Understanding ESOP Programs and Benefits

What is ESOP? How Employee Stock Ownership Plans Work in 2025

Guide on Understanding ESOP Programs and Benefits

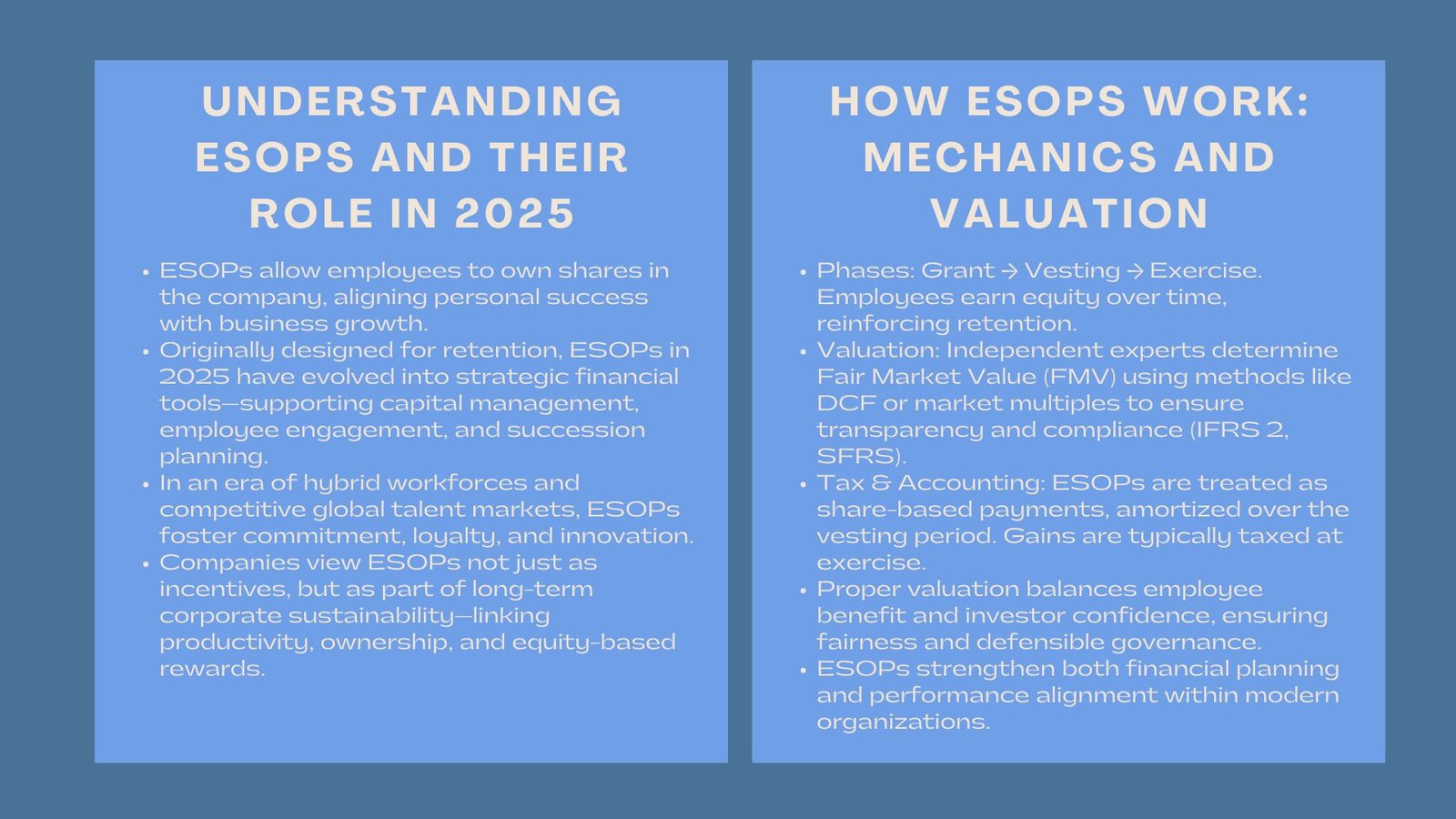

In the modern dynamic business world, equity-based compensation has taken its place as a core element of corporate strategy – not only with start-ups, but also with long-established enterprises looking to retain high performers. Employee Stock Ownership Plan (ESOP) is one of the most efficient equity participation forms since it provides employees with a sense of commitment and align the interests of the employee with the long term growth of the company.

With the borders expansion, adoption of hybrid workforces, and the competitive talent markets, ESOPs have been on the rise. By 2025, ESOPs are not considered as the instruments of retention alone, but rather they form part of the financial planning, capital structure management, and even succession strategies. Learning the mechanics of the ESOPs, the valuation of the ESOPs and the effects of the ESOPs on the employees and the employer is important to both the corporate decision-makers and the finance professionals.

FAQ of ESOPs.

The Form and Essential Intention.

An Employee Stock Ownership Plan (ESOP) is a well-organized system, which enables employees to gain ownership vested interests in the company they serve. In contrast to such performance rewards as cash bonuses or traditional performance incentives, ESOPs have direct links between employee rewards and the financial performance of the company. They foster an spirit of ownership, when done well, they make employees feel and act like shareholders and not employees.

Shares are awarded or offered in a standard ESOP in the form of options which can be exercised after particular vesting criteria. These are regulated by explicit regulations regarding eligibility, vesting, price of their exercise and rights on disposal. In a common practice, firms create a trust or pool of shares, which they passively offer over the years to the employees participating.

The Value Generation by ESOPs.

The inherent value of ESOPs is congruence. The productivity and innovation are directly linked to incentives as the employees gain upon the company valuation. To the management, ESOPs might lower the turnover rate as well as the morale and they increase the number of talents that can contribute not just in the short term. ESOPs also assist in saving cash in a financial perspective, whilst providing competitive wages which is especially applicable in a growing company or a start-up that needs to strike a balance between liquidity and incentives.

Common Structures in 2025

The ESOP structures have been more flexible by 2025. A combination of stock options, restricted stock units (RSUs) and performance-based equity awards are used by companies. There is now the prevalence of hybrid plans, which combine time based and performance based vesting requirements. Another benefit of digital equity management systems is that one can monitor the vesting schedule, share valuation updates, and communication with an employee in real-time, which is a huge improvement compared to the manual spreadsheets of the past.

Mechanics of What How ESOPs Work.

Vesting and Exercise

The process of grant to ownership is normally divided into three steps namely, grant, vesting and exercise. At the grant level, employees who are eligible are granted stock options or share entitlements. The process of the vesting period follows then a fixed timeframe of the three to five years when employees can obtain equity gradually by their continued employment. After vested options become exercisable, they may be exercised by the workers through buying the shares at the agreed exercise price, which in most cases is very low compared to the fair market value of the shares.

Determination of Valuation and Fair Market Value.

In the success of an ESOP, valuation is very vital. ESOP shares are determined in their fair value by independent valuation experts using a methodology that encompasses discounted cash flow (DCF) methodology, analysis of market multiples or similar companies. Not only can such valuation be useful in the areas of internal governance, but it also covers the accounting and regulatory standards of the framework, including IFRS 2 or Singapore Financial Reporting Standards.

The defensible valuation is done so as to strike a balance between the equity benefit to the employees as well as the harm to the investor confidence and integrity of compliance. Without credible valuation, in business, there is a risk of mispricing of equity and there is the possibility of creating inconsistency of accounting or tax.

Accounting and Tax implications.

By the international accounting standards, ESOPs are considered to be share-based payment expenses which are amortised over the vesting period. Under taxation, Singaporean employees, as an example, are taxed on the earning of the difference between the exercise price and fair market value at the time of exercise. Such incomes have to be reported to the Inland revenue authority of Singapore (IRAS). Tax treatment is different across the world, although the rule is the same: ESOP benefits should be based on realized gains as opposed to potential ones, as emphasized in the Professional ESOP Valuation and Accounting Workshop.

Trends and Best Practices in ESOP in 2025.

Equity Platforms and Digitalization.

The computerization of the ESOP administration is one of the characteristics of the year 2025. Cloud-based solutions have become the full lifecycle of equity management, including the issuance of grants and the update of vesting schedules, as well as adjustments in cap table and scenario generation. Such sites lower the number of mistakes made, enhance the requirements of jurisdictional regulations, and enhance the visibility of employees. On-the-fly dashboards enable employees to see how much they will gain in wealth, which will induce the spirit of engagement and ownership.

ESOPs to Corporate Succession.

In addition to start-ups, more established firms are using ESOPs as a long-term succession strategy. Major shareholders and founders have the ability to transfer ownership to the employees gradually through the organized ESOP funding plans where continuity is maintained and the organizational culture is not lost. Within a private firm, such a transition also facilitates equity liquidity events – giving employees a chance to monetize gains at the same time allowing founders to step out of the company over time.

The significance of Independent Valuation and Governance.

By 2025, the regulatory challenges and investor demands have forced the companies to reinforce ESOP governance. It has become a best practice now that independent valuation is used and periodic reviews of fair market value (FMV) are recommended to ensure that it is in keeping with the changing business performance. Partnering with professional valuation experts, such as those specializing in ESOP valuation services in Singapore, helps ensure transparency, audit readiness, and defensibility.

Adequate governance is not merely about valuation, but also touches on documentation, communication of the shareholders and updating plans of the business milestones or funding round. Those companies which view ESOPs as living tools but not a fixed plan have a tendency to have better employee satisfaction and retention.

Conclusion

Employee Stock Ownership Plans are now more than a compensation strategy – it is a long term philosophy of success together. ESOPs represent alignment, empowerment and progressive management in 2025. To businesses, they provide a cost effective performance based approach to retaining and attracting talent; to employees, they are a visible investment in the future success of the business.

But the soundness of any ESOP is pegged on the disciplined design, transparent valuation and sound governance. With companies competing in the global markets, as well as operating in complicated regulatory conditions, the involvement of seasoned ESOP valuation professionals would guarantee that the equity incentive is fair, compliant, and strategical.

ESOPs are not simply financial tools when done with the utmost care and forethought, but plans to create a stronger, more engaged, and more resilient organization in the years ahead.