How Startups Can Implement ESOS Plans

How Startups Can Implement ESOS Plans

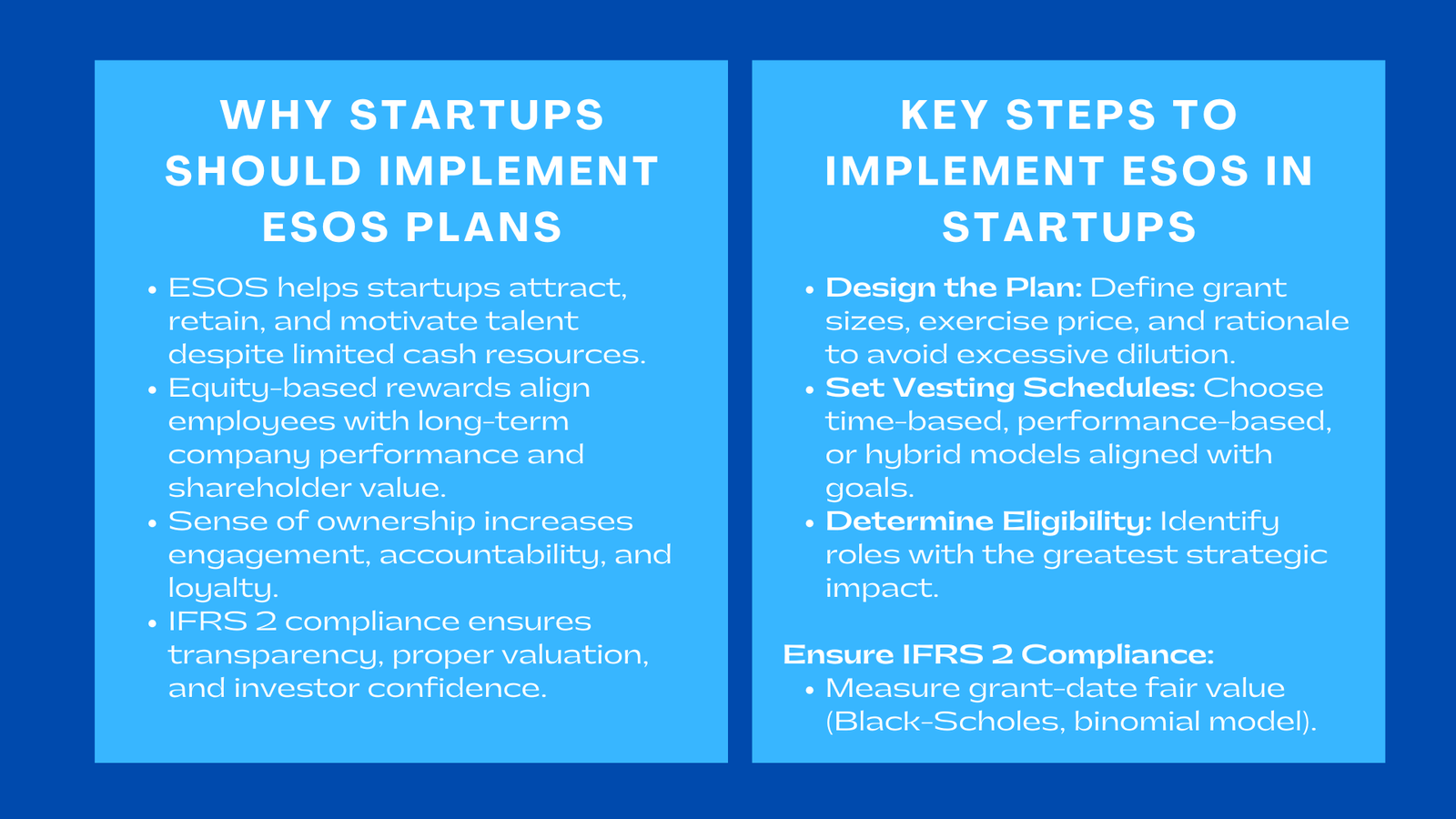

Employee Stock Option Schemes (ESOS) have become an essential mechanism for startups aiming to attract, retain, and motivate employees in highly competitive markets. Unlike established corporations, startups often operate with limited cash resources, making cash-heavy compensation packages difficult to sustain. By offering equity-based incentives, Implementing ESOS in startups IFRS can conserve cash while simultaneously rewarding employees in alignment with long-term company performance.

ESOS not only provides a financial incentive but also creates a sense of ownership and accountability among employees. When employees hold equity in the company, they are more likely to think and act like owners, focusing on business outcomes that increase shareholder value. This sense of ownership strengthens engagement, promotes loyalty, and encourages employees to contribute meaningfully to the startup’s growth trajectory.

Implementing an ESOS plan, however, is not a straightforward task. It requires careful consideration of accounting standards, regulatory compliance, operational processes, employee education, and long-term strategic alignment. IFRS 2, “Share-based Payment,” governs the recognition, measurement, and disclosure of ESOS and other share-based payments. Adherence to IFRS 2 ensures that startups maintain financial transparency, regulatory compliance, and credibility with investors, while strategically using equity to retain and motivate employees.

Designing an Effective ESOS Plan

Determining Grant Size and Exercise Price

The first step in designing an ESOS plan involves deciding the grant size and the exercise price. The grant size should balance the objective of incentivizing employees with the need to protect the equity stakes of founders, early investors, and other shareholders. Excessive allocation of options can lead to dilution, which may discourage investment in future funding rounds, especially when startups rely on insights from business valuation services Singapore to ensure fair and strategic equity distribution.

The exercise price is equally crucial. Startups typically set the exercise price at or above the fair market value of shares at the grant date. This ensures that employees benefit only from genuine appreciation in the company’s value, aligning their interests with long-term performance. For example, if a startup’s shares are valued at $3 per share at grant, granting options at $3 ensures that employees profit only from value growth beyond that baseline. Clear documentation of grant sizes and exercise prices, including the rationale for each decision, strengthens transparency, supports investor confidence, and facilitates audits.

Structuring Vesting Schedules

Vesting schedules are a fundamental component of ESOS plans, as they determine when employees can exercise stock options. Time-based vesting encourages loyalty and retention by rewarding employees for tenure, typically spanning three to four years. Performance-based vesting links rewards to strategic business milestones, such as reaching revenue targets, launching new products, acquiring new users, or achieving market expansion goals.

A hybrid vesting model, which combines time-based and performance-based criteria, often delivers optimal results. For example, a startup might vest 25% of an employee’s options annually over four years, with an additional 10% contingent on achieving a revenue milestone. This combination ensures employees remain committed over time while being motivated to focus on measurable, strategic goals.

Eligibility and Participation Criteria

Eligibility criteria define which employees or executives are entitled to participate in the ESOS plan. Startups should carefully establish eligibility based on role, contribution, seniority, or strategic impact. Transparent eligibility criteria prevent disputes, ensure fairness, and concentrate incentives on employees who can meaningfully influence company performance. For instance, core engineers, senior management, or critical sales personnel might receive higher option allocations than junior administrative staff, reflecting their potential to drive company growth.

Accounting and Valuation Considerations

Grant Date Fair Value Measurement

Under IFRS 2, startups must measure the fair value of stock options at the grant date. This is often challenging due to limited market data, high volatility, or uncertain growth trajectories typical of startups. Commonly used valuation models include the Black-Scholes model and the binomial option pricing model. These models account for factors such as expected volatility, risk-free interest rates, expected life of the option, dividend yield, and any applicable performance conditions.

Accurate grant-date valuation requires cross-functional collaboration between finance, HR, and legal teams to ensure all relevant assumptions are considered. Proper documentation of assumptions, calculations, and rationale is crucial for IFRS compliance, audit readiness, and transparency for investors. For example, a biotech startup may consider anticipated regulatory approvals and industry volatility when calculating fair value to ensure that reported expenses reflect true potential costs.

Expense Recognition Over the Vesting Period

ESOS expenses must be recognized systematically over the vesting period to reflect the true economic cost of employee equity compensation. Recognizing expenses in line with vesting periods ensures that financial statements present a realistic picture of compensation costs. Startups must adjust for forfeitures, cancellations, or modifications to avoid overstating expenses or liabilities.

For instance, if an employee leaves the company before completing the vesting period, unvested options should be forfeited, and corresponding expense recognition adjusted. Transparent recording of these events enhances financial reporting accuracy, supports IFRS compliance, and builds investor confidence in the company’s accounting practices.

Handling Modifications and Cancellations

Startups may occasionally need to modify ESOS terms, such as adjusting exercise prices or extending expiration periods. IFRS 2 requires that these modifications be assessed for incremental fair value changes and recorded appropriately. Similarly, early terminations or cancellations must be accurately accounted for to prevent misrepresentation of equity or liabilities. Implementing standardized policies and clear internal procedures ensures that modifications and cancellations are consistently recorded and fully compliant with IFRS requirements.

Operational Implementation and Administration

Tracking and Monitoring Grants

Effective administration of an ESOS plan requires accurate tracking of grants, exercises, forfeitures, and cancellations. Startups can adopt centralized equity management systems or cloud-based platforms that provide real-time updates and maintain comprehensive records. Such systems reduce administrative errors, facilitate IFRS-compliant reporting, and support audit readiness.

Cross-Functional Collaboration

Successful ESOS management requires collaboration across finance, HR, and legal departments. Finance ensures proper valuation and accounting treatment, HR manages employee records and communication, and legal ensures compliance with regulatory and contractual obligations. This cross-functional approach reduces errors, improves operational efficiency, and strengthens corporate governance.

Employee Communication and Education

Employees need to understand the mechanics of their stock options, including vesting schedules, exercise rights, potential liquidity events, and valuation methods. Providing clear guidance ensures that employees appreciate the value of their equity and understand associated tax implications. Educated employees are more engaged, motivated, and aligned with the startup’s long-term growth objectives.

Clarifying Tax Implications

Startups must provide guidance on tax obligations at various stages, including grant, vesting, exercise, and sale of shares. Clear communication reduces the risk of unexpected tax liabilities and ensures employees are compliant with local tax laws. For example, employees should understand that exercising options may trigger income tax based on the difference between market value and exercise price, and selling shares could trigger capital gains tax.

Strategic Benefits of ESOS for Startups

Talent Retention and Engagement

A well-structured ESOS plan increases employee loyalty by offering a tangible stake in the company’s success. Employees motivated by potential equity gains are more likely to remain with the company, contributing strategically to operational and business growth.

Aligning Performance with Corporate Goals

Performance-based ESOS plans align employee incentives with strategic objectives. Employees are motivated to meet revenue, product development, or market expansion goals because achieving these milestones directly impacts the value of their equity. This alignment fosters a culture of accountability and drives sustainable business performance.

Investor Confidence and Governance

ESOS plans that comply with IFRS 2 demonstrate sound financial governance. Accurate accounting and transparent reporting on grants, exercises, and valuations build investor confidence, enhance credibility, and improve fundraising opportunities. Investors are more likely to support startups that manage equity responsibly and align employee incentives with long-term value creation.

Industry-Specific Considerations

High-Growth Sectors

Startups in high-growth sectors like technology, fintech, and biotechnology face additional challenges due to market volatility, rapid scaling, and uncertain valuation benchmarks. Regularly reassessing assumptions, updating valuation models, and adjusting vesting milestones ensures accurate reporting, compliance, and motivation for employees.

Regulated Industries

Startups in regulated sectors such as banking, financial services, and healthcare must adhere to strict reporting and governance standards. Proper ESOS accounting ensures compliance, supports audits, and reinforces investor trust, providing assurance that equity compensation is managed responsibly.

Case Study: A Singapore-Based Startup Successfully Implementing ESOS

A fintech startup in Singapore implemented an ESOS plan covering its first 50 employees. The company set the exercise price at fair market value and established a four-year vesting schedule with performance milestones tied to revenue growth and user acquisition targets. Using a cloud-based equity management system, the startup tracked all grants, exercises, forfeitures, and modifications in real time.

Finance, HR, and legal teams collaborated closely to ensure accurate valuation, regulatory compliance, and proper documentation. Employees received detailed guidance on vesting schedules, exercise rights, and tax implications. The result was enhanced employee engagement, retention of key talent, and improved transparency for investors. The startup successfully used the ESOS plan to drive strategic growth, demonstrating that careful planning and execution of stock option schemes can be a powerful tool for motivation and value creation.

Conclusion

Implementing an ESOS plan strategy for startups requires strategic planning, accounting precision, operational efficiency, and employee education. Careful structuring of grant sizes, exercise prices, vesting schedules, and eligibility criteria aligns employee incentives with long-term corporate goals. Accurate valuation under IFRS 2, systematic expense recognition, and transparent reporting strengthen investor confidence and ensure regulatory compliance. Leveraging technology, centralizing administration, and fostering cross-functional collaboration enhances operational efficiency and reduces errors.

A well-executed ESOS plan not only motivates employees but also reinforces corporate governance, builds investor trust, and drives long-term value creation. By integrating ESOS into the broader strategic framework, startups can effectively compete for top talent, maintain financial transparency, and ensure sustainable growth in competitive markets.