Certified ESOP Agreement Drafting Course

How to Draft a Compliant Employee Stock Option Agreement

Introduction: Certified ESOP Agreement Drafting Course

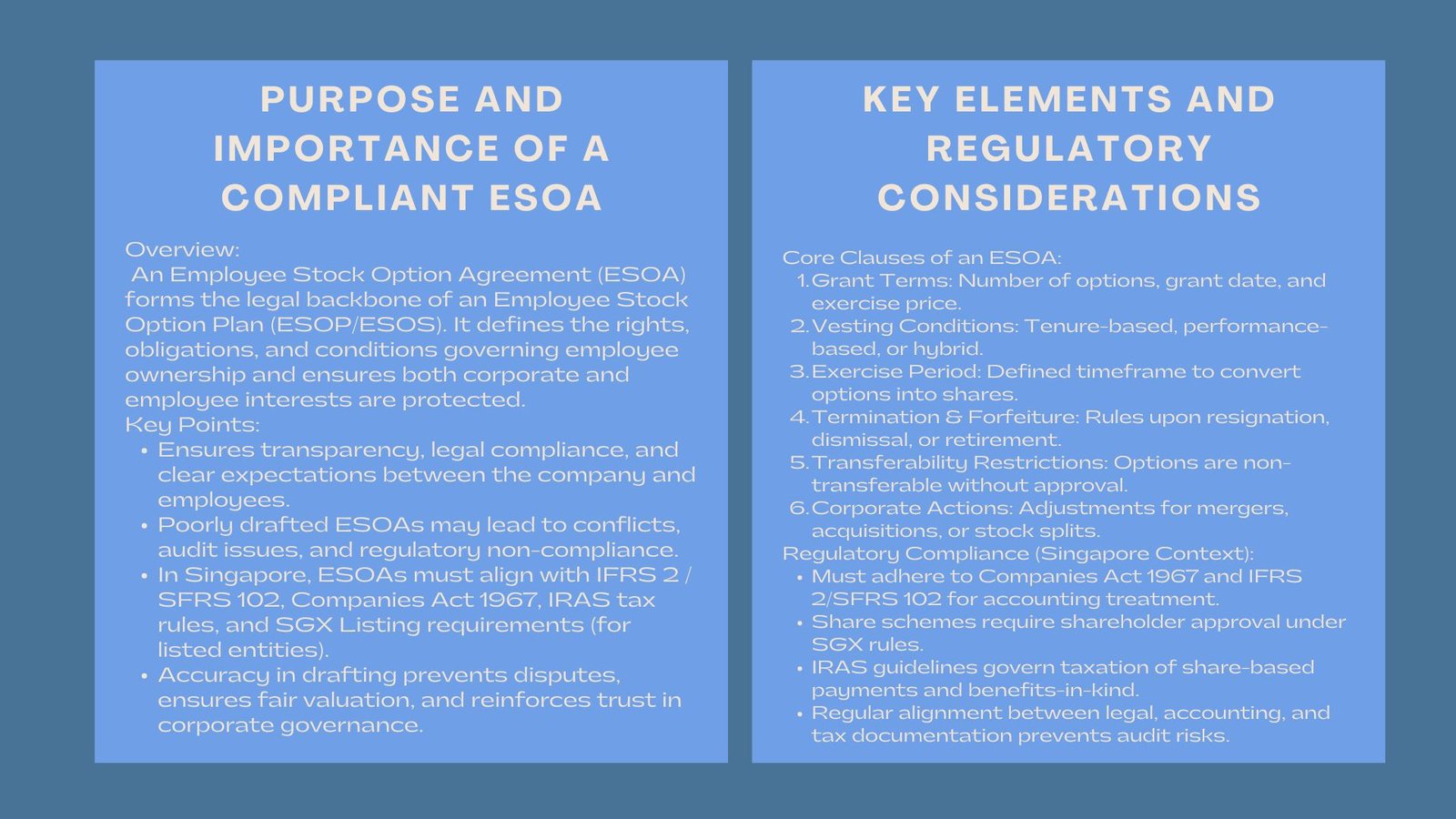

An Employee Stock Option Scheme (ESOS) or Plan (ESOP) is established on a legal basis, which is a well-written Employee Stock Option Agreement (ESOA). It provides the conditions in which the employees are given the privilege to own stocks of the firm, expectations and securing all parties involved. Beyond simply granting options, the ESOA sets expectations for both the company and the employees, protects the interests of all parties involved, and ensures that ownership rights, obligations, and contingencies are clearly defined.

How to draft an employee stock option agreement Singapore

context must be aligned to the corporate laws, accounting standards (IFRS 2 / SFRS) as well as Inland Revenue Authority of Singapore (IRAS) guidelines of the share-based payments. A poorly drafted agreement can create conflicts, cause compliance breaches, or misalign employee incentives with the strategic objectives of the business. Hence, ensuring both legal and financial accuracy is paramount in order to prevent disputes, maintain audit readiness, and build employee trust.

The ESOA that is not negotiated correctly may cause conflicts, the violation of the compliance and the mismatch with the overall vision of the company. Thus, legal and financial accuracy becomes important issues during the designing of this document.

Key Elements of an Employee Stock Option Agreement

An obedient ESOA ought to or ought to clearly define:

- Grant Terms- the amount of options, price of exercise, and date of grant.

- Conditions on Vesting, tenure based, performance based, milestones or otherwise.

- Exercise Period- stating the time, during which workers are allowed to exercise, the options into shares.

- Termination and Forfeiture Clause- spelling out what is anticipated when an employee departs or does not meet the requirements of the vesting contract.

- Options -Prohibits Transferability The transferability of options prohibits their sale or transfer unless authorized by the company.

- Corporate Actions and Adjustments- the impact of mergers, acquisition or a stock split on outstanding options.

By explicitly detailing these key elements, an ESOA establishes transparency, avoids misunderstandings, and ensures that employees have a clear understanding of their entitlements and obligations, while safeguarding the company from potential conflicts.

Regulatory and Compliance Considerations in Singapore

In issuing ESOPs, Singapore-based companies should make use of not only a Companies Act 1967 but also Accounting Standards (IFRS 2/SFRS 102). Shareholders of schemes based on shares must be also approved by shareholders in the case of listed companies according to the SGX Listing Rules.

The private firms should make sure their Constitution can issue options and all the grants are accepted by the Board or shareholders as necessary. Simultaneously, tax obligations under the Inland Revenue Authority of Singapore (IRAS) must be addressed, including proper reporting of share-based payments and benefits-in-kind. Any misalignment between legal agreements, accounting entries, and tax reporting can create audit risks, compliance challenges, and potential disputes with regulators or investors.

Also, businesses need to monitor the fair value of options to be recorded in the books of account and a tax record should also be properly recorded by following the IRAS principles. Lack of congruence between the legal reporting and financial reporting may cause audit risks and compliance risks. By integrating these regulatory, accounting, and tax requirements into the ESOA drafting process, companies not only maintain compliance but also create a stronger foundation for governance, transparency, and investor trust.

Best Practices for Drafting an ESOP

- Be clear and plain in words so as not to create ambiguity.

- Tie-in performance that will make the company successful.

- Contain extensive provisions in the event of change of control.

Make sure that the agreement is equivalent to the valuation and accounting under IFRS 2. The agreement should align performance incentives with company success, motivating employees to contribute toward achieving key business objectives.

Periodically revise and replenish the agreements corresponding to the changes in regulations. The agreement must also be consistent with valuation and accounting principles under IFRS 2 compliant ESOP agreement for startups Singapore, maintaining alignment between financial reporting and legal documentation.

Hybrid structures which have integrated time-based as well as performance-based vesting are also applied in many startups in Singapore to retain important talents but ensure growth. Many startups in Singapore adopt hybrid structures that combine both time-based and performance-based vesting. This approach helps retain key talent while ensuring that employees are rewarded for measurable contributions to growth and strategic milestones. By following these best practices, companies can create an ESOA that is legally sound, strategically aligned, and operationally effective.

Conclusion

It is a legal and strategic process of drafting an Employee Stock Option Agreement that conforms. It determines the aspects of sharing ownership, providing rewards on performance and management of risks.

Good ESOA guarantees transparency, compliance, and correlation between the motivation of employees and the value of shareholders. A properly designed ESOA defines the framework for shared ownership, performance-based rewards, and risk management, ensuring that employees are incentivized while company interests are protected.

With time, a properly-designed ESOA creates trust, minimizes conflicts, and is an improved corporate governance method. Within the competitive Singapore business environment, business agreements are not formality, such agreements serve as tools of accountability, long term success. Companies that invest in accurate, compliant, and transparent ESOAs demonstrate professionalism, ethical governance, and a clear commitment to both employees and shareholders, laying the foundation for lasting corporate success.