investors that the company is committed to strategic growth while simultaneously rewarding the workforce.

Conclusion

ESPs are not only transforming the nature of companies paying attention to talent, but also valuing it. When they are arranged in an intelligent manner, they would draw quality professionals besides keeping investors at ease.

The trick is in the transparency and balance: to understand the ESOPs as a source of incentive and strategic capital tool. When structured intelligently, ESOPs attract top talent, motivate employees to contribute to long-term objectives, and enhance overall corporate value.

When the firms located in Singapore need to integrate the elements of valuation with compliance and communication with investors, it will help to make sure that ESOPs reinforce and not undermine the financial base of the company. With time, equity planning done in a disciplined manner, ESOPs will start to become a sustainable way of growing and creating value. Over time, disciplined ESOP planning evolves from a simple employee incentive into a long-term strategy for building value, loyalty, and shareholder trust, ensuring that both employees and investors benefit from the company’s success.