Certified ESOS Valuation and IFRS Training

Valuation Methods for Employee Stock Options (ESOS) – IFRS Compliant

Introduction: Certified ESOS Valuation and IFRS Training

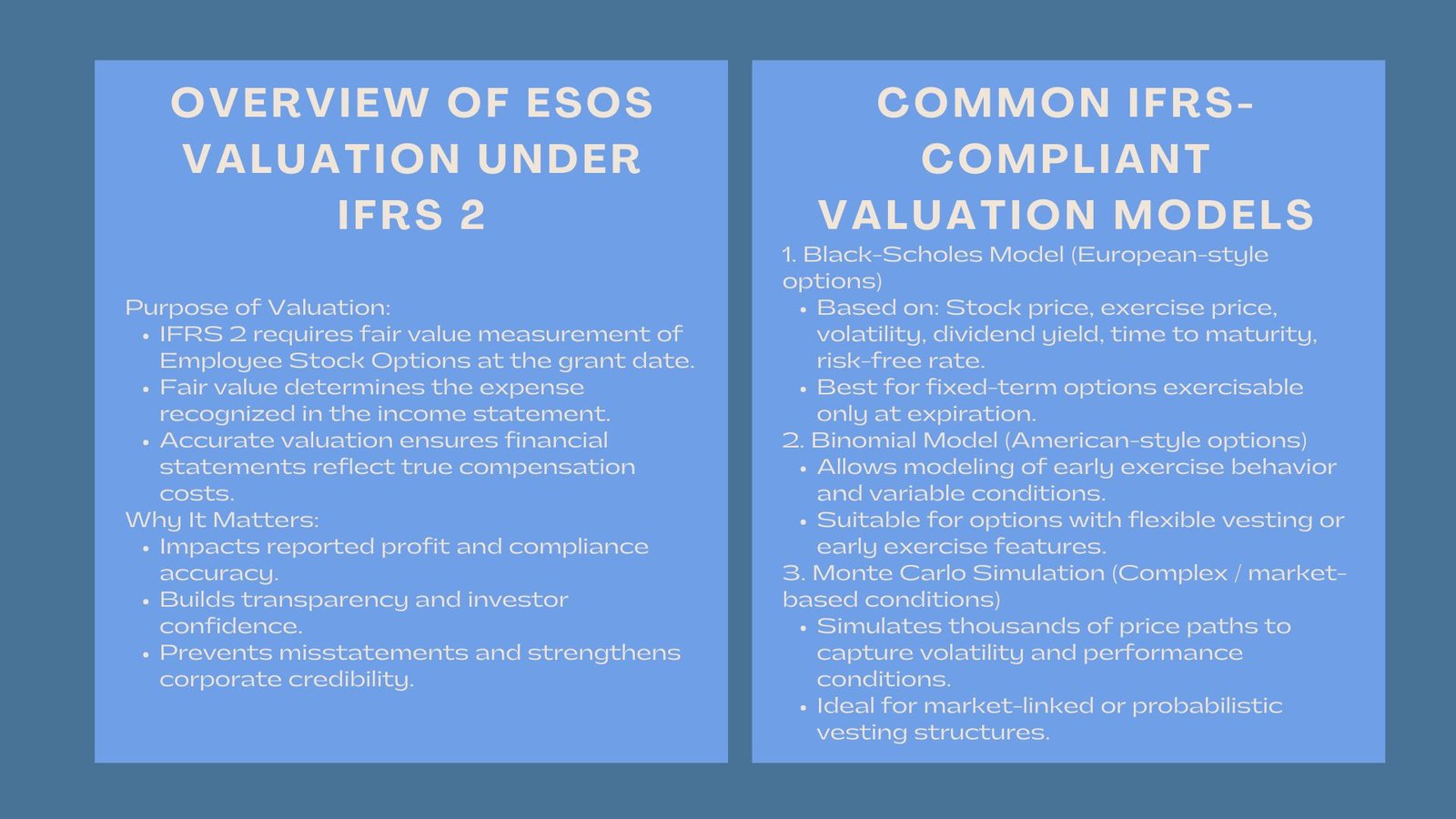

In the IFRS 2, the fair value of the Employee Stock Options (ESOs) is to be measured whenever the stock option is granted. This is a valuation and it is used as the basis on which expenses are recognized. Precise valuation of options is essential since it gives the end result of the amount of compensation cost to be inputted in the profit and loss statement. Accurately calculating the fair value is not merely a technical requirement; it directly affects the reported profit and loss, ensuring that the financial statements reflect the true cost of incentivizing employees through equity. Any miscalculation can lead to misstated expenses, potentially affecting both regulatory compliance and investor trust.

Fair value is the cost of equity provided to the employees used as an economic value. However, because the stock options are not traded instruments, their value has to be estimated with the help of the advanced financial models. This process is accurate and therefore compliance as well as increased investor confidence. Commonly used models include Black-Scholes, Monte Carlo simulations, and binomial option pricing, which take into account variables such as the exercise price, expected volatility of the stock, expected life of the option, dividend yields, and risk-free interest rates. These models allow companies to arrive at a precise estimate of the economic value of the stock options granted.

Popular IFRS-Compliant Valuation Models

The most extensive models that are applied using IFRS are the Black Scholes model and the Binomial model. Black-Scholes model, which is related to the European-style options, takes into account the current price of the stock, the exercise price, the volatility, the yield of the dividends, days to maturity, and the interest rate of the risk-free rate. It is instead the Binomial model which is desirable in the case of American-style options and gives it more freedom to model the exercise behavior at the early stages.

The Black-Scholes model, IFRS 2 compliant ESOS valuation methods primarily used for European-style options, calculates the fair value of stock options based on a range of inputs, including the current stock price, the exercise price, expected volatility, dividend yield, time to maturity, and the risk-free interest rate. Its analytical framework assumes that options can only be exercised at expiration, making it ideal for options with fixed exercise dates and relatively straightforward terms.

More complicated cases- like performance conditions based on market-based performance may need Monte Carlo simulations which apply probabilistic modeling to reflect the variations in the movements of the share prices. The models will guarantee that fair value will represent the results employees could endure in the real market situation. By running thousands of simulated price paths, Monte Carlo models provide a robust estimation of fair value that reflects both market volatility and the conditional features of the stock options.

Choosing the Right Model

The model would be based on the characteristics of the option and the company circumstances. Options with only simplified accessories like non-variable vesting or with performance-related vesting conditions can be worth using Black-Scholes, whereas such complex options can entail the need of Binomial or Monte Carlo simulation. Monte Carlo simulations, on the other hand, are ideal for highly variable or probabilistic scenarios, as they simulate thousands of potential future outcomes to generate a realistic estimate of option value under uncertainty.

This is aimed at making sure that the methodology adopted is realistic on what is expected in the future. By tailoring the model to the complexity of the option, companies can achieve accurate, Fair value measurement of employee stock options measurements, supporting reliable financial reporting and informed decision-making. This approach not only meets regulatory standards but also reinforces transparency, investor confidence, and alignment of employee incentives with long-term corporate performance.

Conclusion

Under the IFRS 2 ESOS accounting is all about valuation. Equity-based compensation involves the measurement of fair value that converts the abstract concept of equity-based compensation into the financial cost. This fair value is then recognized as an expense in the income statement over the vesting period, ensuring that the reported profits reflect the total cost of compensating employees—including the non-cash, equity portion.

Companies comply with the accuracy and integrity of reporting by using the appropriate models, recording the assumptions in a transparent manner and in line with the guidelines of the IFRS. An effective valuation procedure is not only a pleasing endeavor among auditors, it also improves the credibility of a corporation and gives its investors a boost of confidence in regards to how the employee rewards are being accounted for.

An effective and transparent valuation procedure benefits the company in multiple ways. It reassures auditors of the reliability of financial statements, mitigates the risk of compliance violations, and signals to investors that employee compensation is managed with rigor and fairness. By providing a clear picture of the cost and impact of equity-based incentives, accurate ESOS valuation enhances corporate credibility, strengthens governance, and fosters confidence among stakeholders. In essence, robust valuation practices under IFRS 2 transform employee rewards from an intangible commitment into a measurable, accountable, and investor-friendly financial reality.