ESOS Accounting Best Practices

ESOS Accounting Best Practices

Introduction to ESOS Accounting Best Practices

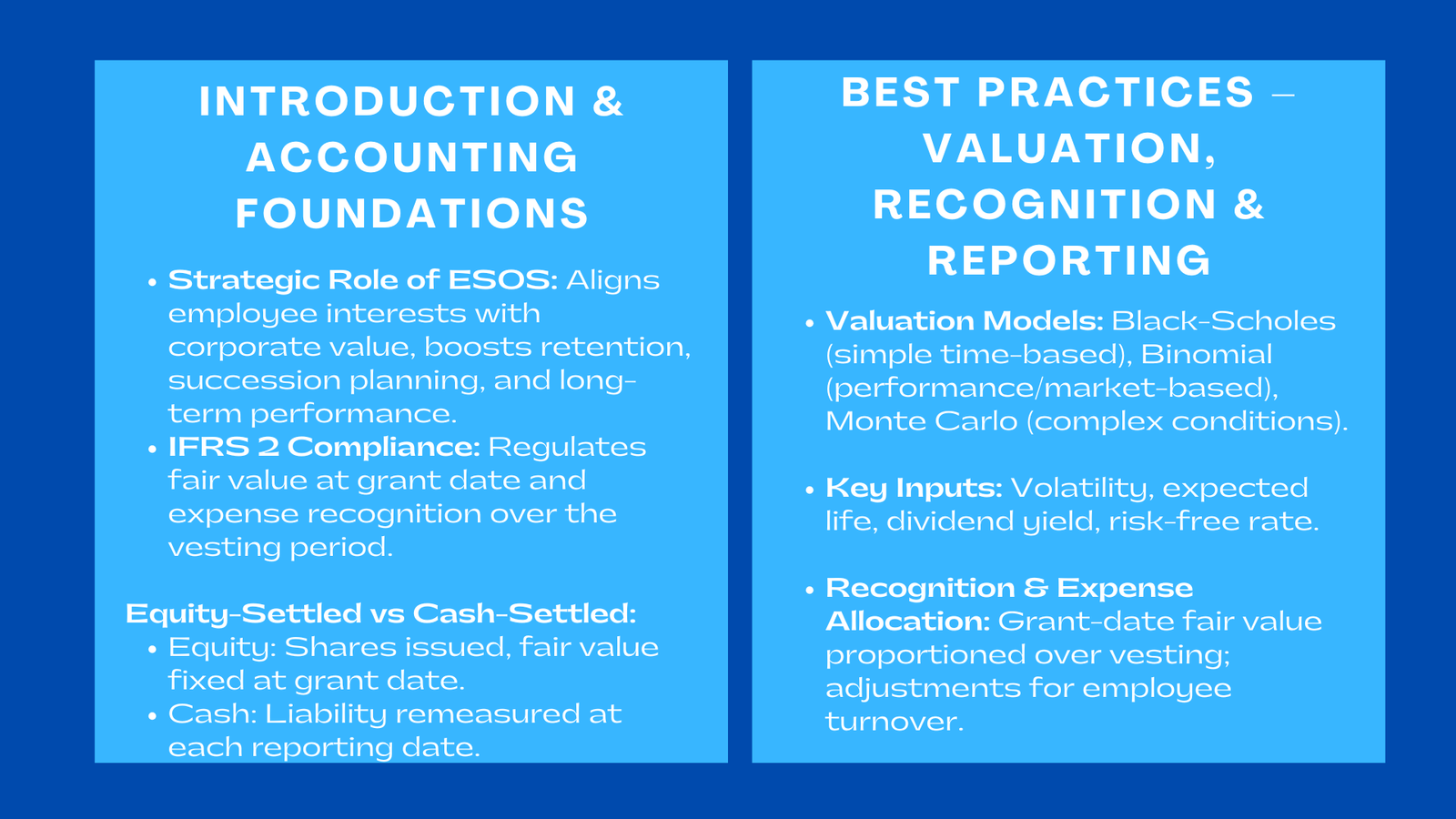

Employee Share Option Schemes (ESOS) have emerged as part of the new compensation policy, and companies have been able to align the interest of employees with the corporate value over long-term scope. Not all is rosy behind their inspirational call though: there is an intricate accounting issue involved as to how to be compliant with IFRS 2 and at the same time be truthful about the cost of share-based payments in financial statements.

Proper ESOS accounting is not only a regulatory obligation but it is also a strategic need. Unrecognized expenses, inappropriate models of valuation or poor disclosed information may undermine investor trust and expose themselves to audit questioning. With an increasing number of companies in Singapore and the wider Asian region implementing ESOS in their bid to recruit and retain the most talented people, the need to set best practices in the accounting and reporting field has never been more imperative, especially for those following an accounting firm valuation Singapore step‑by‑step guide.

The next sections will describe a logical and realistic method of ESOS accounting – not only valuation and recognition but also compliance monitoring and disclosure excellence.

1. Learning the Accounting Foundation.

1.1 The IFRS 2 Framework

The international financial reporting standards (IFRS) 2 regulate the accounting of the share-based payments such as the ESOS. It involves the record keeping of fair value as of the grant date and expenses during the vesting period. This will guarantee that the cost of compensation as reported is based on the economic benefit that employees get.

Most companies tend to initially underestimate the bureaucracy that can arise when harmonizing the needs of a number of tranches, performance requirements or market-based vesting requirements. Adhering to employee stock options accounting IFRS guidelines ensures consistency across reporting periods and comparability with peer companies.

1.2 Equity-Settled vs. Cash-Settled Options

Under the IFRS 2, ESOS transaction may be equity-settled or cash-settled.

Equity-settled: It is where the company issues shares or options and fair value is determined on the date of grant and a remeasurement is not made after that date.

Cash-settled: The company pays cash, which is as big as the share value and liability should be remeasured at each reporting date.

This difference will be the determinant of how the accounting entries, disclosures, and expense recognition will be organized within the lifetime of the plan.

2. Valuation and Measurement Practices.

2.1 Selection of the appropriate valuation model is

To make proper financial reports, selection of proper model is essential. The Black-Scholes or binomial models are used by most organizations. Simple, time-based vesting is typical of the Black-Scholes model, whereas more flexible performance or market based models can be found using the binomial (lattice) model.

In case of complex ESOS structures, Monte Carlo simulations are used to provide sound modeling of probability-weighted results. Regardless of the model selected, the management should report its explanation, and prove the assumptions every year.

2.2 Key Inputs and Assumptions

The accuracy of valuation is based on volatility, risk free, expectations of life and expected dividend yield assumptions. An example is a firm where the share price history is volatile in nature, so combined historical and implied volatility is used, and a private firm is likely to refer to similar listed firms.

There is a risk of audit adjustments and reputational risk in case the assumptions are not justified. Proper estimation ensures compliance with IFRS reporting for employee stock options and provides transparency to shareholders.

2.3 Independent Valuation Reviews

The involvement of an independent valuer would increase objectivity and credibility. External specialists have the ability to assist in the process of validating modeling techniques, benchmarking, and fair value estimates that are in line with the prevailing market conditions. Third party valuation reviews are regarded as best practice in most jurisdictions, especially those companies going to the IPO.

3. Recognition and Expense Allocation.

3.1 Grant-Date Recognition

On the grant date, fair value total of options that will be vested is settled. This will be divided by the vesting period at a proportionate share to the service that the employees render. The only adjustment that can be made is not the adjustment in the market value but the adjustment in the number of options that are likely to be vested.

To illustrate, in the event that it is estimated that 5 percent of the employees would leave the company before the vesting period, then the expense should be recognized on the percentage amount that is expected to be vested. The re-evaluation of these estimates on a reporting date maintains the correctness of expenses and up-to-date status.

3.2 Processing Amendments and Payment cancellations.

Incremental fair value should be recognized when the terms are changed (e.g., reduction of the exercise price or acceleration of the vesting). Any unamortized expense is recognized immediately in case of cancellations or settlements. This is where many companies fail; with proper documentation and regular enforcement of the policies mistakes are eliminated.

3.3 Deferred Tax Implications

The accounting treatment is often different to the tax treatment. Deferred tax assets can be a result of differences in book deductions versus the tax deductions. Conciliation is done on a regular basis which is a guarantee of proper recognition and not the unexpected surprises when auditing.

4. Disclosure and Transparency Disclosure and Transparency Information

4.1 Compulsory disclosure in terms of IFRS.

Full disclosure enhances transparency and confidence of the investor. Companies must report:

- The essence and conditions of ESOS arrangements.

- The price of options in terms of its number and weighted-average.

- Fair value assumptions (volatility, expected life etc.)

- Reconciliation of options outstanding, exercised or expired.

The disclosures should be clear to enable the investors know the possibility of dilution and the real expense of employee compensation.

4.2 Communication of ESOS Value to Stakeholders

There are two classes of stakeholders, in particular, employees and investors. Besides compliance, proper communication creates trust. The description of the alignment of employee interests with shareholder value under ESOS makes the scheme seem more legitimate. The company has simplified employee guides and management commentary which are used by many companies to supplement IFRS disclosures.

4.3 ESG and Governance Linkages

By 2025, investors are moving to achieve evaluation of ESOS on an ESG basis. Open management of equity incentives, such as inclusion and fairness in granting and practices in grants, enhances corporate image. The accuracy of accounting has become an ingredient to the sustainability story of a company.

5. Process Optimization and Technology.

5.1 ESOS Management Platforms.

Spreadsheets in the manual format are vulnerable to errors and have no record of audit. ESOS management platforms which are based on cloud computing autonomize the vesting plans, document the computations of fair values and associate with general ledgers. Automation is helpful in mitigating operational risk and enhancing financial reporting data reliability.

5.2 Linkage with HR and Finance Systems.

One of the best practices is to align HR, payroll, and accounting information. That way the ESOS records are always updated immediately when employees change (resign, get promoted, etc.) and expense recognition is kept in line with actual movements in the workforce.

5.3 Internal Control and Audit Readiness.

Segregation of duties, regular reconciliation and approval hierarchies are strong internal controls over the administration of ESOS. Any one and two year audit of share-based payments should be internal or external to improve the governance and avoid lapse of compliance.

6. Constant Enhancement and Examination.

6.1 Industry Standard Benchmarking.

Top performing organizations habitually compare their ESOS accounting and reporting with the rest of their industry counterparts. The practice of reviewing annual reports of listed companies may help to demonstrate the emerging disclosure practices or valuation methods that are focused on favor by regulators.

6.2 IFRS Amendments updating.

The interpretations of IFRS change. Being attentive to changes or updates on the performance conditions or change of classification are other ways of ensuring that one remains in compliance. Seeking advice of external auditors or valuation specialists on a regular basis assists in forecasting the effects of new standards prior to them being adopted.

6.3 The Connections between Accounting Insights and Strategy.

Lastly, ESOS accounting can no longer be seen as a separate compliance activity. HR policy, reward design, and long-term incentive strategy can be informed using insights form valuation and employee behavior data. When HR works closely with the finance, ESOS will be a competitive advantage as well as a governance tool.

Conclusion

Correct ESOS accounting fills the gap between compliance, transparency and strategic performance. Companies are able to address the IFRS 2 requirements and establish investor confidence by applying sound valuation models and disciplined documentation and by exploiting technology.

The most prosperous companies in a market where the equity incentives are used to establish the employer attractiveness will be those who marry accounting excellence to the strategic aptitude, that is, an ESOS will not just be considered as a cost, but a long-term investment in human capital and value creation by the corporation.