Professional IFRS 2 Accounting Standards Workshop

IFRS 2 Explained: Accounting for Employee Stock Options

Professional IFRS 2 Accounting Standards Workshop

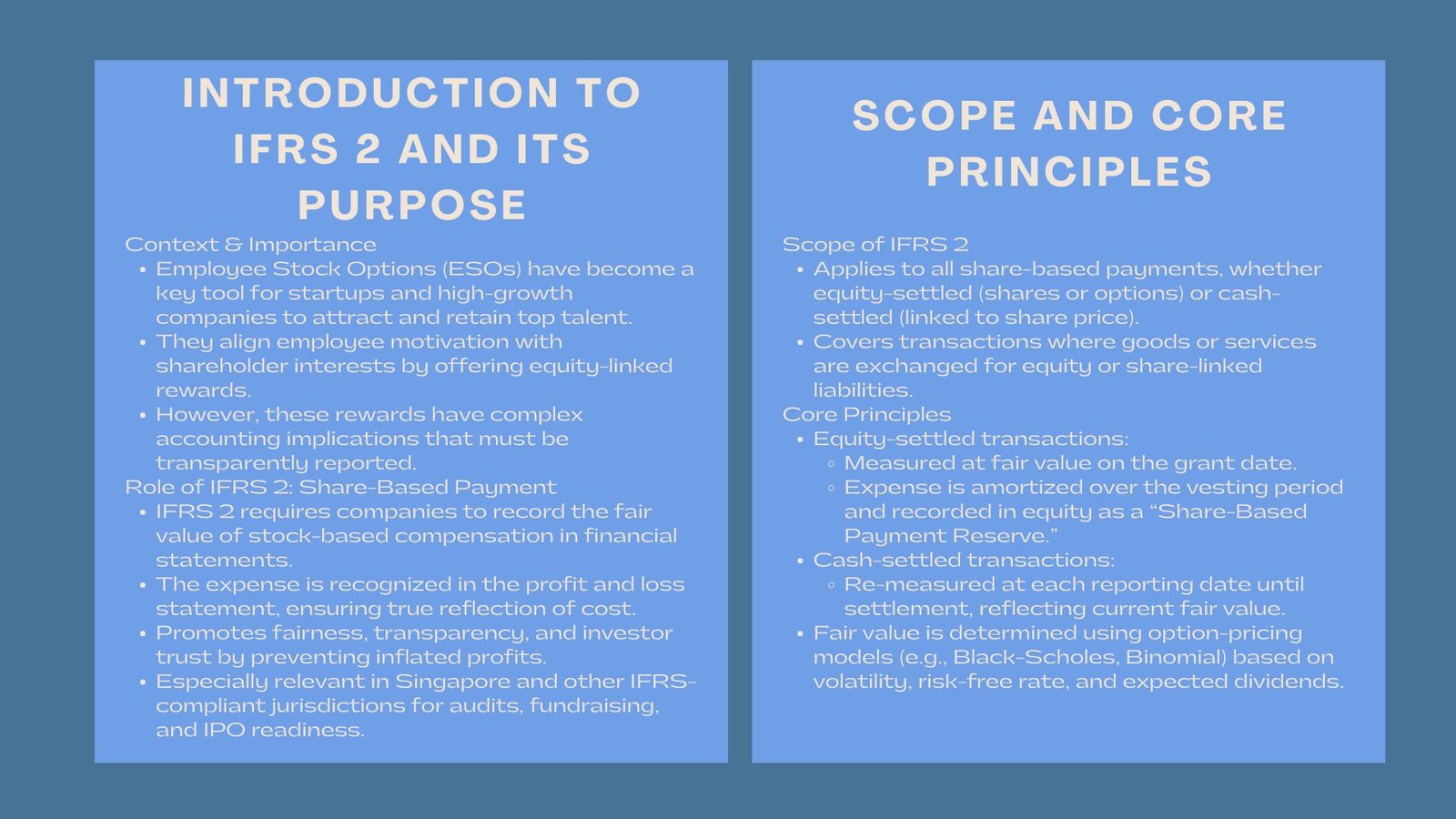

Amazing talent attraction and retention started to be a vital aspect of an enterprise, as Employee Stock Options (ESOs) have become a very important asset of startups and high-growth companies. These alternatives will provide the workers with a company interest in its eventual success, and their interests will coincide with that of shareholders. Although, there is a tier of accounting sophistication hidden under the motivational rewards which are accounted for by IFRS 2 Share-Based payment, the need to ensure the financial consequences of such compensation is effectively demonstrated. For finance professionals, understanding IFRS 2 employee stock option accounting Singapore has become essential to align transparency with corporate growth and compliance expectations.

Under the IFRS 2, companies are under obligation to record the fair value of share-based payments, i.e., stock options or restricted stock units in the financial statements. This implies the cost of equity is recorded as an expense in the profit and loss account and it would allow transparency and fairness. In the absence of IFRS 2, companies would hide exercising the economic cost of granting equity to employees because then it would inflate profits by overstating them.

This standard is especially applicable in Singapore and other jurisdictions that follow the IFRS in that it is necessary to ensure that the accounting of share-based payments is followed in order to ensure audits, fundraising, and eventual IPO preparedness. Knowledge of its principles enables finance managers to be accurate, compliant, as well as investor trusting.

What Are Employee Stock Options?

Employee Stock Options (ESO) refers to employee compensation that grants the employee the right, but not a compulsory requirement, to buy a share of a company at an agreed price, which is referred to as the exercise or strike price, after a certain time interval, which is referred to as the vesting period. This would enable employees to potentially have a share in the future growth in the value of the companies shares, a move that would make them share the same interests as the shareholders.

Essentially, ESOs are not rights to own but to own later. In this case, employees do not get shares immediately they are granted. They are instead given an option which can be exercised by fulfilling a set of requirements which are usually performance based, tenure based or a combination of both. As an example, a certain worker can be given 1,000 options to be vested after four years, so that he or she could buy the company stocks, but only at the price of 10 each one, in case the company shares price increases more than that.

In terms of accounting, the ESOs are categorized into equity-settled transactions of share-based payment in the IFRS 2 Share-Based Payment where shares are issued when exercised. The IFRS 2 stipulates that the companies must record the fair value of such options as an expense throughout the vesting period as the cost of compensating employees using equity instrument. This makes sure that the cost of granting stock options according to the financial statements is the economic cost irrespective of there being no cash outflow that would have taken place.

One of the requirements of IFRS 2 is to value ESOs. Because options are time-dependent the fair value of options is commonly calculated by financial models, such as the Black-Scholes model or binomial models, that take into account financial variables such as the anticipated volatility, the risk-free interest rate, anticipated dividends, and the life period of the option. Finance teams can better understand these calculations through share-based payment valuation and disclosure training, which ensures accurate financial reporting and compliance under IFRS standards.

Employee Stock Options differ with other equity compensation such as restricted stock units (RSUs), or share appreciation rights (SARS). The employee uses the exercise price to purchase shares unlike RSUs where ownership is given upon vesting without purchase.

The ESOs are essentially a motivation and financial instrument. They also compensate workers who are allowed to contribute to the growth of the firm besides having a share in its success. Nonetheless, they have their own dangers, as in case the share price of the company is lower than the exercise price, the options become underwater and will not have any financial value.

In the case of organizations, ESOs are a form of non-cash compensation which can be used to attract and retain talent, especially in start ups and high growth companies where saving cash is extremely important. However, accounting-wise, they bring the issues of complexity in valuation, recognition and disclosure, which is tightly regulated by IFRS 2 to provide transparency and comparability among financial reporting.

Why Companies Use Stock Options to Reward Employees

Employee Stock Options are a form of compensation that the company employs as a strategy to motivate, retain, and align employees to the long term organizational success. Stock options have the advantage of being based on the performance of the company, unlike fixed salaries or cash bonuses, as a result of which an employee will feel that he/she owns and is responsible.

Alignment of interests is one of the main motives companies arrange stock options. Employees who have the option to gain value only in the event that the stock price of the company appreciates are instinctively prompted to reason and aim like shareholders. This alignment helps in making decisions that are more effective, productive and an emphasis on sustainable growth as opposed to short-term rewards.

Options are also a good retention strategy with stock. Since most ESOs require years to fully become effective, an employee has to remain at the company to achieve the maximum payoff. This ensures that turnover is minimized and long term commitment is promoted particularly of key executives or technical personnel who is very vital in the continuity of business. The vesting system substantially forms a golden handcuff, whereby the employees are motivated to stay and build the success of the company in the long run.

Stock options may also serve to save cash flow as far as financial management is concerned. New businesses and emerging firms do not have much to pay in terms of cash hefty rewards. They alternatively employ stock options as a deferred payment which compensates the employees without the use of cash. Through this strategy, the top talent will be attracted at the initial levels when cash flow is low, and the project may have a huge potential should the company expand.

Stock options can also be used to improve performance culture. Organizations can establish a meritocracy by pegging rewards on quantifiable results, including share performance or company achievements. The workers are made aware of the fact that their work will directly affect the valuation of the company and by extension their own financial gain.

The motivational benefits are evident, however, it is also necessary to design and govern stock options. When they are not well structured or communicated, they might cause impractical expectations or disparities within the employees. In addition, accounting wise, firms have to be aware of the cost of options under IFRS 2 with transparency on the effect of these instruments in terms of profitability and shareholder equity.

In the case of publicly traded companies, stock options can also be used as an indicator to investors. The implementation of rewards based on equity is evidence in the fact that the company is positive about its growth and the management feels that the stock will gain value. On the other hand, over-dilution of stock options may have several implications to the shareholders and this is why there is a need to balance between incentives to employees and the interests of the investor.

Financial prudence and psychological motivation finally come together as strategic use of stock options. They assist firms in recruiting top caliber talent, creating loyalty and creating a sense of ownership (the much needed ingredient of long term performance). Under the IFRS 2 when handled in a clear structure, the stock options prove to be an effective tool that is beneficial to both the employees and the shareholders. This is particularly critical for corporate finance compliance for startups in Singapore, where clear accounting practices strengthen investor relations and audit readiness.

Scope and Core Principles

All transactions where an entity is receiving goods or services with a price of equity instruments or liabilities that are pegged to the price of its share are covered by IFRS 2. The equity-settled share-based payments such as ESOs being the commonest case require employees to be given shares upon fulfillment of specific vesting terms.

The standard allows companies to determine the cost of such equity instruments based on fair value at the date of grant and charge against equity. The metrics are often option-pricing model, including Black-Scholes or Binomial, considering the factors of volatility, risk-free interest rates, and expected dividends.

In case of cash settlement of share based payments, IFRS 2 requires that these should be re-measured at each reporting date up to the time of settlement, and that the liability is thus always reflecting current fair value. This difference between the equity-settled and cash-settled transactions will allow the stakeholders to know the kind of the compensation and its effect on the capital structure of the company.

Recognition, Disclosure, and Transparency

The income statement is influenced by the recognition of ESOs which influences the balance sheet. The company involves a compensation cost in the income statement that necessitates the noble value of the options which are amortized through the vesting period. In the balance sheet this value will be recorded under equity as a share-based payment reserve.

Another important concern in regards to IFRS 2 compliance is disclosure. These companies should disclose the quantity of options awarded, exercised, lost and the rest, and significant valuation assumptions. Transparency of this kind guarantees that the investors are able to estimate dilution risk correctly and comprehend the financial impact of stock-based compensation.

Conclusion

Under the IFRS 2, share-based payments are recorded with accuracy and integrity. When organizations determine the fair value of employee stock options, they will create an accounting environment that is in line with economic reality that will gain the confidence of both regulators and investors.

To the startup and corporations in Singapore, learning to use the IFRS 2 is not an obligation imposed by the regulatory authority, but a pillar of good governance. When correctly applied, it enhances financial reporting, leads to investor trust, and makes sure that its worker incentives ensure a long-term value creation process. The adherence to IFRS 2 signifies financial reasonableness and future orientation in the modern world where opaque corporate accounts are demarcated by corporate credibility.