Step-by-Step Certified ESOP Planning

Step-by-Step Guide to Implementing an ESOP Plan

Introduction: Step-by-Step Certified ESOP Planning

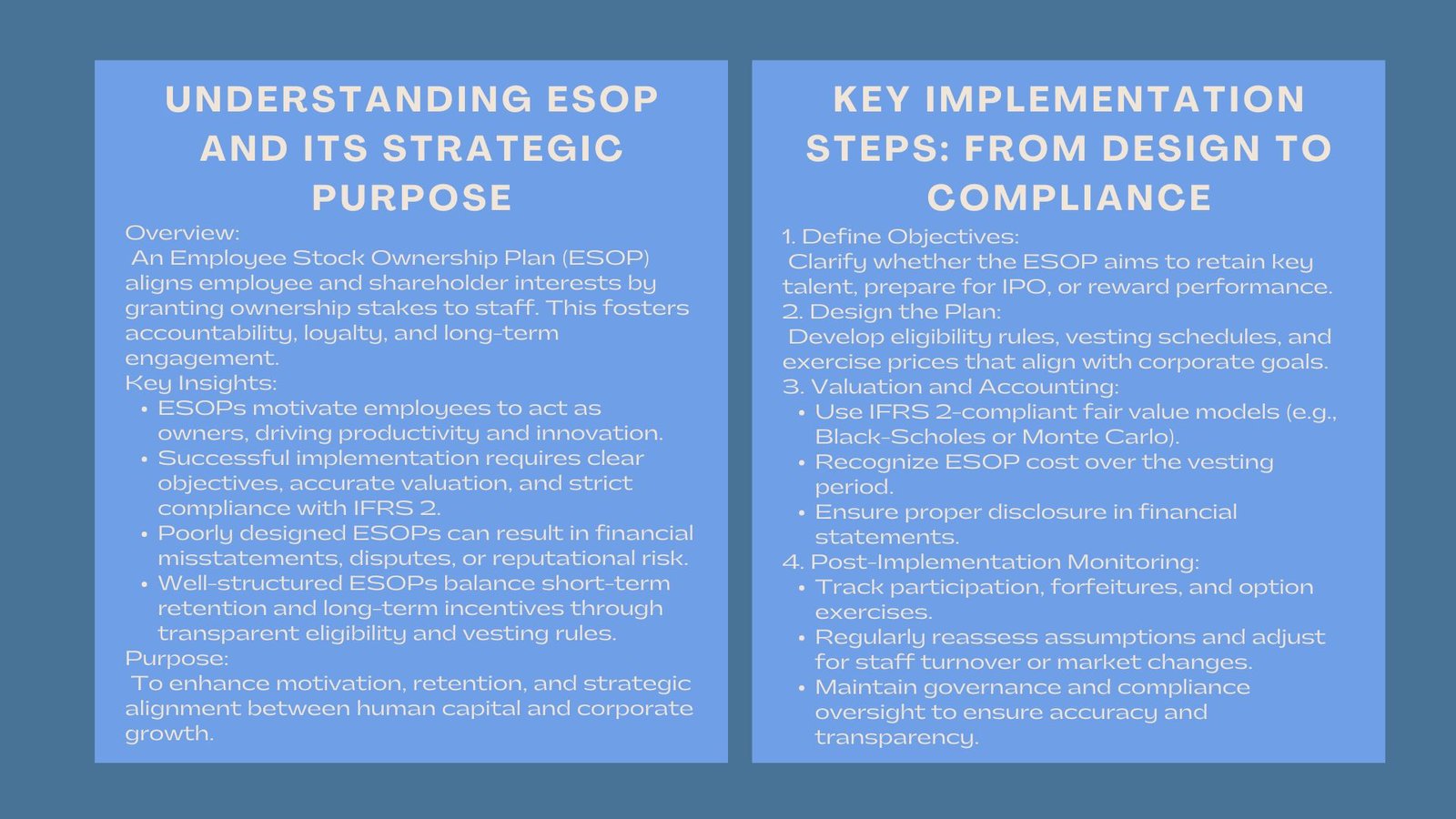

An Employee Stock Ownership Plan (ESOP) is one of the best options that should be implemented in order to compensate performance and promote loyalty. This alignment of ownership encourages employees to think and act like owners, ultimately promoting a culture of shared responsibility and long-term engagement. However, while the benefits are clear, the successful implementation of an ESOP requires careful planning, accurate valuation, and strict accounting practices. Without these, a poorly designed ESOP can lead to financial misstatements, regulatory scrutiny, and reputational setbacks for the organization.

ESOPs generate alignment in ownership and make the employees a stakeholder interested in the success of the company. Nevertheless, their application should be well planned, valued and accounted for to prevent flops and embarrassment. Every component of the plan must be carefully articulated to prevent ambiguity or disputes later on. For example, How to implement an ESOP plan for startups in Singapore, the vesting schedule should balance short-term retention with long-term incentive, ensuring that employees remain motivated over the course of several years. Eligibility rules should clearly define which employee levels or roles are entitled to participate, avoiding potential misunderstandings or perceptions of favoritism.

Key Implementation Steps

First of all, state the objectives based on whether it is retention of talent, incentivizing the management, or preparing IPO. Second, design the ESOP agreement, which consists of eligibility, vesting plans, and exercise price. Understanding these objectives is critical because they shape the structure of the plan, the selection of eligible participants, and the design of vesting schedules. A startup preparing for an IPO may structure the ESOP differently from a company focused primarily on retaining senior employees.

After designing, ascertain IFRS-compliant models of fair value of options. The accounting departments should then identify the cost during the vesting period and all transactions should also be disclosed.

Monitor plan performance, post-implementation and adjust on forfeittance and perform continued compliance with IFRS 2 and corporate governance techniques.

Finally, the company must monitor the ESOP plan after implementation. This includes tracking participation, exercising of options, forfeitures, and adjustments that may affect financial reporting. Regular reviews and updates ensure the plan remains aligned with company objectives, continues to meet IFRS 2 compliant ESOP accounting and valuation guide requirements, and supports sound corporate governance.

Adjustments may be necessary to account for changes in valuation assumptions, employee turnover, or evolving strategic priorities. By actively managing and reviewing the ESOP, companies can ensure that the plan continues to motivate employees while contributing to long-term business growth.

Linking ESOPs to Organizational Goals

Good ESOP is one that combines both financial reporting and the human capital strategy. By linking ownership to performance, employees are encouraged to take responsibility for the company’s success and engage in long-term thinking. When properly aligned with organizational goals, ESOPs can drive accountability, enhance engagement, and strengthen the company culture.

Regular evaluation of plan effectiveness allows the company to sustain its benefits, ensuring that the ESOP continues to serve the purpose for which it was designed.It enhances responsibility and promotes long term participation. The frequent reviews help to sustain the plan to the business for which it was made. This alignment between individual and organizational objectives helps the company achieve strategic milestones, whether it is scaling operations, preparing for funding rounds, or driving profitability.

Conclusion

The adoption of ESOP is a strategic process as well as a financial process. It is more than just compliance, but that is what a company is committed to, fairness, transparency, and mutual success.

When companies adhere to the rules of IFRS 2, keep clear records and make ESOPs consistent with the goals of the organization, they bolster the organization’s culture and credibility. A carefully enforced ESOP is more than an incentive as time goes by; it turns into a keystone of growth, loyalty and corporate excellence. Adherence to IFRS 2 rules, careful documentation of plan design and valuations, and alignment with organizational objectives enhance both corporate credibility and internal culture.

Over time, a well-structured and properly managed ESOP evolves from a simple employee incentive into a cornerstone of growth, loyalty, and corporate excellence. It becomes a strategic tool that motivates employees, strengthens governance, and signals to investors and stakeholders that the company operates with professionalism and integrity.