Understanding Stock Options Accounting Under IFRS

Understanding Stock Options Accounting Under IFRS

Stock options have emerged to be one of the most prevalent forms of equity-based compensation particularly in high growth companies that want to compete and retain the best talents. With the increased understanding of equity incentives in businesses in Singapore and other businesses in the world markets, accounting standards need to be made clear. The International Financial Reporting Standards (IFRS) have a broad standard in terms of recognising, measuring, and disclosing stock options. Understanding the benefits of ESOP for business owner Singapore can also help companies design stock option schemes that align employee incentives with long-term ownership goals. However, the application of the rules in many organisations is still a challenge particularly when valuation, grant-date measurements and expense recognition at a vesting period are being done.

The paper is devoted to a single subject: the interpretation of the IFRS regarding accounting treatment of employee stock options, which provides insight into the technical conditions, techniques and practical aspects on which companies should operate.

1. Primary Principles of IFRS of Stock options.

1.1 The basic knowledge of the principle of IFRS 2.

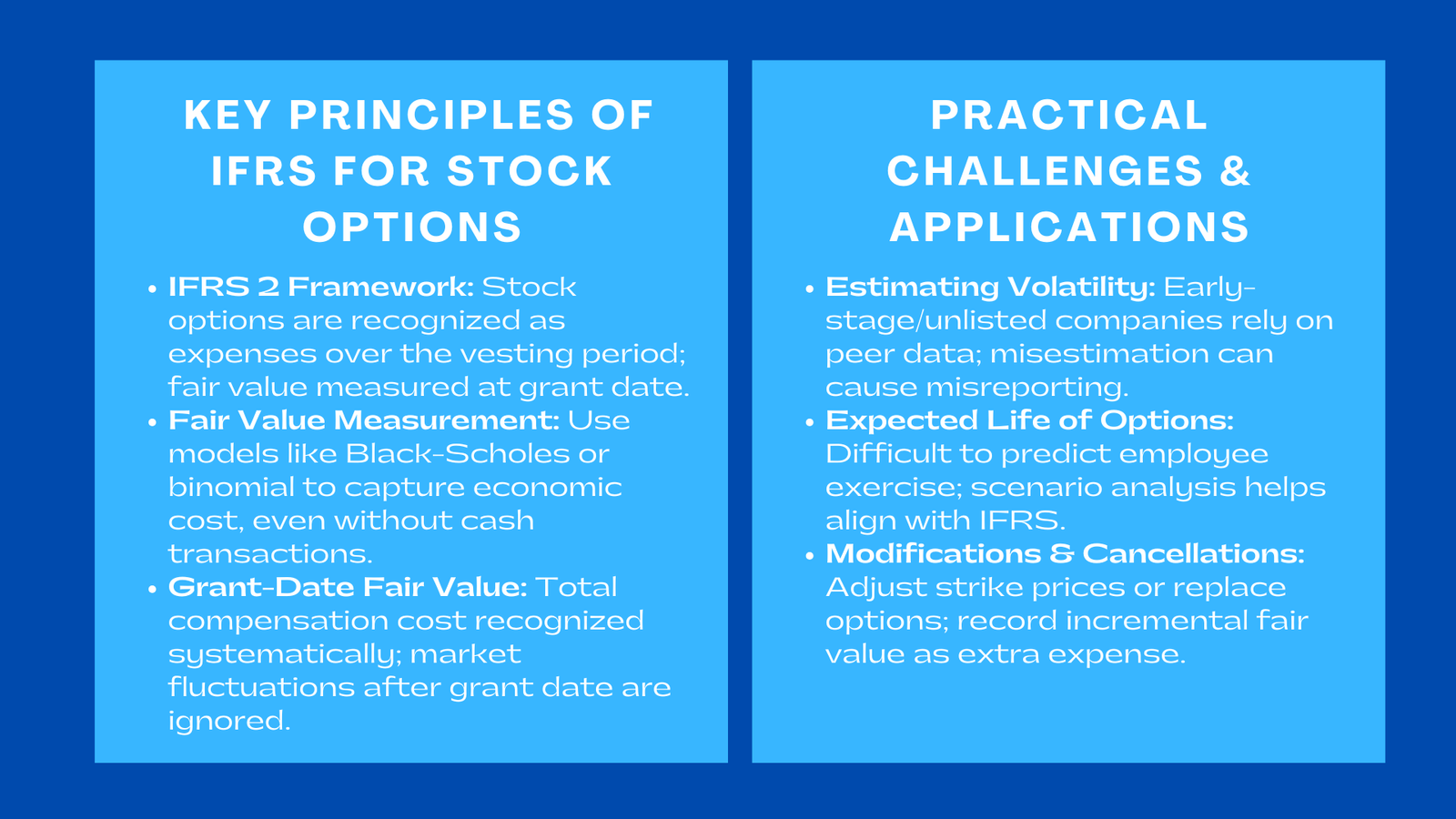

The recognition of the stock options is on IFRS 2 Share-based Payment that determines the principle that equity compensation should be recognised as an expense as long as employees deliver services in respect of the future equity. This implies that the fair value of options is determined as at the grant date, and expensed during the vesting period. The standard does not just consider the stock options as incentives but a contract, the value of the contract should be reflected properly in the financial statements.

1.2 The significance of fair value Measurement.

IFRS obliges firms to determine the fair value of stock options, usually through option-pricing models, such as the Black-Scholes or binomial. Transparency is guaranteed by fair value measurement which endeavors to measure the economic cost of granting equity even when there is no cash transaction. Indicatively, when a technology start-up provides alternatives to a newly employed CTO, it should realise the fair value of the alternatives as an expense during the period of vesting, of which the actual price of paying the executive. The complexity of estimating inputs like volatility, risk-free rates, expected life and behaviour of employees during exercise is a challenge that faces many companies.

2. Valuing and recording the Stock Option Expenses.

2.1 In this section, I will discuss the concept of Grant-Date Fair Value and its effect on the firm.

The grant date is critical, since IFRS stipulates fair value that should not be revaluated in future but rather revaluated at the particular time as far as market conditions are concerned. This fixed valuation method provides a sense of certainty to the companies, yet requires accuracy to work with in the first place. Assume that one firm has 200,000 options and the fair value of these options on the grant-date is SGD 2.50 per option. Today, the total compensation cost of SGD 500,000 will have to be recognised systematically throughout the vesting period, irrespective of what will be the future change in the price of the stock.

2.2 Vesting Requirements and Cost apportionment.

The IFRS identifies service conditions, performance conditions and market conditions of vesting associated with varying accounting implications. The service conditions mandate the employees to be employed within a certain period whereas the performance conditions can be revenue or EBITDA targets. As an illustration, when employees are required to spend three years in order to get the options, the company spreads the cost of the compensations over the three years. The fair value is built up to reflect market conditions, e.g., the attainment of a certain share price and is not re-assessed post-grant.

Another aspect of IFRS that is not shared with other reporting frameworks is the treatment of forfeitures. Under IFRS, companies are expected to estimate the future forfeitures but change it during the period when employee turnover has become apparent. This dynamic methodology will make sure that the reality of expense recognition is realized during the vesting period.

2.3 Incorporating Long-Tail Keywords

At this stage of measurement and recognition, companies often refer to Stock options accounting guidance to refine assumptions, improve valuation accuracy, and ensure compliance. Similarly, adherence to IFRS share-based payment rules remains critical for producing transparent, investor-ready disclosures.

3. Practical Challenges Companies Face in IFRS Accounting

3.1 Estimating Volatility for Unlisted or Early-Stage Companies

Share price volatility is a major challenge especially when it comes to estimating the share prices, especially in unlisted companies. In the case of startups, peer-group volatility data, or other methods of making estimations, are typically used. As an example, a scale-up fintech with no trading history could use the volatility of similar listed payment companies. This entails professional judgement and when it is done poorly can cause misvaluation and misreporting.

3.2 Expected Life Determination of Options.

IFRS also mandates that expected life of options to be used in valuation models would be contractual life. Nevertheless, the exercise behaviour is sometimes complicated to predict. When liquidity events or even volatile markets occur, employees will exercise early. Misinterpreted expected-life assumption may have a significant impact on fair value. This is alleviated by a number of companies through studying past exercise patterns or by carrying out scenario analysis.

3.3 Movement through Modifications, cancellations and replacement.

The arrangement of stock option usually becomes dynamic. Firms can fix the vesting, adjust the strike price or substitute old options in case of restructurings. The IFRS states that companies should record incremental fair value, i.e. the amount of value added because of the change, on top of the original cost. The reduction in the price of exercises when the economy is in a bad condition is one such example and this normally escalates fair value and should be recorded as the extra cost in the period when the decision is made or during the remaining period of vesting.

4. Practical application of IFRS.

4.1 Starting with Technology-based Startups and Rapid Scaling.

Accelerated companies often use stock options to poach the best technical employees. An example of such a Singapore-based software startup could provide developers and product leads with ESOS packages. Under IFRS, the company should carry out a grant-date valuation, a binomial model, and identify expenses through the vesting period. With new rounds of funding altering the value of companies, the management needs to distinguish between market-driven changes in the prices (which they are ignored in accounting) and changes (which will incur extra charges).

4.2 Multinationals and Performance-Based Schemes.

Multinational companies that are based in several jurisdictions may provide performance-based stock options based on a financial KPI, like ROE or EBITDA. Under the IFRS, where performance conditions are non-market conditions, then the expenses are adjusted on the basis of probability of the condition being fulfilled. To illustrate, when initial results show a poor performance, then then such company will have to lower the number of options that are supposed to be vested and accordingly the cumulative expense.

4.3 Privates that are Undergoing IPO Planning.

Businesses that are about to go to the public listing need to shift to the full use of the IFRS in case they were using the simplified frameworks. This change tends to expose miscalculations in valuation assumptions, vesting, or change in accounting. Before an IPO, companies usually conduct an IFRS-escalated ESOS audit in order to rectify past inaccuracies in order to be approved by the regulatory authorities and to assure investors.

Conclusion to Understanding Stock Options Accounting Under IFRS

It is essential to acknowledge that the accounting of stock options in IFRS is essential in the quest of transparency, good governance and investor confidence by companies. With the increasing popularity of equity compensation in industries, the necessity to properly value, appropriately identify expenses, and well document shall only increase. Stock-based compensation will increasingly integrate analytics, more dynamic valuation models, and tie more closely to the corporate strategy in the future. Firms that take the first step in enhancing their IFRS compliance capacity, particularly in the area of stock option accounting will find it easy to navigate audit procedures, foster better investor relations and have a more plausible financial reporting.