How to Implement ESOS Plans Successfully

How to Implement ESOS Plans Effectively

Guide on How to Implement ESOS Plans Successfully

The ESOS has become an important aspect of the contemporary compensation frameworks, particularly to the growth-oriented firms and startups. ESOS compensates the shareholder value by enabling employees to buy the company shares at a set price at a later date to motivate employees. Nevertheless, the actual effectiveness of an ESOS is not only related to its design but to its implementation and management as well.

In the modern competitive talent environment, ESOS implementation needs to be viewed as a strategic and operational project by the organization. Since plan design to compliance, valuation and communication, each of the stages is significant to the provision of the desired outcomes by the scheme.

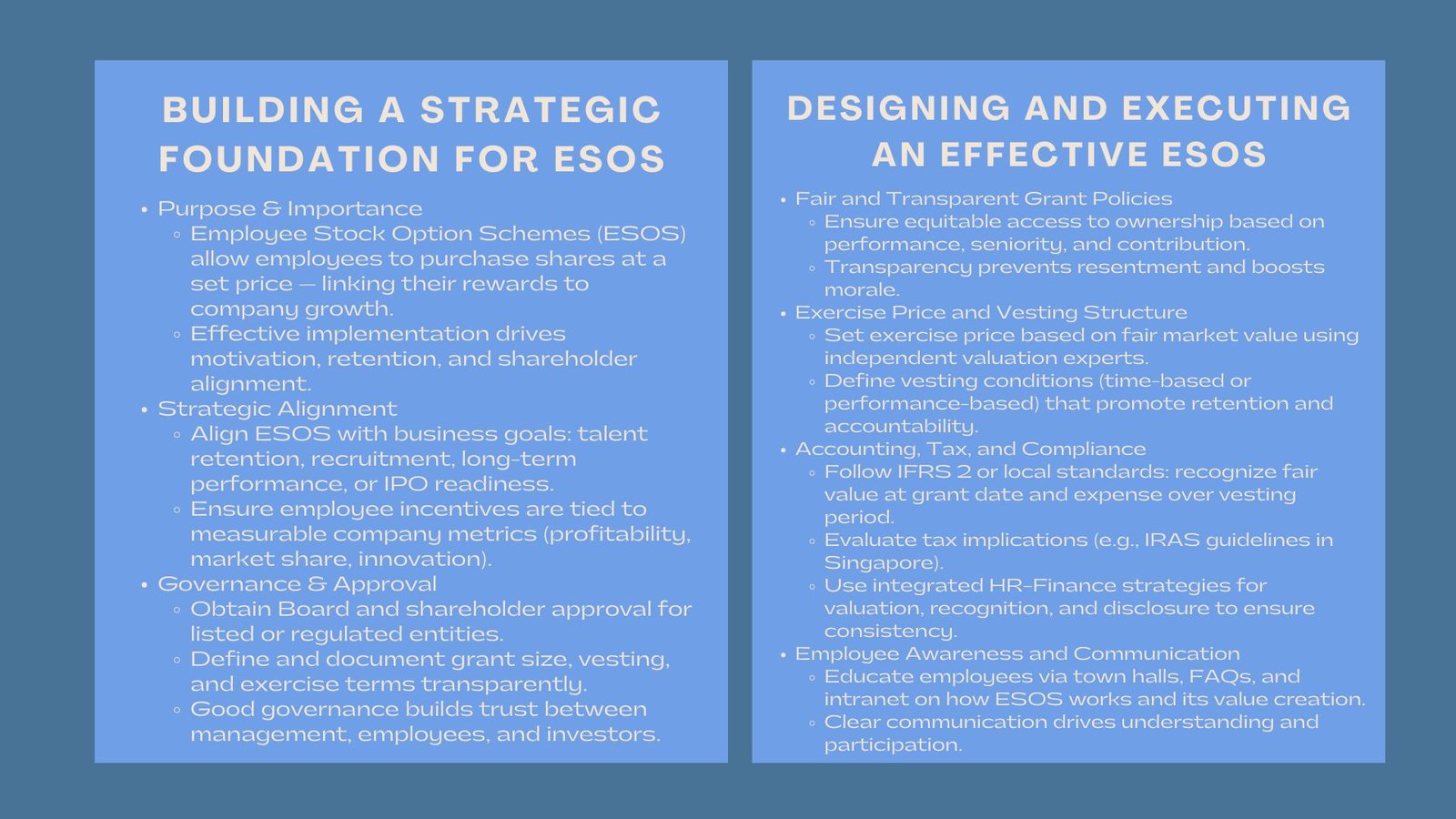

Creating a Strategic Foundation of ESOS.

Tuning ESOS to Business Objectives.

An ESOS cannot be applied on its own. The initial measure towards successful implementation would be to make sure that it is aligned with the overall business strategy of the company. Top management should specify the reason behind the scheme – is it to retain the best talent, recruitment, reward long term performance, or preparing to go public.

An effective ESOS has employee incentives that are tied to company achievements that can be measured such as profitability, growth in share, or innovation achievements. The engagement and loyalty increase automatically when employees are able to see the way their input converts into the equity value.

Gaining Board and Shareholder Approval.

In the case of listed companies or entities that are subject to regulatory supervision, ESOS introduction is usually sanctioned by the board and shareholders. The design, size of the grant, terms of vesting and exercise price should be recorded in a transparent manner. The existence of a distinct approval procedure will guarantee that governing standards are maintained and possible conflict of interests are reduced.

Good governance inculcates trust too, which is intra-organizational as well as inter-organizational, between the employees and outside investors who can take ESOS programs as a demonstration of an organization that is mature and growth-oriented.

Designing an ESOS That Works

Setting Fair and transparent grant policies.

The allocation of grants is the key to the success of an ESOS. This is because a fair and transparent approach makes rewards to be viewed as fair. Although top managers and executives may get bigger grants because of their role in strategy formulation, employees at all levels who perform well should have the feeling that they can get access to ownership.

The objective performance metrics, seniority, and value addition to the long term should also be used in the grant allocation policies. The openness of such policies will prevent resentment within the team and enhance morale in general.

Deciding the Exercise Price and Vesting Conditions.

The price at which the employees are to purchase shares (exercise price) should be paid according to the fair market value at the moment of granting. Independent valuation experts are usually employed by companies in order to be regulatory and accountable.

The Earning conditions determine the time at which employees are entitled to exercise options. These may be based on time (i.e. vesting after four years) or performance (i.e. based on a revenue or EBITDA target). The structure adopted must contribute to retention as well as to rewarding constant contribution.

Accounting and Regulatory.

All ESOS have to meet the applicable accounting standards, including IFRS 2 or local financial reporting standards. Compliance is the recognition of fair value at the grant date as a result of which the fair value is expensed as the vesting period.

Business organizations ought to also gauge the tax consequences of the organization as well as those involved employees. In Singapore, the Inland revenue authority of Singapore (IRAS) has certain requirements on the manner in which and when the gains linked to ESOS are taxed. Working together with auditors and advisors will be making sure that there is accuracy and compliance with the statutory requirements.

For many finance teams, developing an Implementing ESOS share-based payment strategy helps establish consistent processes for valuation, recognition, and disclosure. Such strategy not only improves compliance but it also simplifies communication between HR and the finance and auditors.

Publicizing and Implementing the ESOS.

Education and Awareness of the employees.

None of the ESOSs can achieve success when the employees do not realize its worth. Community communication is paramount, the employees should be aware of what the plan is, they should be aware of how the options are provided, and what is vesting and how working on the shares can result in wealth generation.

The technical issues of ESOS can be demystified by using town hall meetings, intranet materials and specific FAQs. Employees feel valued through the plan when they see how it connects their efforts to the growth of the company and this results in higher participation and more of them being engaged.

Legal Paperwork and Bookkeeping.

All terms of the plan ought to be well documented once approved in an ESOS agreement. This document defines the suitable amount of options, the timeframe during which they will come into force, the price of the exercise, and the forfeiture. It is important to keep the meticulous records such as grant dates, modifications and exercises to facilitate audit and compliance.

Equity management systems can also be automated to make this process easier through digital equity management platforms that automatically track and create statements and link with payroll and accounting systems. This saves time on the administration process and alleviates the possibility of human mistakes.

Post Implementation of ESOS Management.

Vesting and Performance Monitoring.

Continuous management is equally beneficial as preliminary installation. The HR and finance departments need to pay close attention to vesting plans, option exercises and forfeitures. The real-time tracking provides the accuracy of all accounting entries and the financial statements are updated with the current data.

The performance-based vesting terms must be revisited after one year to make sure that they remain in line with the corporate goals. In the event of a need, this may be adjusted– but such adjustments are regarded under IFRS 2 as incremental fair value adjustments.

How to deal with Employee Departures and Transfers.

The ESOS management has difficulties with employee turnover. Employers must have straightforward procedures that outline what will be done with unvested or even those that have been vested once the employee leaves, retires, or even when they are transferring to another country. There are plans where a grace period of exercising the vested options after termination is allowed and some plans require forfeiture upon termination.

These conditions need to be defined in advance to avoid conflicts and to treat cases in a similar way. Two more issues that have to be resolved by multinational companies are the taxes across borders and translation of currency values.

Continuous Checking and Reporting.

Regular reviews enable the management to formulate whether the ESOS is still achieving its targeted objectives. These reviews can involve the examination of the participation rates, turnover of the grantees, financial impact on the statement and feedback of the employees.

An ESOS plan implementation checklist can be an invaluable internal tool — covering governance documentation, valuation reports, expense recognition schedules, and audit compliance. Frequent reporting to the board and the shareholders enhances control and ensures transparency.

Taking advantage of ESOS to create Long-Term Value.

When properly applied, ESOS is not just a compensation process, it is a strategic engine that can make the employee ambition matching the success of the company.

ESOS allows startups to acquire early talent when cash compensation is scarce. It is used by established corporations as a reward of long-term service and to hold on to key leadership. The philosophy in both cases is similar because in each case, employees are empowered to be shareholders, which leads to sustainability in growth and prosperity.

To be effective, it should be implemented by a combination of various stakeholders such as HR to design it, finance to evaluate it, legal to comply, and management to give a strategic direction. The teams working together make sure that the plan is functional and inspiring, not just lawful.

Conclusion

An ESOS is not a single undertaking, it is a strategy that is linked to financial accuracy and culture-fitting. The key to success is the prudent design, sound governance, open communication, and constant monitoring.

Firms which take the time to establish an organized ESOS system which is based on compliance and equity will achieve increased employee participation and a long-term corporate growth. Competition in talent will only continue to worsen, and the ones that will be better placed to retain their top talent as well as encourage their better sense of ownership and responsibility both in their employees and the entire organization will be the ones who manage to implement equity incentives well.