Accounting Challenges in Share-Based Payments

Accounting Challenges in Share-Based Payments

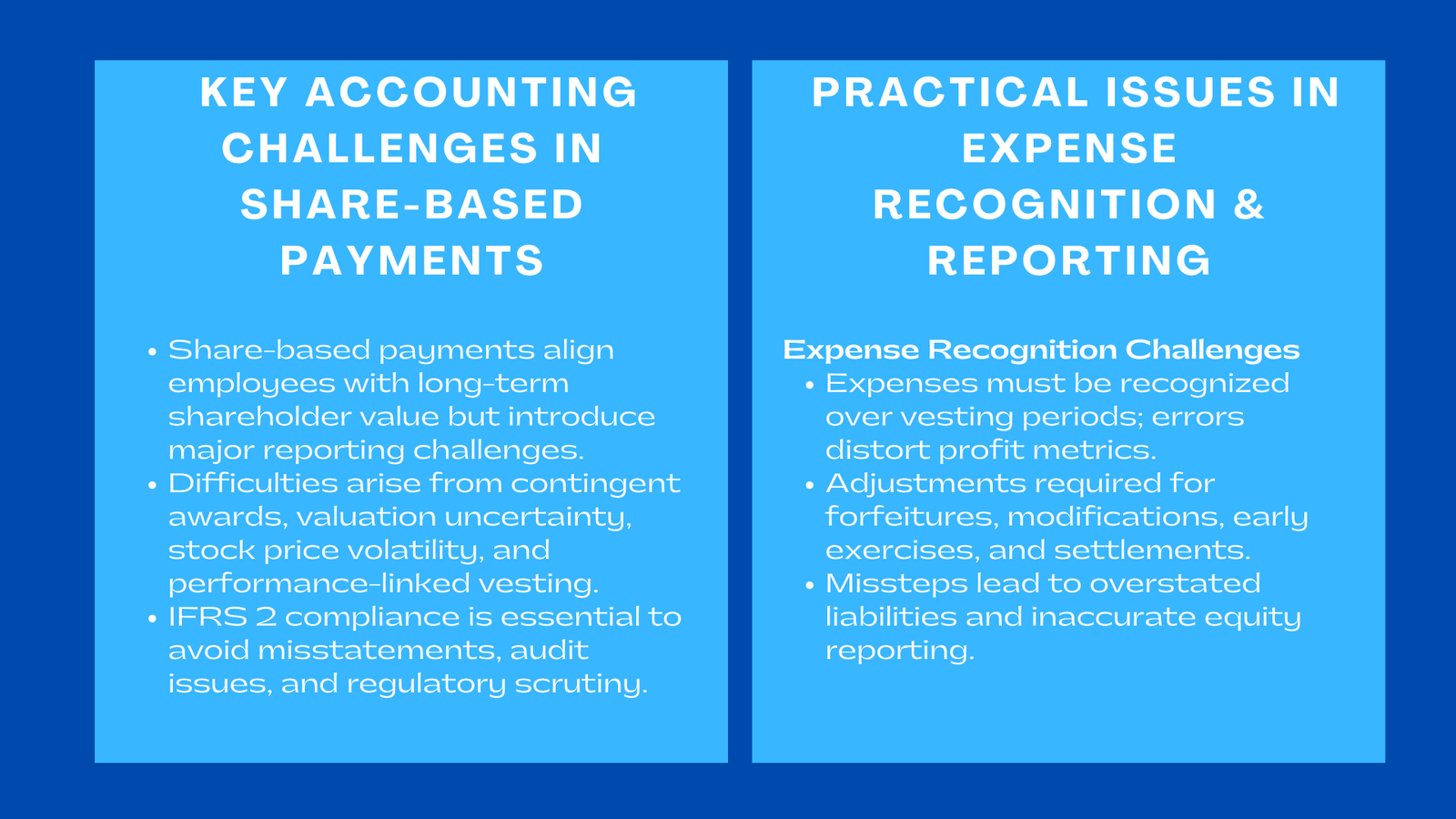

Share-based payments (SBPs) have become essential tools for modern businesses to attract, retain, and motivate employees while aligning their interests with long-term shareholder value. These instruments include stock options, restricted shares, performance shares, and other equity- or cash-settled awards. By granting employees a stake in the company’s success, organizations can incentivize performance, improve retention, and create a culture of ownership.

However, the strategic advantages of Share-based payment accounting challenges come with significant accounting and reporting challenges. These challenges are compounded by the contingent nature of awards, the volatility of underlying stock prices, performance-linked vesting conditions, and the need to comply with IFRS 2, “Share-based Payment.” Companies that fail to manage these complexities effectively risk financial misstatements, audit complications, regulatory scrutiny, and reputational damage. Accurate accounting is therefore not only essential for compliance but also critical for maintaining investor confidence and supporting informed strategic decision-making.

Valuation Challenges in Share-Based Payments

Grant Date Fair Value Estimation

A core principle of IFRS 2 is the measurement of fair value at the grant date. This valuation establishes the expense recognition and impacts both the income statement and equity accounts. Companies typically employ models like Black-Scholes for standard European-style options or binomial models for more complex, multi-stage options, and understanding these valuation principles also aligns with the benefits of purchase price allocation in Singapore, where accurate fair value measurement supports clearer financial reporting.

Key inputs include expected volatility of the underlying shares, risk-free interest rate, expected life of the option, dividend yield, and market or non-market performance conditions. In the case of startups or private companies, estimating fair value is particularly difficult due to the absence of an active market for shares. For example, a technology startup issuing stock options to early employees must consider potential dilution, exit scenarios, and expected IPO timing, which all affect fair value estimation.

Accounting for Performance-Based Conditions

Many share-based payment arrangements include performance-based conditions, such as achieving revenue growth, EBITDA targets, or operational KPIs. IFRS 2 requires that expense recognition reflects the probability of achieving these conditions. Misjudging these probabilities can lead to either overstatement or understatement of expenses, potentially affecting reported profitability and shareholder perception.

For instance, if a biotech firm issues options contingent on FDA approval of a new drug, accounting for the likelihood of approval is complex and requires careful judgment. Proper assessment ensures that the reported expenses realistically reflect economic exposure without overstating costs.

Hybrid Instruments and Complex Arrangements

Hybrid SBPs that combine equity and cash settlement or incorporate multiple performance conditions require nuanced interpretation of IFRS 2. Companies must determine whether the instruments are classified as liabilities or equity and calculate fair value accordingly. Hybrid awards often require ongoing remeasurement, with changes impacting profit or loss. Misclassification of these instruments can significantly distort financial statements and may mislead investors or stakeholders.

Expense Recognition and Timing Challenges

Vesting Period Allocation

Expenses related to SBPs are typically recognized over the vesting period, reflecting the period during which employees provide services or meet performance conditions. Accurate allocation ensures financial statements reflect the economic cost of awards over time. Misallocation can distort net income, impact earnings per share calculations, and misinform investor decisions.

For example, a startup offering stock options with a four-year vesting period must recognize expenses proportionally each year. If an employee leaves after two years, the remaining unvested portion must be forfeited, and the company must adjust previously recognized expenses accordingly.

Adjusting for Forfeitures, Modifications, and Cancellations

Employees may leave the company, cancel options voluntarily, or have their grants modified due to changes in performance or corporate restructuring. IFRS 2 requires that these changes be accounted for accurately, adjusting expenses and liabilities accordingly. Failure to adjust for forfeitures or modifications can result in overstated liabilities and misstated equity.

Handling Early Exercises and Settlements

Employees may exercise stock options before vesting or receive cash settlements instead of equity. These events require precise accounting treatment to avoid misrepresentation of liabilities, equity, and expenses. Properly accounting for early exercises ensures that financial statements accurately reflect the company’s obligations.

Disclosure and Reporting Complexities

IFRS 2 Disclosure Requirements

IFRS 2 mandates comprehensive disclosure of share-based payment arrangements. Companies must report the number and type of instruments granted, exercised, forfeited, or expired, along with grant-date fair value assumptions, vesting conditions, and the impact on profit, loss, and equity. Transparent disclosure allows investors and regulators to assess the financial and operational impact of SBPs.

Challenges in Multi-Jurisdiction Reporting

For multinational corporations, additional complexities arise due to varying local accounting standards, tax regulations, and currency fluctuations. Reconciling IFRS reporting with local requirements requires close collaboration among finance, HR, legal, and tax teams. Without proper coordination, inconsistencies can occur, increasing audit risk, complicating regulatory compliance, and reducing investor confidence.

Leveraging Technology for Transparency and Efficiency

Automated equity management systems can streamline tracking of grants, exercises, cancellations, and forfeitures, calculate fair values, and generate IFRS-compliant reports. Centralized platforms reduce manual errors, ensure consistent application of accounting policies, and simplify audit preparation. Advanced analytics also allow companies to simulate different scenarios, improving accuracy in expense recognition and disclosure.

Internal Control and Process Challenges

Cross-Functional Coordination

Accounting for SBPs involves multiple departments. Finance teams handle calculations, HR tracks vesting and exercises, and legal ensures compliance with contractual terms. Misalignment or poor communication between departments can lead to accounting errors, compliance breaches, and misinformed decisions. Effective cross-functional coordination ensures that all inputs, assumptions, and changes are accurately reflected in financial reporting.

Documentation of Assumptions and Policies

Maintaining comprehensive documentation is critical for compliance and audit readiness. This includes the rationale for valuation assumptions, vesting schedules, grant agreements, and modifications. Clear documentation also supports consistency across reporting periods and facilitates transparent communication with auditors and investors.

Continuous Monitoring and Revaluation

As market conditions and company performance evolve, regular reassessment of valuation assumptions is essential. Companies must monitor factors such as share price volatility, interest rates, and employee turnover to ensure that reported expenses remain accurate and reflective of economic reality.

Strategic Implications of Accounting Challenges

Impact on Investor Confidence

Accurate accounting and transparent disclosure of SBPs enhance investor trust. Investors gain insight into compensation costs, potential equity dilution, and governance practices. Conversely, errors or unclear reporting may erode confidence, reduce stock value, and limit access to funding.

Operational and Strategic Decision-Making

Accounting inaccuracies can distort profitability metrics and misinform executive decision-making. By ensuring correct SBP accounting, companies can make better-informed strategic decisions, align employee incentives with corporate goals, and optimize capital allocation.

Implications for M&A and Strategic Transactions

During mergers, acquisitions, or fundraising events, accurate SBP accounting is crucial to reflect contingent liabilities and equity obligations. Transparent reporting mitigates risks, ensures proper due diligence, and supports successful negotiations.

Industry-Specific Considerations

High-Growth Startups and Technology Companies

Startups often grant options at low exercise prices, creating substantial potential tax and valuation implications upon exit or IPO. Estimating fair value requires careful judgment, considering dilution, liquidity events, and potential market growth. Transparent accounting and communication are essential to maintain trust with employees and investors.

Regulated Industries

Sectors like banking, insurance, and pharmaceuticals face strict governance requirements. Accurate SBP accounting ensures compliance with both IFRS and industry-specific regulations, reducing regulatory risk and maintaining corporate reputation.

Multinational Corporations

Global companies must navigate complex, cross-border issues including multiple accounting standards, diverse tax regimes, and currency exposure. Centralized reporting systems and interdepartmental coordination are essential to ensure consistent and compliant financial reporting across all jurisdictions.

Case Study Example: Technology Startup

Consider a high-growth technology startup that decides to implement a stock option plan for its early employees. The plan is structured so that options vest over four years and are contingent on meeting specific performance targets, including achieving revenue milestones and successfully launching new products. Accounting for these options presents several challenges. At the grant date, the company must estimate the fair value of the options using a suitable valuation model, such as a binomial model, due to the multi-stage vesting conditions and the uncertainty around the timing of achieving performance goals. This valuation must take into account share price volatility, expected life of the options, risk-free interest rates, and anticipated dividends.

Once the fair value is determined, the company must recognize expenses proportionally over the four-year vesting period. Adjustments are necessary to account for potential forfeitures, such as employees leaving before completing the vesting period. For example, if an employee resigns after two years, the company must accurately adjust the previously recognized expense to reflect only the portion of the options that were earned. In addition, any modifications to the plan, including changes in performance conditions or exercise periods, must be carefully documented and reflected in the financial statements to comply with IFRS 2 requirements.

The startup also needs to track exercises and cancellations in real time to ensure accurate reporting. Implementing an automated equity management system can streamline this process by maintaining a centralized record of all option grants, exercises, cancellations, and forfeitures. Such a system not only reduces the likelihood of manual errors but also provides timely, IFRS-compliant reporting for internal decision-making and external disclosure.

Transparent communication with employees is equally critical. The company must clearly explain the mechanics of the stock option plan, the implications of performance conditions, and the potential tax obligations associated with exercising the options. By combining rigorous accounting practices, reliable reporting systems, and clear employee guidance, the startup can ensure compliance with IFRS 2 while also reinforcing employee engagement and trust. This approach allows the company to align employee incentives with strategic objectives, attract and retain talent, and maintain investor confidence through accurate and transparent financial reporting.

Conclusion to Accounting Challenges in Share-Based Payments

Share-based payments are powerful tools to align employee incentives with company performance, but they come with significant accounting and reporting complexities. These include fair value estimation, performance-based vesting, modifications, disclosure requirements, and multi-jurisdiction challenges.

Companies that implement robust internal controls, leverage technology, maintain comprehensive documentation, and ensure cross-functional collaboration can manage these challenges effectively. Accurate SBP accounting enhances compliance with IFRS reporting for stock options, strengthens investor confidence, supports strategic decision-making, and mitigates regulatory risk.

By mastering the intricacies of SBP accounting, organizations can transform what might appear as a reporting burden into a strategic advantage, fostering employee engagement, enhancing governance, and driving sustainable enterprise growth. Properly managed share-based payments contribute to financial transparency, organizational efficiency, and measurable long-term value creation for shareholders and employees alike.