Certified ESOP Accounting under IFRS Standards

Understanding ESOP Accounting Under IFRS

Introduction to Certified ESOP Accounting under IFRS Standards

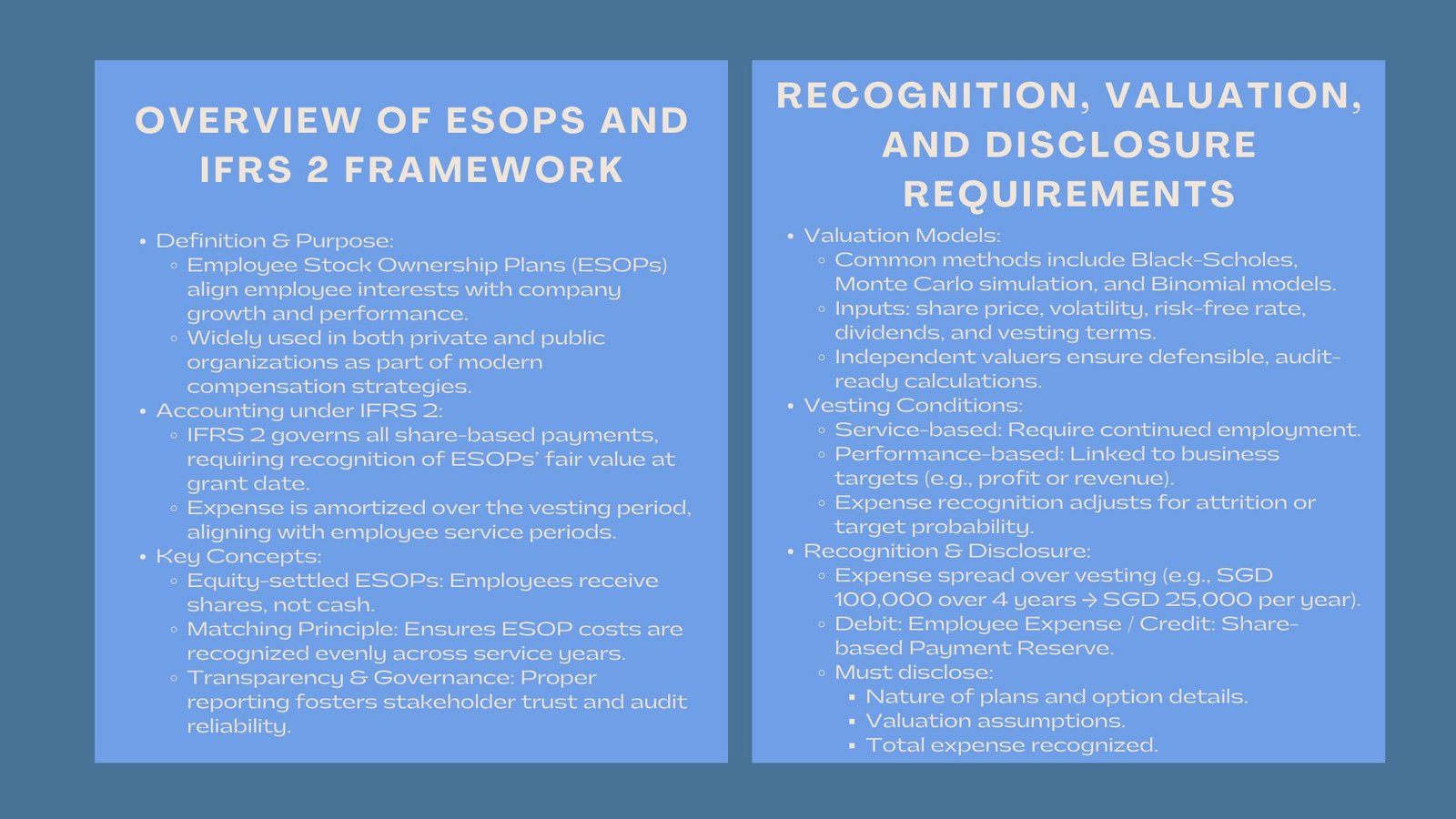

ESOPs have now become part of the contemporary compensation plan, especially in developed compensation plans such as Singapore where the purpose of the compensation plan is to harmonize the interest of the employees with the growth of the company. With the increased popularity of ESOPs in the private and the government organizations, the role of proper accounting using International Financial Reporting Standards (IFRS) has increased immensely.

To finance departments and auditors, the actual accounting of ESOPs is much more complicated than recording an expense. It entangles the fair value recognition, monitoring of the vesting terms, adherence to IFRS 2 and consistency of disclosures. Effective implementation not only aids in transparency, but it will also create trust amongst the stakeholders and investors.

The article is an in-depth review of the accounting of ESOPs under the IFRS – it discusses the valuation principles, recognition of expenses, reporting requirements and the overall effect on the corporate governance.

The Framework of ESOP Accounting (under Ifrs).

IFRS 2: The Foundation

The accounting standard that regulates the share-based payment such as ESOPs is the IFRS 2. This standard stipulates that the companies should acknowledge the fair value of the equity-based compensation at the grant date and expense it during the vesting period.

The hidden logic is easy to understand: as a company issues shares/purchases options to its employees as a part of buying their services, there is a cost that the company has to incur which should be reported in the financial statements. This cost however, and the way it is disclosed, is subject to complex valuation and disclosure provisions.

Both equity-settled and cash-settled share-based payments come under the IFRS 2. Most of the arrangements are equity-settled in the case of ESOPs where the employees end up owning shares and not cash.

Recognition at Grant Date

Under the IFRS 2, companies should record fair value of the ESOPs at the time of grant date, which is the date on which the company and the employee agree on the terms of the plan. This fair value does not change during the vesting period despite the later developments in the market price of the shares.

The identified cost is amortized over the period of the vesting, so that it corresponds to the duration of time when the employees provide services to earn equity. This is a matching principle that would assure that the cost of ESOPs is well captured in every reporting period.

The Role of Valuation Models

In order to come up with fair value, companies normally apply the known financial models including black scholes, Monte Carlo simulation, or binomial techniques. Such models use such variables as share price, volatility, interest rates that are risk free, anticipated dividends, and vesting terms.

This is aimed at estimating the fair value of the ESOPs at the grant date. Any error might result into misrepresentations in the financial statements, which may influence investor confidence and audit results. Therefore, companies often rely on external valuation experts to ensure IFRS compliance for ESOP accounting and maintain defensible documentation for audits and regulatory reviews.

Accounting for Vesting Conditions and Modifications

Conditions of Service and Performance.

The terms of vesting identify when employees can get their shares. With IFRS, a vesting could be grounded in service (e.g., one must remain employed three years), or performance (e.g., be able to achieve revenue or profit targets).

Service conditions influence when the expense is to be recognized whereas performance conditions influence the ultimate recognition of the expense. As an example, when an employee retires before the vesting is done, the unvested cost is reverted.

There is also added complexity with the performance-based vesting where a company has to act as an estimator of the probability of meeting performance targets and modify the recognition of expenses based on the performance target.

Change of address and cancellations.

When an ESOP plan is altered, e.g. the vesting schedule or the exercise price, IFRS 2 requires the company to recognize any incremental fair value as a result of the alteration. This makes sure that the cumulative figure of expense being identified reacts to the reconsidered value of the worker pay.

On the same note, in case of an ESOP cancellation or substitution of an old plan with a new one, the companies have to charge the balance cost at that point unless it is canceled because of non-performance or resignation. These changes are important to ensure transparency and compliance by disclosing these changes in financial statements properly.

Requirements of Recognition and Disclosure of Expenses.

Recognition of the Expenses during the Vesting Period.

The fair value of the ESOP is charged out as a cost during the vesting period. As an illustration, when grant fair value is SGD 100,000 and the four-year vesting schedule is applied, SGD 25,000 is expected to be counted as compensation expense every year.

This cost is recorded in the income statement through employee benefits or share-based payment cost. At the same time, an equal value is charged against the equity, typically in a share-based payment reserve.

The overall effect is a zero effect on the total equity – as the retained earnings fall, the contribution equity also rises in the same direction. This will guarantee that the financial statements reflect the true economic cost of the employee ownership program.

Required Disclosures

Under IFRS 2, companies are required to make disclosures in detail in the financial statements and such include:

- The character and condition of the ESOP.

- The amount and weighted average price of exercise of options granted, exercised and forfeited.

- The assumptions and valuation model applied.

- The gross cost to be identified within the period.

Such disclosures will avail transparency to shareholders and regulators so that the effects of share-based compensation are well comprehended. A comprehensive ESOP accounting and reporting guide helps organizations establish consistent documentation and ensure audit readiness.

The Importance of Accurate Valuation

Audit Assurance and Compliance.

ESOP accounting is based on accurate valuation. Given that ESOPs are associated with some estimations and future forecasts, a small amount of error can have serious repercussions on reported earnings. The independent valuations are useful in mitigating these risks by offering an objective evaluation of fair value in accordance with the market conditions and financial assumptions.

Use of qualified professionals would guarantee adherence to IFRS 2 and other standards of reporting to minimise potential conflicts with auditors or regulators. It also gives the management more confidence in the reporting accuracy of reported figures.

Stakeholder and Investor Confidence.

Investor trust is also increased by the transparent ESOP accounting. Equity-based compensation is becoming a more popular indicator of long-term alignment between the management and employees to investors. The consistent and transparent reporting will be a reassurance to the stakeholders that the financials of the company are a true representation of the compensation policies.

In the case of publicly listed companies, strong ESOP accounting practices can enhance the quality of corporate governance ratings and can help in investor relations, especially in situations of fundraising, mergers or IPOs.

Typical Problems of ESOP Accounting.

Although the IFRS 2 has a definite structure, businesses are usually faced with difficulties when applying it. These are valuing non-market conditions in performance, assumption of the employee turnover and adaptation in plan changes.

In the case of multinational companies, there is just an added complexity when the employees are located in various jurisdictions that have dissimilar taxation and reporting requirements. These factors require effective liaison between the finance, HR and legal units.

In Singapore where ESOP is still on the upward trend, firms are increasingly turning to external advisory services and technology platforms as the means of facilitating valuation, reporting, and disclosure processes in the most efficient manner.

Challenges in Greater Transparency by 2025.

With the move in global standards, regulators are focusing on standardization and disclosure in share-based payments reporting. Valuation tools driven by technology now allow more accurate modeling and verification through audit, which can easily be performed by the administrative burden on the finance team.

Regulators in Singapore where corporate governance is a key agenda push businesses to integrate the best global practices in ESOP reporting. These trends are leading to the situation when equity compensation can not only be used as a motivational tool but can be taken as a model of corporate management that is ethical and transparent.

Conclusion

Learning the ESOP accounting based on IFRS is mandatory to those companies who want to build trust, to ensure compliance and to attract investors. The economic impact of employee ownership should be correctly reflected in the financial statements, which are achieved through proper recognition, valuation and disclosure.

The trick, as far as finance heads are concerned, is to combine both the technical accuracy and the strategic acuity – applying right valuations and reporting consistency and clarity to enhance good governance and transparency.

When the business environment in Singapore keeps developing, firms that maintain the high standards in ESOP accounting will not only remain within the existing framework but also become differentiated as progressive, responsible, and reliable entities.