Common Mistakes in ESOS Accounting

Common Mistakes in ESOS Accounting

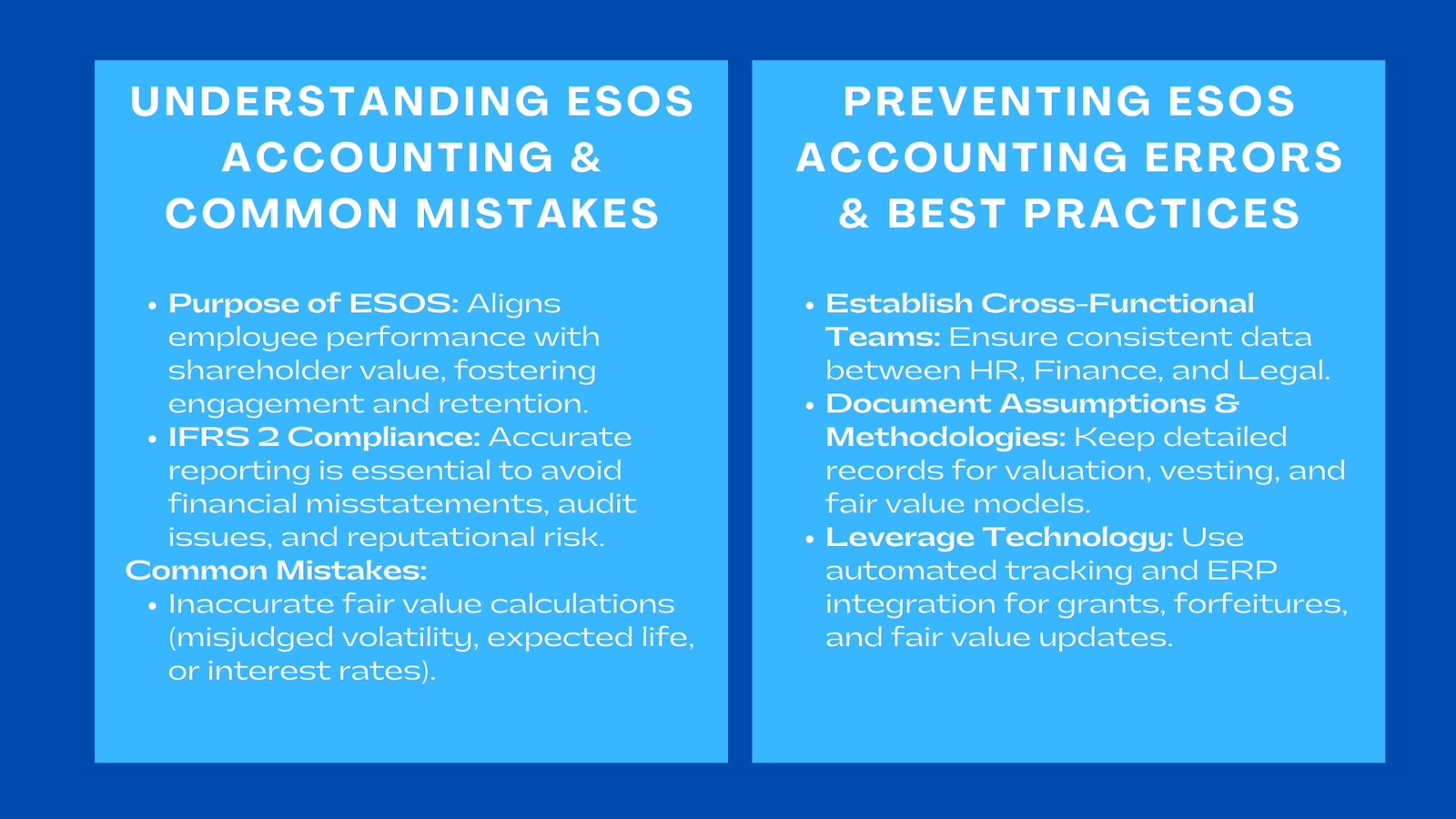

Employee Stock Option Schemes (ESOS) are widely recognized as effective tools for aligning employee performance with shareholder interests and promoting long-term corporate growth. By offering employees the right to purchase company shares at a predetermined price, ESOS incentivizes retention, fosters engagement, and encourages employees to contribute meaningfully to business objectives. However, the accounting and reporting of ESOS are inherently complex and require strict adherence to IFRS 2, which governs share-based payments.

Mistakes in ESOS accounting errors to avoid can lead to significant repercussions, including financial misstatements, audit complications, regulatory scrutiny, and reputational damage. Common pitfalls include inaccurate fair value calculations, misapplication of vesting and performance conditions, improper handling of modifications or cancellations, and incomplete or inconsistent disclosures. Organizations that fail to address these challenges risk undermining the credibility of their financial statements and eroding stakeholder trust.

With the growing use of ESOS in competitive labor markets, especially in regions like Singapore, India, and Southeast Asia, companies must develop robust accounting frameworks, implement cross-functional collaboration, and adopt technological solutions to ensure compliance and strategic alignment. Beyond regulatory adherence, accurate ESOS accounting provides actionable insights for management, supports investor relations, and contributes to long-term corporate sustainability.

Valuation Errors and Fair Value Miscalculations

Challenges in Grant Date Fair Value Estimation

One of the most prevalent mistakes in ESOS accounting arises during the grant date fair value determination. IFRS 2 requires that the fair value of stock options be measured at the grant date, considering all terms and conditions. Many organizations underestimate or overestimate critical inputs such as expected volatility, expected life of the options, risk-free interest rate, dividend yields, and market conditions. Ensuring accuracy in these valuations also aligns with ESOP regulatory standards Singapore compliance and advisory by ValueTeam, which helps organizations maintain transparency and meet reporting obligations effectively.

For example, startups often miscalculate volatility in high-growth sectors, leading to an overstatement of employee compensation expenses. Similarly, assumptions regarding expected life may not reflect realistic employee retention patterns, distorting expense recognition. Accurate grant-date valuation requires a thorough understanding of market behavior, historical stock performance, and projected business growth.

Importance of Cross-Functional Coordination

Fair value measurement is not solely a finance function. It necessitates coordination among finance, HR, and legal teams. Legal review ensures that contractual terms are correctly interpreted, HR provides data on employee eligibility and retention trends, and finance applies appropriate valuation models. Lack of coordination often results in incomplete assumptions, inaccurate valuations, and IFRS non-compliance.

Organizations should maintain detailed documentation of assumptions, rationale for adjustments, and valuation methodologies. Such documentation is vital not only for audit purposes but also for strategic decision-making, as it provides transparency regarding compensation costs and potential dilution.

Improper Handling of Vesting and Performance Conditions

Service-Based Vesting Errors

Another common mistake involves misapplying service-based vesting conditions. ESOS expenses must be allocated over the period during which employees earn their rights, often called the vesting period. Recognizing the entire expense upfront or failing to adjust for forfeitures distorts profit and loss statements.

For instance, if an organization grants options with a four-year vesting period but recognizes the expense immediately, net income may be understated in early periods and overstated later. This misalignment affects financial ratios, investor perception, and management decision-making.

Performance-Based Vesting Misalignment

Performance-based vesting adds further complexity. Options tied to revenue targets, operational KPIs, market share growth, or other performance metrics must be recognized probabilistically. Companies often fail to adjust expenses based on the likelihood of achieving performance conditions.

For example, if a company grants options contingent on achieving a 20% annual revenue growth but the probability of meeting this target is only 50%, expenses must be recognized proportionately. Overestimating achievement probability inflates reported compensation costs, whereas underestimating it can understate true expenses, misleading investors and management alike.

Sector-Specific Considerations

Industries with volatile market conditions, such as technology or biotech, face higher risk of miscalculating performance-based vesting. For these sectors, frequent reassessment of assumptions and scenario modeling is critical. Similarly, multinational corporations must adjust assumptions for regional differences in market conditions, employee retention, and regulatory frameworks to avoid reporting errors.

Errors in Modifications, Cancellations, and Settlements

Modification Risks

Modifications to stock options, such as changes to exercise price, extension of expiry periods, or adjustments due to restructuring, require careful accounting treatment under IFRS 2. Many organizations overlook the incremental fair value arising from modifications, resulting in understated expenses.

For example, if an option’s exercise price is reduced to reflect market downturns, the increase in fair value must be recognized immediately. Ignoring this leads to financial misstatements and potential audit queries. Companies should implement standardized processes to track and evaluate all modifications, ensuring consistency and transparency.

Handling Cancellations and Voluntary Exits

When employees voluntarily leave or options are canceled, proper accounting adjustments are crucial. Failure to reflect cancellations accurately can overstate liabilities or equity, creating misaligned financial reporting. Similarly, improper settlement accounting—whether in cash or shares—can distort profit and loss and balance sheet presentation.

Transparent documentation and clear internal policies reduce the risk of errors and ensure that financial statements accurately reflect the organization’s obligations. For large-scale ESOS programs, automated tracking systems can streamline the management of modifications, cancellations, and settlements.

Disclosure and Reporting Challenges

Completeness and Transparency

Incomplete or inconsistent disclosures are widespread mistakes in ESOS accounting. IFRS 2 requires organizations to disclose comprehensive information, including the number of options granted, exercised, forfeited, or expired, fair value assumptions, vesting conditions, and impact on profit or loss. Failure to provide detailed disclosures reduces transparency and investor confidence.

For multinational organizations, reporting across jurisdictions adds complexity. Currency fluctuations, tax treatments, and local regulations must be reconciled with IFRS standards to ensure accurate reporting.

Leveraging Technology for Accuracy

Centralized reporting systems, automated tracking tools, and standardized templates are essential for ensuring transparency, audit readiness, and operational efficiency. These systems track grants, exercises, cancellations, forfeitures, and fair value calculations in real time. Automation reduces human error, ensures consistent application of accounting policies, and supports scenario-based modeling for performance-based vesting.

Internal Controls and Audit Readiness

Robust internal controls help prevent and detect errors. Segregation of duties between HR, finance, and legal teams ensures that assumptions, approvals, and calculations are independently verified. Regular audits, reconciliation processes, and stress-testing of assumptions further strengthen compliance and accuracy.

Strategic Implications of Accounting Errors

Impact on Financial Decision-Making

ESOS accounting errors can distort reported profitability, misinform capital allocation decisions, and affect strategic planning. Overstated expenses may lead management to underinvest in growth initiatives, whereas understated costs can mask the true financial impact of compensation plans.

Risks in Mergers, Acquisitions, and Fundraising

Accurate ESOS reporting is critical during M&A or fundraising events. Incomplete or erroneous reporting complicates valuation assessments, investor negotiations, and due diligence processes. Potential acquirers or investors rely on transparent and accurate data to assess outstanding obligations and determine enterprise value.

Employee Engagement and Retention Consequences

Improper ESOS accounting can also impact employee trust and morale. If employees perceive delays, miscalculations, or inconsistencies in option recognition, engagement and retention may decline. Transparent communication, accurate recording of grants and vesting schedules, and timely settlements help maintain confidence in the program.

Sector-Specific Strategic Risks

Industries with high employee mobility, such as IT or consulting, are more sensitive to ESOS accounting errors. Mismanagement in such environments can result in misaligned incentives, loss of top talent, and competitive disadvantage. Companies in regulated sectors, such as finance or healthcare, must also consider compliance risk as part of their overall ESOS governance strategy.

Best Practices to Avoid ESOS Accounting Mistakes

Establish Cross-Functional Teams

Finance, HR, and legal teams should collaborate on ESOS design, implementation, and reporting. Cross-functional teams ensure that all assumptions, legal terms, and employee data are correctly captured, providing consistency and accuracy in financial reporting.

Document Assumptions and Methodologies

Clear documentation of valuation models, fair value inputs, vesting assumptions, and modification treatments enhances audit readiness, mitigates disputes, and supports transparent reporting.

Adopt Automation and Centralized Reporting Systems

Automated systems can track grants, exercises, forfeitures, and cancellations efficiently, reducing administrative burden and human error. Integration with ERP systems ensures real-time accuracy and compliance with IFRS 2.

Regular Training and Updates

ESOS accounting requires ongoing education to ensure staff remain updated on IFRS changes, best practices, and technological tools. Training programs and internal workshops help maintain consistent and accurate accounting practices.

Scenario Analysis and Stress Testing

Organizations should conduct scenario analysis and stress testing to evaluate the impact of changes in stock price, volatility, interest rates, or performance targets on compensation expenses. This proactive approach reduces the likelihood of misstatements and ensures strategic resilience.

Conclusion to Common Mistakes in ESOS Accounting

Employee Stock Option Schemes are powerful tools for incentivizing talent and aligning employee performance with long-term corporate success. However, their effectiveness depends heavily on accurate accounting, diligent reporting, and strict adherence to IFRS 2.

By avoiding common mistakes such as miscalculating fair value, misapplying vesting and performance conditions, improperly accounting for modifications or cancellations, and neglecting disclosure requirements, companies can maintain financial integrity, regulatory compliance, and stakeholder confidence. Implementing best practices, leveraging technology, fostering cross-functional coordination, and conducting regular audits enhances the reliability and transparency of ESOS accounting.

Accurate ESOS reporting transforms a complex compliance requirement into a strategic advantage, enabling organizations to reward talent effectively, maintain governance standards, and drive sustainable growth. With robust controls, meticulous documentation, and proactive risk management, Share-based payments compliance tips companies can ensure that their employee stock option programs support corporate objectives, strengthen employee engagement, and maximize enterprise value over the long term.