Advanced ESOP Implementation Professional Training

How the Employee Share Ownership Plan and ESOP Employee Stock Ownership Plan Are Reshaping Modern Workforce Wealth

Introduction to Advanced ESOP Implementation Professional Training

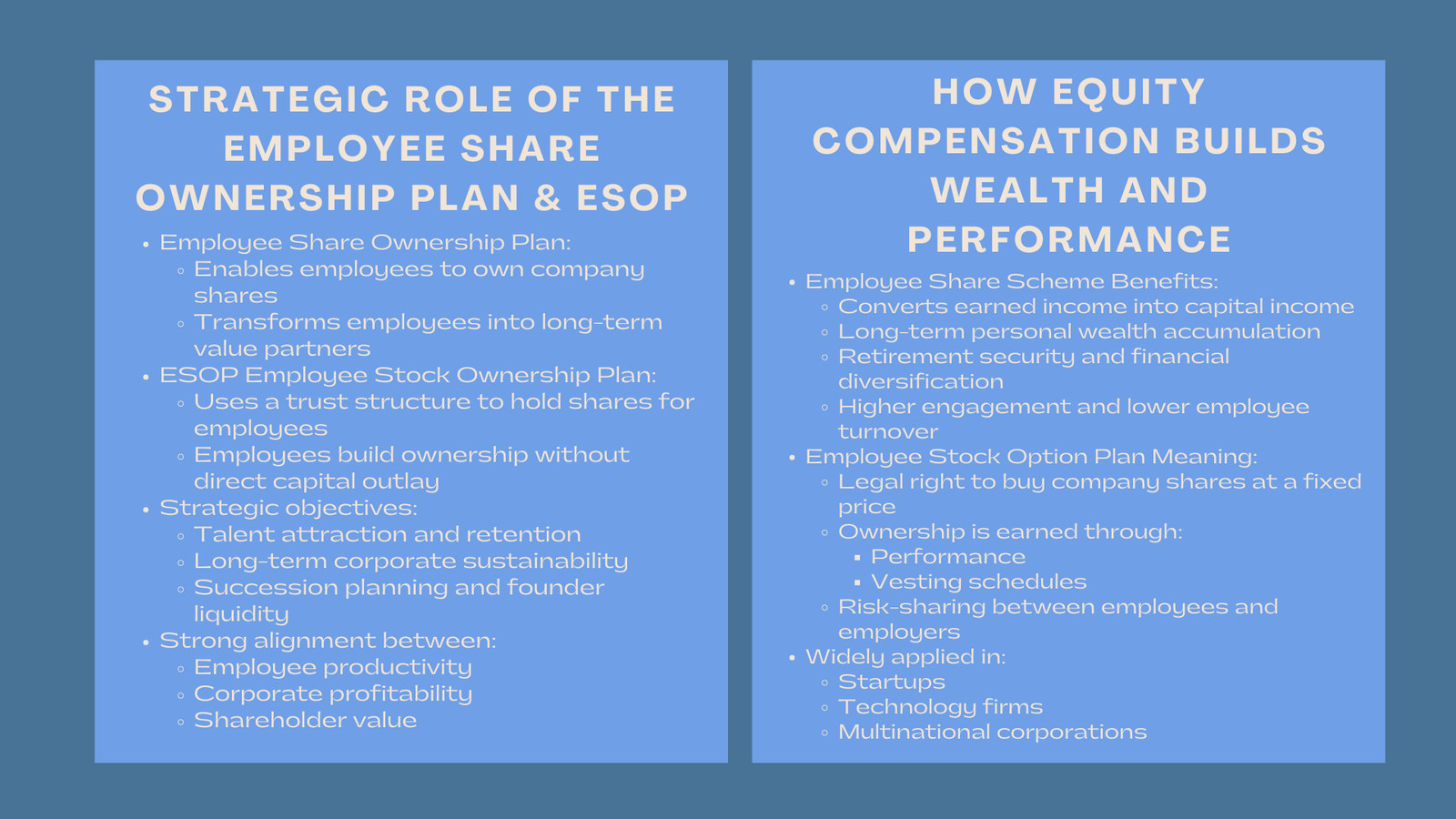

In the modern global economy, which is highly innovation-driven, talent retentive and long-term corporate sustainability, ownership-based compensation has emerged as a key human capital management pillar. Now the employee share ownership plan, which has often been combined with the esop employee stock ownership plan, is one of the most powerful instruments employed by corporations in order to bring employee interests and shareholders together.

There is a growing use of the employee stock option plan meaning as a fundamental financial incentive alongside this structure and with formal documentation in the form of employee stock option form. These structures combine to provide quantifiable employee share scheme benefits, such as wealth creation, productivity improvement, and corporate stability. With the competition among companies to secure competent professionals in the industries that are knowledge-based, employee equity participation is no longer a luxury but strategic need.

1. Strategic Foundations of the Employee Share Ownership Plan

The employee share ownership plan refers to a company structure of buying company shares by the employees. This model entrenches the employees into long-term financial flow of the organization as opposed to the short-term cash incentives. The culture of accountability, loyalty and value creation is actually created through employee share ownership plan. Once employees are turned into co-owners then the performance of the corporation is directly associated with the corporate success.

Current companies embrace employee share ownership plan to achieve three fundamental strategic goals namely attraction of talents, and retention of workers, as well as sustainable expansion. There is an increased likelihood of employees with ownership exposure to become involved in innovation, productivity improvement, and cost discipline as their own wealth gains the direct relationship with enterprise performance.

The employee share ownership plan is also a succession planning tool in closely held companies so that the ownership of the company does not leave the organization but the founders can cash in a quota of their shareholding over time.

2. Understanding the ESOP Employee Stock Ownership Plan

The esop employee stock ownership plan which is also known as an employee stock ownership plan is an organized legal and fiscal system where a company creates a trust that purchases and owns company shares on behalf of the employees. The esop employee stock ownership plan is unlike the traditional equity grants in that the employees are allowed to accumulate shares without necessarily investing their own capital.

In an esop employee stock ownership plan, shares are divided into accounts of individual employees according to their salary levels, tenure or contribution. These shares allocated are vested with a period over time following fixed schedules. Upon full vesting, employees become legally entitled to the monetary gain pertaining to their shares such as dividends and capital gain.

The esop employee stock ownership plan has a significant role to play in the private companies where the shares are not publicly traded. It gives funding liquidity to founders and early investors and maintains continuity of the organisation and operational autonomy. In multinational corporations, the esop employee stock ownership plan has become a cornerstone of executive and mid-level incentive structures.

3. Employee Share Scheme Benefits in Long-Term Wealth Creation

The economic reason for employee share scheme benefits is intrinsically entrenched in incentive alignment and compounding wealth influence. The possibility of transforming labor income into capital income is one of the most effective employee share scheme benefits. Workers are no longer paid on the basis of monthly salaries but they also enjoy enterprise value appreciation.

Wealth diversification with time is another of the greatest employee share scheme benefits. This long-term financial security accumulated systematically over time through a share-building program provides employees with long-term financial security to supplement their retirement plans. These advantages are optimized in organizations that have steady inflows, which are scalable and well-established systems of governance.

In addition, employee share scheme benefits include higher employee engagement, reduced staff turnover, and stronger organizational cohesion. Equity employees are more committed to strategic goals, operational productivity, and customer experience perfection.

4. Employee Stock Option Plan Meaning in Corporate Compensation

The employee stock option plan meaning refers to a contractual right vested in employees to buy shares in the company at a specified price following a process of making a specific number of requirements that are known as vesting requirements. The stock options are only a prospective ownership as compared to immediate ownership of shares depending on further service and performance.

The employee stock option plan meaning also reflects a risk-sharing arrangement. The employees take the risk that the value of the shares in the market in future might be more or less than the exercise price. They in exchange have an entry in to potential upside without the requirement to capitalize on it.

The employee stock option plan meaning has evolved significantly in technology firms, startups, and multinational corporations where equity upside represents a major component of total compensation. These strategies are designed in a way that they encourage innovation, contribution to leadership and strategic implementation in long term.

5. Legal and Operational Role of the Employee Stock Option Form

The employee stock option form is a legally binding document that outlines the rights, obligations and conditions relating to grant of stock options. This paper regulates the vesting schedules, the exercise windows, conditions of termination and taxation.

Each employee stock option form clearly specifies the strike price, the time of vesting and option exercise procedures. It also determines what the unvested options do in the case of resignation, retirement, disability or termination due to cause.

The employee stock option form is advantageous to the employer and the employee in terms of governance as it is transparent and enforceable. This documentation is strongly scrutinized by regulatory bodies to ascertain that securities laws, taxation regulations, and shareholder protection systems are upheld.

6. Integration of ESOP and Stock Options in Modern Corporations

The employee share ownership plan and the esop employee stock ownership plan tend to be used in conjunction with stock option programs to develop a stratified equity compensation system. Whereas ESOPs emphasize a mass-oriented ownership, stock options are concentrated upside incentives or rewards among the key contributors and management.

This combined strategy enhances the entire employee share scheme benefits because employees at varying organizational levels will be able to have a share in the ownership using relevant tools. The entry-level employees can be engaged mainly by ESOP allocation and the senior management can be granted bigger upside exposure by stock options under the employee stock option form.

This mix of structure increases equity, operational incentives and multi-generational wealth generation throughout the corporate chain of command.

7. Taxation and Regulatory Treatment of Employee Equity Plans

One of the most important dimensions of implementation of employee share ownership plan and esop employee stock ownership plan is tax treatment. ESOP contribution is tax-deductible to the company in a number of jurisdictions, and the employees receive deferred tax benefits until they dispose of shares.

There are also serious tax implications to the employee stock option plan meaning. Various countries have the taxation of stock options at the time of the exercise or sale based on the classification under regulations. The form of the employee stock options forms a direct impact on the tax exposure to both the company and the employee based on the structure.

In an effort to encourage employee share scheme benefits, governments frequently provide favorable tax regimes, as they acknowledge that universal ownership helps in the accumulation of social capital, retirement benefits, as well as in the inclusive growth of the economy.

8. Corporate Performance Impact of Employee Ownership

The empirical studies invariably demonstrate that firms with sound employee share ownership plan structure perform better than the others in terms of productivity, profitability, and innovativeness. Shareholders have more strategic alignment and less tolerance to short term volatility in the pursuit of long-term enterprise growth.

The drive that is familiar in the esop employee stock ownership plan establishes a psychological contract beyond the normal employment relationships. Ownership helps in stewardship, accountability and long-term orientation at any level of an organization.

Furthermore, employee share scheme benefits have a stabilizing effect during economic downturns. When employee-owners realize the direct correlation between corporate revival and personal prosperity, they will be more willing to participate in restructuring plans, efficiency and turnaround plans.

9. Risk Considerations for Employees and Employers

Despite the powerful employee share scheme benefits, there are dangers involved with equity-based compensation. The concentration risk originates when employees concentrate a great part of their individual wealth in the employer stock. When the corporate performance is negative, it is possible that the employees would experience both unemployment in their jobs and loss of capital simultaneously.

In the perspective of the employer, the wrongly designed employee share ownership plan models may result in dilution of shareholders, complexity of manageability, and exposure to regulations. The outcomes of poorly defined employee stock option form agreements might be legal disputes, misclassification in accounting and tax penalization.

Thus the governance discipline, valuation transparency, and compliance on regulation continue to be not negotiable pillars of successful ESOP and stock option execution.

10. ESG and Workforce Capital Integration

The employee share ownership plan is one of the social capital indicators in the contemporary environmental, social and governance frameworks. Employee ownership is becoming a good indication of inclusive growth, equitable compensation policy, and long-term stakeholder alignment to investors.

The esop employee stock ownership plan directly facilitates the inclusion of workforce wealth that is not reliant on a wage-only model of income. This improves corporate ESG ratings, credibility of governance and confidence of long term investors.

11. Digital Transformation in Equity Compensation Administration

ESOP administration, equation conception and stock option lifecycle administration are currently automated on digital platforms. These technologies facilitate the employee stock option form administration, perform automation of the vesting calculations, and create real-time valuation dashboards to both employers and employees.

These innovations enhance transparency in the employee stock option plan meaning, allowing employees to visualize future wealth trajectories under varying performance scenarios.

12. Career and Financial Planning Implications for Employees

Under an employee share ownership plan professionals have access to a long-term wealth creation system previously the prerogative of founders and institutional investors. Knowing the meaning of employee stock option plan enables an individual to make sound choices on the areas of vesting, timing of exercise, diversification and efficiency of taxes.

The effective management of the employee stock option form provides the employees with the power to incorporate equity compensation in retirement planning, acquisition of property, and diversifying in their portfolios.

Conclusion

The employee share ownership plan, supported by the esop employee stock ownership plan, has fundamentally transformed modern compensation philosophy by shifting employees from wage earners to long-term value participants. The meaning of the employee stock option plan is sufficiently clear, and is supported by impressive instruments, like the employee stock option form, which is enforced by law and represents a safe legal and financial environment in which equity participation will take place.

Some of the most revolutionary employee share scheme benefits include accumulation of wealth, productivity, stability of an organization and capital ownership. With the world becoming an increasingly competitive place when it comes to talent, and ESG responsibility becoming an increasing force in corporate governance, employee ownership is bound to become one of the most efficient ways of sustainable enterprise growth.