How to Choose Between ESOP ESOS

Difference Between ESOP and ESOS – Which One Should Your Company Choose?

Introduction: How to Choose Between ESOP ESOS

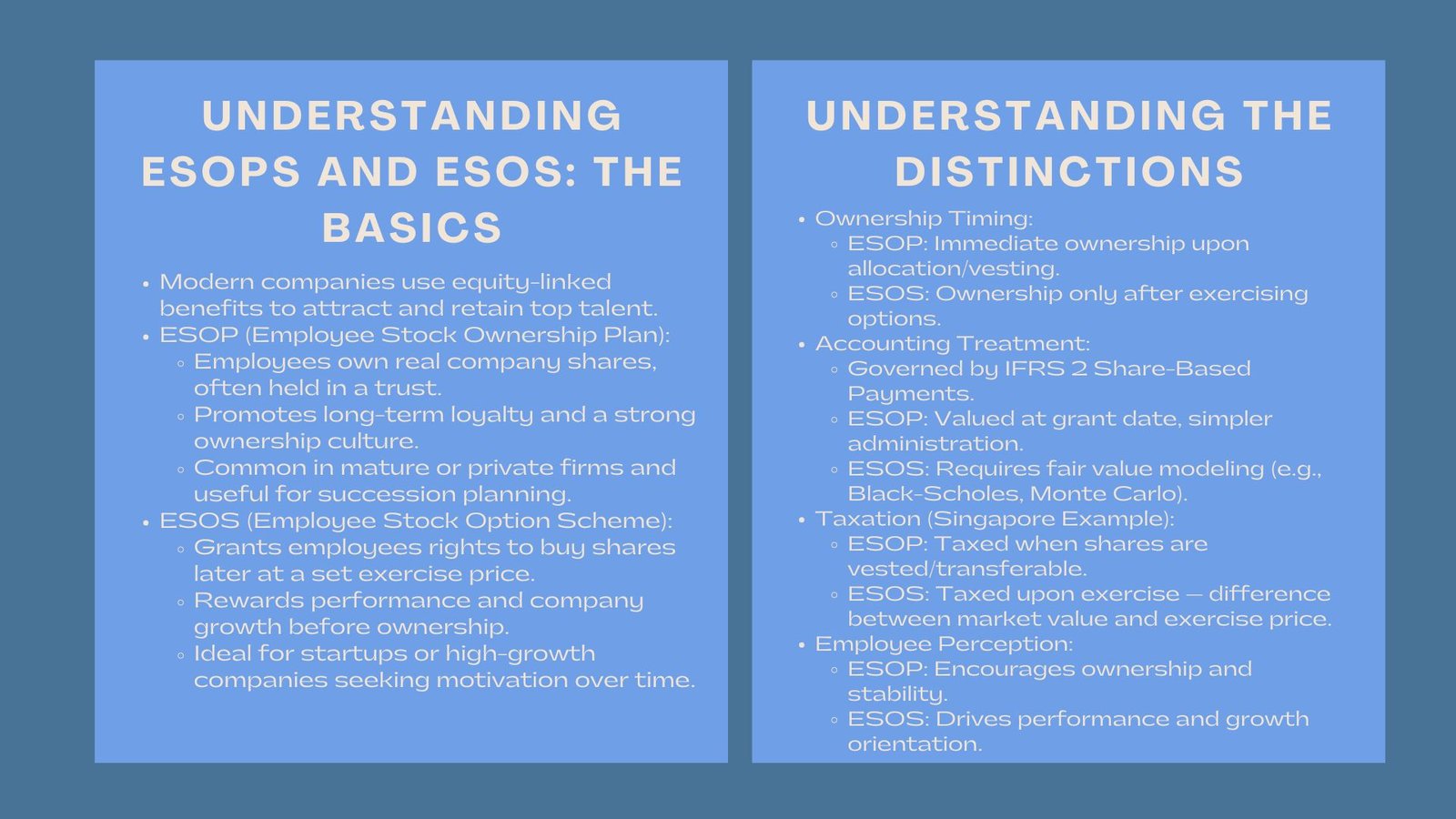

In a world where businesses are vying against each other to get talented professionals, pay has developed much beyond the conventional pay and bonuses. Equity-based incentives – providing employees with a direct interest in the company performance – have become a hallmark of the contemporary corporate culture. The Employee Stock Ownership Plan (ESOP) and the Employee Stock Option Scheme (ESOS) are two of the best known plans which make this ownership mindset possible.

The two are very different though both involve the participation of equity. The selection of the appropriate one may influence financial structure of your company, treatment of the accounting, taxation, and even motivation of the employees. It is important to understand the difference between these programs to help decision-makers formulate a sustainable compensation policy in 2025 and further.

What is ESOPs and ESOS: The Basics

What Is an ESOP?

An Employee Stock Ownership Plan (ESOP) is an employee benefit scheme which enables the staff to own real shares of the company. ESOPs are commonly formed in the form of a trust, with the shares being distributed among employees either in a bonus scheme or as a progressive vesting plan. The employees eventually own the firms over time making them real shareholders who have both the right to dividends and to vote when the shares are fully vested.

ESOPs are particularly favoured in long-established or privately-owned companies when they want to create long-term loyalty or when succession planning is required. ESOPs bring all organizational levels together; including executives and operational staff by transferring ownership to the employees progressively.

What Is an ESOS?

An Employee Stock Option Scheme (ESOS), on the other hand, allows employees the right (but not the compulsion) to purchase shares in the future at a specific set price which is called the exercise price. Contrary to ESOPs, employees held under an ESOS do not own shares instantly. They are instead given a right to obtain them upon satisfying some vesting requirements.

In case the share price of the business increases higher than the exercise price then the staff members can use their options to attain a profit. This possible benefit can stimulate performance, productivity, and retention in sectors where growth is the new driver like in the technology, finance, and professional services.

The Important Differences between ESOP and ESOS.

Ownership vs. Option to Own

The difference between ESOP and ESOS is most fundamental in the time the employees own the shares. Within an ESOP, the ownership occurs upon allocation or vesting of the stake, employees own real equity, which could possibly attract dividends and voting rights. ESOS, conversely, is a right to acquisition of shares in the future, which is usually at a discount or at a specific price.

This difference impacts on motivation as well as perception. ESOPs work best in firms where the employees prefer to be treated as shareholders at the very start. However, ESOS bases ownership on performance achievements, which acknowledges growth and persistence.

Compliance Treatment and Accounting.

Accounting-wise, ESOP and ESOT are subject to share-based payment standards like IFRS 2. However, the valuation and expense recognition differ. ESOP shares are valued at the time of grant, while ESOS requires a calculation of the fair value of employee stock options, often using models like Black-Scholes or Monte Carlo simulations.

The valuation for ESOS takes into account multiple variables — volatility, interest rates, vesting periods, and expected dividends — to estimate potential outcomes. Accurate valuation ensures compliance with audit requirements and prevents discrepancies in financial reporting. ESOPs, in contrast, require less complex modeling but greater administrative effort due to the transfer and management of actual shares.

Tax Implications and Employee Benefits

Tax treatment is another key differentiator. In Singapore, for example, ESOS benefits are taxed at the time of exercise — when the employee converts options into shares. The taxable amount is the difference between the fair market value of the shares and the exercise price paid. ESOPs, conversely, trigger taxation when employees actually receive shares or when those shares become vested and transferable.

From an employee’s standpoint, ESOPs offer immediate ownership value, while ESOS potentially delivers higher gains if the company’s valuation grows substantially. However, ESOS participants also bear the risk that the share price may not rise above the exercise price, in which case the options expire worthless.

Strategic Decision of ESOP vs ESOS.

Stage and Capital Structure of the Company.

The decision to take is ideal depending on the size of the company, its level of growth, and level of liquidity. In startups with a small valuation, ESOS is typically popular since it enables it to preserve cash and provide significant upside to staff. The option plan also guarantees that the employees will only gain when the company is valued higher- this is because rewards are pegged to long term performance.

More established or privately owned enterprises can choose ESOPs specifically when considering the succession process or transfer the ownership to the employees. ESOPs in these situations generate direct culture of ownership and promote permanence.

Employee Motivation and Retention Objectives.

ESOP and ESOS are both potentially strong motivational instruments, but they do not operate in the same way. ESOPs promote sense of ownership, which is best suited in organizations that focus on team work and accountability. ESOS, though, is more inclined towards burnishing employees that are driven by the growth and motivated by the possibility of the increase in capital.

Practically, the hybrid practices are used in some companies as they combine ESOPs and ESOS characteristics in the sense that top executives are provided with the ownership by the ESOPs, and the achievement of high-performing teams is prompted by the use of ESOS. This two sided strategy is the combination of stability and performance-based reward.

The significance of Governance and Valuation.

Irrespective of structure, there should be independent and transparent valuation. A credible ESOP and ESOS valuation service in Singapore helps ensure compliance, fairness, and defensibility during audits or investor reviews. The frequent reappraisal of the fair market value ensures the safety of both the company and its employees as it supports the transparency and avoids conflicts.

It is also important in governance. The terms of grants, schedules of vesting and exercise conditions must be well documented so that employees are well informed of their rights and responsibilities. Those companies that effectively convey the economic benefits have a higher chance of attaining the desired motivational impact.

Future Prospects: The Future of Employee Ownership 2025.

Due to the development of the corporate culture, employee ownership is turning into the hallmark characteristic of the competitive compensation. ESOP and ESOS programs are becoming more and more attractive to investors as a sign of progressive management and sustainable governance. The digital equity platforms have made plan administration simpler, automated the process of vesting and reporting, and improved visibility to the employees bringing efficiency to what was previously a tedious and paper-heavy task.

Furthermore, the introduction of environmental, social and governance (ESG) measures in the incentive plans is transforming the way firms establish equity plans. Through the association of ownership incentives with ESG performance, businesses enhance responsibility and attract talent with a purpose.

Conclusion

Both ESOP and ESOS are highly effective tools of achieving employee ambition with the success of the company, however, they are used to achieve various strategic purposes. ESOPs are instant ownership and long term stability; ESOS is conditional rewards which motivate growth and performance. The decision to make is dependent on the lifecycle, objectives and culture of your organization.

The companies that will achieve success using equity-based incentives in 2025 are those who will do so with precision, which will be backed with expert valuation, open communication, and clear governance. Increasingly, an appropriately structured equity plan can also change your workforce into authentic value-creating partners regardless of your ultimate aim, whether it is of retaining important talent, nurturing innovation, or succession planning.