Understanding ESOP Valuation and Accounting What Companies Need to Know

Guide on Understanding ESOP Valuation and Accounting What Companies Need to Know

The ESOPs are now a popular method of compensating employees, attracting commitment over time, and allowing a seamless acquisition. They are a special mix of employee benefit and corporate finance instruments and provide tax benefits to both the company and its employees. Nonetheless, due to the fact that ESOPs are a matter of transferring the ownership of a company, they are also associated with the demand of proper and clear valuation, as well as rigidity in accounting and reporting. ESOP valuation services Singapore play a crucial role in ensuring accurate and compliant transactions. Many businesses rely on ESOP valuation companies Singapore trusted to guide them through this complex process.

In the absence of proper knowledge of ESOP valuation and accounting practices, the business owners, executives, and employees will not appreciate the actual financial implications of the plan and will thereby jeopardize compliance requirements or face skewed views of business performance. It is due to this that it is important to understand the main points about valuation and accounting in ESOPs whether one is a participant to implementing or administrating such a program, often relying on professional ESOP valuation Singapore. Many organizations also turn to ESOP valuation consultants Singapore for Companies to ensure accuracy and compliance.

Valuation forms the core of every ESOP transaction since it establishes the share price that the employees are to be given. Whereas publicly traded firms can know the market price easily, in the case of private companies, independent evaluation agencies must be hired to determine the share prices. Such valuation is not merely a formality required by law, it has a direct impact on employee benefit, plan funding obligations, in addition to financial undertakings of the company as a whole. Likewise, when accounting ESOPs, it is necessary to understand how the contributions and allocations of shares and costs will be vested on the financial statements, highlighting the importance of ESOP accounting and valuation Singapore.

The accounting treatments may have a drastic impact on the reported accounting earnings, cash flow statements, and balance sheets structures. Through an in-depth comprehension of both the valuation and the accounting aspects, the companies can be assured that their plans are fair, transparent and compliant and significant strategic advantages to an ESOP are reaped.

Why ESOP Valuation is Essential

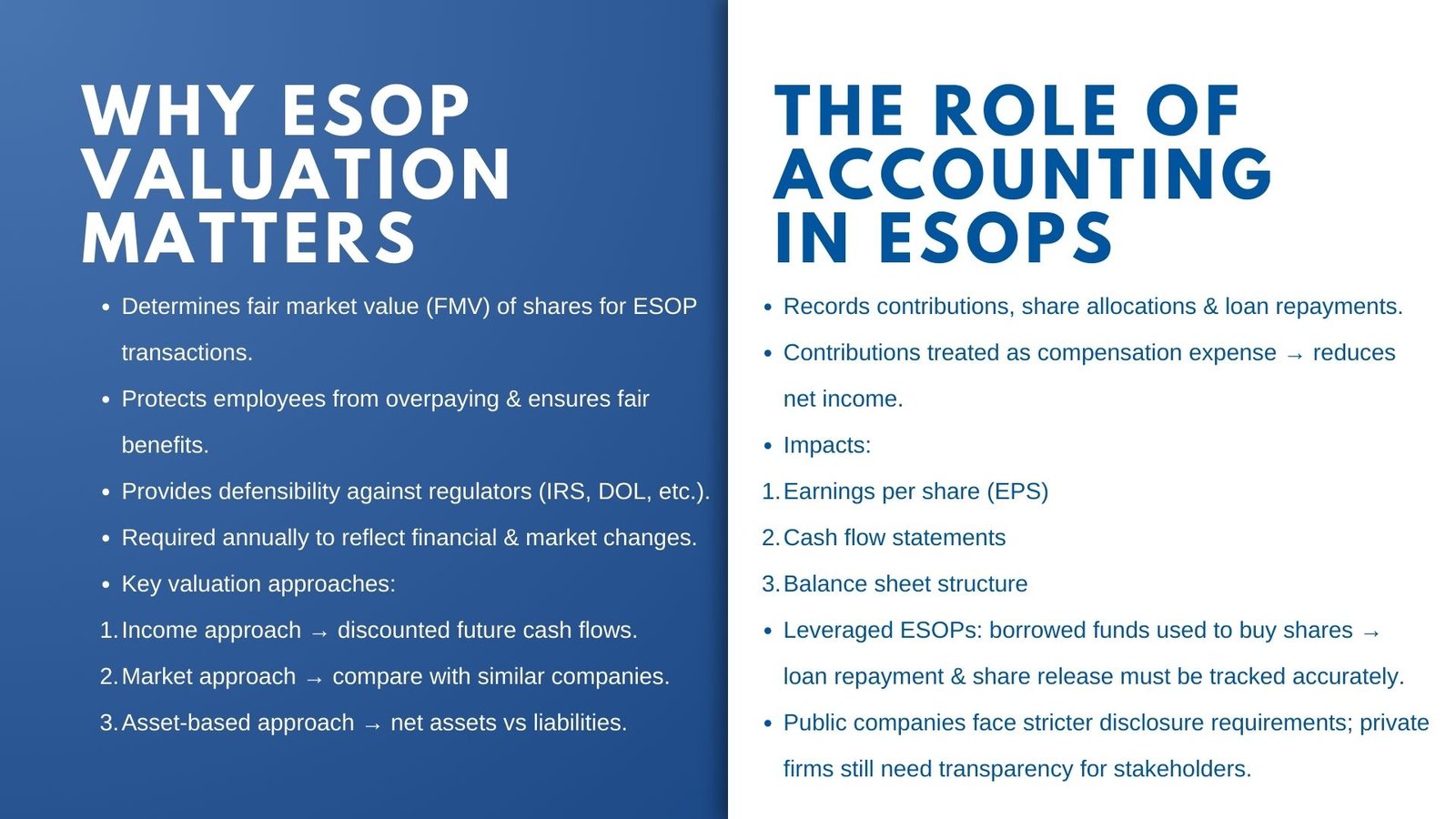

Basically, the strategic question that is addressed by ESOP valuation is easy but also vital; what is the fair market value of its stock? This amount decides the price on which shares are to be sold or bought in the ESOP that can influence future and present transactions. When undertaking valuation of a privately-owned company, the guessing game does not come into play; instead, what would occur is a calculated assessment of the performance of the company, its assets, market standing and future direction using established standards of valuation.

The most typical examples of the approaches used by independent appraisers include the income approach, where future cash flows are estimated and discounted to the present time value; the market approach which involves comparing the company to other companies; and the asset-based approach which involves gauging the net worth of the assets of the company as against the liabilities.

The proper valuation is necessary on several grounds. To employees, it makes sure that they are not paying a sum that is excessively high or rewarding them off-market. To the company, it provides the defensibility of transactions that cannot be echoed by the regulators, including the Department of Labor or the Internal Revenue Service, (in the United States), as well as similar organizations in other legislations. To the selling shareholders, it helps in issuing them proper compensation because of their ownership interest.

In addition, they have to conduct valuations yearly as long as the ESOP is in operation, and this will help the plan to consider the changing financial state of the company. The fact that this is a process implies that valuation is not a one-off exercise but is part of a periodic exercise of good ESOP management.

Understanding the Role of Accounting in ESOPs

Even though valuation defines the value of shares, accounting is necessary in ensuring that ESOP transactions are well reflected in the company books. ESOP accounting may be complicated by normal equity accounting due to the fact that it is associated with crediting contributions to the plan, the subsequent discharge of the shares at a suspense account and distribution of the shares or the cash to the workers in due time.

With a leveraged ESOP, such as is the case, the firm obtains the funds to purchase the plan shares through borrowing and it responds by paying an annual amount to pay off the loan. These contributions are then released in proportionate number of shares to the employee account as the contributions are made which entails a financial cost to the company as well as an equity transaction.

Accounting standards also necessitate, expenses relating to an ESOP shall be recognized in a manner that depicts the economic reality of the scheme. The dollars paid into the ESOP are normally put as a compensation expense that lowers the net income. Also, earnings per share may be influenced and the shareholder equity by treatment of shares, that is, whether being issued or repurchased. In the case of the public companies, additional requirements are provided, which declares specific effects of the ESOP to the governments.

In case of the individual companies who are not subjected to the expense of audits, disclosure may not be as formal, but still, proper accounting is vital to the decisions made by the management and in the stakeholder understanding of the financial effects of the plan.

How Valuation and Accounting Interconnect in ESOPs

There is a close connection between valuation and accounting as far as ESOPs are concerned. Valuation of shares is done which in turn influences the way ESOP is recorded in company accounts. As an example, should the fair market value of the shares change to higher due to the annual valuation, then the cost to repurchase shares of the departing employees will increase and this may increase the future liability. It can affect the projections of cash flow and this needs to be incorporated in planning by accountants. Likewise, accounting records are also vital inputs in valuation, which include the past financial performance, balance sheets, as well as the capital structure.

Practically, both functions need to strike a balance since consistency and accuracy need to go hand in hand. Professionals in valuation use the audited or thoroughly prepared financial statements to stake their analysis whereas the accountants must be aware of the assumptions and outcome of the valuation to ensure that ESOP transactions are computed appositely and accurately. The effect can be severe in the event one of the processes is flawed i.e. an inflated valuation or incomplete accounting, where the effects can vary in the manner of regulatory fines, shareholder and employee wrangles. This is the reason why most firms prefer to liaise well between their valuation, finance, and accounting advisors in order to streamline their operation of ESOP.

Common Challenges in ESOP Valuation and Accounting

Although it is apparent that valuation and accounting are critical, companies sometimes cannot succeed in implementing these activities appropriately. It is one of the most shared problems that the valuation has been made based on outdated or incomplete financial data. Otherwise, in case the base of data fails to properly represent the performance or the financial position of the company, the valuation obtained will be erroneous. There is also the issue of accounting treatment of complicated transactions of ESOP, and in leveraged plans, this is an important component as the flow of loan payment, share release, and compensation costs should be accounted strictly.

Possible modifications in the market situation or company performance may make it problematic as well. An instance would be that a collapse in the demand of the industry may make the valuation go down affecting the value of the employee ESOP accounts. On the other hand, a high growth may push up valuation that although good, may heighten repurchase liability.

Accounting wise, it is paramount to have clear records of the share allocation, expense on the plan and loan balances to eliminate errors that would misrepresent the performance of the company. Also, it is paramount to respond to the development of the accounting standards and regulatory framework and avoid the penalties, legal claims, or damage to reputation that is possible under the noncompliance.

Best Practices for Accurate and Compliant ESOP Management

Companies ought to be proactive and disciplined in order to make the valuation process and accounting a success. Within this context, independent and qualified valuation experts should be engaged on a yearly basis to prove the idea of credibility and compliance with laws. These professionals ought to be experts in the industry so that they can adequately evaluate the position of the company in the market and where it wants to go in its growth. On the accounting side, it is important to have adequate and well-documented records relating to all the ESOP transactions, loans repayments and stock allocations to create clarity and accuracy in accounting.

Surprises can also be averted by incorporating the management of ESOP with other financial planning. To take an example, knowing, long before the time to repurchase will occur, what repurchase obligations will be helps the company set aside funds to spend over time, and being able to observe how much ESOP-related costs are affecting profitability may inform operating choices. The provision of consistent and frequent training to the finance and accounting personnel on issues that relate to ESOP keeps them abreast of the most current and accepted best practices and regulations.

Lastly, encouraging open communication among the valuation professionals, the accountants, the management, and the workforce, creates trust and makes everybody aware of how the ESOP works and influences the financial welfare of the company.

In summary, The process of ESOP valuation and accounting is two sides of the same coin without which a fair and transparent functioning of the plan, as well as the plans compliance with the law, is impossible. The benefit paid to employees and obligations to the company depend on valuation, which amounts to determining the fair market value of shares. Through accounting, the correct bookkeeping of these transactions is obtained to give a genuine idea of how the plan affects financial performance. When taken precisely, professionally and synchronized, ESOP valuation and accounting may complement each other making the plan a valuable resource to engage employees, change the ownership and ensure long-term business prosperity.