Accounting Treatment for Stock Options

Accounting Treatment for Stock Options

Introduction to Accounting Treatment for Stock Options

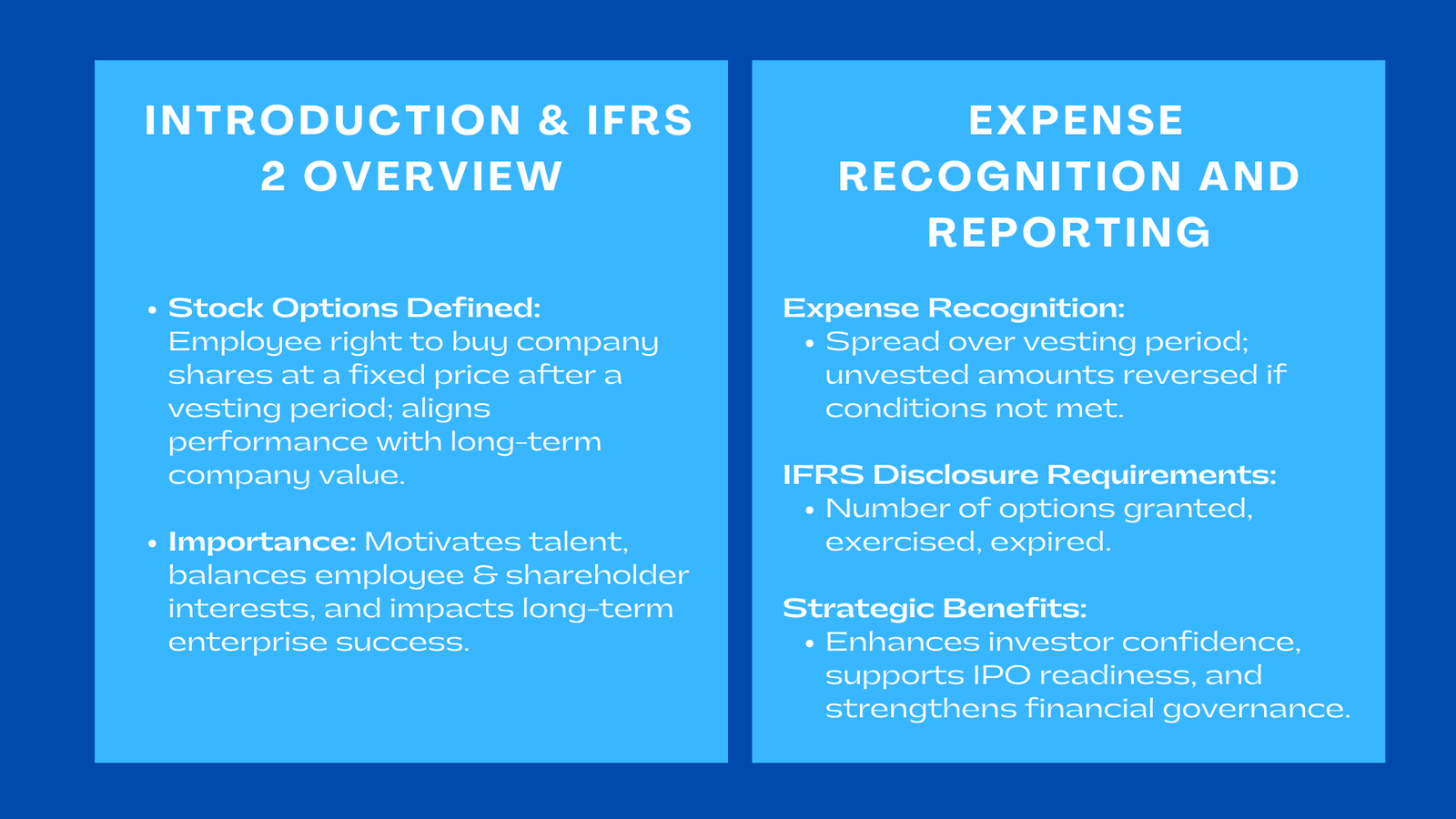

Stock options have emerged as a foundation of contemporary rewards, especially to organizations that want to attract and retain top talent and also to balance the interests of employees with the interests of the company in the long term success. These incentives are equity-based and are important in rewarding performance and ownership whether bestowed by multinational corporations or an emerging start-up.

Despite the motivational appeal, however, there is a complicated accounting and reporting problem beneath. In order to properly identify, measure and recognize as well as to disclose the stock options, it takes a profound knowledge of the financial reporting standard, particularly the IFRS. Similarly, understanding how to value a trademark in Singapore with ValueTeam requires expert assessment and accurate methodologies. The errors in this field may result in the material misstatements, regulatory investigation and the loss of trust.

The article describes the application of the accounting of stock options by companies giving their perspectives on the principles of recognition, valuation, recognition of costs and disclosure requirements under the IFRS.

Introduction to Stock Option Accounting.

The definition of a Stock Option?

A stock option is an agreement between the employees and the company that empowers them but does not compel them to buy shares of the company at an agreed price (also called exercise or strike price) after a defined period of time (vesting period). The aim is to encourage the workers to help in creating long-term value to the company- in case there is an increase in the share price, then the employee will benefit, which will help to solidify the performance alignment.

Accounting-wise, stock options are regarded as a kind of share-based compensation, which is viewed as a cost that reflects a rational value of equity-based instruments that employees provided in exchange to be able to offer their services.

IFRS 2: The Governing Standard

According to the IFRS 2 Share-based Payment, the cost of stock options should be recognized as an expense in the course of the vesting period, and a credit made to equity. This would make the financial statements reflect the economic cost of providing equity-based compensation to employees.

The standard puts an emphasis on fair value measurement at the grant date i.e. companies will not be allowed to use the exercise price or intrinsic value and should estimate the value that can be reflected by the market of the options by use of relevant financial models.

The significance of Compliance and Transparency.

Good accounting treatment is evidence of good governance and enhances investor confidence. It will also provide the stakeholders with the confidence that the management decision making process is open and that the incentives provided to the employees are aligned with the interests of the shareholders. Compliance also aids in avoiding the expensive re-statements which may hurt the credibility in the financial markets.

Identification and Measuring Fair Value.

Determining the Grant Date

The date of grant is whereby the entity and the employee have agreed on the conditions of the stock option. This is where fair value measurement is calculated. The changes in the market conditions do not influence the original valuation anymore, however, they can affect the expense recognition in case of the changes in the options later.

Valuation Models and Assumptions.

Black-ScholesMerton or binomial lattice models are generally option-pricing models that are used to measure fair value. These approaches take into account such variables as the price of shares on the date of the grant, the anticipated volatility and risk free interest rates, the anticipated dividend yield, and the anticipated option life.

These assumptions should be estimated accurately. Indicatively, volatility is supposed to be calculated using the historical data after adjusting to various expectations in the future whereas the option life estimates should also be calculated using employee behavior such as their tendency to exercise options early.

Many organizations engage professional valuers to ensure that fair value estimations meet the standard of accounting for stock options IFRS compliance, particularly when complex performance or market conditions apply.

Barrier to Market vs. Market Vesting Conditions.

The difference in the IFRS 2 is between the conditions of the market (e.g., share price target) and non-market conditions (e.g., further employment or revenue goal). The grant-date fair value includes market-based conditions, whereas the non-market conditions influence the amount of options that would be vested and should be reviewed periodically throughout the vesting period.

This difference will make sure that the expenses are recognized correctly and do not overstate or understate the compensation costs.

Expenses Recognition and Equity Recording.

Expense Recognition over the Vesting Period.

After the fair value, it is recognized as an expense and is spread over the period of vesting in which the workers are required to deliver services before the right to exercise his or her options is vested in him or her. The fair value has been divided equally over reporting periods, so that the expenses are stressed to the economic service period.

Unvested amounts of the expense are inverted in case workers do not fulfill the vesting requirements (e.g. do not remain in the company until it vests). This dynamic methodology encourages the truthfulness and avoids inflating the compensation expenses in the books of accounts.

Equity Classification

In the majority of instances, stock options are equity-settled share-based payment or put differently, they are paid in terms of shares and not cash. The entry to the equity under the share-based payment reserve is made upon the recognition of the expenses.

In the exercise of options, the reserve is exchanged to share capital and the proceeds of exercise are incorporated to cash balance of the company. The process represents the transition of the possible ownership to the actual involvement in the equity.

Amendments and Cancellations.

Companies occasionally reform stock option programs in order to change strike prices, vesting schedules or performance terms. According to the IFRS 2, any incremental fair value since a modification has to be recognized during the remaining vesting period. In the contrary, in case options are cancelled, the unrecognized expense should be recognized at once in profit or loss.

When these changes are well documented, the transparency and compliance are well captured and the chances of audit challenge or restatement are minimized.

Under IFRS, Disclosure and Reporting.

Financial Statement Transparency.

The IFRS 2 disclosure requirements on stock options are comprehensive, and their goal is to give the stakeholders a complete picture on the effect of share-based payments on the performance and equity of the financial statements. The nature and terms of share-based payment arrangements including the number of options granted and exercised and expired during the year should also be disclosed by the companies.

Also, companies are supposed to provide a description of valuation techniques, material assumptions, and the overall cost of recognizing the period. Such disclosures improve the investor confidence and give the insight into the compensation philosophy of the company.

Role and Internal Controls of Auditors.

The accounting of stock options is sensitive to the auditors because it is complex and can be misstated. Business enterprises are supposed to have solid internal control measures on assumptions of valuations, recognition of expenses, and records.

Consistency in HR records, valuation reports, and accounting entries is achieved by the regular reconciliation. To ensure compliance with the requirements of IFRS, many companies carry out annual compliance controls or internal audits to ensure that the requirements are fulfilled.

Maintaining such rigor supports an effective employee stock options accounting treatment process and strengthens overall financial governance.

Strategic Implications of Proper Accounting

Shareholder Perception and Financial Robustness.

Exact identification and clear reporting of stock options portray financial maturity and corporate control. In the case of publicly listed companies, the reputation of the companies in terms of credibility is enhanced through the regular observance of IFRS standards by the company in the company analysis, contributing to investor confidence and regulators.

In the case of startups preparing to raise funds or IPOs, clear accounting treatment would help the investors know that the compensation structures are sustainable and inclusion in financial statements is correct. This improves the valuation performance and creates confidence in due diligence.

Integrating Finance with Human Resources.

The accounting of stock options involves smooth work between the HR and the finance departments. HR is responsible of grant documentation and vesting, and finance makes sure that it is properly valued and reported. The lack of alignment between these functions will cause discrepancies that are costly.

Accuracy of this can be achieved by using integrated systems and holding cross-functional reviews to regular reviews especially in organisations that have frequent grants or global operations.

Beneficial in the Long term to the Corporation.

In addition to compliance, appropriate accounting treatment assists the management to identify the actual cost of incentives to employees. It enables sound judgments on the amount of grant to be awarded in the future, the possible dilution, and economic sustainability.

Finally, open accounting establishes trust among all stakeholders including the employees and investors, and strengthens the image of the company as ethical and responsible in its financial management.

Conclusion

Stock options continue to play a critical role in the current compensation systems by balancing the objectives of talent management, motivation and shareholder wealth generation. However, their accounting treatment must be carefully taken under the IFRS.

Companies not only demonstrate integrity in financial reporting by making sure that they are compliant by ensuring that their valuation is correct, by ensuring expenses are recognized on time, and full disclosure is carried out. The appropriate accounting treatment ensures credibility of the corporation, governance excellence, and investor confidence, which are the critical components of sustainable business development.