Step-by-Step ESOP Implementation Guide

Step-by-Step ESOP Implementation Guide

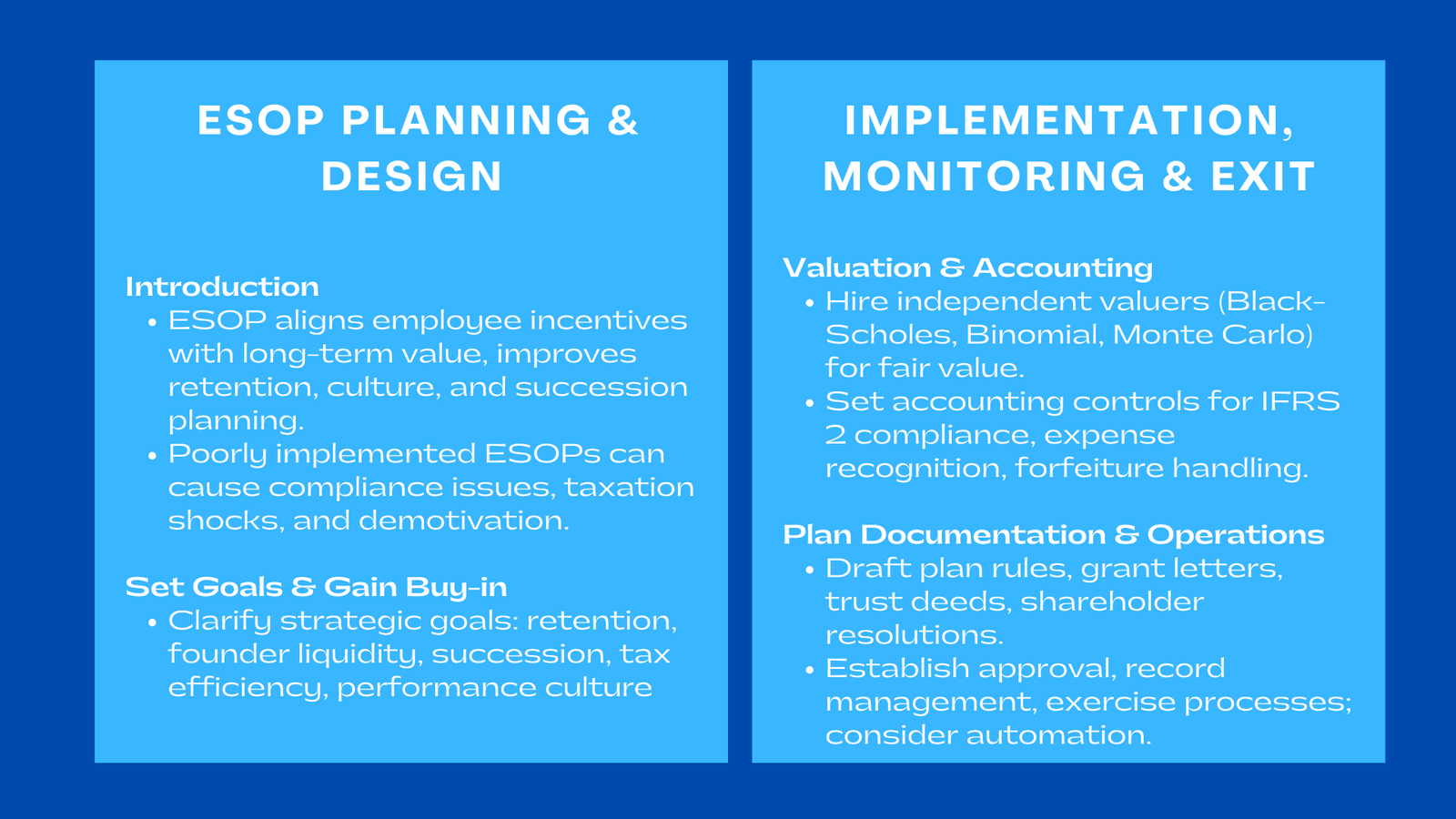

Introduction to Step-by-Step ESOP Implementation Guide

The adoption of an Employee Share Ownership Plan (ESOP) is a tactical move that will help change the culture, retention profile, and the succession strategy of a firm. When done effectively, ESOP will align the incentives of the employees with the long-term value creation and will help in the liquidity or succession planning. When it is bad, it may result in bureaucratic headaches, taxation shocks and dismotivated employees. This reference takes executives and implementation teams on a realistic, phase-by-phase journey—starting with initial goals and plan development through governance, ESOP valuation Singapore compliance with Singapore Financial Reporting Standards, and continued administration—to ensure that the ESOP achieves the desired results and can survive the audit and regulatory process.

1. Establish goals and aim to achieve buy-in.

1.1 Clarify strategic goals.

The board and the executive team need to be clear on the reason why an ESOP is being considered before writing any documents. Is it employee retention, founder liquidity, succession planning, tax efficiency, or is it to develop a performance culture? The objectives selected will determine plan architecture, eligibility of participants, and strategy of communication. By way of illustration, a founder intending a non-rapid exit will develop a new vesting and financing system than a tech scale-up aiming to develop large-scale retention.

1.2 Secure governance approval.

It should commence at an early stage with the board, significant shareholders and legal advisors. Show a business case of how dilution is expected to be diluted, future cost as under accounting standards and the effect on capital structure. When possible, request a preliminary approval or even a tentative commitment by the shareholders; a properly documented course of decision decreases the chances of future conflict.

2. Design the plan structure

2.1 Choose the model of instrument and allocation.

Choose between issue of options, restricted stock, restricted stock units or hybrid. Conservation of cash and then having an upside are typical characteristics of options; RSUs are used in a mature company that values issuing shares that have lower timing complications. Identify the amount of the option pool, usually written as a percentage of fully diluted equity and implement allocation policies that can avoid unfairness as well as prioritize strategies by level of seniority and functions.

2.2 Categorize vesting and performance standards.

The vesting schedules are to be determined based on retention objectives and business cycles, popular models are four-year schedules that are based on time with a one-year cliff or performance-based schedules that are based on revenue, EBITDA, or market milestones. State leaver conditions – defreece terms of leaver unvested and vested awards on resignation or termination on reasons or retirement or disability to prevent future confusion and disputes.

3. Meet legal, tax and regulation needs.

3.1 Local legal compliance.

Seek advice with the corporate and securities counsel to ascertain the conformity of plan documents with the company law, securities, and listing regulations where necessary. In the case of multinational work forces, examine cross-border limitations: local securities filings, foreign ownership limitations and differences in employment laws. Lack of consideration of jurisdictional peculiarities may undermine the implementation or may sentence the company to fines.

3.2 Tax treatment and reporting.

Engage tax advisors to plan tax impact of employees and employers at grant, vesting, exercise and disposal. In the location of the company, which is Singapore, plan communications should include tax implications on the exercise and reporting to the Inland Revenue Authority. The question to ask is whether there is a tax-favored relief or a deferred taxation scheme available and whether the plan design is capable of maximizing the after-tax results of the employees.

4. Standardize the valuation and accounting system.

4.1 Independent valuation.

The process of accounting, disclosure, and communication with employees is based on accurate valuation. Hire qualified valuation experts to estimate fair value on grant, using relevant model (Black-Scholes, binomial or Monte Carlo) and explain the basis of main assumptions, including volatility, expected life, and dividend yield. In the case of the private companies, the similar company proxies and recent financing rounds educate defensible inputs.

4.2 controls and accounting treatment.

Work with the finance and other outside auditors to map the process through which the awards shall be recognized under the applicable standards, especially the IFRS 2 of share-based payments. Put in place controls to determine cost during the vesting period, treatment of forfeiture as well as documentation of amendment or waiver. Document policy with regard to estimating forfeiture rate and exercise; well documented policies help in minimizing audit risk.

5. Write plan documents and operations.

5.1 Prepare legal plan documents.

Prepare plan rules, grant letters, trust deeds (where utilisation of a trust vehicle is involved) and any shareholder resolutions that are required. The plan is to specify eligibility, grant clock, exercise procedures, transferability and post-termination exercise window, in a language that is clear and unambiguous.

5.2 Develop working processes.

Establish gradual processes to approvals of grants, record management, and processing exercises, as well as updating of cap tables. Decide on the administration management in-house or through a third party equity management platform. Automation minimises mistakes, results in time-saving reporting, and simplifies statutory filings.

6. Bring communication and training of employees.

6.1 Launch with clarity.

Arrange a systematic communications initiative that informs about the purpose of the plan, mechanics, and vesting schedules as well as tax consequences. Give examples to demonstrate the possible results and give instruments, like calculators or sample situations, that should allow employees to understand how much they can gain and how much they will pay taxes.

6.2 Ongoing education.

Give periodic refresher courses particularly when there is a big event like funding rounds, IPOs or an exit opportunity. Being straight and tell-it-like-it-is creates a basis of trust and avoids misunderstandings that could undermine the motivation spirit of the ESOP.

7. Monitor, govern, and adjust

7.1 Introduction of governance and audit.

Select an administrator of the plan, and a governance committee or designate board supervision. Periodically re-examine the rates of participation, forfeiture experience and behavior in exercising. Make sure that records are balanced with the financial ledger books and audit trails.

7.2 Review and adapt.

Increase and decrease valuation assumptions and plan parameters as the business changes (through fundraising, acquisition, or listing). There might be the need to make changes, but are aware that changes cause accounting implications; any increase/decrease of fair value by changes should be recorded. Regular review of the strategic plans ensures that the ESOP is focused on strategic objectives.

8. Prepare an exit strategy and liquidity strategy.

8.1 Liquidity mechanisms.

Bring some clarity on how the participants can achieve the value: via secondary share buybacks, tender offers, IPO lockups or company-sponsored repurchase programs. Create pricing systems and notice periods that would give reasonable access to the employees and give fairness to the remaining shareholders.

8.2 Post-exit administration.

The conversion, exercising and transfer of awards should also be smooth after an IPO or sale. Expect tax treatment changes and disclosure requirements, and revise employee advice to avoid coming as a surprise when liquidity occurs.

Conclusion

An effective ESOP is based on strategic intent, good legal, tax and accounting practices and is reinforced by effective employee communications and sound operational controls. A staged approach, which includes defining objectives, designing the plan, gaining governance consent, dealing with compliance, setting up valuation and accounting mechanisms, operationalizing administration, employee education and liquidity planning, will reduce the risk, and maximize the motivational and retention effects of the plan. Companies that adopt an ESOP implementation checklist and embed ESOP compliance best practices into their operating rhythm are more likely to realize the cultural and financial benefits of shared ownership and to protect stakeholder value through every stage of growth.