Professional ESOP Tax Implications Certification Program

Tax Implications of ESOPs and ESOS in Singapore

Guide on Professional ESOP Tax Implications Certification Program

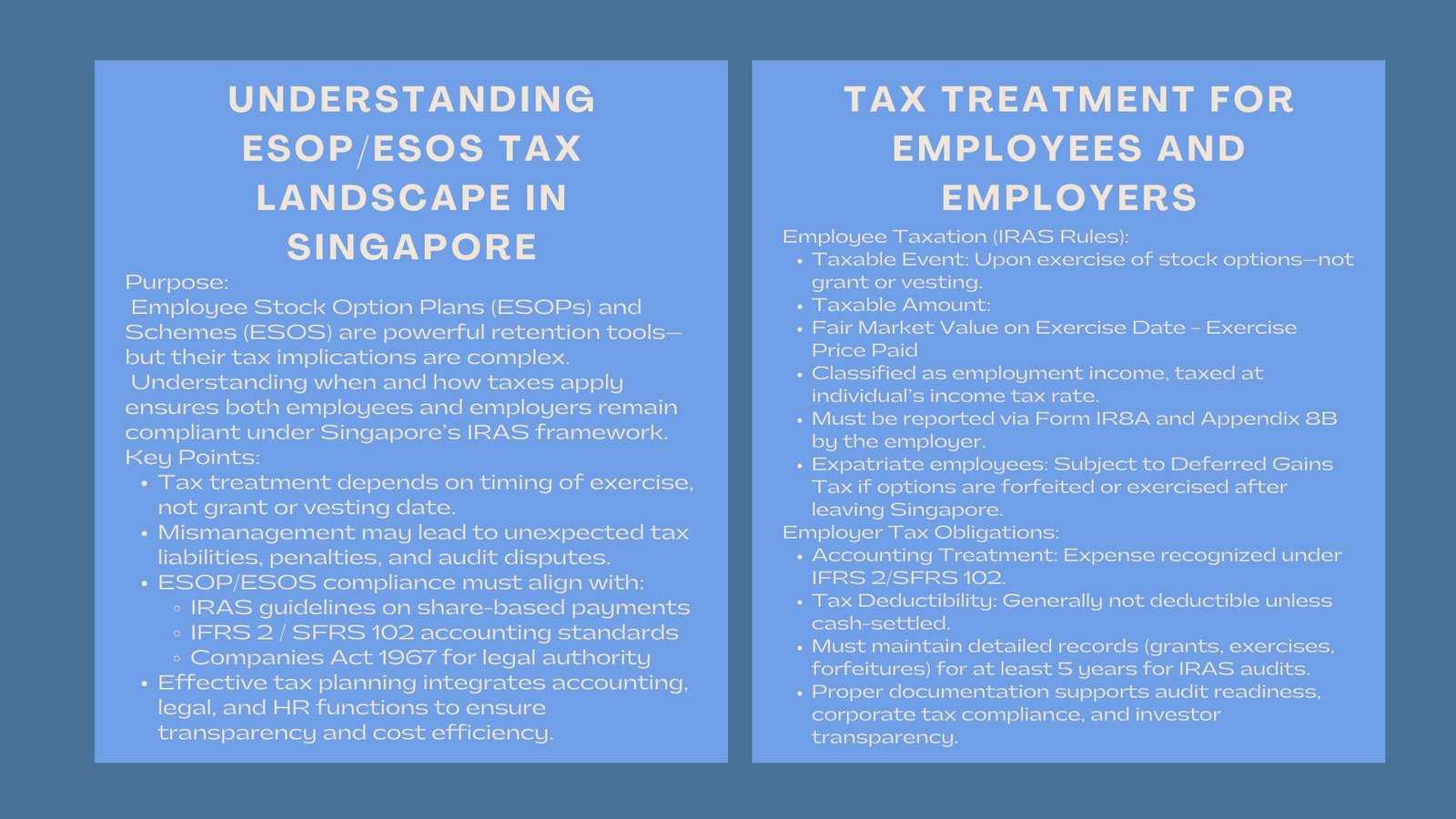

Although it is true that Employee Stock Option Plans (ESOPs) and Employee Stock Option Schemes (ESOS) are a perfect solution to rewarding and retaining employees, their tax status can be difficult to understand.

Both employers and employees need to learn and know when and how they should be taxed in Singapore because the timing when they are taxed has a great impact on the net compensation and the corporate deductions.

The correct tax planning will ensure that the Inland Revenue Authority of Singapore (IRAS) adheres to all the requirements without making expensive mistakes that may occur when abusing or not realizing the tax consequences of share based payment. Failure to accurately manage tax obligations can lead to costly penalties, unexpected tax liabilities, and potential disputes with auditors. Understanding the interaction between accounting standards, employee taxation, and corporate reporting requirements is therefore critical for any company implementing an ESOP or ESOS in Singapore.

How ESOPs and ESOS Are Taxed in Singapore

Employees according to IRAS ESOP and ESOS tax compliance Singapore are subjected to taxation on the gains of stock options upon its exercise, and not on its stipulation or vested. The taxable income is the difference between:

Fair Market Value of the Shares on Exercise Date -(Exercise Price Paid by the Employee). This gain is classified as employment income and is subject to personal income tax at the employee’s applicable tax rate.

This profit is classified under employment income which is liable to personal income tax. These gains are to be reported by the employers through the IRA Form and Appendix 8B with the right year of assessment.

In the case of expatriate employees, there are special provisions under the scheme of Deferred Gains Tax, in case they forfeit their options, and leave Singapore. For expatriate employees, there are special provisions under the Deferred Gains Tax scheme, particularly if they forfeit their options or leave Singapore before exercising their shares. Companies must be aware of these rules to prevent misreporting or non-compliance issues.

Employer Tax Obligations

Under the employer position, the ESOP costs classified in the financial statements under the IFRS 2 /SFRS 102 are usually not deductible in corporate income tax unless the costs entail actual expenditure (e.g., cash-settled options). Despite this limitation, maintaining accurate records of stock option grants, exercises, and forfeitures is critical for both auditing purposes and corporate tax compliance.

Nevertheless, proper reporting is essential to auditing and the corporate tax requirements.

Employee stock option taxation rules Singapore should too keep a record of the detailed options grants, exercise and forfeitures at least five years as per the IRAS audit requirements. These records serve as proof of compliance during tax audits and provide a transparent history of all stock option activities, which is vital for both regulatory scrutiny and investor confidence. Proper record-keeping ensures that companies can substantiate their tax positions while demonstrating adherence to governance and reporting standards.

Tax Planning Strategies

With a well thought out structure of ESOP, companies are able to minimize the effect of tax friction. One common strategy is to set exercise prices closer to the fair market value of the shares, which reduces the taxable gains recognized by employees upon exercise. Another approach is to implement staggered vesting schedules, which spreads tax liabilities over multiple years and mitigates the risk of large tax burdens in a single year.Common strategies include:

- Pricing exercises more in accordance with fair market value to reduce agent taxable gains.

- Staggered vesting plans to cover the taxes of the employees.

- Provision of cashless exercise systems or net-settlements.

Training the workers on how to practice timing exercises during low tax years. Overall, a well-structured ESOP plan integrates accounting, legal, and tax considerations to create a tax-efficient framework that benefits both employees and the company.

Conclusion

Tax compliance is among the poorest but highly significant issues about ESOPs and ESOS in Singapore. Firms who actively manage their duties in paying their taxes and keeping their audit ready avoid punishments, employees are also satisfied. Companies that actively manage their tax obligations, maintain audit-ready documentation, and provide guidance to employees reduce the risk of penalties while enhancing employee satisfaction and trust.

Through an effective combination of sound tax planning, accounting, litigation planning, and the design of ESOPs, organizations can make ESOPs not only a compliance issue, but also a strategic think tank.

The point is not to reward the employees only, but in a manner that is more economical, transparent, and holistic to the laws of Singapore. The ultimate goal is to reward employees in a manner that is both legally compliant and economically efficient, fostering a culture of trust, accountability, and alignment between employees and shareholders. Properly managed, ESOPs become more than compensation—they become a strategic lever for sustainable corporate success in Singapore’s competitive business environment.