How an ESOP Compares to an Equity Incentive Plan

Learn How an ESOP Compares to an Equity Incentive Plan

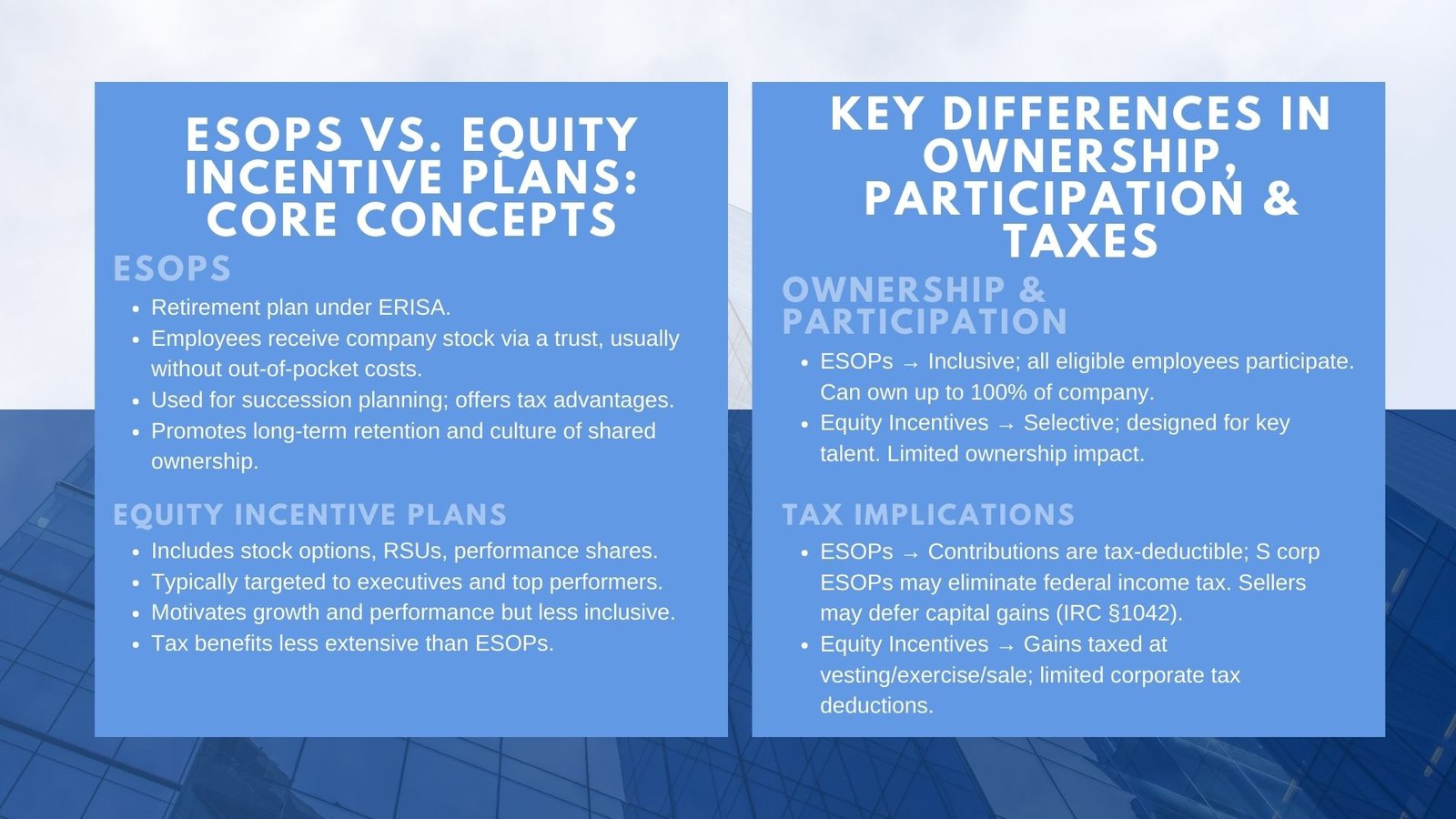

Businesses tend to contemplate the use of equity-based pay structures when they want to reward employees, align their interests, and develop long-term loyalty. The popular ones include ESOPs and equity incentive plans. Both initially sound like they are doing more or less the same and entail providing employees with a stake in the company, but the manner in which they are run, the tax treatment, and the effects on ownership may differ markedly.

Knowledge of such differences to understand their meaning as a business owner or executive or even as an employee pondering their future with a company is critical. This comparison does not only show the way the plans operate, but also covers their greater business and cultural implications.

Understanding the Core of ESOPs

An Employee Stock Ownership Plan is an employee retirement plan that is governed by the Employee Retirement Income Security Act (ERISA). The major objective it aims to fulfill is to enable the employees to own the enterprise by giving them stocks which are vested in a trust up to their retirement or until their departure. In contrast to an obvious purchase of the stock, employees are typically not required to pay the money out of their pockets to acquire such shares.

The company donates instead cash to purchase shares, or rather shares to the ESOP trust in the name of the employees. This organizational design distinguishes the ESOP since it is a combination of the notion of employee benefits and corporate finance strategy.

The ability through the ESOP to act as a succession mechanism to the business is one of the chief features of the latter. Owners wishing to divest want to either sell all or part of their shares to the ESOP, handing ownership over bit by bit or at once. Not only does this provide the business the continuity but it also maintains the culture within the business, in terms of ownership remaining within the group.

Also, the sale of shares using ESOP might offer substantial tax advantages to an individual selling the shares as well as the company. The contributions of stock are tax-deductible and in most circumstances, the company can take tax deductions on repayment of ESOP loans thereby taking taxable income low.

In the view of the employee, ESOP contributions made by the company will grow with time depending on years of employment and compensation paid. This promotes a retention strategy since the longer a person is retained, the more significant the ownership is. When they do leave, the value of their stock is paid to them by the company buying the stock back as per the provisions of the plan converting their equity into retirement benefits.

Understanding Equity Incentive Plans

Equity incentive plan is a more general term which refers to a number of stock-based compensation plans including stock options, possession of stock and performance stocks. These plans are meant to encourage their employees through the provision of a chance of gaining directly in the company growth and improved valuation, often supported by Growth equity valuation services in Singapore. In contrast to ESOPs that are usually retirement-based plans that all the participating employees take advantage of, equity incentive plans can cover key executives and managers, and other employees who have been performing remarkably well, which has had a direct effect on the destiny of the company.

Under a stock option scheme, the employees are given the right to acquire company stocks at a set price, referred to as the strike price, upon investment period, and a set period of vesting. In case the market value of the stock appreciating exceeds strike price, then the employee may exercise the option and gain profit in difference, making Employee stock option valuation services in Singapore essential for accurate planning.

The restricted stock units are different in that they can be seen as an agreement to present real shares to the worker when some conditions are fulfilled, including the accomplishment of performance milestones or staying in the company over a specific time frame. Performance shares are also linked with certain company parameters in the sense that it can only be vested when the company achieves certain predetermined hurdles.

One of the features about the equity incentive plans is that it can be customized to suit the growth goals of the company. Nevertheless, they lack taxis often compared to those provided by ESOPs in the retirement plan. Profit to employees is normally taxed at the selling or vesting time, and the firm could not be allowed to get a similar degree of tax deductions that ESOP allotment leads to, highlighting the importance of ESOP regulatory compliance in Singapore.

Comparing Ownership Structures and Employee Participation

The basic distinction between an ESOP and the equity incentive plan can be made by the people who will participate and the ownership allocation. An ESOP is inclusive only that as long as an employee meets some service requirements, he or she is covered by the ESOP. This renders it an instrument of establishing organization-wide participation and a common cause. All the top-level executives to juniors are interested and this aspect can bring about good morale and teamwork.

On the contrary, equity incentive plans are discriminative. The companies see it as a strategic valued addition and move to retain the best talent in any leadership or specialized positions. This may provide a powerful motivational tool to such people to improve company performance at the possibility of leaving other employees without holding equity directly. This targeted action can be very effective to smaller enterprises or startup companies with the desire to save cash during the rewarding of key individuals. Nevertheless, it is not a source of the same all-inclusive culture of ownership which an ESOP is a source of.

The other prominent contrast is the scale of ownership. The trust may own between a low figure to one hundred percent of companies shares in an ESOP. In a 100 percent ESOP-owned company, 100 percent of corporate profits ultimately are returned to employee-owners. Equity incentive plans tend to leave the overall ownership of those who took part in it at a lower level, since their purpose is rather to motivate the employees than to transfer the full control.

Tax Implications for Companies and Employees

The tax treatment issue is very crucial to put these two models in a comparison. ESOPs have been given special tax treatment under the United States law. Contributions to the ESOP will be tax deductible whether they come in the form of stock or cash. Furthermore, when the company is an S corporation and the entity is wholly owned through the ESOP, the business effectively pays no federal tax on its income since the company is not taxed as a result of being owned by the ESOP which is a tax-exempt organization.

This has the potential to greatly increase the cash flow and thereafter reinvestment in the growth, or repayment of debt. In the case of the selling shareholder, it can be arranged so that the profits are treated as capital gains, then in some circumstances the capital gains taxes can be deferred, e.g. under Internal Revenue Code Section 1042.

Equity incentive plans, in their turn, do not normally allow the company such extensive tax deductions. In case of stock options, when employees exercise the options and then the stock is sold by him/her, the employee owes tax based on whether that stock was maintained by the employee long enough to enjoy the long term capital gains tax rate, or not. In the event that they are vested, RSUs are treated as ordinary income according to the value of shares at the fair market. This may impose more tax on employees than the sale of the shares to the company via ESOPs, whereby the sales tax levied on the stock is typically the capital gains levy.

In a case where the businesses are positioned to achieve maximum tax efficiency in a series or liquidity event, the ESOPs tend to be at an advantage. Nevertheless, equity incentive plans might prove more adaptable and easier to manage by the companies which do not intend or do not feel ready to deal with the complexity of an ESOP trust arrangement.

Long-Term Impact on Company Culture and Retention

Both ESOPs and equity incentive plans are drawn to align employee interests to the success of the company but in different ways. The ESOPs foster a culture of ownership that runs long term since every employee feels like an owner of the company in the future. It can result in reduced turnover, greater engagement and even individual employee productivity as they are now aware that the value of their retirement benefit depends directly on their effort. Research efforts have indicated that ESOP firms tend to be very profitable and perform better when faced with economic recession than non-ESOP firms.

Incentive plans which include equity incentive plans can increase retention particularly of executives and employees with specialized skills. The vesting plans motivate the recipients to stay in the company until the maturity of the equity they have been given, and it is possible to motivate innovation and goal attainment through performance based awards. Nevertheless, due to the limited nature of participation by these groups, the cultural effect could be less captivating at the large scale as compared to an ESOP. Motivation is more likely to be in the form of those who take up the equity and not between different members of an organization as a whole.

As far as succession planning is concerned, ESOPs are a systematized process that may be used to complete partially or entirely both the owner transfer. They are not necessarily the purpose of equity incentive plans, although one can use them as an addition to the other succession plans, maintaining key personnel in place during a transition period.

Choosing the Right Plan for Your Company

Whether a company intends to use ESOP or an equity incentive plan is dependent on its objectives, cash flow position and vision of the company in the future. An ESOP might work as the more preferable alternative in case it is necessary to change ownership, maintain the company culture, and utilize tax-saving opportunities. It is more effective in enterprises already in business and profitable with a stable cash flow and leadership that believes in the employee-ownership employee-model.

An equity incentive scheme may be more suitable in case if the desire is to recognize and retain some critical talent especially in an initially growing company or a start up. It can have focused rewards that do not require organizational and regulatory obligatory actions. The lease plan can be modified according to the requirements of companies since it can adapt to business plans and revised strategies.

In the end, some firms even prefer to merge the aspects of these two strategies by utilizing an ESOP to deliver wide-spread ownership and having an additional equity compensation plan available to award top performers. The hybrid model has the capability of providing the same inclusivity and cultural advantages of an ESOP as well as the desired effect of equity incentives.

In both instances, the sound decision must rely on the advice of financial experts, legal cautionaries and valuation consultants. Such plans are associated with complicated regulatory aspects, tax implications, and strategic plans. With a well thought-out strategy in place, which may either be the ESOP, the equity incentive plan, or a combination of the two, the company can be reinforced and the employees can be better encouraged, and the future of the company secured several decades ahead.