How to Develop ESOP Strategy

How to Develop ESOP Strategy

Introduction to How to Develop ESOP Strategy

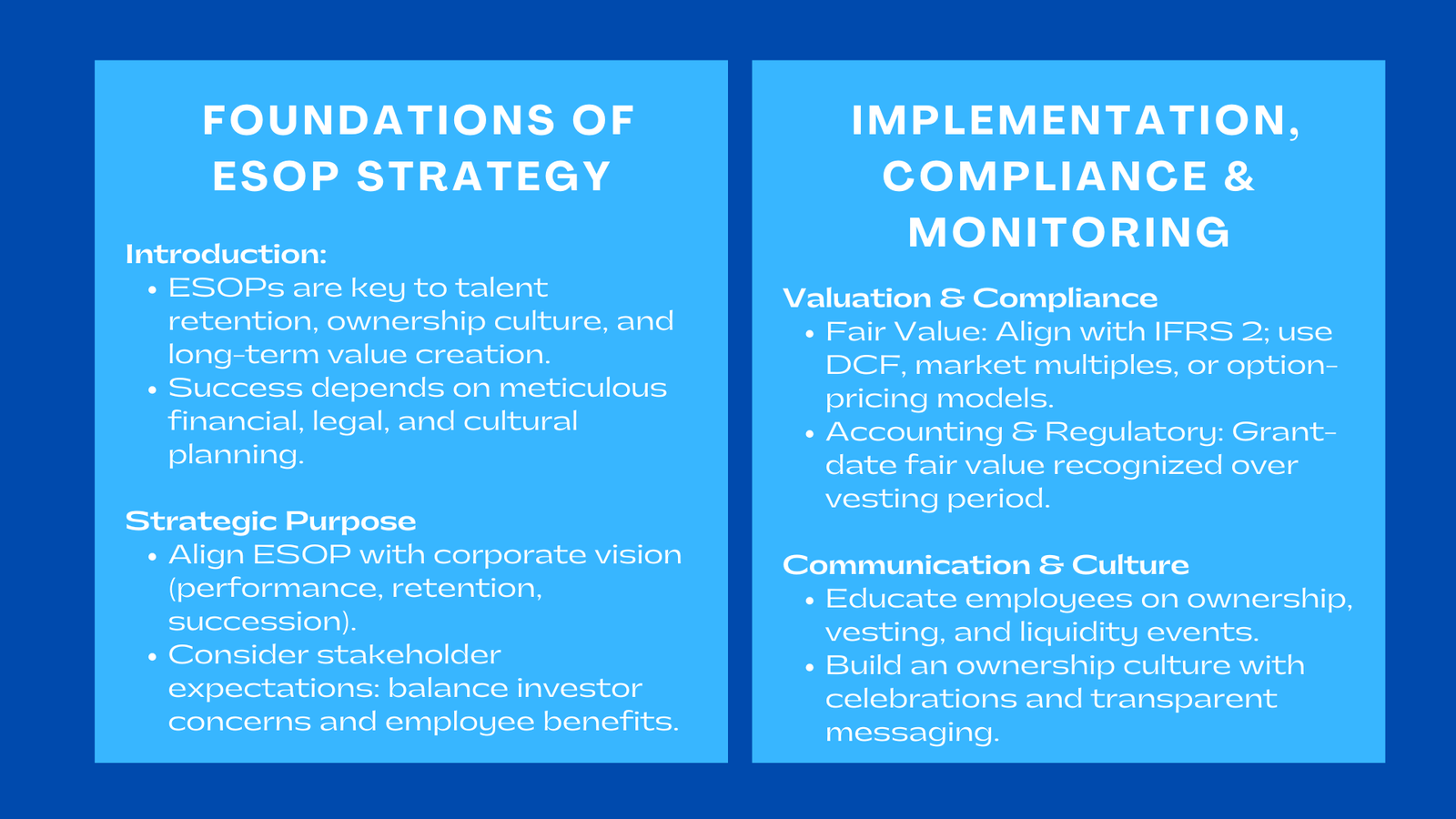

One of the key components in current talent and capital strategies is the employee Share Ownership Plans (ESOPs). At a time when companies are under pressure to not only be innovative but also employee-focused, the ESOPs are a rare incentive, retention, and ownership fit. The most successful organizations do not look at ESOPs as a one-time benefit anymore; they have it as a component of their long-term governance and creating value system, often complemented by business valuation services Singapore ValueTeam to ensure accurate assessment of company worth and informed decision-making.

Formulation of an ESOP strategy however does not merely involve the issuance of shares. It is a process of planning in a very meticulous manner both financially, legally, and culturally so that the plan does not contradict organizational goals, yet is in line with accounting and taxation laws.

1. Establishing the Strategic Purpose of an ESOP.

1.1 Adapting the Ownership to the Corporate Vision.

The initial action plan in establishing an ESOP strategy is explaining why ownership participation is being given. There are those companies that develop ESOPs to attract talent of high caliber; others are doing so to performance or succession. To take a case example, an average-sized Singaporean technology company can use an ESOP to ensure that its engineers remain within the company over the long term and as an indication to investors that they are committed to the company during the pre-IPO periods.

Once the management knows what the purpose is; it could be performance alignment, funding optimization, or leadership continuity, the rest of the design process can be constructed based on those goals.

1.2 Stakeholder Expectations

Buy-in of the stakeholders is also critical. Ownership is perceived differently by founders, investors and even employees. Investors can stress on the dilution control whereas the employees are concerned with the practical benefits. Both groups should be consulted early enough to create a balance between motivation and financial prudence. Such a disclosure averts disputes that might arise in the future with regards to valuation or a vesting decision.

2. Developing the ESOP Framework.

2.1 The identification of Eligibility and Pool Size.

The strategic question which is critical is on who is involved and to what degree. Broad-based ESOP plans involve the entire group of employees; focused plans involve senior employees or high impact contributors. The amount of the pool taken to be 10-20 percent of the company equity should match with the estimated growth and finance requirements. The danger of over-allocation is the chances of being over-diluted and the under-allocation reduces the effect of motivation.

2.2 Developing Vesting and Performance Requirements.

Under vesting terms, employees are entitled to ownership rights at a specific time. Vesting (e.g., 25 percent each year, over four years) can be based on loyalty and performance-based on KPIs achievable through performance (e.g., revenue or EBITDA targets). A combination of both, hybrid models are becoming more popular among the growth-stage startups that strive to maintain a balance between fairness and performance discipline.

An effective vesting schedule will be company culture-specific-conservative companies will prefer long vesting schedules, whereas the start-up can prefer short-term, milestone-based vesting.

2.3 Liquidity Planning and Funding.

Liquidity is also an issue to be considered by privately held firms. The shares of an ESOP in the private context cannot be freely traded as is the case in the listed companies. Employees can value themselves by having internal buyback mechanisms or trust structures. The lack of liquidity provisions will cause ESOPs to be seen as mere theories, but not practical gifts.

3. Valuation and Compliance Issues.

3.1 Determining Fair Value

Any ESOP plan should entail a justifiable valuation procedure. Valuations typically follow ESOP accounting and reporting guide standards, aligning with international frameworks such as IFRS 2. Depending on the structure and availability of data, companies can use income-based, market-based, or option-pricing models.

To illustrate, a fintech firm may depend on a discounted cash flow (DCF) approach to reflect the growth potential of the firm, whereas a well-established logistics firm may rely on another comparable company multiples to quantify the fair market value.

3.2 Regulatory and Accounting Compliance

Singapore-incorporated firms follow the principles of IFRS compliance for ESOP accounting, ensuring transparency in reporting and expense recognition. The grant-date fair value should be measured and amortized throughout the vesting period, which in IFRS 2 is the same. Compliance does not only guard the company against legal liabilities, but also increases trust of the investor in the company when auditing or raising funds.

3.3 Tax Implications

There are tax implications of ESOPs to the employer and also to the employee. Knowledge about timing of tax liability, such as grant, vesting or exercise, influences employee motivation and retention. Tax advisors are usually hired by companies to ensure that the structure of the plan is made to be consistent with the local regulations in order to reduce the impact of unexpected obligations.

4. ESOP Strategy Communication.

4.1 Teaching the Employees on Ownership Value.

Even an esop which is technically perfect may fail when the employees are not aware of its benefits. Communication thus is not an administrative process but a strategic one. HR and finance groups must clarify the issue of ownership rights to the performance of the company, the concept of vesting and how liquidity events take place.

Financial jargon can be demystified through workshops, internal dashboards and transparent question and answer sessions. Once the mechanics are known, the employees will be more willing to become genuine partners in the creation of the long-term value.

4.2 Establishing an ownership Culture.

ESOPs are successful when it is a part of the company identity. The ownership spirit is cemented by the firms that commemorate the milestones, like the inaugural exercise session or significant vesting round. In culture-based communication, employees would not feel that ESOPs are a farfetched reward, but actual appreciation of their role in the growth.

5. Implementation and Review

5.1 Legal Documentation and Administration.

The ESOP has to be formalized once it has been designed in a legal plan document, shareholder approvals, and grant agreements. Equity management platforms or specialist administrators assist in keeping the records of the cap-table accurate, monitoring the vesting and controlling compliance. Such systems minimize human mistakes during the administration and enhance management.

5.2 Periodic Reconsideration and Reappraisal.

The markets change and the ESOP ought to change too. Periodic appraisals will keep the valuation policies, vesting conditions and eligibility requirements up to date. A firm, which will evolve into a listed company, out of a private start-up firm, will certainly move towards long-term incentive plans (LTIPs) that are designed to motivate the executive level.

5.3 Keeping up with Corporate Events.

Major transactions such as fundraising, mergers, or IPOs can be of great influence on ESOP design. A proactive plan works towards avoiding the conflict on how to treat shares in case of exit or reorganization. Corporate governance policy should have ESOP review triggers so that it is prepared against this.

6. Measuring Long-term Impact and Success.

6.1 Key Performance Indicators (KPI)

A successful ESOP must be one that is motivating. The typical KPIs are retention rates, employee satisfaction, productivity increase, and consistency of shareholder and employee interests. As an illustration, retention at the time of ESOP enactment and at its conclusion is frequently tracked in firms, and a 20-30 percent increase in tenure in key positions has been observed.

6.2 Ongoing Communication and Feedback.

Companies need to maintain communication after the implementation. Occasional questionnaires or town meetings also measure whether ownership remains inspiring to the employees. In a case of a drop in sentiment, leaders might have to re-price vesting provisions or add more liquidity events.

Conclusion

An effective ESOP plan is a combination of monetary discipline, legal adherence, and natural communication. With purposeful design and governed using a transparent authority, ESOPs have the power to turn employees into true stakeholders- innovation, strength and value to the enterprise.

The companies that are capable of designing strategic ownership will be unique in attracting and retaining the following generation of leadership talent as Singapore business ecosystem matures. The future is in the companies where the ownership is not only given but shared.