Practical IFRS ESOS Disclosure Training Program

How to Record ESOS in Financial Statements Under IFRS

Introduction: Practical IFRS ESOS Disclosure Training Program

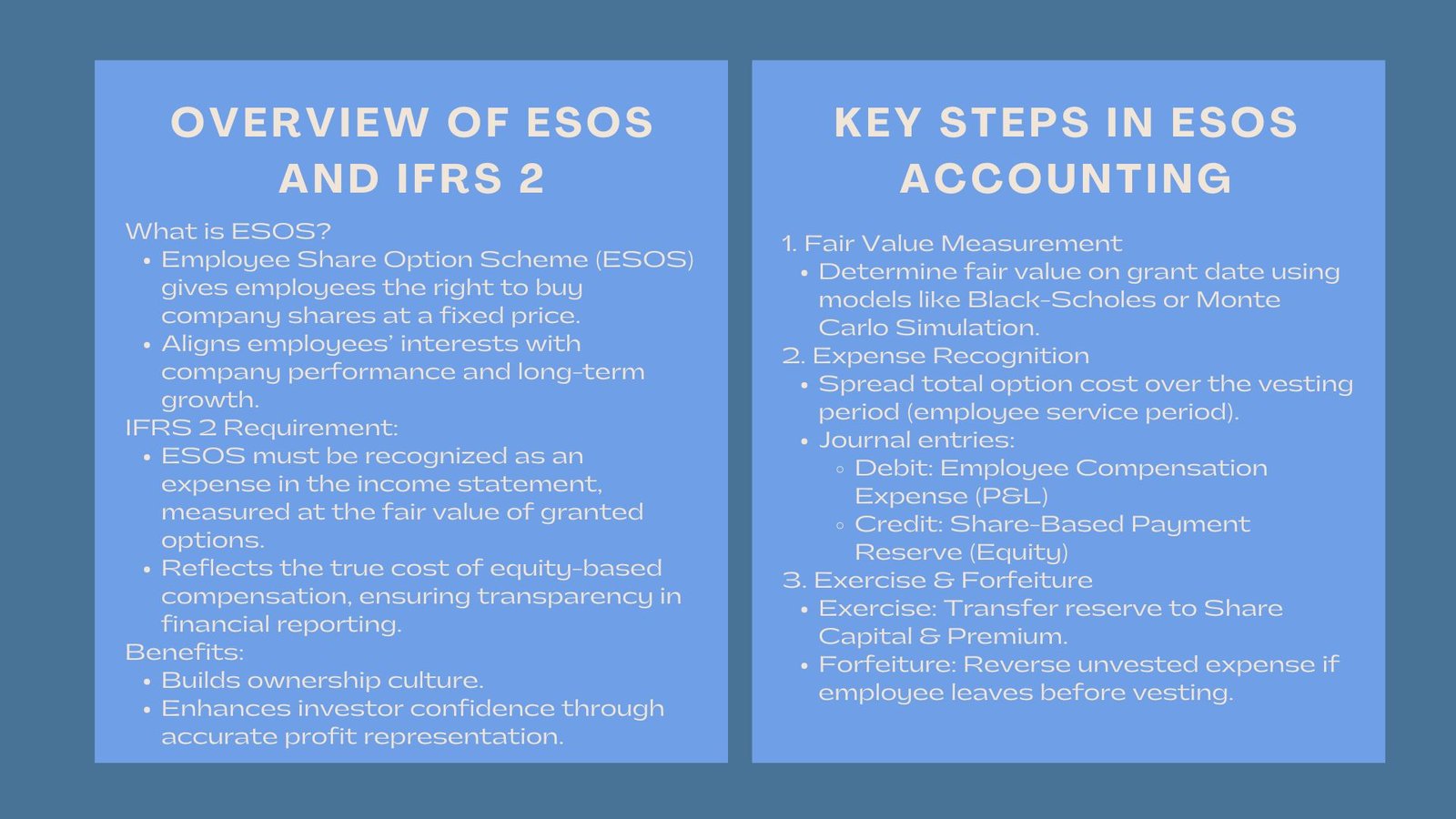

Employee Share Option Scheme (ESOS) is one of the best methods of aligning employees to the long term development of a company. By granting employees the right to purchase shares at a predetermined price, ESOS incentivizes performance and fosters a sense of ownership in the company’s success. As per the IFRS 2 ESOS accounting compliance for companies Singapore should be an expense in the income statement with fair value of options that the company has granted. This makes the profits that the company reports to reflect comprehensively all the compensation costs, even the costs paid in equity, and not in cash. This approach provides a more accurate and comprehensive view of the company’s financial performance.

The proper recording of ESOS must be well informed about the IFRS 2 principles. It is the option of measuring fair value of options, apportionment of expenses during the period of the vesting and the journal writing. Wide visibility and transparency would prevent audit problems, misstatements, and compliance violations. Maintaining transparency and wide visibility in ESOS accounting prevents potential issues such as audit discrepancies, financial misstatements, and regulatory non-compliance. Organizations that implement robust ESOS accounting practices not only comply with IFRS requirements but also strengthen investor confidence and internal governance.

Key Steps in Accounting for ESOS

The company calculates the fair value of the stock options at the grant date based on such valuation models as Black-Scholes or Monte Carlo simulation. When the value is set, the company starts realizing the cost throughout the vesting period- the period within which the employees should stay within the organization to be able to accrue the options.

The entry in the book of accounts of the company is stated as follows:

- Credit: Employee compensation expense (Income Statement)

- Credit Share based payment reserve (Equity)

If an employee leaves the organization before the options vest, the unvested portion is forfeited, and the previously recognized cost is reversed. Upon exercise of vested options, the company transfers the reserve to share capital and share premium accounts, employee share option scheme fair value calculation Singapore reflecting the issuance of new shares and the conversion of equity-based compensation into paid-in capital. Proper documentation and accounting of these transactions ensure compliance with IFRS 2, maintain transparency for auditors and investors, and accurately reflect the financial impact of employee incentives on both the income statement and equity.

Disclosure and Impact

The IFRS 2 disclosure is essential. The amount of options that are granted, the price at which exercising takes place, the conditions of the vesting, and the assumptions of fair value have to be presented by the companies. Such disclosures enable the analysts and investors to evaluate the share earnings and dilution possibilities.

Lack of the acknowledgment of ESOS might lead to falseness of profits and the possibility of violating various compliance. In the case of a publicly listed company or a company aiming to be listed, it proves to be transparent and builds investor confidence due to the compliance to IFRS based ESOS accounting.These disclosures allow analysts and investors to assess potential earnings dilution, evaluate the impact on shareholder value, and understand how employee incentives affect the company’s financial statements.

Failure to properly recognize and disclose ESOS can lead to misstated profits, non-compliance with accounting standards, and potential regulatory violations. For publicly listed companies or those planning to go public, adherence to IFRS 2 in ESOS accounting not only ensures compliance but also demonstrates transparency, governance, and accountability, thereby enhancing investor confidence and supporting a positive perception in the capital markets.

Conclusion

ESOS is not merely a bookkeeping practice under the IFRS; it reflects good governance. Proper recognition of share-based rewards will mean that financial statements will be accurate on the actual cost of compensating employees using equity. Proper recognition of share-based rewards ensures that financial statements accurately reflect the true cost of compensating employees through equity rather than cash. This transparency allows stakeholders to understand the real impact of employee incentives on profitability and shareholder value.

To CFOs and finance teams, ESOS accounting is best learned to ensure there is level of consistency, audit preparedness and trust by the investors. With aspects of equity based incentives being fundamental to the corporate strategy in a business context, adherence to the IFRS 2 converts transparency into competitive edge without losing conscience to give rise to growth and credibility. Companies that rigorously apply these principles not only uphold financial integrity but also reinforce their commitment to growth, accountability, and credibility, demonstrating that ethical and strategic management go hand in hand.