Guidelines for IFRS Employee Stock Options

IFRS Guidelines for Employee Stock Options

Introduction: Guidelines for IFRS Employee Stock Options

Stock options of employees (ESOs) have become a very important part of the contemporary compensation plans as they provide employees the chance of being part of the prosperity of their company. But lurking in the background of these motivational advantages is a morass of accounting and reporting reporting requirements. International financial reporting standards (IFRS) are important when the company is based in different jurisdictions or preparing consolidated financial statements.

The IFRS accounting of the employee stock options is designed to provide transparency, consistency, and comparability in the recognition and disclosure of share-based payment by the companies. Effective implementation is not just a box-ticking exercise, but a measure of good governance, good integrity and good financial reporting.

This article discusses the manner in which companies are supposed to use IFRS in employee stock options with the major consideration being the principles, techniques of valuation, reporting, and best practices in ensuring that compliance is upheld.

Introduction to IFRS and Share-Based Payments.

IFRS 2: The Core Standard

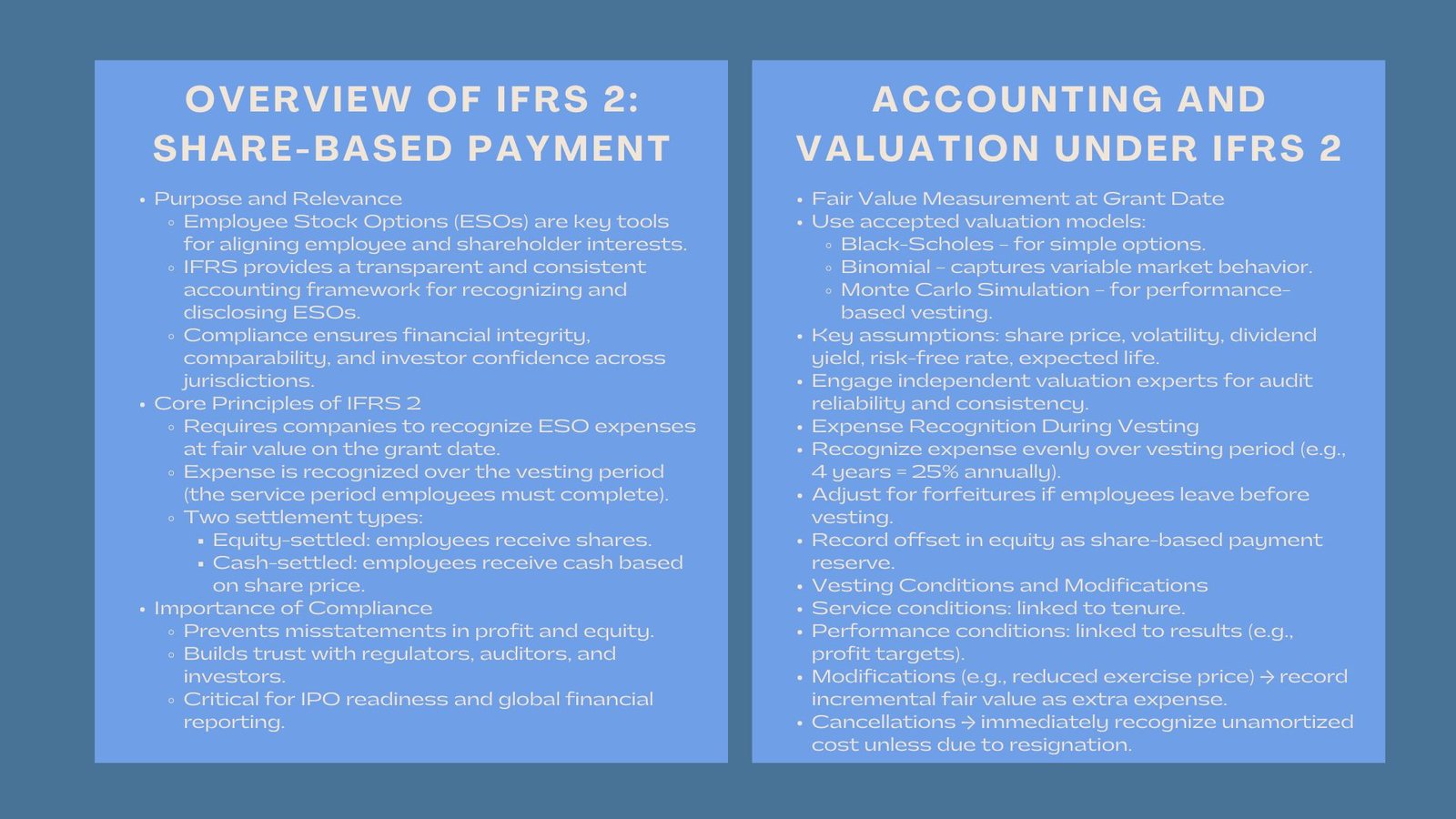

Employee stock options are regulated by the primary accounting standard, which is IFRS 2 — Share-based Payment. It expects firms to acknowledge that there is the cost of equity-based compensation as an expense to be calculated at fair value and in the duration of time during which the employees provide services in exchange of the award.

This fair value is calculated at the grant date, and it will be the same value throughout the vesting period. This is to be done so that the financial statements will depict the economic cost of granting options regardless of whether there is cash outlay at that point or not.

There are two forms of share-based payments under IFRS 2:

- Transactions settled with equity Employees are given shares or options.

- Transactions done by cash-settlement, whereby the employees receive payment according to the price of the shares.

The majority of stock options of employees belong to the category of equity-settlement, i.e., shares are issued by the company after fulfillment of the conditions of the vesting and exercise the options.

Why IFRS Compliance Matters

Proper recording of stock options has not only the financial reporting impact, but investor confidence, taxation and regulatory status. These irregularities during the provision of treatment may skew earnings, misrepresent equity and create compliance problems in the audit or IPO process.

Companies seeking to maintain transparency and credibility must therefore adopt frameworks that support IFRS reporting for employee stock options — ensuring fair valuation, clear disclosure, and robust internal controls.

The Accounting Process for Employee Stock Options

Measuring Fair Value

The stock options should be valued based on an adequate valuation model at the grant date. Most popular ones are:

- Black-Scholes Model – appropriate to straight-forward options that are predictable in nature.

- Binomial Model – an early exercise flexibility and variable market behavior captures.

- Monte Carlo Simulation – applied in situations where the vesting is based on the performance of the market.

In each model, several assumptions that are taken into consideration include share price, volatility, risk free interest rate, expected dividends, and expected life of the option. It is important to choose the appropriate model and justify inputs because minor changes can have tremendous impacts on expenses reported.

Most companies hire independent valuation experts who are conversant with the accounting standards as well as capital markets to guarantee reliability. This makes sure that the values reported in the financial statements pass through audit examination.

Expense Recognition During the Vesting Process.

The overall fair value of the granted options should be charged on the expense during the period of the vested term – normally in three to five years terms. This corresponds to the time of working with an employee to the right to exercise the right to their options to be granted.

What this means is that where options with a value of SGD 100,000 are awarded with a four-year vesting term, the company would record SGD 25,000 of the value as an expense on its income statement and an equal value in the equity section as share-based payment reserves.

Unvested shares are reversed in case employees resign before the vesting time ends. This will make sure that costs are accurate reflecting the actual service provided and financial statements are accurate.

Vesting Conditions and Vesting Modifications.

Conditions of Service and Performance.

Vesting conditions are important in deciding when and how the expenses are to be identified. Under IFRS 2, the timing is dependent on service conditions (e.g., how long the employee has been employed), whereas the ultimate vesting of the options depends on the performance conditions (e.g., performance/revenue targets).

The companies have to make assumptions about how likely they are to achieve the conditions of performance and make the appropriate adjustments to expense recognition. This should be done on a case basis and should be checked on a frequent basis to prevent under- or overstatements.

Amendments, Dismissals and Substitutions.

In situations where a business varies the conditions of an already outstanding stock option plan such as reducing the exercise price or increasing the vesting period, IFRS 2 requires any further fair value generated by the change should be recognized as an incremental expense.

In a similar way, in case of an option plan cancellation, all the unrecognized expenses should be recognized upon the cancellation, unless the cancellation will be because of non-performance or resignation. These events must be well documented to be audited and comply.

Disclosure Requirements under IFRS.

IFRS is based on transparent reporting. In their annual statements, companies should make extensive disclosures to enable investors and other stakeholders to know what is happening in stock option plans and their effects. Such disclosures normally entail:

- An account of the share-based payment arrangements that are in place.

- The amount and weighted-average price of the options granted, exercised, and forfeited in the year.

- The fair value of options obtained during the grant date and the assumptions employed in the valuation.

- The total expense of share-based payment borne in the period when the reporting is of the expense.

These conditions make sure that the readers of the financial statements are able to evaluate the dilution impact, cost implications, and alignment of the management incentive with the interests of the shareholders.

Many organizations rely on an Employee stock options accounting IFRS framework or internal policy manual to ensure disclosures remain consistent, audit-ready, and compliant year after year.

Practical Considerations for Implementation

Corporation between Finance and HR.

The cross-functional collaboration is necessary in order to implement IFRS-compliant ESOP or ESOS plans. HR takes care of plan design and employee engagement whereas finance ensures the valuation accuracy and accounting compliance. Communication between the two departments should be regular so as to synchronize the grants, vesting schedules and the time frame of recognizing expenses.

Technology and Data integrity.

The complexity of share-based payment plans has increased and therefore manual record keeping cannot be relied upon any more. Equity management systems based on the cloud are able to synchronize valuation updates, monitor a vesting schedule and integrate data with the financial reporting software. This reduces errors and improves the audit traceability.

Preparation and Review of Audits.

Companies ought to run stock option accounting audits internally before end-year audits. Certain powers aid in completeness and accuracy Reconciliation of grants, forfeitures, and exercises. Auditors are provided with the required transparency and assurance as the documentation of valuation approaches, model assumptions, and approval procedures is made.

The Global Context of IFRS 2

With the current growth of equity-based compensation internationally, IFRS 2 is a harmonizing standard that facilitates cross-border uniformity. Companies that have subsidiaries in various jurisdictions are able to include comparatively more accurate results, and investors gain a better understanding of the incentive structure by management.

As an example, Singapore has implemented the Singapore Financial Reporting Standards (SFRS), which are entirely based on IFRS regulators. This makes sure that the local companies, particularly those that are seeking foreign investments or public listing, are able to provide financials that are international standards.

Conclusion

Employee stock options represent an effective tool of aligning corporate success with the ambition of employees that should be accounted with strictness, discipline, and transparency. IFRS has offered a healthy system to make sure that even economic worth of such awards is well represented in financial statements.

Through the application of principles of the IFRS 2, effective internal controls and the use of valuation expertise, companies can make sure that they comply with the standards and still maintain the motivational focus of their equity compensation plans.

With transparency being as important as performance in an environment requiring, organizations that excel in reporting stock options using the IFRS not only satisfy their regulators, but also enhance their reputation to uphold good governance and financial integrity in the company.