IFRS 2 Explained for Stock Options

IFRS 2 Explained for Stock Options

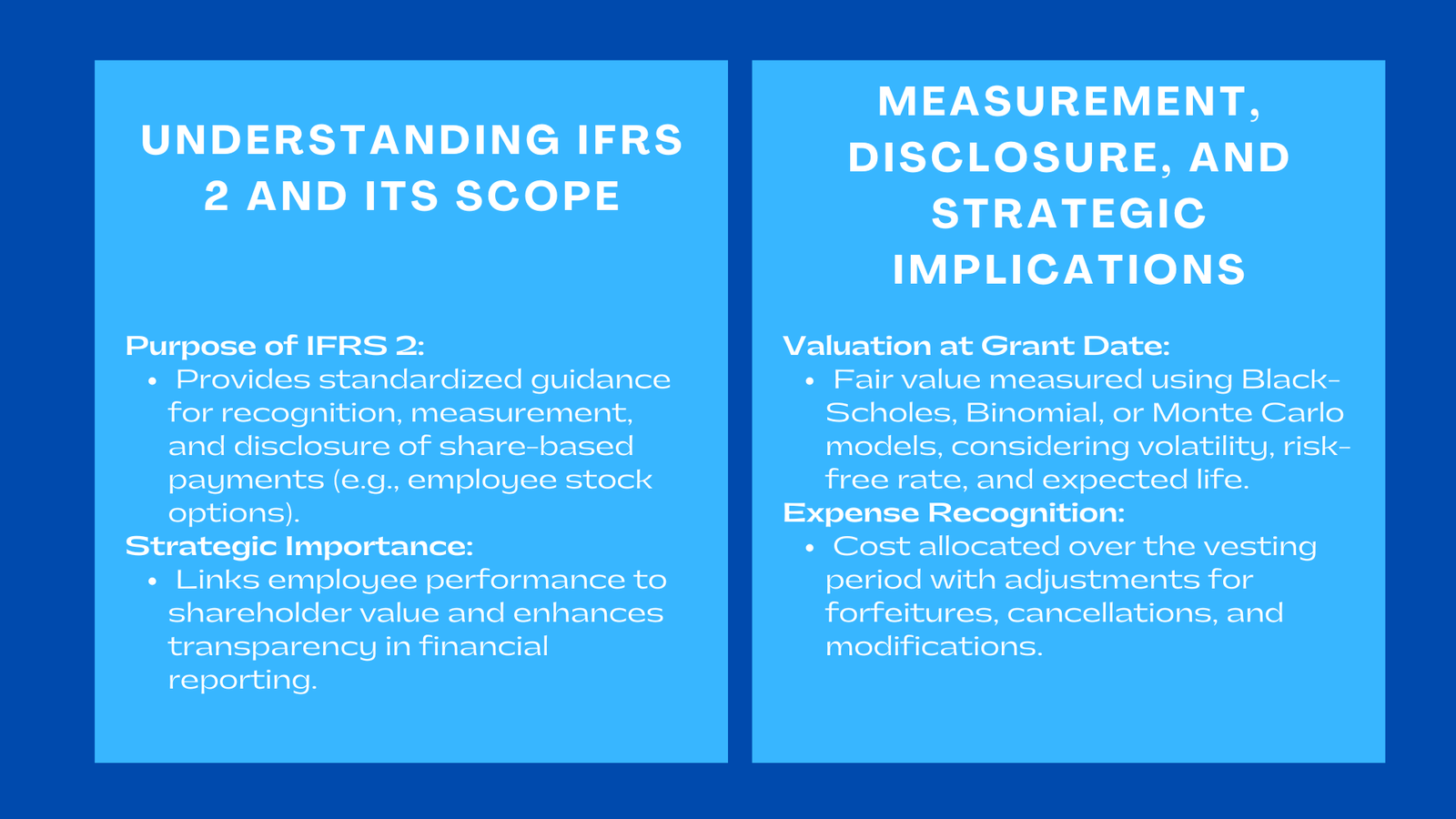

Employee stock options (ESOs) have become a widely adopted mechanism for incentivizing employees, executives, and other stakeholders across various industries. By offering employees the right to purchase company shares at a predetermined price, stock options directly link employee performance and motivation to long-term shareholder value. They act as a retention tool, reward high performers, and encourage employees to think and act like shareholders, contributing to sustainable organizational growth.

Despite their strategic benefits, stock options are inherently complex from an accounting and reporting perspective. Their valuation depends on multiple uncertain factors such as market volatility, employee behavior, performance conditions, and the potential for modifications or cancellations. This complexity makes accurate accounting both challenging and critical.

IFRS 2 guidance for stock options, provides companies with detailed guidance on the recognition, measurement, and disclosure of share-based payments, including stock options. Compliance with IFRS 2 ensures that companies provide transparent, reliable, and consistent financial reporting. Beyond regulatory compliance, adherence to IFRS 2 is a strategic imperative. Organizations that correctly implement these guidelines not only reduce the risk of financial misstatements but also enhance investor confidence, enable effective performance evaluation, and support strategic decision-making.

In competitive markets such as Singapore, where startups, multinational corporations, and technology firms heavily rely on equity-based incentives, IFRS 2 ensures that stock options are accounted for systematically and fairly. Companies that invest in proper accounting procedures and internal controls can transform stock options from a reporting challenge into a strategic tool for value creation and employee engagement.

Scope and Applicability of IFRS 2

Types of Share-Based Payments Covered

IFRS 2 is applicable to a wide spectrum of share-based payment arrangements. These include equity-settled, cash-settled, and hybrid instruments. Equity-settled payments, such as stock options or restricted shares, are recognized as increases in equity rather than liabilities. In contrast, cash-settled arrangements create a liability for the company that must be remeasured at fair value at each reporting date, with any changes recognized in profit or loss. Hybrid arrangements, which combine features of both equity and cash settlements or include complex performance conditions, require careful evaluation under IFRS 2 to determine the appropriate accounting treatment, as emphasized in the ESOP valuation and intangibles guide Singapore ValueTeam services for accurate compliance and reporting.

Transactions with Employees and Other Parties

IFRS 2 extends beyond traditional employee arrangements to cover transactions with directors, consultants, suppliers, and any other parties providing goods or services. Each share-based payment arrangement must be assessed individually to determine whether IFRS 2 applies. This assessment includes newly issued stock options, modifications to existing awards, and complex performance-based equity schemes. The standard’s broad applicability ensures that reporting is consistent, transparent, and comparable across organizations and jurisdictions.

Global and Local Considerations

For multinational companies, IFRS 2 provides a harmonized framework for share-based payment accounting across multiple jurisdictions. While IFRS ensures consistency, local tax laws, legal regulations, and labor rules can differ significantly, creating additional reporting considerations. Companies must reconcile IFRS-compliant financial reporting with local statutory requirements to prevent inconsistencies, audit challenges, or regulatory penalties.

Exemptions and Special Cases

IFRS 2 includes specific exemptions, such as transactions where goods or services are received in a wholly unidentifiable form or certain non-employee arrangements meeting defined criteria. It is critical for companies to evaluate whether these exemptions apply to avoid misclassification or over-reporting. Careful consideration of special cases ensures that financial statements present an accurate reflection of equity-based compensation.

Measurement of Stock Options

Grant Date Fair Value Determination

A cornerstone of IFRS 2 is the measurement of the fair value of stock options at the grant date. The fair value reflects the market price of the underlying shares and the specific terms and conditions of the award. Valuation models such as Black-Scholes for standard European-style options or binomial models for more complex, multi-stage options are widely used.

Key inputs in valuation include expected stock volatility, risk-free interest rate, expected life of the option, dividend yield, and performance conditions. Market or non-market performance conditions, such as revenue targets or share price hurdles, also impact fair value. Accurate valuation requires coordination across finance, HR, and legal teams to ensure that all relevant assumptions are incorporated and documented. Thorough documentation is crucial for regulatory compliance, audit readiness, and transparency.

Vesting Period and Expense Recognition

Stock options are expensed systematically over the vesting period, which corresponds to the period during which employees must meet service or performance conditions to earn the award. Proper allocation of expenses ensures that financial statements reflect the economic cost of equity-based compensation accurately.

Companies must adjust for forfeitures, cancellations, or modifications to avoid overstating expenses or liabilities. Transparent documentation of vesting schedules and assumptions provides auditors with verifiable evidence and supports governance frameworks. Additionally, companies should regularly review assumptions, such as employee turnover rates or the probability of achieving performance conditions, to ensure that expense recognition remains accurate over time.

Handling Modifications and Cancellations

IFRS 2 mandates that any modifications to stock options, such as changes to exercise price or vesting conditions, be accounted for using incremental fair value measurement. Similarly, cancellations, early terminations, or voluntary settlements must be recognized correctly to avoid misrepresentation of liabilities or equity. Companies benefit from having standardized procedures, policies, and accounting guidelines in place to handle modifications consistently. This approach ensures compliance while providing management and investors with clear information on the financial impact of stock option programs.

Disclosure and Reporting Requirements

Transparency in Financial Statements

IFRS 2 requires comprehensive disclosure of stock option arrangements. Disclosures should include the total number of options granted, exercised, forfeited, or expired, the fair value assumptions used at grant date, the terms and conditions, and the impact on profit, loss, and equity. Such disclosures allow investors, regulators, and stakeholders to assess the effect of share-based payments on the company’s financial position and performance.

Complexities in Multi-Jurisdiction Reporting

Multinational corporations face unique challenges in reporting stock options across multiple jurisdictions. Differences in local accounting rules, tax regulations, and currency fluctuations may require additional reconciliations. To maintain IFRS compliance while aligning with local statutory requirements, cross-functional collaboration between finance, HR, tax, and legal teams is essential. Failure to reconcile these differences can result in inconsistent disclosures, audit issues, and a loss of investor confidence.

Technology and Automation in Reporting

Implementing automated systems for tracking grants, exercises, forfeitures, and fair value calculations can enhance the accuracy and timeliness of reporting. Technology also helps standardize disclosures, reduce human error, and simplify the audit process. Modern financial management platforms can integrate IFRS 2 compliance directly into payroll and HR systems, ensuring that companies meet reporting deadlines and maintain reliable financial records.

Strategic Implications of IFRS 2 Compliance

Enhancing Investor Confidence

Accurate application of IFRS 2 strengthens investor confidence by providing transparency regarding compensation costs, potential equity dilution, and the financial implications of stock options. Investors benefit from clarity in financial statements, allowing for better-informed decisions and improved trust in corporate governance.

Employee Engagement and Retention

Transparent and reliable accounting for stock options reinforces employee trust and motivation. When employees understand the financial treatment of their equity rewards, they are more likely to value these incentives, leading to higher retention rates and engagement. This alignment fosters a sense of ownership, accountability, and commitment to long-term organizational performance.

Operational Efficiency and Governance

Integrating IFRS 2 compliance into company systems streamlines operations, improves accuracy, and enhances governance. Automated tracking of stock option metrics and valuations reduces manual errors, simplifies audit procedures, and supports timely reporting. Companies can maintain consistency in accounting, facilitate internal audits, and demonstrate regulatory adherence to stakeholders.

Industry-Specific Considerations

High-Growth Technology and Biotech Sectors

Companies in high-growth industries face unique challenges due to stock price volatility and performance-based vesting conditions. Continuous reassessment of assumptions and valuation models is necessary to reflect market realities. IFRS 2 compliance ensures that valuations remain accurate and credible, preserving investor confidence and internal decision-making accuracy.

Regulated Industries

In banking, financial services, and other regulated sectors, accurate stock option reporting is critical for governance, compliance, and risk management. Regulators often require detailed disclosures of incentive programs to assess financial stability, compensation alignment, and governance practices. IFRS 2 compliance ensures that organizations meet these regulatory obligations while maintaining transparency for investors.

Startups and Emerging Markets

Startups often issue stock options as a primary form of compensation due to limited cash resources. Accurate accounting under IFRS 2 is essential to reflect the economic cost of these options, attract investors, and manage dilution. Emerging market companies must also consider local taxation, legal requirements, and valuation challenges when applying IFRS 2 guidance.

Conclusion to IFRS 2 Explained for Stock Options

IFRS 2 provides a structured and comprehensive framework for the accounting of stock options, ensuring that Share-based payment accounting IFRS are measured accurately, recognized appropriately, and disclosed transparently. Compliance with IFRS 2 mitigates financial reporting risks, strengthens governance, and enhances investor confidence.

By integrating IFRS 2 into financial systems, maintaining thorough documentation, leveraging advanced valuation methodologies, and fostering cross-functional collaboration, companies can transform stock options from a complex accounting requirement into a strategic tool. Transparent and accurate reporting not only enhances employee engagement and retention but also enables better-informed strategic decisions and supports long-term growth.

Ultimately, proper IFRS 2 compliance allows organizations to create measurable value from stock-based incentives, retain top talent, satisfy regulatory expectations, and uphold the integrity of financial reporting. Companies that master IFRS 2 practices can convert share-based payments into both a financial and strategic advantage, turning a challenging accounting obligation into a driver of sustainable enterprise performance and shareholder value.