Certified Startup Equity Incentive Course

Share-Based Payment Strategies for Startups

Introduction to Certified Startup Equity Incentive Course

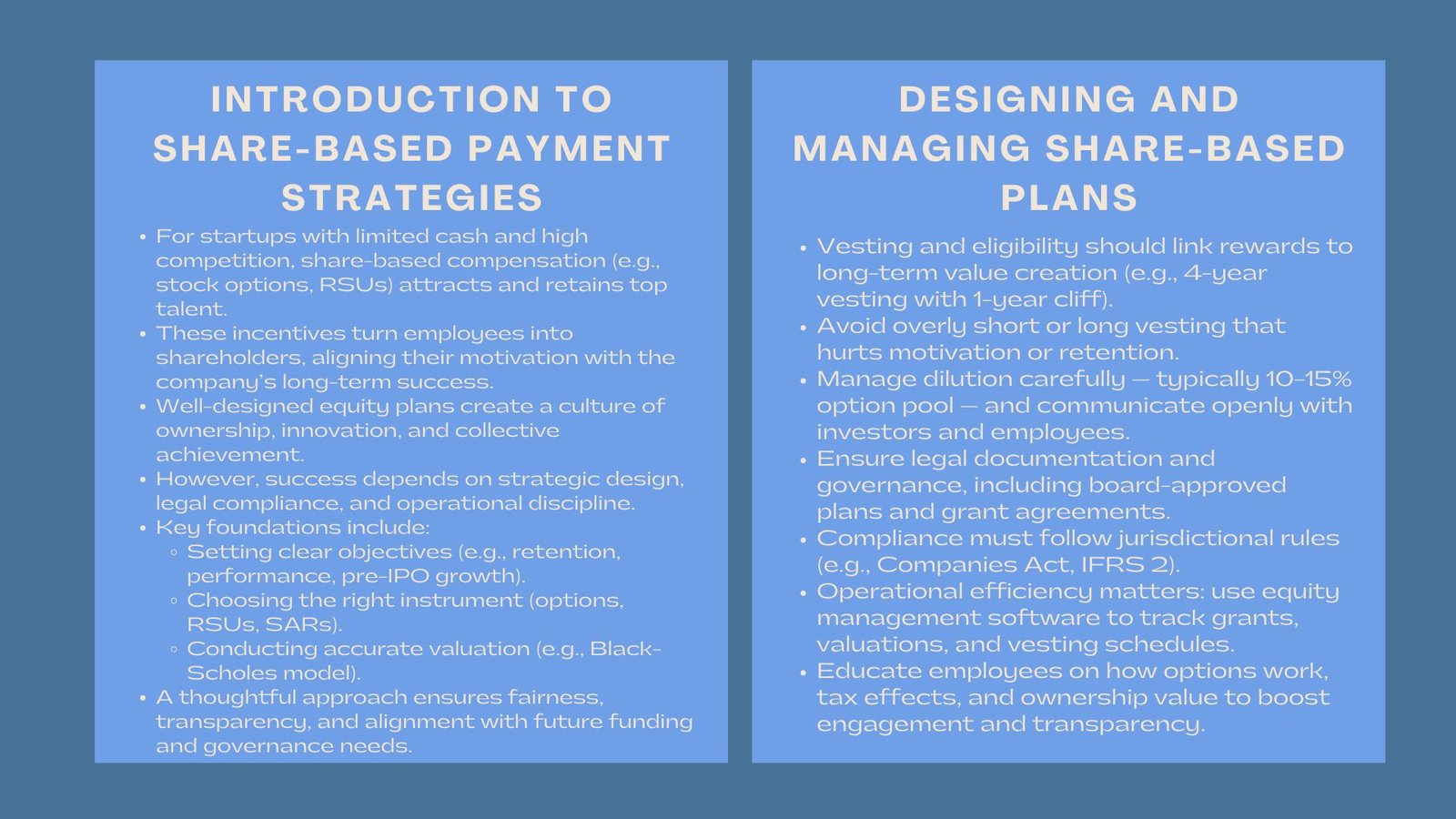

Talent is all that it is in the case of start ups. In case of limited funds and high competition in the market of skilled professionals, founders should be creative about how to attract and retain high performers. The incentive of share based payment, especially in the shape of stocks option or restricted stock unit (RSUs), has taken the favourite position as a means of aligning worker motivation with the business development.

These rewards based on equity do not only reward employees but also turn them into shareholders of the business project. Tying individual efforts to company success, startups develop the culture of the common cause and long-term investment.

Nonetheless, these plans have to be designed and implemented with strategic visioning, compliance consciousness, and operational accuracy. This paper will examine how start-ups may design effective share-based compensation plans, including planning, implementation, and disclosure.

Developing a platform of Equity-based Rewards.

Learning the Role of Share-Based Payments.

A startup has to establish the purpose of the introduction of any equity compensation plan before it is launched. Is it to save on cash and rewarding early employees? In order to reinforce retention prior to a subsequent round of funding? Or to motivate performance of leadership prior to IPO?

The objective behind all design choices will be the purpose behind every design option, including who will receive an option, and how vesting will be designed. A clear goal will make the plan stay on course as far as financial capacity and growth path will be concerned.

Selecting the Right Equity Instrument.

There are a variety of instruments Starups can employ such as stock options, RSUs or performance based share grants. The most widespread are stock options as it grants an employee the right (without an obligation) to purchase shares at a specified exercise price in future.

RSUs on the other hand are less complicated but usually costlier to account. Phantom shares or share appreciation rights (SARS) are also used by a company to issue shares when it is impractical to issue equity because of ownership limitation or local law.

The choice of the appropriate structure is determined by the level of development of the startup, the stability of valuation, and the jurisdiction laws. The flexibility and simplicity in many cases are at a higher priority than the complexity in small firms.

Valuation as the Foundation Stone.

All share-based payment plans revolve around valuation. The fair value of the stock options or shares should be estimated during the grant date and usually by models like the Black-Scholes or binomial simulations.

Proper valuation will provide equity to the employees, adherence to accounting rules such as the IFRS 2, and openness to investors. Hiring an experienced valuation specialist in the initial part of the work can prevent the upcoming disagreements and reporting inconsistencies.

Establishing a successful Share-Based Pay Structure.

Vesting Conditions and Eligibility Definitions.

This is because eligibility must be based on those roles that lead to long-term value. The biggest grants usually go to the founders, executives, and even early employees, yet even support personnel should be offered smaller allocations to encourage collective ownership.

Conditions of vesting are also important. An example is four years of the vesting period with one-year cliff, i.e. employees have to remain at least one year before the shares can be vested. Alternative performance-based vesting in startups can be based on revenue goals or market achievements.

The vesting program must balance both retention and the motivation of employees – not too long that it makes them not participate, and not too short as this may demoralize the employee.

Striking the right balance between Dilution and Incentives.

The rewards based on equity are bound to lead to dilution of ownership. The size of their option pool must be managed by founders paying close attention to their sustainability above funding rounds, which is normally 10-15 percent of overall equity.

Being able to communicate this on a clear basis to the investors and employees will instill trust and avoid any friction in the future. Dilution and valuation-related transparency enhances equity and trust in the company compensation strategy.

Administration andization and Records.

Formal governance documents, such as shareholder resolutions, board-approved plan and employee grants agreements must support every share-based payment plan.

The compliance with laws depends on the location. As an example, share plans in Singapore have to comply with the Companies Act and, in the case of listed companies, SGX Listing Rules. In the case of startups planning to expand regionally, the legal cross-border checks might be required further.

Establishing a Share-based payment compliance strategy early in the process helps ensure that documentation, disclosures, and reporting align with both regulatory requirements and best practices.

Implementing and Managing the Plan

Employee Communication and Education.

A successful share plan is based on transparency. Most employees, particularly the new ones to equity compensation, might not be fully aware on how the options work, how the vesting works and the tax benefits on exercising.

Informational sessions, written guidelines, and open channels of questioning should be organized in the startups. Motivation naturally increases when the employees have a clear understanding of the relationship that exists between their performance and the possible ownership.

Tracking, Valuation, and Record-Keeping.

The process of running an equity plan manually with spreadsheets proves to be inefficient with the expansion of a company. Specialized equity management software could automate the process of tracking grants, schedules of vesting and valuations, and be accurate and audit ready.

Effective record-keeping also assists in the regular reporting of the financial performance and assisting the investors to evaluate the future impact of dilution on the company. Precise record keeping on grant dates, fair values and modifications is required by auditors especially.

Tax and Accounting Investigations.

Accounting wise, share-based payments are controlled by the IFRS 2 or local standards. The fair value of options will have to be recognized as an expense throughout the vesting period. Companies should also reveal important assumptions according to valuation like volatility and expected life of options.

The taxation can be complicated where employees can face a liability on exercise or sale of shares. Tax advisors must collaborate with startups to help them comply with and to inform the participants about tax obligations.

In the case of the early-stage firms whose internal resources are limited, a Stock options implementation guide may be used to describe significant milestones in the process, such as grant approval to financial recognition to ensure that there will be consistency and compliance all the way through the lifecycle of the plan.

Attractive Strategic Advantage of Share-Based Compensations.

Performance and Retention Alignment.

Share-based compensation will promote retention by ensuring that employees are rewarded to remain at the company even during periods of major growth. It also aligns their financial interest with the performance of the company, that is the employees are directly benefited when the company is valued.

Such a success mindset is especially strong in start ups, where the nimbleness and teamwork are what constitute success. Workers who also own shares will tend to take challenges as entrepreneurs, thus making them innovate and take responsibility.

Fundraising and Exit Strategies Support.

Properly organized equity plans are also strategic in the process of fundraising. The intensity of the compensation scheme in a startup is an evaluation that is usually done by investors to determine the quality of governance and the maturity of the leadership.

Once an IPO or acquisition takes place, the worth of such share-based compensations comes to life, that is, the paper incentives turn into real monetary rewards of the committed employees. This story makes the hire reliable and a good reputation to be hired again.

Developing Culture of Ownership.

Participation in equity changes the culture of the company. Employees become more than passive participants, and they become active stakeholders with a drive to act due to enthusiasm and to win the prize. It builds internal cooperation in addition to enhancing productivity due to this sense of ownership.

This can be considered to be one of the greatest and the long term advantage of having a considered share-based payment plan to the founders.

Conclusion

In the case of startups, share-based payment strategies are not just a financial instrument, but it is a foundation of the sustainable development. These plans create loyalty, a driving force of innovation, and a good sign of good governance to investors by matching the aspiration of employees and the success of the organization.

Strategic clarity, strict compliance, and clarity of communication are essential in effectual implementation. Startups that invest in these principles continue to enjoy important competitive advantages early on – able to retain the best talent and develop a culture of shared success and ownership.