Best Practices for ESOS Implementation

Best Practices for ESOS Implementation

Introduction to Best Practices for ESOS Implementation

ESO schemes have become a crucial part of current compensation architecture particularly where a firm faces competition in specialised talent, is growing rapidly, or in a shift to new business models. Although it can be seen that ESOS can be a very effective tool in terms of retention and alignment, their efficacy depends on thorough planning and rigorous implementation. Weak or inconsistently administered programs may pose compliance risk, bias financial reporting and destroy employee trust, highlighting the need for guidance often provided by a business valuation services Singapore expert firm.

This paper dwells on a single field namely best and practical practices that companies ought to consider to introduce ESOS effectively whether in terms of strategy and design up to the administration, accounting and compliance.

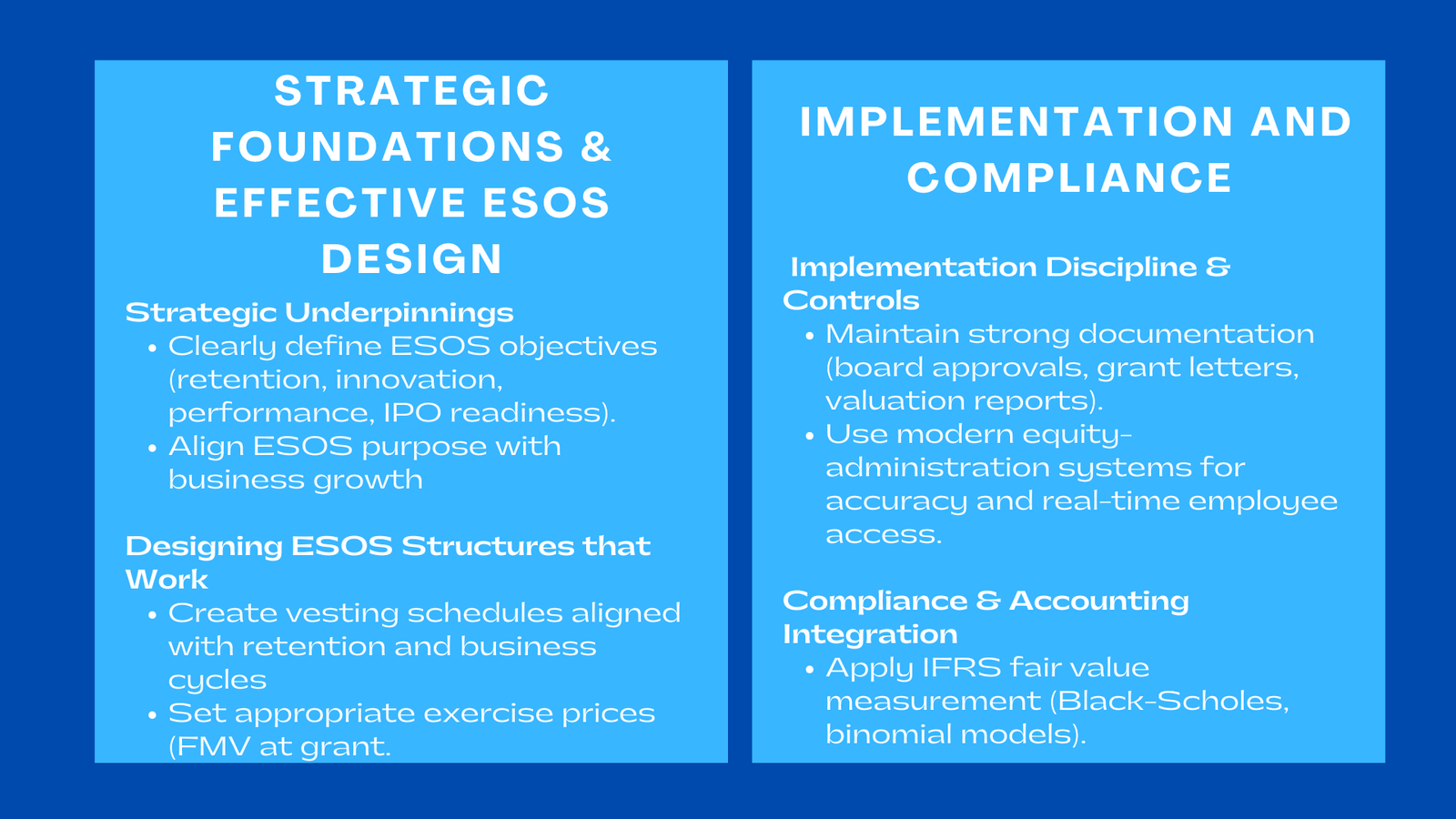

1. Strategic Underpinnings to ESOS Implementation.

1.1 The first step involves the setting up of Rationales and Objectives.

Prior to releasing the share options, companies should articulate the reasons as to why the ESOS is being implemented and what results it is supposed to justify. Examples of goals can be the retention of top executives, the incentivization of innovation, the incentivization of performers, and the IPO preparation.

An example is a developing technology company that is initiating a local growth, thus it implements an ESOS to enhance long-term commitment by the engineering and product leaders who lead innovation. Setting up strategic clarity in the early stages assists in the establishment of the vesting terms and performance conditions as well as grant sizing.

1.2 Determining the ESOS Equity Pool.

The option pool size has a direct influence on shareholder dilution and motivation of the employees. ESOS at the early stage may be 10-15 per cent. of share capital, and in large companies, smaller pools with specific grants of mission-critical positions could be implemented.

The only thing necessary is a balanced approach. A pool that is too small undermines retention value; a pool that is too large will provoke shareholder opposition. Firms intending to conduct an IPO should also take into consideration what the market places in terms of the level of dilution.

1.3 Increasing ESOS and Organisational Culture.

Culture dictates the perception of fair pay by the employees. It is important to be transparent, just and communicate. Other corporations focus on ownership mentality and employees are motivated to look at the company as a place of long term investment. To illustrate the previous point, a company that is in the digital transformation process typically uses ESOS to foster a culture of innovation to reward employees based on the present value and future value creation.

2. Designing ESOS Structures That Work.

2.1 Vesting Schedules to Support Business Needs.

The terms of vesting should be based on the retention objectives and cycles of business. Time-based vesting promotes long-term employment and performance-based vesting relates performance to value creation. Mature companies generally apply hybrid models in order to strike a balance between commitment and performance.

The restructuring of operations by a logistics company led to the introduction of performance-based options based on cost-efficiency goals where equity bonuses were pegged on operational enhancement.

2.2 Setting the Exercise Price

The perceived value and the participation rates depend on the exercise price. At grant date, companies usually determine the price as fair market value. Rapidly growing firms, in their turn, may employ high-priced options to encourage breakthrough performances.

A fintech company that expected its valuation to increase rapidly selected options priced at a premium to make sure that the rewards are proportional to future value and employees are motivated to work towards scaling.

2.3 ESOS Eligible Groups Design.

Choosing the recipients of options- and the reasons why- is a part of fairness and strategic fit. Other companies offer broad-based options to the entire workforce, whereas other companies save ESOS to leadership or vital teams.

The principle that is directed is consistency. The leaders should explain to the employees the reasoning behind the allocations to maintain trust and avoid feeling inequitably treated.

3. Construction Implementation Discipline and Controls.

3.1 Correct Documentation and Compliance with the Law.

Effective documentation is also very crucial in audit preparedness and compliance. This includes:

- The resolutions of each grant cycle by the board.

- Grant letters to employees that contain both a vesting and an exercise term.

- Fair value assumption valuation reports.

- Introduction of modifications, forfeiture and early exercise policies.

Firms which do not keep records always experience difficulties when being audited or when undergoing due-diligence particularly prior to fundraising or IPO.

3.2 ESOS Administration Technological Implementation.

Equity-administration systems in the modern world minimize error-prone processes, compute automatically and give workers real time access to their awards.

An e-commerce organization in the region moved to a cloud-based equity management system which combined grant data, vesting plans and accounting records. This minimized paper work, enhanced quality and assisted in consolidating across entities.

3.3 Securing Continued Monitoring and Internal Controls.

ESOS touches on accounting, finance, HR, legal and payroll departments. Cross-functional cooperation would keep the information regarding grants, employee trafficking, and forfeiture in sync. Regular internal controls – quarterly reconciliation of grants, mapping of change in vestsing, and checking of valuation assumptions are some of the measures that can avoid misstatements and ensure that reporting periods remain in compliance.

4. Compliance and Integration of accounting.

4.1 Fair Value Measurement Under IFRS

Equity-settled ESOS have to be measured in fair value at grant date in accordance with IFRS. The markets and behavioural assumptions should be fairly represented by option-pricing models, which can be Black-Scholes or binomial.

This is where companies benefit from following an established ESOS implementation strategy guide, which outlines appropriate valuation models, market data sources, and documentation standards.

4.2 Recognition Compensation Expense.

Fair value is ascribed as expense during the time of vesting period, after deduction of the anticipated forfeitures. Estimates should be reviewed by companies on a regular basis and expense profiles are to be updated in case of employee turnover.

One of the technology companies that restructured has revised its forfeiture assumptions in the middle of the year to capture more current retention assumptions leading to more accurate recognition of expenses and higher transparency in audit.

4.3. The Management of Changes and Repricing.

In situations where businesses reprice options, or change the vesting arrangements, IFRS needs modification accounting, which usually raises compensation cost.

Those companies that do not implement the rules of modifications properly experience high risks of restatement. Regular instructions and procedure audit-tested to manage such complexities are useful to fraternalize and maintain compliance.

5. Communication and Engagement of Employees.

5.1 Effective Communication Works against Mistrust.

The employees should be aware of the functionality of the ESOS, its value and how it is in tandem with the growth of the company. Effective communication enhances the rate of participation and commitment in the long term.

Another thing that companies planning IPOs often invest in is internal ESOS education to prepare employees in case of a liquidity event and taxes.

5.2 Disclosure on Rewards and risks.

Stock options are often overvalued in the short run by employees. Companies need to share long-term value producers and risks to promote decision-making by employees.

A biotech company has internal equity literacy programmemes that were adopted to enable employees to understand the meaning of vesting, valuation, dilution and market situations, which enhanced satisfaction and participation.

5.3 Developing a Culture of Ownership.

Employee engagement improves when ESOS is seen as a way of becoming an owner. Strengthening the culture of ownership – by communicating to employees about ownership with company-wide updates or briefs about performance or strategy, are also helpful.

6. Constant Enhancement and Extensibility.

6.1 Annual Review of ESOS Design

The business strategies change, and the ESOS structures have to change. Annual reviews also make sure that vesting, allocation policies and grant sizing is in tandem with organisational needs.

Any company going global might have to re-structure ESOS to deal with local labour laws or taxation policies.

6.2 Competitor Analysis against Industry standards.

Benchmarking will guarantee competitiveness and avoid excess or deficient equity allotment. Companies at the growth stage tend to peer benchmark in the process of updating their compensation systems.

6.3 Implementing the Best Practices into the Corporate Governance.

Good governance guarantees the ESOS sustainability. To ensure consistency in their policies over time, many organisations entrench policies on grant cycles, valuation procedures, and board approvals.

This forms part of broader share-based payment best practices, strengthening governance and positioning the organisation for future audits, fundraising rounds, or public listings.

Conclusion

ESOS implementation takes more than coming up with an effective compensation plan but strict strategy, discipline in administration, internal control and open communication. Organizations with systematic best practices will not only guarantee adherence but also increase employee involvement and engagement, protect financial reporting integrity, and improve long-term enterprise value. With the trend of increased equity compensation on its way, organisations who learn to make the most out of ESOS implementation will have a high strategic edge in terms of attraction and retaining talent, as well as competitive growth.