Key Compliance Tips for ESOS Plans

Key Compliance Tips for ESOS Plans

Introduction to Key Compliance Tips for ESOS Plans

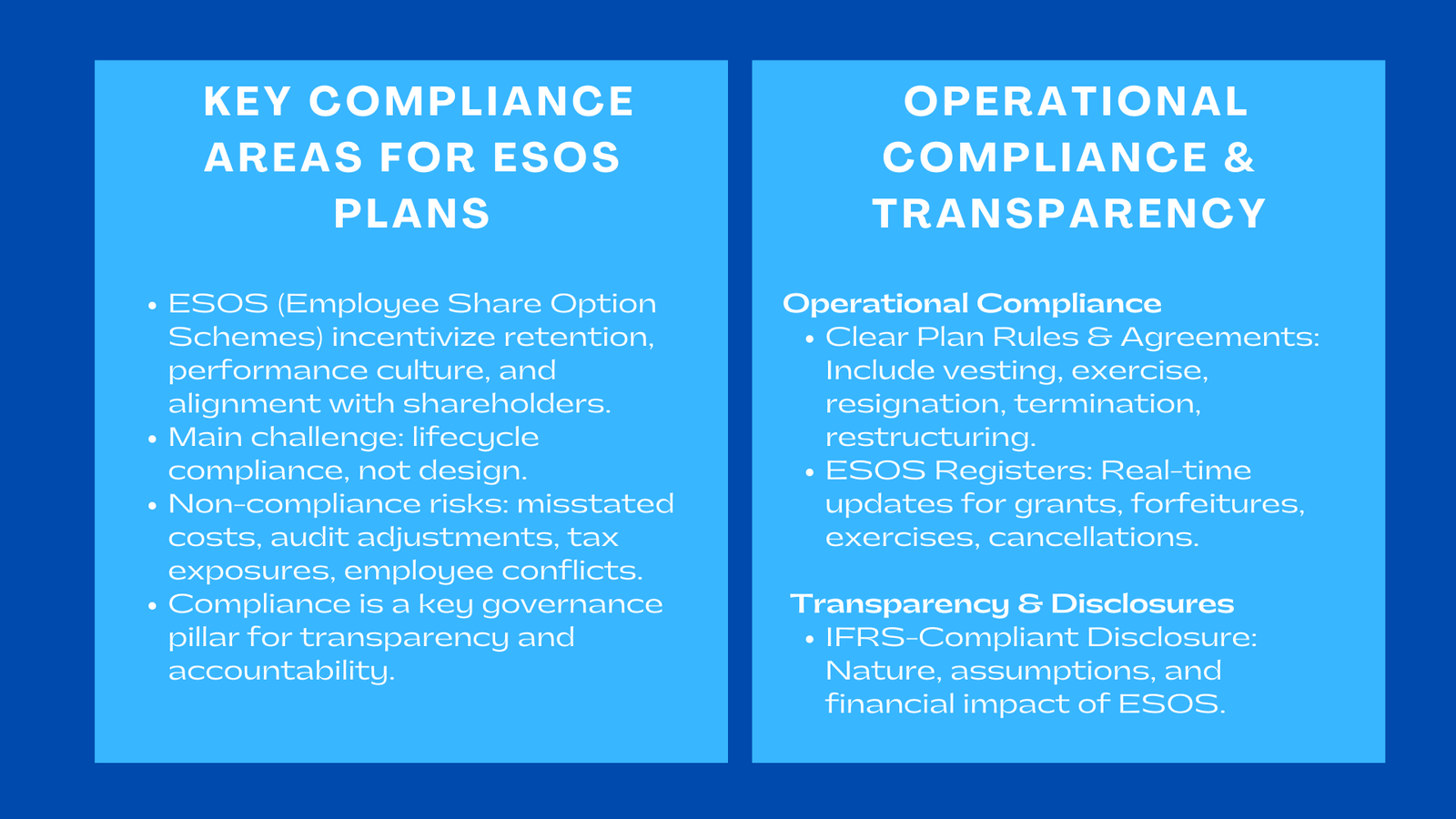

Employee Share Option Schemes (ESOS) is an incentive scheme that has become very common in firms that desire to retain their key talent, encourage performance culture and long term synergy between employees and shareholders. The use of ESOS is incorporated in larger corporate governance and financial reporting as organisations grow. However, the most prevalent difficulty that most companies experience is not the scheme design per se, it is the continued compliance along the lifecycle, including ensuring fair market value ESOS Singapore for accurate accounting and reporting.

Lapse in compliance may cause misstated costs, audit adjustments, tax exposures and even conflict with employees. In the modern regulatory climate, whereby transparency and accountability are the main pillars, an organization should consider ESOS compliance as a key governance pillar. In this article, the author has presented a systematic review of one area of interest namely the major compliance areas that firms should address to achieve correct, defensible and IFRS compliant ESOS reporting and administration.

1. Developing a Powerful Regulatory Framework.

1.1 Interpreting Legal and Corporate Governance Requirements.

The initial move toward compliance with ESOS is to ensure that it has a clear-cut awareness of the jurisdiction-specific law. Issuing share options in most nations, must be approved by boards, shareholder resolutions, company constitutions amendments or by submitting filings to the regulatory bodies.

The typical real-life example is where private companies do not revise their constitutions to authorize issuance of options or do not establish a special ESOS pool. The impact of such structural gaps emerging in the course of audits or funding rounds may deal with delay, legal expenses, or any other remedial measures that may be required as a post-factum.

1.2 Adapting ESOS Terms to Local Employment Law.

The laws of employment affect the way options are awarded, vested and handled in case of resignations or terminations. An example is the need by some markets to have express employee acceptance before grant date can be recognised, and rules on how to treat retrenchment or retirement.

Any company that goes international needs to consider such differences and be careful that ESOS regulations should be used uniformly even with long term or mobile workers.

1.3. The verification of the adherence to corporate policies.

The ESOS rules are expected to be in line with wider HR/governance systems. These involve alignment of ESOS terms to performance management systems, reward cycles and promotion policies. Due to misalignment, the granting practices may not be consistent, which compromises fairness and internal compliance.

2. Enhancing Financial Statement Reporting in line with IFRS.

2.1 The company accurately measures its fair value at the date of grant

ESOS accounting is based on the fair value measurement as far as reporting is concerned. The IFRS 2 makes companies calculate fair value at the time of granting based on recognized valuation models, which may include Black-Scholes, binomial, or Monte Carlo simulations.

Technology firms, such as those, usually award options that have complicated vesting requirements based on product accomplishments. In the absence of the right valuation model, fair value can be either understated or overstated and this influences the expenses that are recognised in the income statement.

2.2 Recognition of Expense over Vesting Period.

After determination of the fair value, the companies should treat the ESOS cost uniformly over the span of the vesting pattern unless the vesting terms demand an alternative pattern of allocation. It is at this point that sound processes are needed.

One multinational corporation had an experience with an audit problem since the company did not revise the anticipated forfeiture rates when the employees exited the company. This led to an overstatement in the ESOS expense in two years. This depicts the reason behind compliance not merely valuation at the outset but monitored constantly.

2.3 Coherent Documentation and Evidence.

It has good documentation practices, which facilitate IFRS-compliant reporting and minimize the possibility of audit findings. Valuation assumptions, grant resolutions, vesting calculations and treatment of modifications should be presented in workpapers.

Companies that maintain clear documentation build a defensible audit trail aligned with IFRS reporting ESOS tips, enabling transparency across financial reporting cycles.

3. Ensuring Operational Compliance

3.1 Clear ESOS Rules and Employee Agreements

The start of compliance is properly developed plan rules. These regulations ought to include the terms of vests, exercising, resignation treatment, termination, corporate restructuring and change of control.

One of the emerging fintech firms learned to be precise when the employees argued against option forfeitures because of loose language in initial ESOS agreements. Modifying their plan rules did away with any ambiguity and ensured no further controversies.

3.2 Esos Registers: This requirement is fulfilled by upkeeping accurate ESOS Registers.

Compliance depends on the right administration. Grants, forfeitures and exercises and cancellations should be reflected in real time in registers. Businesses that are based on spreadsheets only, usually face version control problems or accuracy errors and this leads to discrepancies between the HR records and the financial statements.

3.3 HR, Finance and Legal Functional Integration.

Silos are usually the basis of compliance failures. HR can update the employee data, but the finance might not get the updated information in time to use during accounting. Legal can update the ESOS terms, yet HR teams can still be using archaic templates.

Development of cross-functional workflows will also enable uniform treatment of the organisation, especially during events of vesting and option exercises.

4. Tracking and controlling Plan Amendments.

4.1 Management of Modifications and Repricing.

According to IFRS 2, incremental fair value is to be recognised when the terms of an award are rewritten in a manner that is favourable to the employee. This involves discounts of prices of exercises or offer extensions of option lives.

A consumer goods company having repriced underwater options had to discover that despite the good intentions behind employee retention programs, additional costs could be generated that otherwise under IFRS 2 that might not be reflected in the accounting processes.

4.2 Corporate Transactions Management.

ESOS adjustments are usually caused by acquisitions, mergers, or restructurings. Compliance involves determination of whether the awards are being substituted, expedited or reorganized. There are accounting implications of each scenario.

When companies plan on such events, valuations and disclosures can be planned beforehand and such situations do not create any complications when it comes to executing the deal at the last minute.

4.3 Reviewing the Vesting Conditions on a Periodic basis.

The performance-based awards should be checked after every quarter or year. In the event of changes in likelihood of vesting, companies need to change the number of options that will be vested.

This ongoing reassessment is essential to maintaining alignment with ESOS plan compliance checklist requirements and ensuring reported expenses reflect current expectations.

5. Enhancing Transparency and Disclosures

5.1 Providing Comprehensive IFRS Disclosures

Open disclosures raise investor confidence. According to IFRS 2, companies are to report:

Nature and important terms of ESOS plans.

* Fair value procedures and assumptions.

* Repercussions of outstanding, vested, exercised, and forfeited options.

* The effect of share-based payments on the profit and loss.

Obvious disclosure reflects a strong governance and the avoidance of being misinterpreted by analysts or shareholders.

5.2 Communicating ESOS Value to the Employees.

It is not only regulatory, but it also concerns employees in matters of clarity. Most organisations fail to remember that employees need to know the structure, value, and risks of their ESOS awards.

Effective communication increases the perceived value of scheme and minimizes uncertainties surrounding the scheme in terms of vesting, taxation and exercise procedures.

Conclusion

An effective ESOS program is the one that is not only a well-conceived program, but also carefully managed. Regulatory compliance is not just about fulfilling the requirements of the regulators but also encompasses the constant oversight, discipline in the accounting, well organized records and effective communication.

Firms with a high emphasis on compliance, which is reinforced by effective IFRS procedures, interdepartmental working/cooperation and effective work controls, produce ESOS plans that can withstand audit and scrutiny, enhance corporate governance, and provide sustainable value to the employees and shareholders.