ESOPs Determine the Fair Market Value of Company Stock

ESOPs Determine the Fair Market Value of Company Stock

In privately owned businesses that use Employee Stock Ownership Plans (ESOPs), determining the fair market value (FMV) of company stock cannot become optional, it is mandatory, regulatory, financial and cultural. In absence of a public market where trading can occur, these companies must be guided by a stringent procedure of valuation of the stock to allow employees to buy or sell the stocks at a fair and economic price. This information on how ESOPs determine the fair market value are used to calculate FMV is of vital importance to the employer, trustees, employees and their advisors.

Legal Requirements and Fiduciary Responsibility

ERISA (Employee Retirement Income Security Act) and associated IRS regulations control the operation of ESOPs and demand that all transactions involving company stock should occur at FMV. The publicly traded shares are priced by a market, whereas the privately held shares do not have a publicly observable price, thus, requiring an independent appraisal to determine that fair value. Fiduciaries of the ESOP, who are usually trustees or members of the plan committee, have to make use of credible valuation to fulfill their legal responsibilities and prove that they care about the interests of employees.

The Department of Labor (DOL) and IRS are regulators that question ESOP dosage against internal bias. Allowing the determination of stock price based on an independent third-party valuation will prove to be an objective determination of stock price and any potential conflict is minimized and fiduciary duties are held. It also gives documentation to aid decision-making processes in the case of audits or questions of the participants.

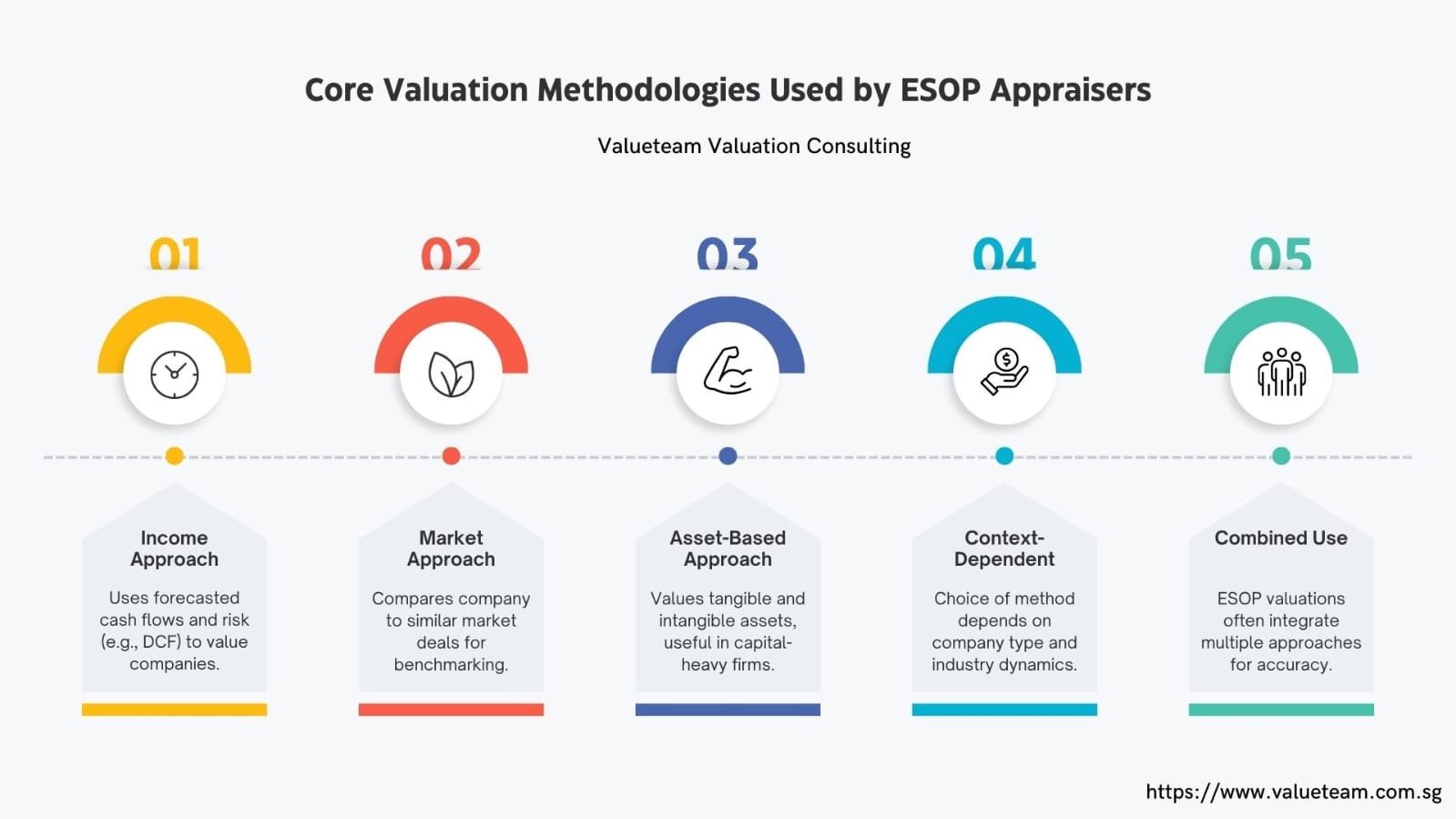

Core Valuation Methodologies Used by ESOP Appraisers

In practice Most ESOP valuations utilize some combination of approaches; the most common in ESOP valuation is the income approach (e.g. discounted cash flow) and its correlation to the market approach (comparables). The asset-based approach can also be added in certain situations particularly in companies that have huge amounts of tangible assets. All have a primary lens: income-based valuation characteristics consider forecasted money flows and operational risk management ESOP Singapore, market-based ones back relative to market dealings and deals, and asset-based ones index values on physical and intangible possessions.

Valuers consider these approaches depending upon the nature of the business and circumstances. To illustrate, a mature company with a steady cash flow may be highly dependent on DCF projections and a business, in a dynamic industry, may take market comps as a benchmark to price. In capital intensive enterprises, asset based valuations are more prevalent since it is easier to determine a bottom price based on the liquidation value of such assets.

Key Inputs in Determining ESOP Stock Price

The valuation relies on specific data that is inside the business: the history of financial statements, profitability, revenue forecast, spending on capital budget, and the balance sheet accounts. Qualitative factors also taken in consideration by valuers include management strength, concentration of customers, position in the industry and growth strategy.

After the acquisition of the information, the estimates regarding the cash flows projection, discount costs and premiums or discounts are made. Pass-through entity treatment is another example of tax considerations projected earnings. Finally, the valuation firm combines these inputs with total equity value which, in turn, is dissected by the amount of outstanding shares and comes up with per-share FMV.

Discounts, Control Premiums, and Minority Adjustments

The ESOP stock is normally owned by a trust and shows minority ownership. Lack of control and lack of marketability is reflected in discounts that are implied by the appraisers. Lack-of-control discount provides an admission that an ESOP trustee has no decision-making powers over strategy or exit events and lack-of-marketability discount reflects the illiquidity of ESOP stock-shares that can only be sold back to the firm at specific instances.

On the other hand, valuations can incorporate controlled premiums when the organization possesses a majority shareholder or group. ESOP stock is valued in consideration of these dynamics to come up with a balanced price that is acceptable to the holdings and continuity of the company.

Timing and Frequency of FMV Determinations

Every year, ESOP valuation has to take place. This makes FMV current in terms of financial performance, market conditions and forward-looking. It is also applicable to the plan administration requirements, it facilitates share buyback costs on retiring or leaving workers and aids in the observation of the contribution and distribution guidelines. Depending on the circumstances, some plans might need to be updated more often in case of material changes in financial position or in the prospects of the business.

Based on the financial analysis, meeting with the management, model building, sensitivity analysis, and valuations can take around several weeks. Once a valuation is settled, trustees examine and authorize the FMV, and subsequently send out the information about the FMV to plan users.

Importance of Valuation Documentation and Transparency

A well written valuation report would entail adequate methodology, assumptions, sensitivity work and reconciliation of various valuation techniques. It should be clear of how discount rates have been arrived at, the computation of the number of shares, and why certain premium due or discount were applied. This evidence is essential when defending the price of ESOP in audit or when answering questions posed by participants.

As the valuation process becomes more transparent when participants meaningfully participate and there is visible documentation that is followed, the trust in the plan develops. Methodological uniformity, evident disclosure of premises and the availability of valued summaries are seen to build trust among the employees and supports the engendering of the perceived fairness.

Conclusion: Valuation as the Cornerstone of ESOP Integrity

Valuation of ESOPs determine the Fair Market Value company stocks is more than a formal financial process, it is the core of legal conformity, employees stock option of ESOP perception and good governance. The ESOPs act as a guarantor of the fairness, openness, and fiduciary integrity of all the stock deals because it places the determination of a defensible FMV to the independent appraisers.

Be it with regard to setting price of share (for instance), providing assurances in support of making liquidity planning to meet regulatory obligations, ESOP valuations ensure employees-owners and stockholders at large have reason to gain a sense of recognition and reward that proportionately represents actual economic value of their stocks.