Comprehensive ESOS Training for Employees

ESOS Explained: Everything Employees Need to Know About Stock Options

Comprehensive ESOS Training for Employees

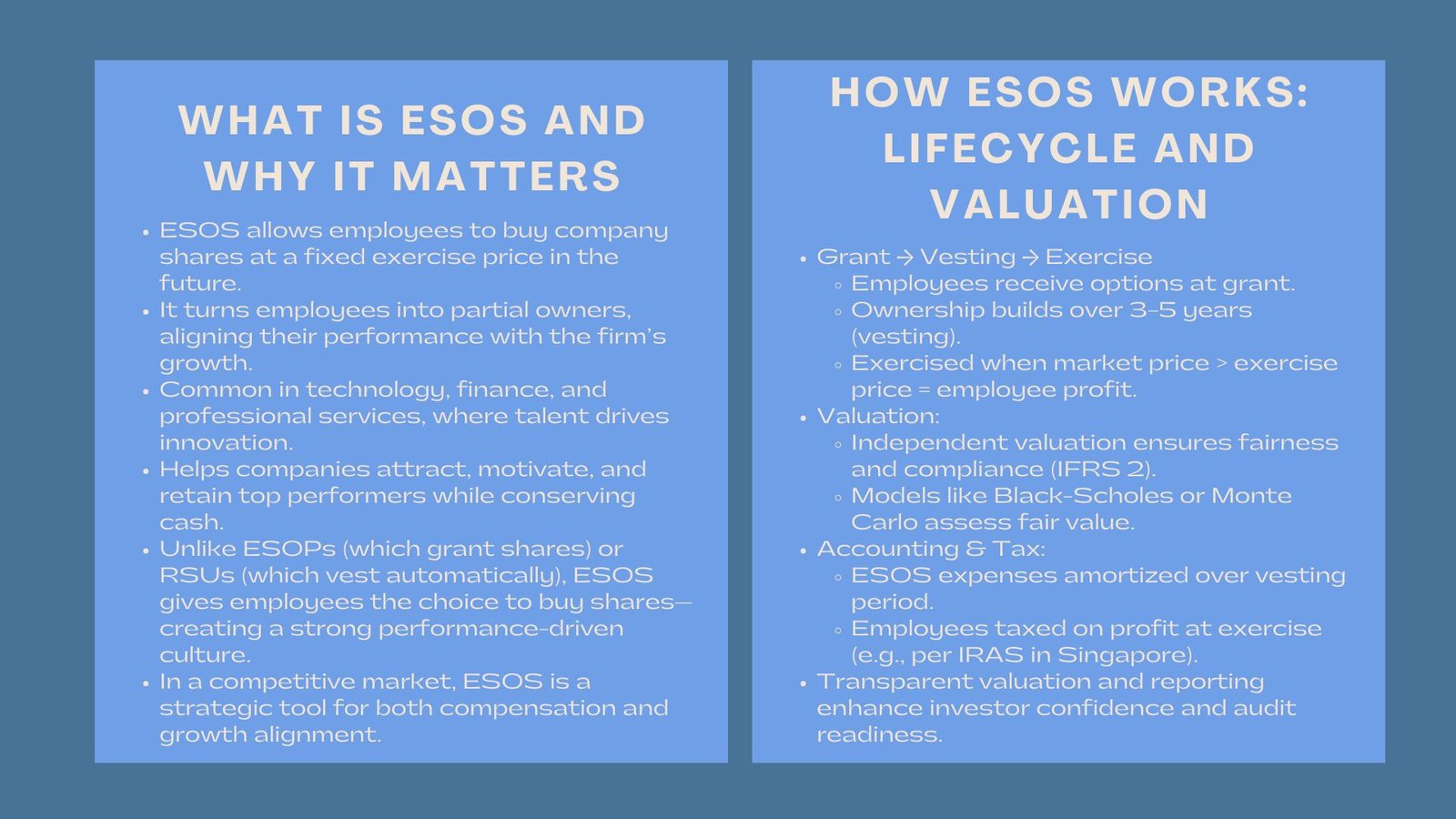

In the current dynamic business environment, remuneration of employees is becoming more than just salary package. More and more companies have been providing equity based rewards that provide employees with a direct interest in the long term success of the organization. Employee Stock Option Schemes (ESOS) are one of the most effective and versatile tools of matching the performance of employees with the expansion of the company.

An ESOS entitles employees to, but not compels them to, buy the shares of the company at a set price in future. This process transforms employees into partial owners to help them make contribution towards the overall profitability and value of the firm in the long term. Nonetheless, it is critical to have knowledge of the ESOS operation, its valuation, and its effects on both employees and employers in order to achieve its full potential.

What Is an Employee Stock Option Scheme (ESOS)?

Concept and Purpose of ESOS

An Employee Stock Option Scheme is an official scheme under which the qualified employees are granted the right to purchase shares of the company at a fixed exercise price, which is usually lower than the market value of the company at the time of grant. ESOS is not just the money reward, but it is also a strategic measure to attract, motivate, and retain the talent. Employees become partners in the generation of value through the companies giving them the ownership potential which creates loyalty and commitment in the long run.

This is common most especially in booming industries like technology, finance and professional services where human capital is the driver of innovation and performance. Since companies are seeking the best talent, the stock options have become an ideal means of giving meaningful upside without excessive cash outlay.

ESOS and other equity plans differ in three major ways.

The similarity between ESOS and Employee Stock Ownership Plans (ESOPs) or Restricted Stock Units (RSUs) is apparent, but the difference between the two is pronounced. There is a difference between ESOS and ESOPs in that in ESOS employees are given a choice of buying the shares at a certain price within an agreed time frame whereas in ESOPs it is usually a case of share allocations without any purchase requirements.

RSUs, however, can be considered as unconditional grants of shares which are vested over time. The flexibility is generated by the optional nature of ESOS i.e. the exercises are only exercised when the share price of the company rises above the exercise price so that then the options become real financial gain.

Strategic Value in the Company Development.

Corporately, in terms of finance, ESOS assists in aligning the performance of employees and those of the shareholders. In cases where the employees have options, their prosperity is also pegged on the future value of the company hence motivating the employees to innovate the company, increase productivity, and bring prosperity to the company. The ESOS also promotes capital efficiency – organizations have the option of paying out cash later on but are able to offer good remuneration packages to their employees that are able and willing to be invested in the long term objectives of the firm.

How ESOS Works in Practice

Granting, Vesting and Exercising Options.

An ESOS lifecycle usually starts at the date of grant where employees receive a number of stock options at a pre-agreed price. Ownership is however not transferred immediately. Instead, it has options that vest after a certain duration of time, and this may be three to five years. This type of vesting plan would motivate employees to stay in the company and accumulate the maximum benefit of their options.

Employees who have been vested are able to exercise their options, i.e. purchase the company shares when it is exercised, irrespective of the prevailing market value. When market price is more than the exercise price, the differentiation is the profit of the employee. This is a significant potential in a growing company.

The Role of Valuation in ESOS

Proper valuation is the key to any ESOS system. Business organizations should establish the fair value of employee stock options in order to satisfy accounting standards including IFRS 2 and be transparent not only to the employees but also the shareholders. Various models such as the Black-Scholes model of valuation or Monte Carlo simulation have been frequently applied to determine the fair value of the options, taking into account the volatility, interest rate, anticipated dividends and the terms of vesting.

This valuation is neither an accounting requirement only, but also a communication tool. A well-planned and justifiable valuation increases confidence, makes employees comprehend the actual value of their options, and pleases auditors and regulators. In the absence of sound valuation, there is the danger that ESOS implementation will become non-compliant or deceptive.

Implications in Taxation and Accounting.

In the global accounting standards, ESOS grants are regarded as share-based payment expenses, which are amortized over the period of the vesting. To employees, taxation would usually be done at the time of exercise where the difference between the market price and the exercise price is considered as taxable income. These gains are counted as employment income in Singapore and they should be reported to the Inland Revenue Authority of Singapore (IRAS). It is also mandatory that companies should not only reveal the ESOS costs in the financial statements, which must be transparent to the stakeholders, as emphasized in the ESOP Valuation and Accounting Training Singapore.

The Optimum Benefits of ESOS.

To Employees: Developing Long-Term Wealth.

An ESOS means more than a financial reward to employees, it is an opportunity to be involved in the story of growth of the organization. With stock options, employees will be able to amass a lot of wealth as the value of a company grows with the course of time. The trick is in the knowledge of the conditions of vesting, timing in the market and taxation. Early exercise can minimize the possibility of upside but late exercise may put the employee at risk of price volatility. The most important thing is to maximize the benefits by strategic planning.

Employers: Retention and Alignment.

ESO is still one of the most effective long-term incentive tools to employers. When designed properly, it balances the performance of the employees with the returns of the shareholders and decreases the rate of short term turnover. The deferred nature of vesting also stabilizes the workforce, ensuring continuity in key roles. However, to maintain credibility, employers must ensure independent and transparent ESOS valuation services in Singapore, especially for audit and compliance purposes. A robust valuation framework strengthens investor confidence and meets regulatory requirements.

Best Practices in 2025 and Beyond

Digitalization is going on to shape the ways that companies will use ESOS programs in 2025. The equity management software handles grant tracking, vesting schedule, and reporting automatics, which means that there is no problem with coordinating the HR, finance, and legal departments. Business enterprises are also incorporating the performance based conditions into their plans where the option vesting is tied to the main performance measurement like increase in the revenues or EBITDA increase. In addition to this, the environmental, social, and governance (ESG) goals are starting to be incorporated into equity compensation systems, which demonstrates why sustainable business practices have become essential.

Conclusion

Employee Stock Option Schemes (ESOS), is a form of reward that lies between individual performance and company performance. On the side of the employees, they give employees a chance to share in the wealth that they have created in the form of their contribution; on the side of the company they give it an upper hand in attracting and retaining the best employees.

Nevertheless, an effective ESOS should be based on rigorous design, precise valuation, and continuous disclosure. The culture of ownership, accountability, and motivation can be cultivated in companies that have well-managed and properly communicated ESOS programs. With the financial environment changing in 2025 and beyond, ESOS is going to remain an element of the contemporary compensation approach – the interests of individuals resonating with the long-term development of organizations.