IFRS Compliance for Share-Based Payments

IFRS Compliance for Share-Based Payments

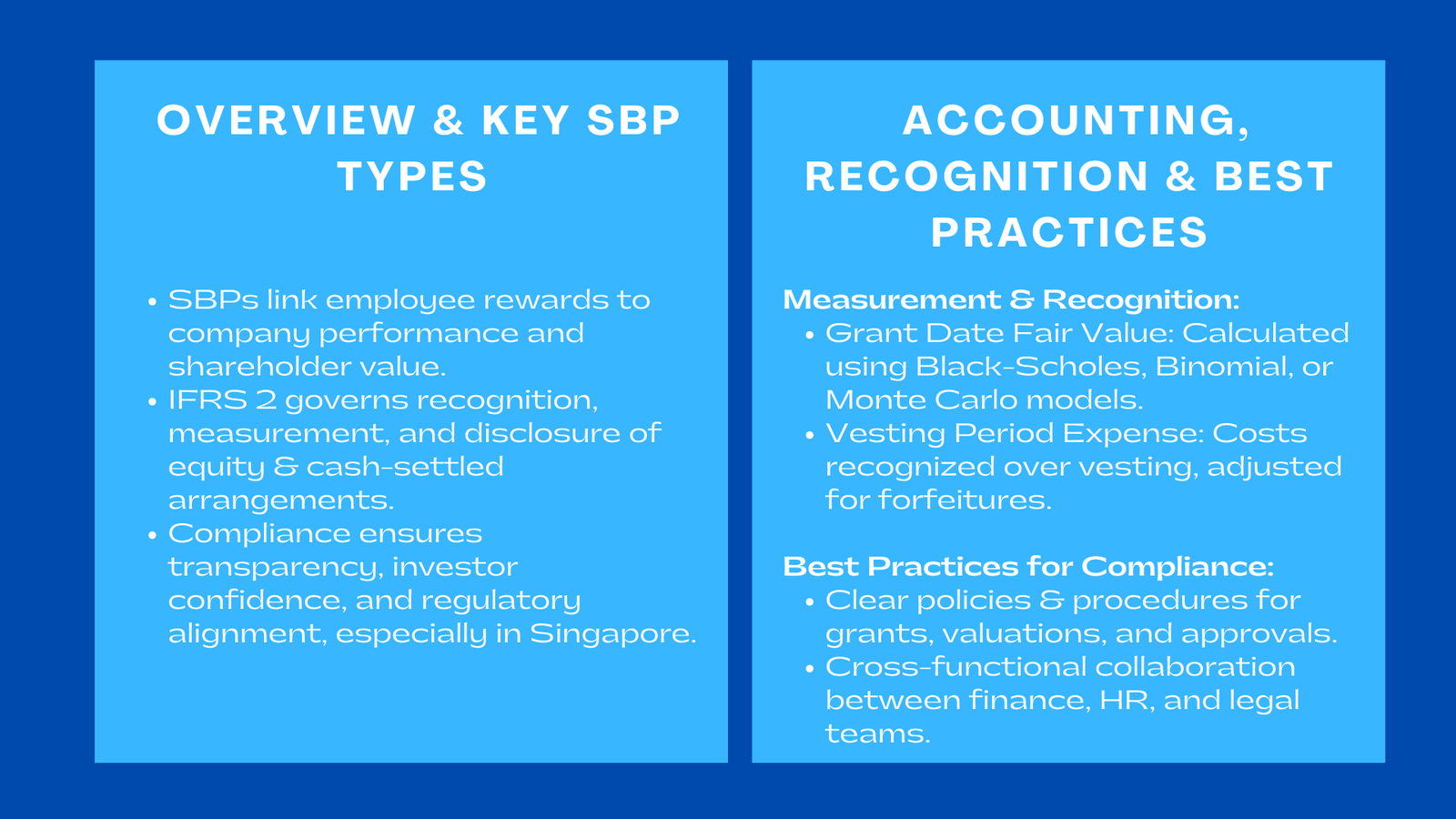

Share-based payments (SBPs) have become a central component of modern corporate compensation strategies. Organizations worldwide, from startups to multinational corporations, are increasingly leveraging SBPs to attract, retain, and motivate employees and executives. These payments, which may include stock options, restricted shares, performance shares, or share appreciation rights, directly link employee rewards to company performance and long-term shareholder value. By providing employees with a stake in the company’s growth, SBPs foster alignment between employee objectives and organizational strategy, creating a culture of ownership and accountability.

However, while SBPs provide significant strategic benefits, they also introduce complex accounting and compliance challenges. Companies must comply with IFRS 2, Share-based Payment accounting guidelines, which governs the recognition, measurement, and disclosure of equity and cash-settled share-based arrangements. Non-compliance with IFRS standards can lead to financial misstatements, regulatory penalties, audit difficulties, and reputational damage.

For organizations operating in highly regulated and competitive markets such as Singapore, adherence to IFRS 2 is both a legal requirement and a strategic necessity. Beyond regulatory compliance, effective SBP accounting ensures transparency for investors, supports informed decision-making, and enhances corporate governance. Companies that fail to maintain proper accounting and reporting mechanisms risk overstating profits, misrepresenting equity, or creating uncertainty regarding employee compensation costs.

Scope and Types of Share-Based Payments

Equity-Settled Share-Based Payments

Equity-settled SBPs involve granting employees or other stakeholders shares, or rights to acquire shares, as compensation. These awards are recorded in equity rather than creating a liability on the balance sheet. For example, a startup might issue stock options to early employees to foster retention, encourage performance, and reward long-term commitment. Companies can leverage employee stock option plan Singapore ValueTeam services to design, implement, and manage these plans effectively, ensuring compliance and alignment with business goals.

Accounting for equity-settled SBPs requires measuring the fair value of the instruments at the grant date and recognizing the expense over the vesting period. The grant date valuation incorporates market price, expected volatility, risk-free interest rates, and projected dividend yields. This ensures that the expense recorded in financial statements reflects the true economic cost of granting equity incentives, providing investors and management with a clear understanding of the company’s financial obligations.

Equity-settled SBPs are widely used in high-growth sectors such as technology, fintech, and biotechnology, where cash constraints make equity compensation an attractive option. Accurate accounting also facilitates scenario planning for potential dilution of shares and helps management align incentive programs with strategic growth objectives.

Cash-Settled Share-Based Payments

Cash-settled SBPs result in a liability that is re-measured at each reporting date until settlement. The liability reflects changes in the fair value of the underlying shares or equity instruments, with gains or losses recognized in profit or loss.

For instance, a multinational bank may offer cash-settled share appreciation rights (SARs) to executives, where the payout depends on stock price appreciation over a defined period. This allows the company to link compensation with performance while managing cash flow strategically. Each reporting period, changes in fair value are recorded, requiring accurate market data and robust accounting systems to ensure compliance with IFRS 2.

Cash-settled SBPs are particularly common in regions with highly liquid equity markets, where companies seek to align executive incentives with share performance without issuing new shares. Accurate accounting also protects shareholders by ensuring transparency regarding potential cash obligations arising from SBPs.

Hybrid and Performance-Based Instruments

Some share-based payment arrangements combine features of both equity and cash settlement or include performance conditions such as revenue targets, market share growth, operational KPIs, or ESG-related metrics. Proper accounting requires careful assessment of the contractual terms, measurement of fair value, and transparent disclosure in financial statements.

For example, a technology company might grant options that vest only if annual revenue increases by 20% and customer retention exceeds a defined threshold. Each performance condition affects the likelihood of vesting, which must be incorporated into the fair value calculation and subsequent expense recognition. IFRS 2 provides guidance for allocating fair value across multiple performance and service conditions, ensuring transparency, comparability, and consistency across companies and reporting periods.

Measurement and Recognition Under IFRS

Grant Date Fair Value Measurement

The grant date fair value is a critical factor in SBP accounting. It represents the value of the equity instrument at the time it is granted, reflecting market conditions and any performance or service conditions attached to the award.

Companies commonly use option pricing models, such as the Black-Scholes or binomial models, to estimate fair value. These models incorporate assumptions such as share price volatility, expected term of the options, risk-free interest rates, and anticipated dividends. Accurate grant date measurement ensures compliance with IFRS 2, enhances financial statement reliability, and provides management with a foundation for strategic workforce planning.

For companies issuing large volumes of SBPs, periodic revaluation and sensitivity analysis of the assumptions are recommended to account for changes in market conditions or employee behavior. Transparency in valuation methodology also strengthens investor confidence and reduces audit risk.

Vesting Period and Expense Recognition

SBPs are typically recognized as an expense over the vesting period, the timeframe during which employees must meet service or performance conditions to earn the award. Companies allocate costs systematically, adjusting for cancellations, forfeitures, or modifications.

For instance, if an employee is granted options with a four-year vesting schedule and leaves after two years, the company adjusts the recognized expense to account only for the period of service completed. Proper documentation of vesting conditions, employee turnover assumptions, and performance targets is essential for transparency and audit readiness.

Modifications, Cancellations, and Settlements

IFRS 2 requires careful accounting for modifications, including changes to exercise price, vesting conditions, or grant size. Similarly, cancellations or settlements must be appropriately reflected to avoid overstating expenses or liabilities.

For example, if a company extends the exercise period of stock options to retain top talent, the incremental value created must be recognized as additional expense. Transparent policies, consistent application, and proper documentation are critical to ensure both regulatory compliance and meaningful financial reporting.

Disclosure Requirements and Reporting

Transparency in Financial Statements

IFRS 2 mandates comprehensive disclosure of SBPs, including the nature and terms of awards, the number of instruments granted, exercised, forfeited, and outstanding, and the effect on equity and profit. Transparent reporting enables investors and regulators to understand the impact of SBPs on earnings, equity, and cash flows.

Impact on Profit and Loss

Recognizing SBPs as an expense affects net income and earnings per share. Companies must disclose their valuation methodology, assumptions, and allocation over the vesting period. Transparent disclosure allows stakeholders to assess the company’s compensation strategy, evaluate financial health, and understand potential dilution.

Challenges in Disclosure Compliance

Companies issuing SBPs across multiple jurisdictions may face challenges in obtaining accurate and consistent data. Instruments with complex performance or service conditions increase complexity. Effective solutions include implementing robust internal controls, cross-functional collaboration between finance, HR, and legal teams, and adopting automated reporting systems to ensure accuracy and audit readiness.

Strategic Implications of Share-Based Payments

Aligning Employee Incentives with Corporate Goals

SBPs are strategic tools for aligning employee behavior with organizational objectives. Equity-based incentives promote retention, productivity, and long-term engagement. By linking SBPs to key performance indicators (KPIs), companies create a culture of accountability, ownership, and results-driven performance.

Investor Communication and Market Perception

Transparent reporting of SBPs strengthens investor trust. Analysts and shareholders can evaluate the company’s compensation strategy, potential equity dilution, and financial position more effectively. Clear disclosure of SBPs may also attract long-term investors who value strong corporate governance, transparency, and alignment of management incentives with shareholder interests.

Operational Efficiency and Compliance Readiness

Integrating share-based payment accounting into broader operational and financial systems reduces errors, simplifies audits, and ensures timely reporting. Automated solutions and centralized data management improve efficiency and facilitate compliance with IFRS requirements, even for complex multinational arrangements.

Best Practices for IFRS-Compliant SBP Accounting

Develop Clear Policies and Procedures

Establishing clear internal policies governing grant processes, valuation methodologies, vesting schedules, and modification approvals ensures consistency and minimizes compliance risk.

Engage Cross-Functional Teams

Collaboration between finance, HR, and legal teams is essential to monitor grants, exercises, cancellations, and valuation adjustments. Cross-functional engagement enhances accuracy and transparency.

Leverage Technology and Analytics

Adopting integrated software platforms facilitates accurate tracking of SBPs, scenario modeling, and real-time reporting. These tools allow management to simulate potential impacts of different market conditions, performance outcomes, or employee turnover on SBP expenses.

Regular Audit and Review

Periodic audits, reconciliations, and reviews of policies and assumptions ensure ongoing compliance. Comprehensive documentation of methodologies strengthens transparency, reduces audit risk, and provides stakeholders with clear insights into compensation costs.

Scenario Planning and Strategic Forecasting

Integrating SBP data into broader financial planning enables companies to forecast equity dilution, cash obligations, and performance-linked incentive costs. Scenario planning supports proactive adjustments to compensation programs, ensuring alignment with corporate objectives and market conditions.

Industry-Specific Considerations

SBPs are widely adopted in sectors such as technology, healthcare, finance, and consumer goods. Startups often rely heavily on equity-settled SBPs due to cash constraints, while multinational corporations may prefer cash-settled or hybrid models for executives. Each industry faces unique challenges in valuation, disclosure, and regulatory compliance, which necessitate tailored accounting policies.

For example, a fintech startup may grant options with complex vesting conditions linked to product adoption rates, while a pharmaceutical company may use performance shares tied to successful clinical trials. Understanding the industry context and aligning SBP accounting practices with sector-specific risks ensures IFRS compliance and strategic utility.

Conclusion to IFRS Compliance for Share-Based Payments

IFRS share-based payment compliance accounting is not merely a regulatory requirement—it is a critical strategic tool that enables companies to align employee incentives with corporate objectives, maintain transparency, and reinforce investor confidence. Accurate measurement, recognition, and disclosure of SBPs facilitate governance excellence, support informed decision-making, and enhance long-term value creation.

In competitive markets such as Singapore, where SBPs are widely utilized, robust compliance practices ensure that employees are fairly compensated, financial statements accurately reflect economic reality, and corporate objectives are reinforced. Companies that adopt clear policies, leverage technology, document assumptions, and engage cross-functional teams can minimize risk, optimize operational efficiency, and maximize the motivational impact of SBPs.

Ultimately, IFRS compliance transforms share-based payments from a complex accounting obligation into a strategic enabler of corporate growth. By systematically managing grant valuation, vesting, modifications, and reporting, organizations can retain and motivate talent, maintain transparent financial reporting, and foster long-term alignment between management incentives and shareholder value. Through diligent governance, continuous monitoring, scenario planning, and proactive disclosure, SBPs become a measurable driver of enterprise performance, employee engagement, and sustainable shareholder wealth.