Employee Stock Options Reporting Under IFRS

Employee Stock Options: Reporting Under IFRS

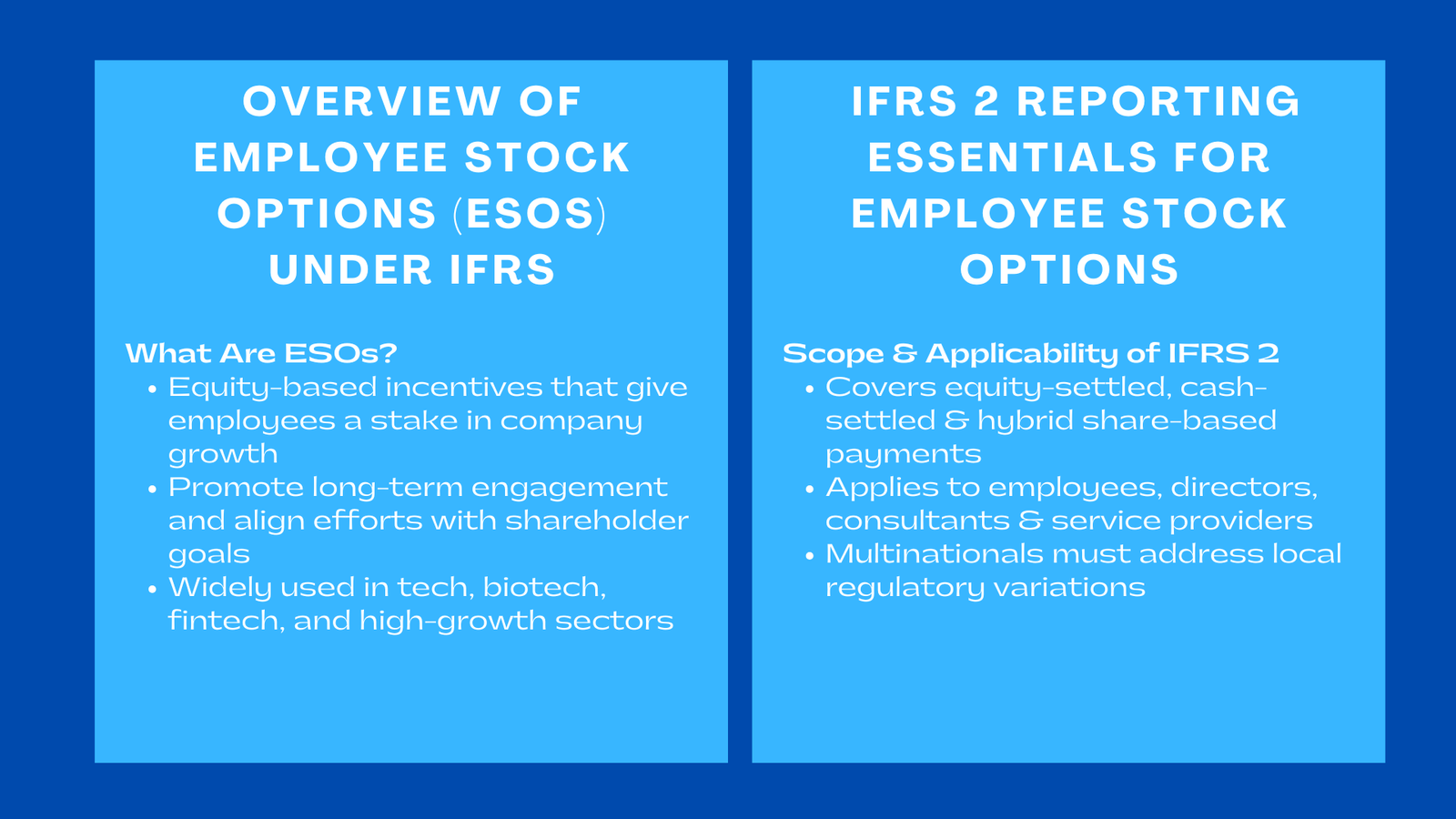

Employee Stock Options (ESOs) are increasingly recognized as a cornerstone of modern compensation structures. They allow companies to incentivize employees, executives, and key stakeholders by giving them a direct stake in corporate performance. Unlike traditional cash-based incentives, ESOs foster a sense of ownership, promote long-term engagement, and align employee efforts with shareholder objectives.

The strategic use of ESOs is especially prominent in high-growth sectors such as technology, biotechnology, and fintech. Startups and rapidly scaling companies often face cash constraints, making equity-based incentives a cost-effective method to attract, retain, and motivate critical talent. For multinational corporations, ESOs are also valuable for aligning global teams with local performance objectives while standardizing incentives across diverse jurisdictions.

Despite their benefits, ESOs pose significant accounting challenges due to their contingent nature, market volatility, complex vesting schedules, and potential modifications. Mismanagement or inaccurate reporting of ESOs can lead to financial misstatements, audit adjustments, regulatory scrutiny, reputational damage, and even legal consequences. Compliance with IFRS 2, “Share-based Payment,” ensures that companies accurately recognize, measure, and disclose ESOs, providing transparency and fostering investor confidence.

A comprehensive understanding of IFRS 2, combined with practical implementation strategies, allows companies to manage ESOs effectively while turning them into a strategic tool that drives Employee stock options reporting IFRS performance, governance, and long-term corporate growth.

Scope and Applicability of IFRS 2 for ESOs

Types of Share-Based Payment Arrangements

IFRS 2 applies to all share-based payment arrangements, including equity-settled, cash-settled, and hybrid instruments.

Equity-settled stock options are recorded as increases in shareholders’ equity, reflecting the issuance of ownership rights to employees. These instruments provide employees with the potential to benefit from future growth in the company’s value, aligning incentives with long-term performance objectives, and they are often evaluated alongside Singapore business valuation services to ensure accurate financial reporting and strategic alignment.

Cash-settled instruments, in contrast, require continuous fair value remeasurement, with changes recognized in profit or loss. Hybrid arrangements combine features of both equity and cash settlement or include complex performance-based conditions. Proper classification of ESOs under IFRS 2 is essential, as incorrect categorization may result in misstated liabilities, inaccurate expense recognition, and audit issues.

Applicable Parties and Transactions

IFRS 2 applies to all transactions in which goods or services are received in exchange for share-based payments. This includes stock options granted to employees, executives, directors, consultants, or other service providers. Companies must assess each arrangement, including newly issued options, modifications to existing grants, and performance-linked equity schemes, to determine the applicability of IFRS 2.

Multinational corporations face additional challenges due to differences in local accounting standards, regulatory requirements, and taxation rules. Ensuring consistency across global reporting is critical to maintaining compliance, supporting investor confidence, and reducing audit risks. Proper application of IFRS 2 also enhances comparability between companies and across industries.

Grant Date Fair Value and Measurement Considerations

Valuation Methodologies for ESOs

Measuring the grant-date fair value of stock options is a critical component of IFRS 2 compliance. Standard valuation models include the Black-Scholes model for European-style options and the binomial model for more complex or multi-stage options. Inputs for these models include expected stock price volatility, risk-free interest rate, expected life of the option, dividend yield, and performance or market conditions.

Valuation challenges are particularly pronounced for startups and high-growth companies, which often have limited historical data and high market uncertainty. Collaboration between finance, HR, and legal teams ensures assumptions are realistic, thoroughly documented, and auditable. Proper valuation not only supports IFRS 2 compliance but also enhances investor confidence by providing transparent and defensible accounting for ESOs.

Recognizing Expenses Over the Vesting Period

ESOs are expensed over the vesting period—the time during which employees fulfill service or performance conditions. Time-based vesting schedules reward employee loyalty, while performance-based vesting ties incentives to strategic objectives such as revenue growth, product development milestones, or customer acquisition targets.

Accurate recognition of expenses requires adjustments for forfeitures, early terminations, and modifications. Transparent documentation of assumptions and methodology ensures compliance with IFRS 2, strengthens audit readiness, and enhances stakeholder trust. Systematic expense recognition over the vesting period also provides a more accurate reflection of the company’s compensation costs in financial statements.

Handling Modifications, Cancellations, and Early Terminations

Modifications, including changes to exercise prices, vesting schedules, or expiration periods, require incremental fair value measurement. Early terminations or cancellations must be recorded accurately to avoid misstatement of equity or liabilities. Clear internal policies, consistent procedures, and thorough documentation are critical to ensure compliance and operational consistency.

Failing to handle these adjustments appropriately can lead to significant misstatements in financial reporting, reduced investor confidence, and challenges during audits or regulatory reviews.

Disclosure and Reporting Requirements Under IFRS 2

Ensuring Transparency in Financial Statements

IFRS 2 mandates detailed disclosure of ESOs in financial statements. Required disclosures include the number of options granted, exercised, forfeited, or expired, fair value assumptions at grant date, vesting conditions, and the impact on profit, loss, and equity.

Transparent reporting allows investors, auditors, and regulators to assess compensation costs, potential dilution, and the effectiveness of incentive schemes. It also provides insights into strategic alignment between employee performance and company objectives. Proper disclosure enhances corporate governance and strengthens trust with key stakeholders.

Managing Multi-Jurisdiction Reporting Challenges

For multinational corporations, ESO reporting is further complicated by differences in local accounting standards, tax regulations, and currency fluctuations. Coordinated efforts among finance, legal, HR, and tax teams are necessary to ensure consistent reporting. Inconsistent treatment across jurisdictions may lead to audit adjustments, regulatory scrutiny, and reduced investor confidence.

Leveraging centralized reporting systems, automated tracking tools, and cloud-based solutions helps companies streamline compliance, maintain accuracy, and support timely disclosures across multiple regions.

Strategic Implications of Accurate ESO Reporting

Enhancing Investor Confidence

Accurate ESO reporting enables investors to evaluate compensation costs, assess potential equity dilution, and understand the alignment between employee incentives and long-term performance. Transparent reporting enhances corporate credibility, facilitates strategic investment decisions, and strengthens corporate governance.

Driving Employee Engagement and Retention

Employees who clearly understand the value, mechanics, and timing of their stock options are more likely to be engaged, motivated, and loyal. Transparent ESO management fosters trust, encourages ownership mentality, and promotes alignment with corporate objectives. Properly managed ESOs can significantly reduce turnover costs and improve long-term retention of top talent.

Operational Efficiency and Governance

Integrating ESO reporting with financial systems, HR processes, and equity management platforms enhances operational efficiency, reduces manual errors, and supports timely reporting. Automated tracking of grants, exercises, cancellations, and fair value calculations simplifies audit preparation and ensures compliance with IFRS 2. Efficient operational processes allow management to focus on strategic initiatives rather than administrative tasks.

Industry-Specific Considerations

High-Growth Technology and Biotech Sectors

Startups and technology companies face high volatility and rapid scaling challenges. Grant-date valuations and vesting schedules must be reassessed regularly to reflect market conditions accurately. Transparent ESO reporting ensures employees remain motivated and aligned with strategic objectives while maintaining compliance for investors and auditors.

Regulated Industries

Financial services, banking, healthcare, and other regulated sectors have strict reporting, governance, and compliance obligations. Accurate ESO accounting ensures adherence to regulatory standards, supports audit processes, and strengthens investor trust. Transparent reporting also demonstrates the company’s commitment to governance, risk management, and corporate accountability.

Case Study Example

A mid-sized fintech startup issued an ESOP granting 20% of equity to executives and key employees, with a four-year vesting schedule combining time-based and performance-based milestones tied to product launches and revenue targets. The exercise price was set at fair market value determined by an independent valuation.

The company implemented a cloud-based equity management system to track grants, exercises, forfeitures, and cancellations in real time. Finance, HR, and legal teams collaborated to ensure accurate grant-date valuations, IFRS 2 compliance, and clear communication of tax implications to employees.

As a result, the company maintained full compliance with IFRS 2, enhanced employee engagement, and provided transparent reporting to investors during a Series B funding round. Investors could assess potential equity dilution, understand incentive structures, and make informed strategic decisions, reinforcing trust and credibility.

Advanced Considerations for Multinational Corporations

Cross-Border Taxation and Compliance

Companies operating in multiple jurisdictions must navigate differing tax rules, social security contributions, and reporting requirements. ESOs may trigger taxable events at grant, vesting, exercise, or sale, depending on local regulations. Proactive coordination among legal, tax, finance, and HR teams ensures accurate reporting, mitigates double taxation, and maintains employee satisfaction.

Currency Risk and Valuation Adjustments

Multinational corporations must account for currency fluctuations when valuing ESOs denominated in foreign currencies. Proper currency risk management, including the use of hedging strategies and periodic revaluation, ensures that financial statements accurately reflect the economic impact of ESOs.

Integration with Corporate Governance Practices

ESOs are not just compensation tools—they are governance instruments. Transparent, IFRS-compliant ESO reporting provides investors and regulators with assurance that executive and employee incentives are aligned with corporate objectives, risk management frameworks, and long-term shareholder value.

Conclusion to Employee Stock Options Reporting Under IFRS

Employee stock option reporting under IFRS compliance for stock options is inherently complex but strategically essential. Companies must ensure accurate grant-date valuation, systematic expense recognition over vesting periods, comprehensive disclosure, and proper handling of modifications, cancellations, and early terminations.

Cross-functional collaboration, integration of technology-driven tracking systems, and transparent communication with employees ensure compliance, operational efficiency, and audit readiness. Proper ESO management enhances investor confidence, drives employee engagement, and supports strategic decision-making.

Accurate ESO reporting transforms stock options from a mere accounting requirement into a powerful strategic tool for talent acquisition, retention, and long-term value creation. In today’s competitive and globalized markets, IFRS-compliant ESO reporting is not just a regulatory obligation—it is a key driver of sustainable corporate growth and stakeholder trust.