Professional ESOP Annual Valuation Requirements

ESOP Full Form in Company Explained: Annual Valuation Requirements and Valuation Practices for Listed Companies

Guide to Professional ESOP Annual Valuation Requirements

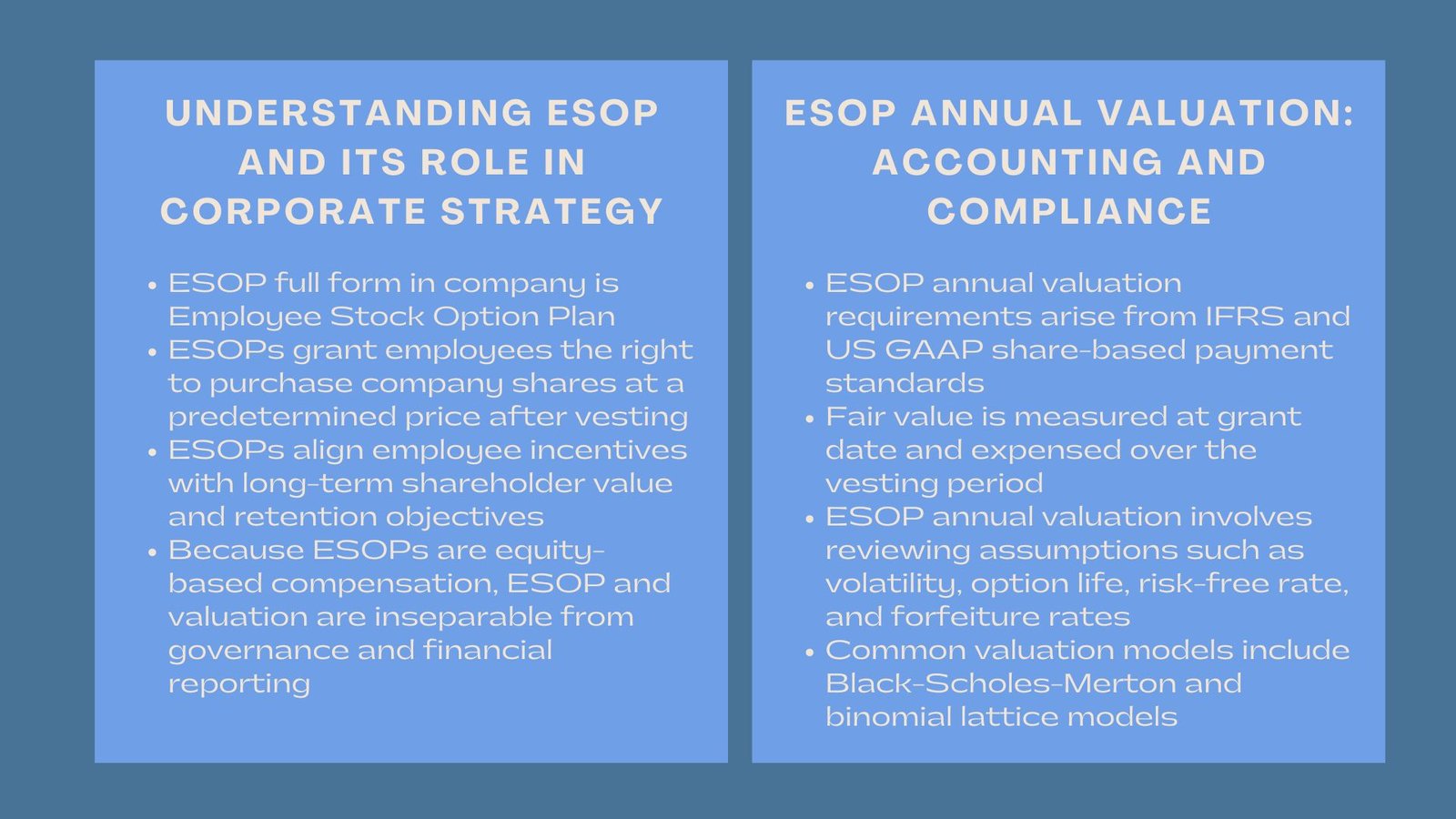

Inclusion of employees in equity has taken a center stage in the contemporary company remuneration and governance. Employee Stock Option Plans (ESOPs) are a common practice in public and private companies to align employee interests with shareholder value, to retain talent and as part of an incentive to perform long-term. Nonetheless, successful and adherence of such plans is largely dependent on sound valuation practices. Learning about the esop full form in company, esop annual valuation mechanism, and regulatory expectation on valuation of esop of listed companies would therefore be very important with regard to finance professionals, human resource representatives, auditors, and board of directors.

The article is a detailed and professional guide specifically on ESOP valuation. It describes the reasons esop and valuation cannot be separated, how the esop annual valuation requirements are practical, and how the listed companies can cope with the complexity of valuation in the changing accounting and regulatory environment.

1. Understanding ESOP Full Form in Company and Its Strategic Role

The esop full form in company is Employee Stock Option Plan. It is an organized scheme in which the employees are provided the right, but not the due, to acquire company shares at a set price after a set period. ESOPs have serious financial reporting, valuation, and governance consequences, although the concept of ESOPs is simple.

Strategically, ESOPs are a long term incentive plan and not a cash plan. The companies apply ESOPs to create ownership culture, retention, and directly relate compensation to the company performance. Since such choices are a type of equity-based compensation, their worth should be determined in a reliable and consistent way, which puts esop and valuation in the spotlight.

ESOPs also affect market perception, earnings measures and dilution of shareholders in listed companies and thus valuation accuracy is not only important to internal management but to external stakeholders as well.

2. Why ESOP and Valuation Are Fundamentally Connected

The connection between valuation and esop is based on the accounting standards and economic substance. ESOPs have the disadvantage of producing an expense to the company, although they are not associated with direct cash outlays. Such expense captures the fair value of the options awarded to employees and should be reflected during the course of the vesting.

Valuation is used to define the amount of compensation cost that will be in the income statement and the equity in the balance sheet. Reported profits may be biased due to inaccurate valuation, investors may be misled, and regulatory scrutiny may be applied to the companies. Consequently, valuation will not be a technical annex but a fundamental element of ESOP governance.

In reality, valuation bridges the gap between HR strategy and finance and accounting where management, independent valuers, and auditors are required to coordinate.

3. ESOP Annual Valuation Requirements: Regulatory and Accounting Perspective

The Esop annual valuation requirements are mainly brought about by financial reporting policies as well as securities regulations. Both the IFRS and the US GAAP have the requirement that a company measures the fair value of the equity settled share-based payments at the time of grant and they ought to recognize the expense within the vesting period.

Although the central role is the grant-date fair value, esop annual valuation is considered to be relevant as companies need to review assumptions, forfeiture rates, and changes in the plan. This is also done in some jurisdictions where annual valuation of disclosures, tax compliance or regulatory reporting is mandatory.

The regulators tend to demand periodic assurance that valuation inputs are reasonable, especially in volatile markets in the case of listed companies. This renders esop annual valuation requirements as a continuous compliance exercise as opposed to being a calculation that is made on a single occasion.

4. ESOP Annual Valuation in Practice

The Esop annual valuation is a review of the assumption applied in the option pricing models, which need to be updated to the present market conditions. The common inputs are share price, volatility, anticipated life of options, risk-free interest rate and dividend yield.

Despite the fixation of the fair value at the grant date to expense accounting purposes, the companies are required to revise disclosures and to determine whether the amendment of plan terms will result in remeasurement. E.g. changes in terms of vesting, or price of an exercise can also demand a value adjustment.

In practice, listed companies frequently conduct annual valuation of the esop, and annual wider equity valuation exercises, so that they are consistent in reporting on ESOP and market disclosure.

5. Valuation Methodologies Used in ESOP Valuation

ESOPs are evaluated using option pricing models, and not the bare comparison between share prices. This is the technical aspect of esop and valuation.

5.1 Common Valuation Models

The most common ones are the Black-Scholes-Merton model and binomial lattice models. These models determine the fair value of options by using assumptions inherent in the market and probability weighted results.

In the case of valuation of esop of listed companies, market inputs like historical volatility and risk-free rates are normally observable, and valuation reliability is improved. Nevertheless, it is important to be judgmental especially when attempting to predict anticipated option life and employee exercise behavior.

5.2 Importance of Consistency and Documentation

Stability of valuation methodology is also a requirement to fulfill esop annual valuation requirements. Any alteration of models or assumptions has to have a reason behind it and should be recorded, since it directly influences the reported compensation expense and investor confidence.

6. Valuation of ESOP for Listed Companies: Specific Considerations

The valuation of esop in listed companies is a special process, and has distinct challenges and expectations over and above that of a private company. The listed entities are subject to high regulatory supervision, disclosure to the market, and market examination.

Since the share prices can be observed, the listed companies need to make sure that the ESOP valuations are consistent with the market data. Meaningful differences in the value of options and market movements may look like the focus of the auditor and regulators.

Also, the listed companies are required to reveal specifics of ESOPs, such as valuation assumptions, cost to be recognized, and dilution. This disclosure creates the significance of strict annual valuation of esop procedures with the involvement of outside professional knowledge.

7. Impact of ESOP Valuation on Financial Statements

ESOP valuation has a permanent and direct effect on financial reporting. The fair value calculated under the procedures of esop and valuation is also considered employee compensation and profits are reported as a loss to profit during the vesting period.

In the case of listed companies, such an expense affects the key performance indicators including earnings per share. Because investors are particularly sensitive to these measures, any errors in the valuation of esop of listed companies can have a substantial impact on the perception of the market and share price dynamics.

Balancing sheet ESOPs add equity that is infused by way of additional paid-in capital and this highlights the necessity of proper valuation in line with accounting principles.

8. Governance, Audit, and Risk Management

These strong governance structures are critical in the management of esop annual valuation requirements. Boards and compensation committees are now more likely to know about valuation assumptions and demand that the management sets them straight where appropriate.

Auditors are important in the evaluation of ESOP valuation procedures and assumptions. Poor documentation or unsubstantiated inputs may lead to audit modifications or qualified opinion especially where it is listed.

As part of the risk management, most organizations hire independent valuation experts to facilitate the esop annual valuation and comply with the regulatory requirements.

9. Best Practices for ESOP Valuation Compliance

It is based on transparency, consistency and professional judgment that results in effective ESOP valuation. The companies which incorporate valuation planning in ESOP design are in better positions to deal with long-term reporting and compliance requirements.

Aligning company objectives of the full form of esop with financial reporting realities will help to make incentive plans sustainable, defensible, and shareholder aligned. This is a comprehensive solution which enhances governance and trust in employees.

10. Conclusion: Strengthening ESOP Governance Through Valuation Discipline

There can be no confusion that a clear understanding of the esop full form in company is only the beginning. The actual difficulty is to be in control of esop and valuation in the long term. With the growing regulatory and stakeholder pressure to be more transparent, the esop annual valuation requirements have become an imperative element of corporate governance.

In specific cases particularly the listed entities, strict valuation of esop of listed companies protects financial statement integrity and confidence of the investors. Using disciplined valuation practices within ESOP management enables companies to have a way of keeping employee incentives, financial reporting and shareholder value creation in balance within a growing complex corporate environment.