ESOP vs ESOS Key Differences Explained

ESOP vs ESOS: Key Differences Explained

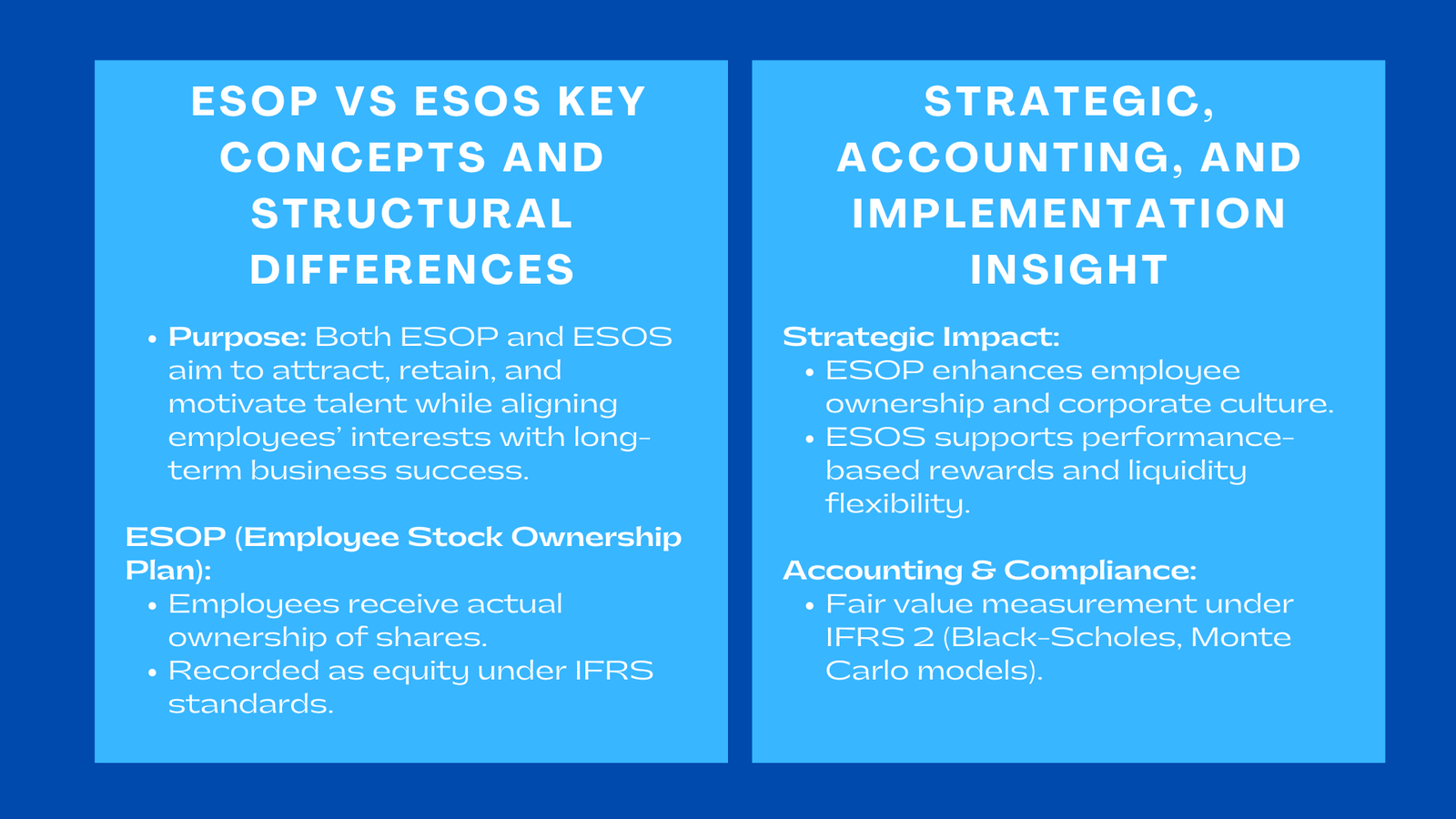

Employee equity plans have become essential tools for organizations aiming to attract, retain, and motivate top talent. These plans offer employees a stake in the company’s success, aligning their interests with long-term corporate performance and shareholder value. Among the most common schemes are Employee Stock Ownership Plans (ESOPs) and Employee Stock Option Schemes (ESOS). While both are designed to incentivize employees, they differ significantly in structure, accounting treatment, regulatory compliance, and strategic purpose.

Understanding these differences is critical for organizations to implement effective governance, optimize compensation strategies, and comply with IFRS standards. Proper implementation ensures that equity incentives drive performance, support transparent reporting, strengthen investor confidence, and enhance corporate culture. In competitive markets such as Singapore and across Southeast Asia, where talent retention is a significant challenge, structured equity plans are a strategic necessity.

Moreover, as global corporations expand and the workforce becomes increasingly mobile, employee equity plans must be designed with international regulations, cross-border tax implications, and diverse cultural perspectives in mind. Companies that carefully structure ESOPs and ESOS plan comparison can attract top-tier talent, enhance motivation, and support sustainable growth, while mitigating financial and compliance risks.

Historical Evolution and Global Adoption

ESOPs were first widely implemented in the United States during the 1950s as a mechanism to give employees ownership stakes and promote worker participation in corporate governance. Over time, ESOPs evolved into tax-advantaged programs that allowed companies to align employee incentives with long-term business success, similar to how firms offering business valuation services Singapore ValueTeam help organizations assess and optimize ownership value for sustainable growth.

ESOS, on the other hand, gained prominence in the 1980s and 1990s, particularly among technology startups and multinational corporations. Stock options became a standard tool for attracting skilled employees in highly competitive sectors, allowing companies to offer potential wealth creation opportunities without immediate cash outflows.

Globally, adoption varies depending on regulatory frameworks, tax incentives, and corporate governance norms. In countries like India and Singapore, ESOS and ESOPs are widely used by technology, financial services, and consumer goods sectors to attract and retain top talent. European adoption is often influenced by local labor laws, accounting standards, and cultural preferences regarding equity ownership. Understanding these historical and regional differences is essential for multinational corporations designing cross-border equity plans.

Structural Differences Between ESOP and ESOS

Ownership and Equity Implications

ESOPs involve granting employees actual ownership of company shares, either immediately or after completing a vesting schedule. Employees gain shareholder rights, including voting privileges, dividends, and the potential for capital appreciation. This fosters long-term engagement and loyalty, as employees’ financial success is directly tied to company performance.

From an accounting perspective, ESOPs are recorded as an increase in equity rather than a liability. Fair value measurement of granted shares and systematic expense recognition over the vesting period are required to maintain IFRS compliance. Transparent documentation of ownership structures, vesting schedules, and board approvals strengthens audit readiness, reduces regulatory risks, and builds investor trust.

Option-Based Incentives

ESOS grants employees the right—but not the obligation—to purchase shares at a predetermined exercise price, typically higher than the grant price. Unlike ESOPs, employees do not initially own the shares but benefit financially if the market value exceeds the exercise price.

Accounting for ESOS introduces complexity due to the contingent nature of options and volatility in underlying stock prices. Under IFRS 2, companies must measure the fair value of options at the grant date, recognize expenses over the vesting period, and disclose assumptions such as expected volatility, life of options, and risk-free interest rates. These requirements demand close collaboration between finance, HR, and legal teams to ensure accuracy and compliance.

Additionally, ESOS provides flexibility to companies with limited liquidity, such as startups, as it allows performance-based incentives without immediate cash outflow. For employees, ESOS provides a future-oriented reward that encourages them to contribute to the company’s growth and increase the value of their options.

Vesting and Performance Conditions

Service-Based Vesting

Both ESOPs and ESOS often include service-based vesting conditions. Employees earn equity by remaining with the organization over a defined period, promoting retention and long-term alignment with corporate goals. Service-based vesting ensures the organization retains institutional knowledge, minimizes turnover risks, and maintains stability in strategic operations.

Performance-Based Vesting

ESOS frequently incorporates performance-based conditions tied to revenue targets, operational KPIs, market share growth, or other measurable outcomes. These conditions link employee rewards directly to organizational success. Accounting for performance-based vesting involves probability-weighted recognition of expenses, requiring robust tracking systems and transparent reporting practices.

Performance conditions also serve as a motivational tool, fostering a culture of accountability and results orientation. Companies can tie executive bonuses or key employee rewards to strategic goals, ensuring that individual performance aligns with corporate objectives.

Accelerated Vesting and Retention Strategies

Some organizations include accelerated vesting provisions to incentivize retention during mergers, acquisitions, or leadership transitions. These mechanisms can be structured to balance short-term incentives with long-term performance goals. Implementing accelerated vesting requires careful accounting adjustments to ensure IFRS compliance and proper expense recognition.

Strategic Implications of ESOP and ESOS Plans

Enhancing Employee Ownership and Engagement

ESOPs create a participatory culture where employees act as shareholders. This ownership mindset can improve productivity, decision-making, and collaboration. Employees with direct stakes in the company are more likely to support strategic initiatives, innovate, and contribute to profitability.

Employee engagement surveys have shown that organizations with broad-based ESOPs experience higher retention, better workplace morale, and increased alignment with corporate missions. The sense of ownership can also reduce internal conflicts and encourage employees to take a long-term perspective on business growth.

Incentivizing Performance and Growth

ESOS motivates employees by offering potential financial upside contingent on company performance. Startups and high-growth companies often prefer ESOS because it conserves cash while providing attractive incentives. Employees have a vested interest in achieving organizational goals, leading to higher engagement, creativity, and focus on results.

Moreover, ESOS can be structured to encourage innovation, with options linked to launching new products, entering new markets, or achieving specific milestones. This creates a measurable connection between employee efforts and company success.

Retention and Talent Management

Both ESOP and ESOS serve as retention tools. ESOPs encourage employees to stay longer due to vested ownership, while ESOS motivates employees to remain until performance milestones are achieved and options are exercisable. Combined strategies balance long-term retention with performance-driven incentives, allowing organizations to address different workforce needs.

Talent-intensive industries, such as technology, financial services, and consulting, benefit significantly from ESOS plans to retain high performers in competitive labor markets. ESOPs are often more suitable in stable industries where long-term loyalty and institutional knowledge are critical.

Cultural and Behavioral Impact

Equity plans shape corporate culture and employee behavior. ESOPs foster collaboration, collective ownership, and long-term strategic thinking. ESOS drives performance orientation, entrepreneurial mindset, and goal-focused behavior. Companies can combine both plans to balance the benefits of ownership culture with results-oriented incentives.

Accounting and Regulatory Considerations

Fair Value Measurement and Expense Recognition

IFRS 2 requires fair value measurement of share-based payments at the grant date. Companies must consider stock price volatility, expected exercise period, risk-free interest rate, and expected dividends. For performance-based options, fair value is adjusted based on the probability of achieving targets. Expenses are recognized systematically over the vesting period, accounting for forfeitures or modifications.

Accurate measurement ensures compliance, minimizes misstatements, and provides investors with reliable financial information. Companies may use advanced valuation models such as Black-Scholes, binomial models, or Monte Carlo simulations to capture complex conditions, especially for options with market-based or multi-dimensional performance criteria.

Disclosure and Investor Transparency

Transparent reporting is critical. Companies must disclose the number of shares or options granted, exercised, forfeited, or expired, along with fair value calculations, vesting conditions, and impact on financial statements. These disclosures demonstrate governance excellence, ensure regulatory compliance, and enhance investor confidence.

Audit Readiness and Compliance

Maintaining centralized databases, robust internal controls, and clear documentation is essential. Accurate record-keeping allows auditors to verify assumptions, calculations, and allocations. Multinational organizations face additional complexities due to cross-border grants, requiring adherence to local regulations, tax laws, and IFRS standards. Automated systems and ERP integration are increasingly used to manage these challenges efficiently.

Real-World Applications and Industry Examples

Startup Environment

Startups often favor ESOS to attract top talent while conserving cash. For example, a SaaS startup may grant options linked to product launch milestones or user acquisition targets. Valuation models such as Black-Scholes or binomial methods are applied to ensure fair value measurement under IFRS 2.

Established Corporations

Mature companies may implement ESOPs to foster ownership culture, long-term loyalty, and employee engagement. Large consumer goods or manufacturing companies often combine ESOPs with pension plans or retirement benefits to reinforce long-term retention.

Sector-Specific Considerations

Industries with high turnover, such as technology or financial services, benefit from ESOS, while sectors with lower turnover, such as infrastructure or utilities, benefit from ESOPs. Combining ESOPs and ESOS strategically allows organizations to address diverse workforce motivations, balancing ownership with performance-driven incentives.

Cross-Border Implementation Challenges

Global organizations must navigate complex regulations, tax implications, and reporting standards across jurisdictions. Cross-border ESOS and ESOPs require careful structuring to ensure compliance, manage currency risks, and coordinate vesting schedules.

Employee Motivation and Behavioral Insights

Understanding employee behavior is crucial. ESOPs foster long-term thinking and loyalty, while ESOS encourages risk-taking and achievement orientation. Psychologically informed plan design ensures that incentives align with employee values, improving satisfaction, retention, and productivity.

Conclusion to ESOP vs ESOS Key Differences Explained

ESOP and ESOS serve complimentary but distinct purposes. Employee stock options guide IFRS promote ownership, long-term retention, and participation in corporate governance, while ESOS drives performance, innovation, and alignment with strategic goals.

Effective implementation requires careful plan design, accurate accounting, IFRS compliance, and robust disclosure. Organizations should consider workforce demographics, industry dynamics, talent retention needs, and regulatory obligations when selecting equity plans.

A well-executed ESOP or ESOS strategy not only incentivizes employees but also strengthens corporate governance, fosters a culture of accountability, enhances investor confidence, and drives long-term enterprise value. Integrating strategic objectives with precise accounting and reporting transforms employee equity plans into powerful levers for performance, retention, and sustainable growth.

In today’s competitive business environment, ESOPs and ESOS are more than compensation tools—they are strategic instruments that convert human capital into measurable business outcomes. Organizations that implement them thoughtfully can build motivated, engaged, and high-performing workforces, ensuring that intangible human capital contributes directly to tangible corporate success.