ESOP Accounting IFRS Requirements Explained

ESOP Accounting: IFRS Requirements Explained

Introduction to ESOP Accounting IFRS Requirements Explained

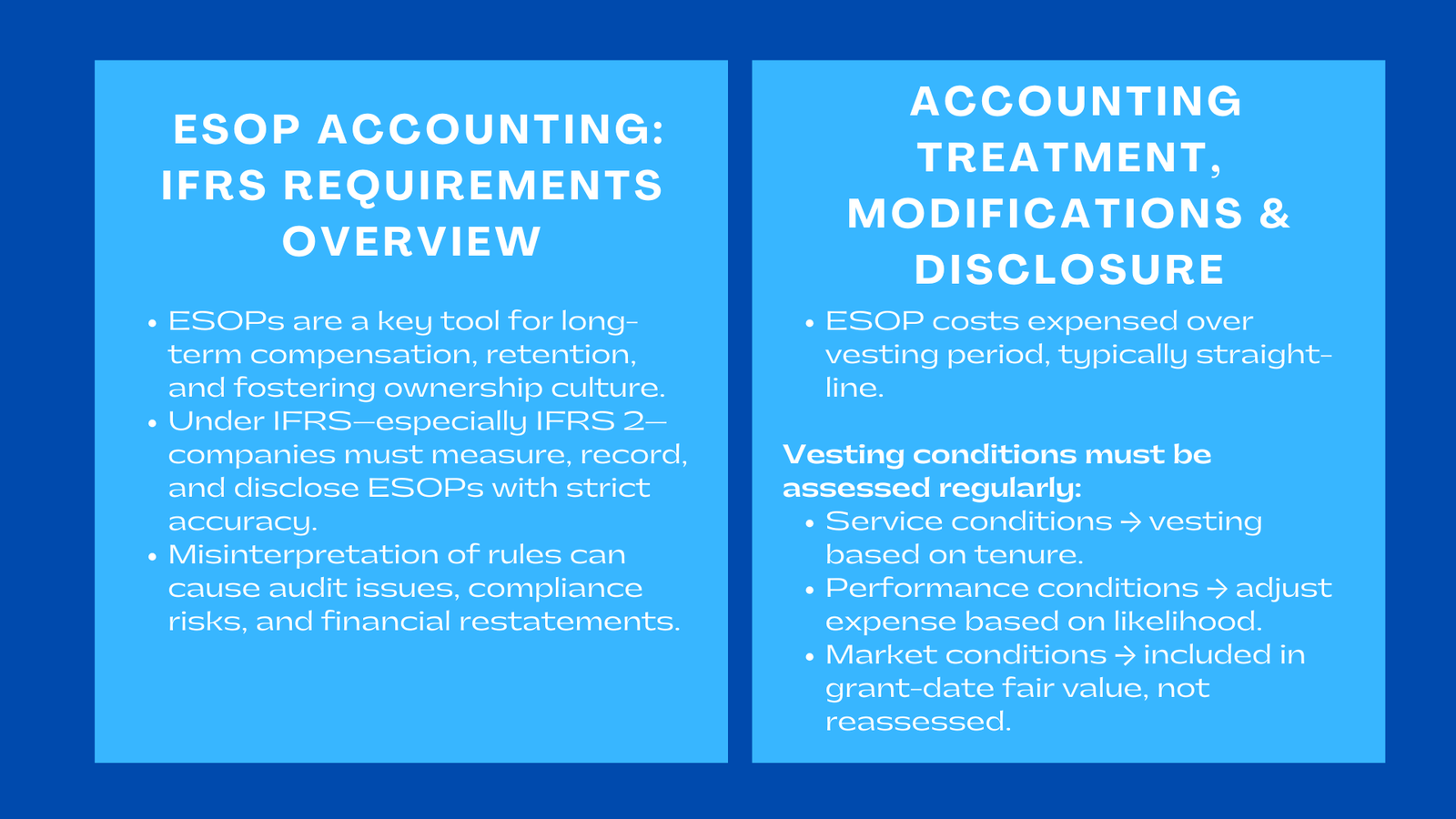

mployee Share ownership plans (ESOPs) have become a significant part of long-term compensation and corporate governance. ESOPs have become of great financial reporting implication as organisations switch to equity-based rewards as a means of retention, enhancing ownership culture and matching incentives with shareholder value. In the case of companies with reporting under the International Financial Reporting Standards (IFRS), the ESOPs have to be measured, recorded, and disclosed in a strict precision. The improper interpretation of accounting rules may lead to adjustments in audit, compliance or financial statement restatements, which often prompts executives to also explore what are benefits of a business valuation Singapore as part of strengthening governance and overall financial clarity.

1. Concepts of ESOPs Under the IFRS.

1.1 ESOPs as Share-Based Compensations.

The ESOPs under the IFRS 2 are treated as a part of share-based payment transactions as employees are granted equity instruments as a reward of services. This is regardless of whether the ESOP grants are universal among the workforce or focused on the senior leaders. Under IFRS, these transactions are considered a kind of employee compensation that has to be measured in fair value, and expenses related to the service of its employees.

One technology services company that introduced ESOP in the recent past found out that the shares were not issued at once but since the agreement was to issue equity on a vesting basis, then the commitment to issue equity was considered to satisfy IFRS 2 recognition requirements. This represents the significance of being aware of ESOP liabilities before the time the shares actually pass hands.

1.2 Classification Equity-Settled and cash settled.

The first accounting ruling is whether the ESOP should be treated as equity-settled or cash-settled. Equity-settled ESOPs compel companies to issue shares when they have vested, whereas cash-settled ESOPs compensate the employees in terms of the cash equivalent of share worth. The most prevalent are equity-settled ESOP which is measured by grant-date fair value.

The major pitfall is misclassification. Another case occurred when a regional logistics group accidentally established a cash-settled ESOP plan which gave cash compensation to the employees based on appreciation of the share. IFRS demanded that liabilities be remeasured on a periodic basis- something the company did not foresee when plans are being developed.

2. Under IFRS 2 Fair Value Measurement.

2.1 The Ascertaining of Grant-Date Fair Value.

In the case of equity-settled ESOP, fair value must be measured on the grant date. The measure is an indication of the price that would be paid to the equity instrument by a knowledgeable willing actor in the market. Valuation should take into consideration these conditions since ESOP shares are usually vested, not marketable and they are also subject to forfeiture.

One of the financial services companies that issued restricted shares employed the services of independent valuation specialists to decide on suitable marketability discounts. This guaranteed grant-date fair value that would represent actual economic conditions and that would be in line with audit expectations.

2.1 Choosing a suitable Method of Approach to Valuation.

The models used to estimate the ESOP valuation often include Black-Scholes options valuation models or modified valuation methods using market-based approaches to the few shares that are restricted. It is determined by the nature of ESOP:

- Time-based ESOPs could be based on the fair market value of the underlying shares.

- ESOPs that are based on performance could need discounted cash flow and probability-weighted results.

- Monte Carlo simulation may be applied to market-linked ESOPs.

Regardless of method, companies must thoroughly document rationale, model assumptions, and data sources—an area critical to demonstrating compliance with ESOP accounting IFRS requirements during audits.

2.3 Assumptions That Influence Fair Value

Expected life, volatility, dividend yield and risk-free rates are some of the assumptions that have a significant impact on valuation. In cases of ESOPs that are designed as simple grants of shares, there is always need to estimate the forfeiture rates since IFRS does not require the recognition of expenses on awards which are likely to vest.

A manufacturing company reformulated its forfeiture expectations when some of its employees suddenly left the company as it underwent a restructuring process. The update has radically altered its cost base, and this demonstrates the importance of dynamic assumptions in the true reporting in the IFRS.

3. Revenue Treatment of ESOP Expenses in Financial Statements.

3.1 Expensing the Expenses during the Vesting Period.

After fair value has been established, the companies record the compensation costs during the vesting period, which is normally on straight-line basis but in the case of performance based vesting then its on a straight-line basis. The recognition of expenses represents the service employees offer despite the fact that shares may be vested in a significant amount of time.

A local e-commerce organization that issues ESOPs that have a four-year vesting plan accrued expenses monthly in line with the services rendered. This guaranteed regular reporting and prevented spikes of expenses at the end of the year.

3.2 Adjusting Conditions of Vesting.

There are service conditions, performance conditions, and market conditions distinguished by IFRS:

- The schedules of vesting are influenced by service conditions.

- Achievement probability should be regularly evaluated as per performance conditions.

- Grant-date fair value takes into consideration market conditions and is not reassessed at a later point.

In the event that the likelihood of control over the performance terms varies, e.g., the revenues-related or EBITDA-related goals, the recognition of the expenses should be adjusted.

3.3 Accounting for Forfeitures

The IFRS obliges the companies to estimate anticipated forfeitings and update them within the course of the vesting. Indicatively, the higher the employee turnover, the less the expenses should be recognized.

The most common policy that many companies use is to revise forfeiture estimates quarterly to have data that is audit-ready and more accurate reporting.

4. ESOP Modifications and Cancellations Accounting.

4.1 Modification Accounting

In case there are terms in the ESOP which vary, i.e. change in the vesting schedule, performing less or more, or repricing the underlying shares, IFRS mandates that the incremental fair value should be recognised as part of the compensation cost.

An fintech company refreezing underwater ESOPs to match employee incentives had incremental costs of significant size, since IFRS had to recognize upgraded economic benefit to employees.

4.2 Cancellations and Settlements.

Cancellations hasten the recognition of expenses that have fair value still outstanding at the date of grant. In case companies substitute cancelled ESOPs with new ones, grant relationships, vesting terms, and fair-value differentials should be evaluated.

The cancellations that are not well documented often come under auditor attention and this creates the necessity to have good governance procedures.

5. Disclosure Requirements: Providing Transparency and Audit Readiness.

5.1 Grant Details

According to IFRS, companies are expected to reveal the nature of ESOPs, such as amount of shares awarded, vesting requirements, exercise values (where applicable) as well as the contractual provisions. Transparency helps the investors to have an understanding of the economic impacts of ESOPs.

5.2 Methodologies and Assumptions of Valuation.

Valuation models utilized, data sources, assumptions, and material judgments have to be disclosed by companies. This is central to demonstrating compliance with IFRS reporting for ESOP plans and facilitates audit verification.

5.3 Expense Impact on Financial Performance

The amount of total expense that has been recognised within the profit or loss during the period shall be presented with movements in share-based payment reserves. This assists the stakeholders to be aware of the ESOP-related dilution and compensation patterns.

Conclusion

ESOPs should be valued strictly and expenses recognized carefully under the IFRS, fully disclosed and assumptions reviewed regularly. Those organisations which treat ESOP accounting in a systematic manner not only attain regulatory compliance, but also increase investor trust and bolster the viability of compensation strategy. The greater the role of equity-based rewards, the more the mastery of IFRS standards of ESOPs will be inevitable to companies in terms of competing, raising capital and expectations in corporate governance.