Comprehensive ESOP Benefits Program Singapore

ESOP Benefits for Employees and Employers in Singapore

Comprehensive ESOP Benefits Program Singapore

In a highly competitive business environment such as Singapore, firms are always trying to find new and effective methods to acquire and retain high performing employees despite the long-term growth. In addition to the traditional types of salary structure, equity-based compensation has been adopted by most organizations today especially the Employee Stock Ownership Plans (ESOPs).

The ESOPs have gained popularity among startups, SMEs and in established corporations as a means of ensuring that the employees are motivated to perform in line with the objectives of the company. The ESOPs enhance loyalty by providing the employees with an interest in the success of the organization in the future as well as an ethos of responsibility and collective aspiration.

This paper discusses the advantages of ESOPs to both employees and employer in Singapore giving the reasons as to why the plans have become one of the most effective talent and ownership plans in 2025.

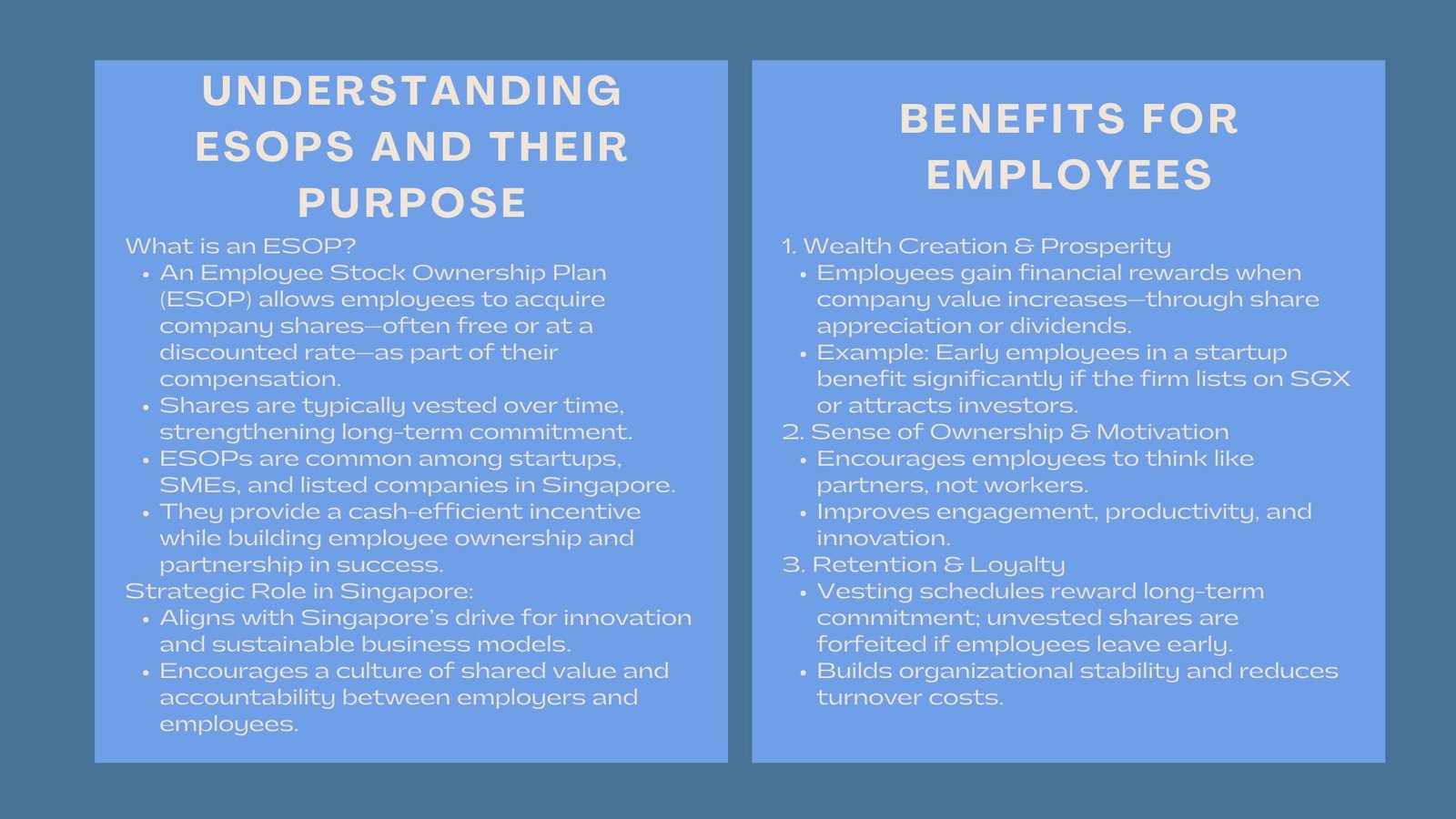

The ESOPs explained: A brief introduction.

An Employee Stock Ownership Plan (ESOP) is an organized plan which enables employees to purchase shares of the organization where they work at no charge or at a reduced rate. Usually, ESOPs are issued as a part of compensation package whereby the shares are vested over a period based on established terms.

ESOPs are also widely applied in Singapore by both listed and non-listed companies as a way to motivate employees without interfering with cash flow. They are particularly desirable to startups and developing companies, as they allow founders to compensate employees without the need to spend money right now.

With each vesting of these shares, an employee is becoming a partial owner of the company, reaping the growth and profitability of the company directly. This common ground changes the old employer-employee relationship to the relationship of partnership and long-term value creation.

How ESOPs Benefit Employees

Prosperity and Creation of Wealth.

The visible advantage of ESOP to the employees is that it can create wealth. In cases where employees are given shares or options at a predetermined price, they will benefit in case the valuation of the company increases in the future. This incentive in form of dividend or sale of shares can contribute greatly to conventional earnings.

As an example, a worker who has been brought on board by a startup and is awarded with stock options when the business is highly valued may experience huge returns of money in case the business grows or even goes to the stock market (SGX). This form of financial involvement provides the employees with a practical cause of working towards the success of the company.

Feeling of Belonging and Driving Force.

ESOPs will foster a true feeling of proprietorship among workers. The fact that the work of a person directly contributes to the value of the company and consequently his/her monetary profit makes people more engaged and responsible. The employees start thinking along the lines of shareholders and not merely employees.

This change of attitude may change corporate culture. There is increased innovation, increased productivity, and teamwork. Employees feel better when it is made known to them that their everyday work will have a long term bearing on company performance and hence are more likely to remain committed and motivated.

Retention and Loyalty on the Long-term.

Retention of employees is a problem in the dynamic job market in Singapore. ESOPs deal with this by incorporating vesting schedules where ownership rights are acquired with time. The long-term employee becomes more of an owner whereas the outgoing employee loses the unvested shares.

This is because this mechanism motivates the employees to remain within the organization and hence continuity and minimized turnover costs. It is also rewarding to loyalty and high commitment, which are key in organizations as it move through the growth and market competition.

How ESOPs Benefit Employers

Recruiting and Maintaining Best Talent.

The talent environment in Singapore is becoming more globalized as professionals are expecting not only generous salaries but also to have a significant contribution to the development of a company. ESOPs give the employer a unique privilege in hiring, where employers can offer equity participation as the whole package in compensation.

This is particularly useful to startups and small businesses. With the payment of the employees in equity, the firms are able to save cash and still be appealing to the high-quality talent. Financial gain and promise of ownership can surpass short-term restraint of salaries.

Increasing Performance and Productivity.

In the view of an employer, ESOPs make the employees a stakeholder. By involving staff in the growth of the company, the staff members will tend to think strategically and make decisions that are in the best interest of the company. This coordination of objectives improves the performance of the departments including the business development and the operations.

Research has always indicated that firms with effective ESOPs have greater productivity, employee morale and improved financial results. When workers are made owners they feel like they own each success – every failure, they own it collectively.

Adhering to Succession and Corporate Stability.

ESOPs are also strategic in planning corporate succession besides being effective in talent retention. ESOPs in the case of privately held companies, particularly family-owned businesses, is an organized means of passing ownership over time to the employees. This is necessary in order to provide business continuity without making any external sale.

ESOPs can make the organizations more stable in the long run. The equity employees are also inclined to develop a vested interest in the continued success of the company making it remain consistent even when the company is passing through a succession of leadership.

Singapore has tax and regulatory benefits.

Singapore has a relatively transparent regulatory framework of implementing ESOPs that is regulated by the Inland Revenue Authority of Singapore (IRAS) and the Accounting and Corporate Regulatory Authority (ACRA).

Tax wise, when employees exercise their options or in case shares become transferable they are normally taxed. The employers are required to declare these benefits through the Employment Income framework and the compliance burden is affordable by most firms as opposed to the benefits obtained.

Furthermore, ESOPs may be designed in a flexible way which allows them to include the local and expatriate workers, different conditions of vesting, performance requirements, and shareholding classes. These aspects qualify ESOPs as a flexible instrument that can be adjusted to fit in the varied corporate environment in Singapore.

To ensure accurate reporting and compliance, companies must determine the fair value of ESOP shares in Singapore, using valuation models that align with accounting standards like IFRS 2. Independent valuation is the best way to achieve transparency, safeguard the interests of the employer and employee and maintain audit integrity.

The successful Implementation of ESOPs.

In the case of companies that are thinking over ESOPs, proper planning and professional advice are paramount. An effective ESOP must have objectives, good governance, and communication with the employees. To be on the safe side, companies need to establish eligibility requirements, vesting conditions, and rights attached to shares.

Professional valuation and legal support also play a central role. Engaging an experienced ESOP valuation service in Singapore helps ensure that share prices, discounts, and option values are accurately calculated. This is not only facilitative of compliance but also helps in building credibility among the stake holders.

Also, communication is a priority. The employees must know how the ESOP functions, when it is due to be vested and how value is generated. The larger the motivational effect the more transparent the plan.

The Wider Implications of ESOPs with regard to the Singaporean Corporate Environment.

ESOPs ceased to be restricted to startups and niche sectors. In Singapore, they are taking the mainstream route to organizational growth and succession. Since the city-state is positioned as an innovation and entrepreneurship center, a balance between corporate aspiration and personal input is created through equity-based compensation.

ESOPs are assisting in the establishment of working environments that embrace teamwork and a spirit of common success. They are an indication of a transition to short-term employment associations to trust-based, accountable and mutually successful relationships.

ESOPs are not only a compensation mechanism but a cultural investment to companies aiming to grow sustainably, they also serve as a reinforcement of Singapore as a destination to conduct business in the world and also as a progressive company in terms of employment.

Conclusion

ESOPs have many advantages that are much more than financial profit. They build shared value, design corporate and employee goals, and encourage long term stability. To the employee, ESOPs give them ownership and a chance to create wealth; to the employer, they give them an effective tool of motivation, retention, and long-term succession.

With a rapidly developing business environment, Singaporean organizations following the right-designed ESOPs can find themselves on the cutting edge of the market – they draw in innovative minds and grow into shared success cultures. Once endorsed with adequate valuation, clear governance and considerate communication, ESOPs would be more than a compensation plan, they will be the basis of a sustainable corporate success.