Tax Implications of ESOP

Tax Implications of ESOP

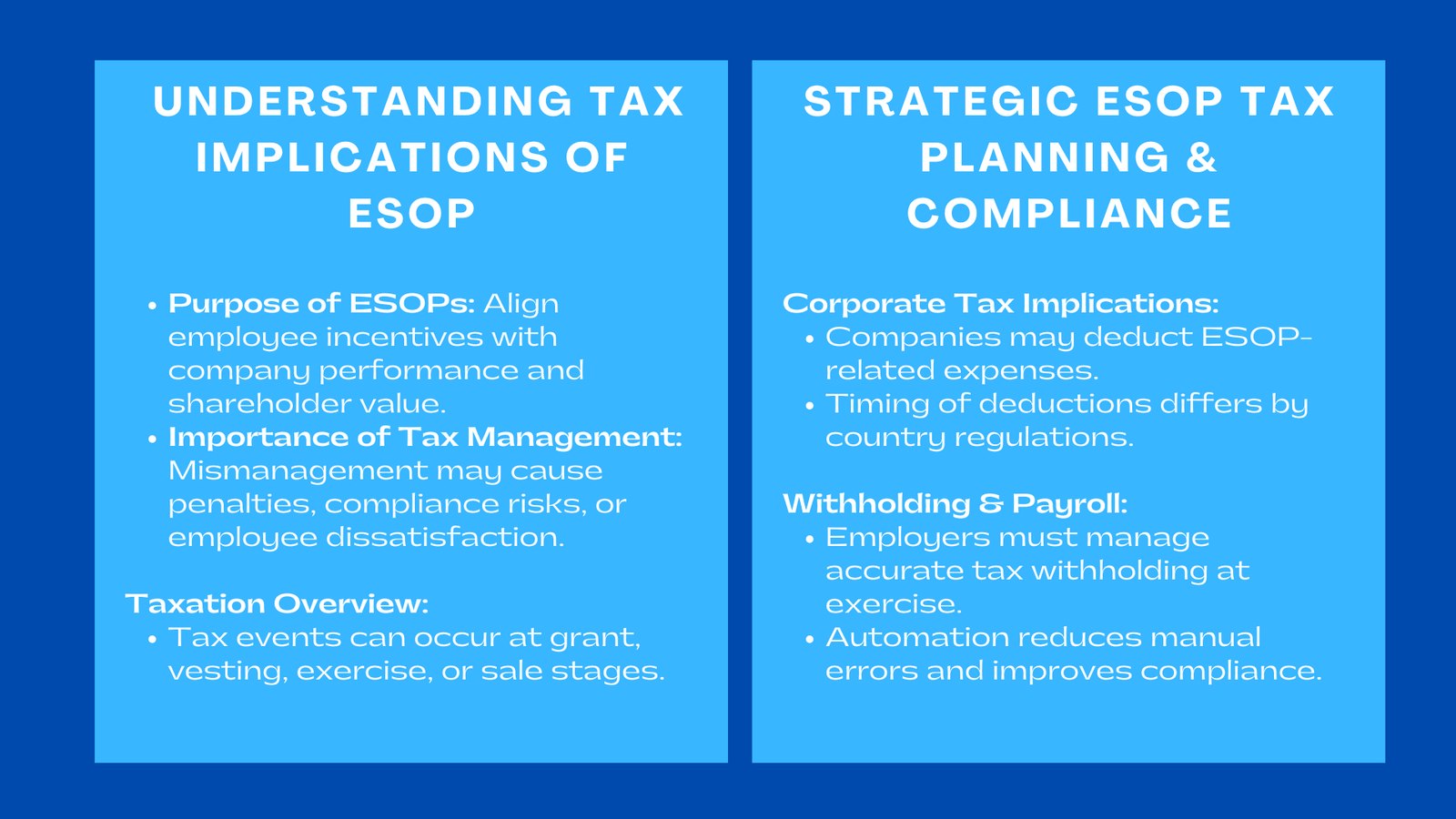

Employee Stock Ownership Plans (ESOPs) are recognized globally as a powerful mechanism for aligning employee incentives with company performance and shareholder value. By providing employees the opportunity to acquire ownership in the company, ESOPs foster a sense of commitment, loyalty, and accountability. They motivate employees to actively contribute to organizational growth and enhance long-term business sustainability.

Despite their strategic advantages, ESOPs carry complex tax implications for both employees and employers. Mismanagement of taxation can result in financial penalties, compliance risks, or even disputes with tax authorities. Additionally, unclear or inaccurate communication regarding tax obligations can lead to employee dissatisfaction and distrust in the ESOP program.

A thorough understanding of ESOP plan taxation considerations is essential for ensuring compliance, supporting financial planning, and maintaining employee confidence. Tax rules governing ESOPs vary by jurisdiction and involve multiple components, including the timing of taxable events, valuation of shares, reporting requirements, withholding obligations, and potential corporate tax implications. Proper tax planning and administration are crucial to ensure ESOPs achieve their intended objectives without imposing undue financial burden on either employees or the organization.

Employee Tax Considerations in ESOPs

Timing of Taxable Events

One of the most significant aspects of ESOP taxation is understanding when taxes are triggered. Employees may face tax liability at different stages of the ESOP lifecycle, depending on local regulations.

For instance, in some jurisdictions, taxes may arise at the grant date if the exercise price is lower than the market value of the shares, effectively creating a taxable benefit. At the vesting stage, when employees gain an unconditional right to the shares, taxation may apply if the country considers the benefit as income at that point. At the exercise stage, employees typically recognize income equal to the difference between the market value and the exercise price, often treated as compensation income. Finally, upon sale of shares, capital gains tax may be applied to the increase in value since the exercise date, emphasizing the importance of ESOP valuation Singapore compliance to ensure accurate reporting and adherence to local regulations.

Accurately tracking these taxable events is critical to compliance. Organizations should implement robust systems that monitor grant dates, vesting schedules, exercises, and disposals. This ensures employees are informed and can plan for potential tax liabilities, while companies remain compliant with tax laws.

Valuation and Reporting

Valuation is another essential component of ESOP taxation. The fair market value of shares at relevant taxable events determines the taxable benefit. Companies must consider factors such as current market conditions, share liquidity, and historical share performance when valuing ESOP shares.

Clear documentation of valuations and assumptions is necessary for compliance and transparency. Employees benefit from understanding the rationale behind valuations, enabling them to plan for taxation effectively. Employers benefit by minimizing disputes with tax authorities and ensuring that financial statements reflect accurate compensation costs.

Failure to maintain accurate valuations or provide clear reporting can lead to misinterpretation, errors in employee tax filing, and potential regulatory scrutiny. Especially in companies with complex ESOP structures or cross-border operations, robust reporting and valuation practices are indispensable.

Jurisdictional Variations

Tax treatment of ESOPs varies widely across jurisdictions, and understanding these differences is crucial for both employers and employees. In Singapore, for instance, certain qualifying ESOPs are eligible for tax exemptions under specific conditions. Employees participating in such programs may defer tax obligations until the shares are sold, providing significant financial flexibility and incentivizing long-term commitment to the company. By contrast, in India, ESOP gains are generally taxed as salary income at the time of exercise, meaning employees must account for the difference between the exercise price and the fair market value as part of their taxable income. This timing can create immediate tax liability, even if the employee does not realize cash from the shares immediately, which necessitates careful planning and guidance from the employer.

In the United States, the taxation of employee stock options depends on the type of option granted. Incentive Stock Options (ISOs) often receive favorable tax treatment, allowing deferral of taxation until the sale of shares and potential eligibility for capital gains treatment, provided certain holding periods are met. Non-Qualified Stock Options (NSOs), on the other hand, are generally taxed as ordinary income at the exercise date, which can lead to significant tax liabilities if not properly anticipated. Companies operating across multiple jurisdictions must reconcile these differences to prevent double taxation, ensure equitable treatment of employees, and maintain compliance with local tax laws.

These jurisdictional variations highlight the importance of coordinated ESOP administration, involving finance, legal, and HR teams. Accurate tracking of grant dates, exercise dates, and applicable tax rules for each location is essential to avoid errors, penalties, or employee dissatisfaction. Furthermore, multinational organizations must consider the interplay between local tax laws and international accounting standards, such as IFRS, to ensure both regulatory compliance and accurate financial reporting. Proactive communication with employees regarding their potential tax obligations under different jurisdictions is also critical to maintain transparency and trust.

Corporate Tax Implications

Deductibility of ESOP Expenses

ESOPs have implications beyond employee taxation. They also affect corporate taxation, as companies may be able to deduct ESOP-related expenses when calculating taxable income. Such expenses typically include the fair value of stock grants and associated administrative costs.

However, the timing of these deductions depends on local laws and accounting practices. For instance, some jurisdictions allow deduction at the grant date, while others only permit deduction upon exercise of the options. Accurate recognition of ESOP expenses is critical to financial reporting and ensures that corporate tax obligations are managed efficiently.

Misclassification or delayed recognition of ESOP-related expenses can distort financial statements, misrepresent profitability, and potentially expose the organization to penalties or reputational risk. Proper integration of ESOP tax planning into financial accounting processes is therefore crucial.

Payroll and Withholding Responsibilities

Employers often bear the responsibility for withholding taxes related to ESOP exercises on behalf of employees. Accurate and timely withholding is essential to comply with tax regulations. Mistakes, such as underpayment or late submission, can lead to fines, interest charges, and reputational harm.

Automated ESOP management and payroll systems significantly improve accuracy in withholding and reporting. These tools can track vesting schedules, exercises, and taxable amounts in real time, generating comprehensive reports for internal audits and regulatory compliance. This approach minimizes manual errors and ensures that both employees and employers fulfill their tax obligations promptly.

Financial Statement Impact

ESOP taxation also creates deferred tax assets or liabilities, as accounting recognition of ESOP expenses may not align with tax deductibility. For example, IFRS requires recognizing the fair value of stock options as an expense over the vesting period, whereas tax authorities may allow deduction only upon exercise. Proper accounting for deferred taxes is necessary for accurate financial reporting, investor transparency, and audit readiness.

Deferred tax considerations are particularly relevant for companies preparing financial statements under IFRS, as discrepancies between tax and accounting treatment can materially impact profit reporting and equity presentation. Transparent disclosure of deferred tax balances ensures that investors and regulators understand the company’s financial position.

Planning Strategies for ESOP Tax Efficiency

Structuring Tax-Efficient Plans

Strategically designing ESOPs can help optimize tax efficiency for employees and the organization. For example, companies can issue qualifying stock options that defer employee tax liability until share disposal, align exercise windows with corporate financial planning, and structure grants based on long-term performance metrics.

Careful structuring ensures that ESOPs incentivize employees effectively while minimizing unexpected tax burdens. For high-growth startups anticipating IPOs or acquisitions, aligning exercise strategies with liquidity events is essential to prevent undue employee taxation.

Employee Communication and Education

Communicating tax implications clearly to employees is vital. Employees must understand when taxable events occur, how taxes are calculated, and what documentation is required for filing. Regular training sessions, detailed guides, and access to ESOP management tools enhance understanding and minimize errors.

Educated employees are more likely to appreciate the value of ESOPs, make informed decisions regarding exercises and sales, and comply with tax obligations. This transparency also strengthens trust between employees and the organization.

Leveraging Technology for Compliance

Automated ESOP platforms and HR-finance integration tools can streamline tax compliance. These systems track vesting, exercises, and taxable amounts in real time, generate IFRS-compliant reports, and maintain detailed records for audits.

Technology adoption reduces manual errors, accelerates reporting, and improves audit readiness. For multinational organizations, centralized platforms help harmonize cross-border tax compliance, ensuring that all stakeholders have access to accurate and consistent information.

Scenario Planning and Forecasting

Scenario planning helps organizations anticipate potential tax outcomes under different market and operational conditions. Modeling the impact of share price appreciation, accelerated vesting, or liquidity events allows companies to prepare employees for tax liabilities and guide corporate decision-making.

For example, technology startups can simulate how rapid valuation increases during funding rounds affect employee taxation. Multinational corporations can project cross-border tax implications to avoid double taxation. Scenario planning ensures proactive risk management, reduces surprises, and enhances employee satisfaction.

Industry-Specific Considerations

Technology and Startups

Startups and technology companies often issue ESOPs at low exercise prices, creating the potential for significant tax liabilities upon exit or liquidity events. Careful planning, ongoing employee guidance, and regular valuation updates are critical to prevent unexpected burdens. These companies must also consider the impact of ESOP taxation on employee retention and satisfaction, as mismanaged taxation can diminish the perceived value of equity incentives.

Multinational Corporations

For multinational corporations, managing ESOP taxation requires harmonization across jurisdictions. Variations in tax treatment, withholding obligations, and reporting requirements must be carefully coordinated between legal, HR, and finance teams. Ensuring compliance while providing equitable treatment for employees globally reduces risk, avoids double taxation, and maintains employee trust.

Regulated Industries

Industries such as banking, financial services, and healthcare must consider regulatory reporting requirements alongside ESOP taxation. Compliance with governance obligations, deferred compensation rules, and local tax laws is essential. Transparent reporting and regular audits ensure regulatory adherence, protect corporate reputation, and maintain investor confidence.

Conclusion to Tax Implications of ESOP

ESOP taxation is inherently complex but essential for ensuring compliance, transparency, and strategic effectiveness. Companies must carefully manage employee taxable events, jurisdiction-specific rules, corporate deductions, withholding obligations, and financial reporting.

Through proactive planning, scenario forecasting, employee education, and technology integration, ESOP taxation can be transformed from a compliance challenge into a strategic advantage. Properly managed ESOP programs enhance employee engagement, foster retention, optimize corporate financial planning, and support long-term value creation.

When organizations maintain accurate reporting, transparent communication, and consistent tax practices, ESOPs not only motivate Employee stock options tax compliance but also strengthen corporate governance and investor confidence. By integrating tax planning into ESOP administration, companies can ensure their equity incentive programs deliver sustainable benefits for both employees and the organization.