IFRS Reporting Requirements for ESOS

IFRS Reporting Requirements for ESOS

Introduction to IFRS Reporting Requirements for ESOS

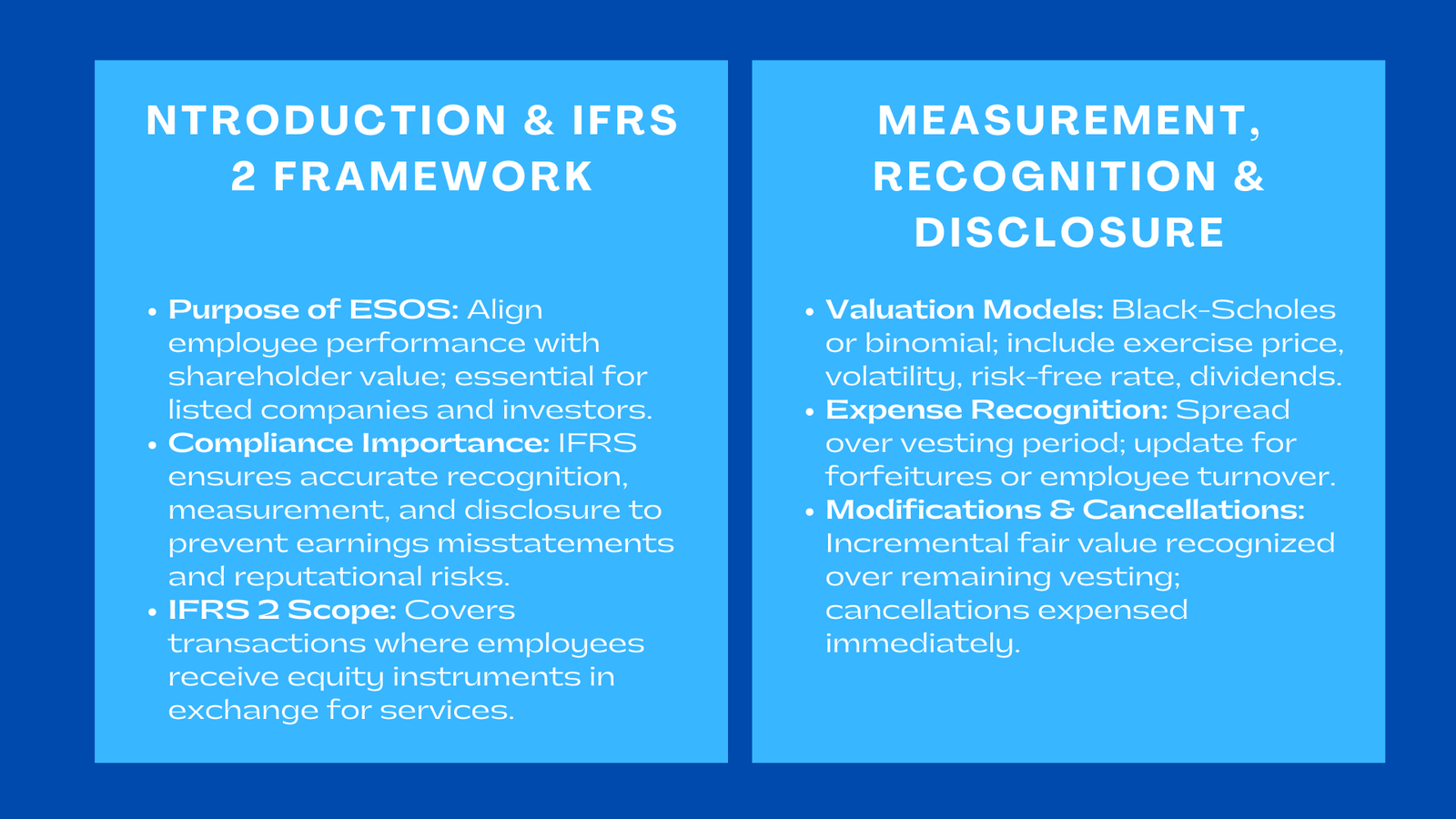

Employee Stock Option Schemes (ESOS) have emerged as one of the most effective methods of aligning the performance of employees with the shareholder value. Any company, particularly a listed one or one that wants to attract investors, in the modern global market, has to consider such share-based payment arrangements as required by International Financial Reporting Standards (IFRS). It is difficult not just to appreciate the options but also to identify, quantify, and report them correctly in the financial reports.

Since regulators and investors require more transparency, compliance with the principles of the IFRS would guarantee that the financial impact of stock options are well reflected. Earnings misstatements, compliance risk and reputational harm may result due to missteps in the reporting. This paper is specifically interested in the accounting and reporting of ESOS according to the IFRS 2, and gives a comprehensive advice to companies that use and issue such plans, including guidance on ESOP valuation services Singapore.

1. The IFRS 2 Framework of ESOS.

1.1 Scope and Core Objective

The IFRS 2, share-based payment, defines how to treat all the transactions where an entity is being provided with goods or services in consideration of equity instruments. In the ESOS, share options are given to employees who give them services within a set of time. The requirement of the standard is that the fair value of such options be calculated at the date of granting and must be charged as an expense during the time of the vesting period.

This will take care of the fact that the cost of the staffs compensation using stock options is reflected in the systematic way that reflects the time that employees have given their services. Thus, financial statements give a true account of the economic cost of equity-based rewards.

1.2 Making the difference between Equity-Settled and Cash-Settled Plans.

One of the key requirements of IFRS 2 is that between a cash-settled and equity-settled transaction, there is a need to differentiate between these two. In the case of ESOS, the general classification is that of equity-settled schemes because employees are given shares on the exercise. Nevertheless, there are also other organizations that provide tax or liquidity reasons to use cash equivalents, which form hybrid structures and demand special accounting treatment.

Equity settled ESOS are determined based on grant-date fair value whereas cash plans are remeasured at the reporting date. This distinction in itself influences the volatility in earnings and the presentation of the balance sheet making classification a highly important initial compliance step.

2. Principles of Measurement and Recognition.

2.1 Two steps are necessary to determine Fair Value at Grant Date.

An option-pricing model, whether the Black-Scholes or the binomial model, is normally used to determine the fair value of a stock option. Such models take into account the exercise price, anticipated volatility, the interest rate which is risk free and anticipated dividends. The IFRS 2 stipulates that only market and non-vesting terms should be reflected in the fair value measurement at the time of grant whereas, service and non-market terms of performance influence the number of options to be vested.

To illustrate, a technology start-up company assigning alternatives to engineers may operate a forecasted volatility relying on analogous traders in the market in case its trading track record is inadequate. This is a cautious projection that will see that the recorded cost actually represents what is anticipated in the market as opposed to making a wild guess.

2.2 Expense Recognition over the Vesting Period

When fair value is ascertained, the overall cost of the ESOS has to be identified as an employee benefit cost during the time of the vesting. The gradual use of employee service is reflected in the accounting entry. Companies have to re-evaluate the estimates of vesting on a regular basis and revised the cumulative expense.

An example of this is in case 10 percent of the workforce is supposed to turnover prior to being vested and this expectation later changes to 5 percent, then the cumulative interest should also be updated to represent the new expectation. This dynamic recognition process would make the financial statements to be up to date and innovative over the vesting period.

2.3 The Process of Modifications, Cancellation and Settlements.

Practically, the firms tend to alter ESOS plans to alter the price of the exercises, lengthen the period of vesting or speed up the process of vesting in the occasion of a merger. In the IFRS 2, incremental fair value due to such modifications has to be recognized throughout the remaining period of the vesting. In case of cancellation of the plan, all unrecognized expense should be recognized in profit or loss.

These regulations make sure that the firms cannot change the amount of profits through the strategic manipulation of the terms of options. It also instills uniformity and comparability over the reporting periods enhancing investor confidence.

- Disclosure and Presentation Requirements

3.1 Financial Statement Disclosures

Transparency is central to IFRS reporting for employee stock options, and companies must disclose detailed information about their ESOS plans. Required disclosures include:

- The nature and size of share-based payment plans in the period.

- The determination of fair value.

- The outstanding options, granted options, exercised options and forfeited options based on the number of options and the weighted-average price of the options at the time of exercise.

- All costs that have been identified to be paid to the share owners.

Such revelations help investors, analysts, and auditors to know the valuation mechanisms as well as its financial impact.

3.2 Case Study: ESOS in Practice Reporting.

Assume a Singapore-based firm which is awarding 100,000 shares of stock to its staff at exercise price of SGD 2.50 in a market where the price is at SGD 2.50. It will be calculated at fair value of SGD 0.80 per option at the date of grant. In the three years the vesting would be done, an annual loss of SGD 26,666 would be recognized including forfeitures.

With the IFRS 2 principles, the company is assured that the cost of rewarding its employees by ownership incentive is well reflected in the financial statements. This also increases investor confidence and credibility of valuation due to such reporting integrity.

3.3 Automation with Consolidated Reporting

The integration with consolidated reporting, which will be discussed in this section, is missing. In cases where a parent company vests options in the employees of subsidiaries, IFRS 2 has a requirement that the subsidiary recognizes the service expense despite the issuance of shares by the parent. The counterbalancing entry will be determined by the type of arrangement, which is the parent contribution of equity or intercompany liability.

It is also a treatment that avoids distortions at the group level and the compensation costs are reflected where the underlying services are rendered. It is a case in point of the IFRS 2 focus on recognition of accounting being in harmony with the substance of transactions.

4. Implementation Problems and Best practices.

4.1 Data and Valuation Accuracy

The correct ESOS accounting depends upon the sound data-employee turnovers, exercise habits and share volatility. The startup or a private firm may have no history, and it is associated with making fair value a complicated task. Engaging in collaboration with professional valuation specialists helps in eliminating this risk and makes sure that models are in line with IFRS expectations.

4.2 Governance and Internal Controls

The company is guided by the law set by the Ministry of Interior. Strong internal controls regarding the share based payment processes are essential. These are approval processes of grants, recording of valuation assumptions and prompt communication with auditors. Open system reduces the possibility of mistakes and regulatory inspections.

4.3 The fourth section is the use of Technology to achieve Compliance.

ESOS reporting is made easier by the modern accounting systems and cloud based equity management tools. Automated process of tracking vesting schedules, forfeiture and fair value updates will minimize the errors in the manual process and increase audit preparedness. Such tools come in handy particularly when multinationals have operations in jurisdictions that have different requirements of disclosure.

5. Strategic Insights: Going Beyond Compliance.

Although the technical requirements of the IFRS 2 are strict, there are strategic gains that companies can get through appropriate ESOS reporting. Clear-cut, properly-layered plans increase employee credibility and investor image. Moreover, accurate employee stock options accounting IFRS compliance can influence business valuation, merger readiness, and funding negotiations by demonstrating sound governance practices.

Firms incorporating ESOS as a strategic reward as opposed to an accounting requirement are in better places to attract and retain talented employees. With the changing markets, by ensuring that their compensation policies are in line with transparent reporting, the companies not only meet the requirements, but also reinforce the corporate reputation and competitiveness.

Conclusion

With the changing environment of financial responsibility, the art of IFRS reporting in relation to ESOS is not only an obligation, but also a strategic chance to exploit. Companies can use the principles of IFRS 2 on classification, valuation, recognition, and disclosure to show the financial statements that present the economic reality in an integrity manner.

In addition to compliance, strong ESOS accounting will help in building stakeholder trust, strengthen alignment between shareholders and their employees, and putting the organization in a strong place to grow sustainably. With world regulators tightening up the disclosure rules and investors expecting more disclosure, companies that are good at reporting the ESOS report will emerge as leaders in financial compliance and corporate credibility.