ESOP Accounting Guidelines for Business

ESOP Accounting Guidelines for Startups and SMEs in Singapore

Learn ESOP Accounting Guidelines for Business

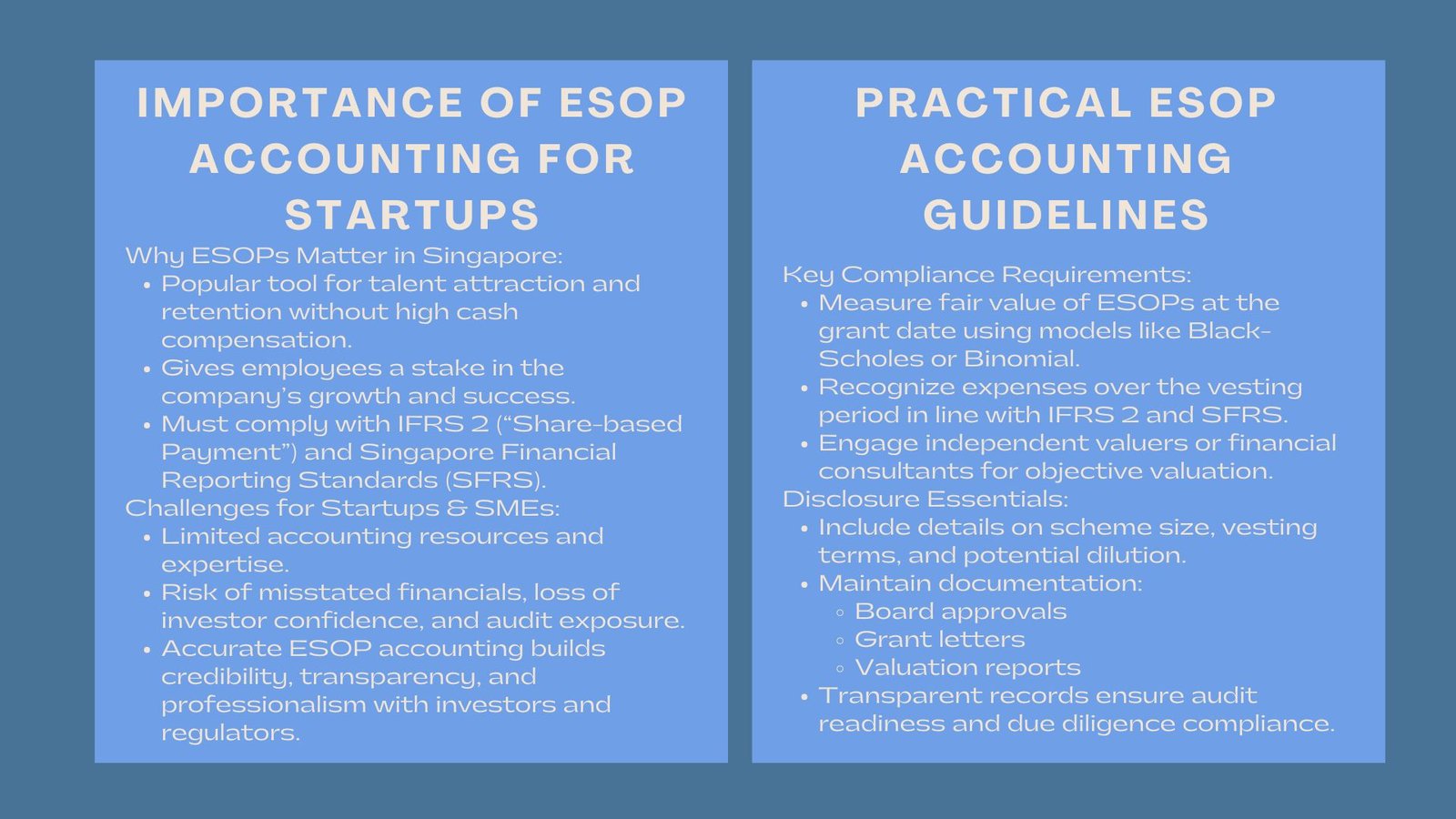

Employee Stock Ownership Plans (ESOPs) are becoming widespread in the startup management of Singapore. They aid in attracting competent talent instead of remunerating them with high cash salaries and offer a stake of success to the employees. Nonetheless, those companies that issue such plans are required to comply with the IFRS 2 and Singapore Financial Reporting Standards (SFRS). However, implementing an ESOP is more than just granting shares. Companies issuing ESOP accounting compliance for startups in Singapore must comply with IFRS 2 “Share-based Payment” and Singapore Financial Reporting Standards (SFRS). Non-compliance can result in inaccurate financial reporting, diminished investor trust, and potential regulatory or audit risks.

The accounting of ESOP is a complex task that is underestimated by many startups. Going wrong with valuation, recognition, or disclosure, however, can contribute to a loss of audit readiness and trustworthiness by fundraiser investors.

For startups and SMEs, which often have limited resources and less mature accounting functions, understanding and implementing proper ESOP accounting is critical to ensure transparency and credibility.

Practical Accounting Guidelines

Under IFRS 2 employee stock option reporting guidelines Singapore need to be recorded at fair value issued on the grant date, and the expenses are to be recognized throughout the vesting period. Independent valuers or financial consultants should be enlisted by the startup to be able to make credible valuations, which may be Black-Scholes or Binomial models.

The disclosures are to contain information regarding the size of scheme, terms of vesting and possible dilution. Having good records including board approvals, grant letters and valuation reports guarantees the compliance with the audit and due diligence. Engaging an independent valuer or financial consultant can provide credibility to the valuation process and ensure that assumptions and results are robust enough to withstand investor and auditor scrutiny.

In addition to proper valuation and recognition, transparent disclosure is essential. Startups must provide clear information regarding the size of the ESOP scheme, the specific terms of vesting, and any potential dilution that may arise as shares are issued. Maintaining comprehensive documentation—including board approvals, grant letters, and valuation reports—is critical not only for compliance with audit and due diligence processes but also for fostering a culture of professionalism and accountability within the company. Well-organized records help demonstrate to stakeholders that the company is serious about governance and committed to transparent financial practices.

Aligning ESOPs with Growth Strategy

Organized in an appropriate manner, ESOPs do not only motivate the employees, but also contribute to the financial credibility. This can significantly reduce employee turnover, particularly in competitive industries where attracting and retaining skilled talent is challenging.It can be a way of attracting investors and regulators to think that the startups are professional using the alignment of accounting practices with SFRs. This perception of professionalism can be instrumental in attracting investment, securing funding rounds, and positioning the company as a mature and trustworthy organization despite its early-stage status.

ESOPs can also be strategically used to align employee incentives with broader company milestones. For instance, granting shares to key employees prior to an initial public offering or a major funding round can motivate employees to focus on increasing the company’s valuation, hitting performance targets, and contributing to sustainable growth. By linking employee rewards directly to company success, ESOPs foster a sense of shared purpose and reinforce a culture of accountability and commitment to achieving long-term objectives.

Conclusion

Compliance of ESOP accounting in Singapore is not just a requirement in reporting only but a sign of business maturity. Companies that implement the concept of IFRS 2 at an earlier stage create a basis of transparent development. Proper ESOP accounting helps build trust among investors, mitigates audit and compliance risks, and demonstrates an ethical approach to rewarding employees.

Accurate ESOP accounting can bring trust and reduce risk amongst stakeholders, as they grow stronger and better corporate governance. Finally, an open and willing ESOP program does show that the corporation respects its employees and its ethics, which is the door to sustainable success in the long term. . By ensuring accurate accounting, comprehensive documentation, and transparent disclosure, companies can strengthen investor confidence, enhance corporate reputation, and create an environment where both employees and the business can thrive. In the long term, ESOPs, when aligned with strategy and executed correctly, become a cornerstone of corporate success and a hallmark of ethical, responsible business practice.