Share-Based Payments Strategy for SMEs

Share-Based Payments Strategy for SMEs

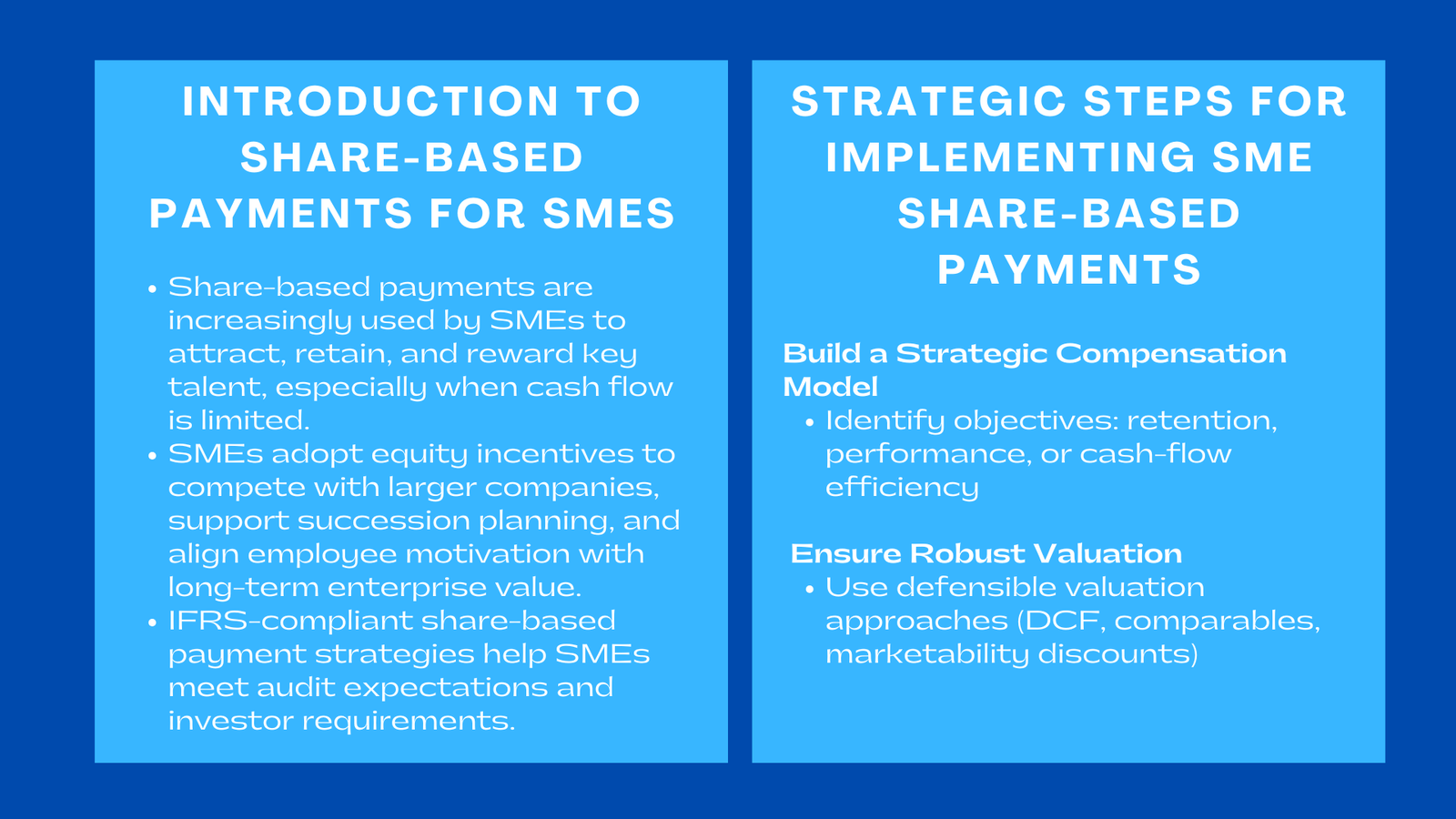

Introduction to Share-Based Payments Strategy for SMEs

Share-based payments are also becoming a popular strategy by small and medium-sized enterprises to acquire, retain and reward key talent, where cash flow can be limited, yet growth potential is high. Although equity instruments have been used in the compensation structure of listed corporations throughout their history, SMEs are now turning to them as a means of competing more efficiently in attracting managerial, technical and creative talent. Share-based payments are also strategically applicable to founder-led business planning to expand, raise or exit; they also align employee incentives to long-term enterprise value, especially when aligned with a small business valuation approach Singapore companies commonly adopt to manage growth and equity planning.

The article will discuss the steps SMEs should adopt in order to develop a working, IFRS-consistent share-based payment strategy using a step-by-step systematic structure. The discussion is still narrowly concentrated on the way in which smaller organizations can address valuation, governance and implementation and find their way around audit expectations and investor requirements.

1. Developing an Adequate Share-Based Compensation Model.

1.1 Strategic Objectives on the Understanding.

An effective equity compensation plan starts with purpose. The choice SMEs will need to make is whether the plan will compensate respondent performance, retainment or capital efficiency by substituting cash pay. As an illustration, a rapidly expanding logistics technology startup may focus on retention to minimize the rate of turnover of sought-after software engineers, but a family-run manufacturing SME may consider equity incentives as a way to prepare succession candidates.

1.2 The appropriate equity instrument should be selected.

Whereas a combination of restricted shares, performance share units, and options are normally used by the large corporations, SMEs usually tend to lean towards stock options because they are simple and easy to communicate with. Options give the employees a chance to be involved in growth in the future without needing instant issue of shares which is advantageous in the case of privately owned companies guarding founders equity. Instruments are also supposed to demonstrate expectations of liquidity; in case a firm anticipates raising finances near in the future, then it can structure options so that they can be vested according to expected valuation targets to enhance motivation.

2. There are valuation requirements of the private companies.

2.1 The reason is that a fair and defensible valuation can be established by the board of directors subject to shareholders’ approval.

In the case of unlisted SMEs, the difficulty is the attainment of an accurate value of the options that have no observable market price. Income-based methods are usually triangulations made by independent valuers, comprising discounted cash flow, with market comparables. The technique of Series A anchoring share value on a minority and liquidity discount where applicable is often used by private engineering firms that are pursuing a Series A financing.

2.2 Prudent Application of the Option Pricing Models.

After the underlying share value has been known, SMEs will have to calculate the fair value of the option using a method like the Black-Scholes or binomial lattice modelling. Since smaller firms frequently lack data to use in estimating volatility, they can use peer groups or sector indexes.

Clear documentation of these inputs supports transparency, particularly when aligning with Share-based payments strategy guide recommendations that emphasize defensibility and audit-readiness.

3. Building Internal Governance for Sustainable Administration

3.1 Establishing Clear Roles and Responsibilities

Good governance needs a close relationship between HR, finance, founders and legal counsel. Finance department is in charge of valuation and recognition of expenses, the HR department is in charge of communication and employee education, and corporate legal advisors are in charge of the compliance with the corporate law and shareholder agreement. In the case of businesses that are found in several jurisdictions, the cross-border legal review is necessary in order to avoid violation of securities laws.

3.2 Retaining Sound Documentation and Controls.

SMEs are required to keep a record of all grant approvals, valuation method, vesting schedule, forfeiture and amendments. The use of cloud-based equity administration systems is also enabling smaller companies to administer grants with audit quality. This high degree of control assists in business continuity particularly when doing due diligence on a fundraising or M&A deal where investors closely examine the equity compensation plans.

4. Recalibration of Share-Based Payments to the principles of the IFRS.

4.1 The difference between Equity-Settled and Cash-Settled Arrangements.

Under the IFRS 2, SMEs have to decide whether the scheme has an impact of creating an equity instrument or a liability. Equity-settled plans (e.g. traditional stock options) result in recognition of grant-date fair value at the expense of the vesting period. Cash-settled plans, where employees get cash depending on the increase in share, are remeasured on a case by case basis, which could result in volatility.

SMEs preparing audited financial statements must demonstrate consistent classification logic aligned with IFRS compliance for SMEs, especially when reallocating between instruments during restructuring or fundraising.

4.2 Accurate Expense Recognition and Vesting Models

The recognition of expenses can be based on the terms of the vesting that can be service and performance-based. To illustrate this, an SME in the renewable energy industry, which grants options to the employee that become exercisable upon sales targets, has to determine the likelihood of hitting sales targets and reconsider it as time goes by. When it ends up making erroneous assumptions, then it will under- or over-recognize expenses, which will influence profitability and investor perceptions. An organized annual audit, combined with past employee turnover data, assists in improving estimates and continuing with the IFRS consistency.

5. Communication of the Plan to Employees/Stakeholders.

5.1 Training the Workforce of Value and Mechanics.

Share-based payments may be ineffective in the case of misunderstanding of employees. SMEs ought to carry out boarding sessions on the mechanisms of the vesting, what is meant by exercising, and how liquidity can be achieved in the privates. Open communication helps to fill the gap between the technical accounting requirements and the realistic employee expectations and avoids disillusionment in case exit horizons are lengthening.

5.3 Dealing with Investor Expectations.

Share-based payment plans are usually considered by external investors (i.e. venture capital firms, and private equity sponsors) in order to achieve economic alignment and dilution control. Having a properly drawn equity compensation plan, with clear frameworks of valuation and regular reporting under the IFRS is a positive sign of maturity and investor confidence. SMEs who expect to raise funds in the future can include option pools in the initial valuation of their business to reduce the problem of friction in the negotiation process in the future.

6. Share based payment strategies are used in SMEs in the real world.

6.1 Technology and SaaS Firms

SaaS firms with rapid growth often rely on share-based compensation as the basis of rewarding product and engineering employees, whose salaries might not even be as high as those of bigger organizations. In order to smooth the profile of expense recognition and reduce employee turnover, these companies tend to use graded vesting. When the recurring revenue is stable, the inputs of the valuation are predictable which enhances the accuracy of the fair-value calculation.

6.2 Industrial and Firm manufacturing.

The options are also used in rewarding long-service employees and technical managers in industrial SMEs that may have slower but stable growth. The companies are inclined to prefer more conservative vesting plans based on operational KPIs, including efficiency of production or quality criteria. They have accurate IFRS reporting records in their share-based payment systems to facilitate their needs of financing purposes by their banks or strategic investors.

6.3 Consulting Firms and Professional Services.

In the case of privately owned consulting companies, equity rewards are common to keep the partner or senior managers that attract clients. The hybrid models of profit sharing that involves a combination of cash bonuses and options or even phantom shares are becoming more common. These companies attach much importance to open valuation policy in order to substantiate compensation and preserve inner trust.

Conclusion

Share-based payments offer SMEs with an effective, non-cash model to develop loyalty, performance, and value creation in the long-term. Equity compensation can be a competitive advantage, as opposed to an administrative burden when it is created with strategic clarity, informed valuation, and good internal controls. With increasingly stricter expectations of the IFRS and the need to provide more transparency to investors regarding the compensation methods, SMEs that have long-term stratagems of compensation via share payment will be in a better position to raise capital, retain talents and grow sustainably in the years to come.